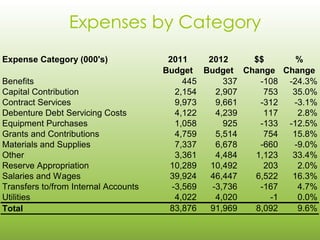

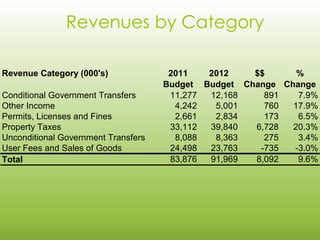

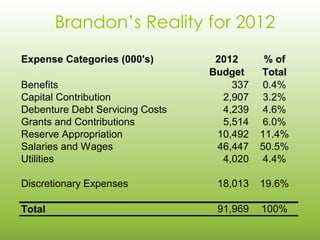

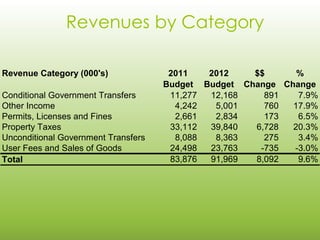

The document summarizes the 2012 budget highlights for the City of Brandon. It outlines strategic and operational challenges including infrastructure, growth management, and new collective agreements. Opportunities include new revenue sources and an asset management plan. The budget allocates funding to priorities like infrastructure, affordable housing, economic development, and recreation. Expenses are projected to increase 9.6% to $91.9 million, with most going to salaries, benefits, and infrastructure. Revenues are also projected to rise 9.6% through increased property taxes, government transfers, and other sources. The next steps include council deliberations and public consultation on the interim and final 2012 budgets.