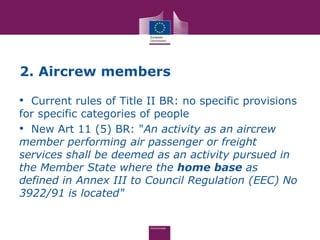

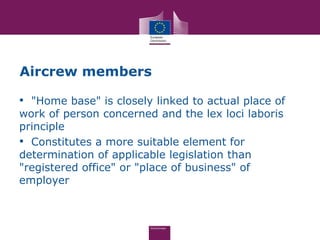

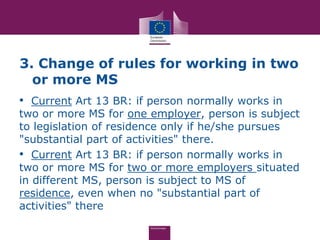

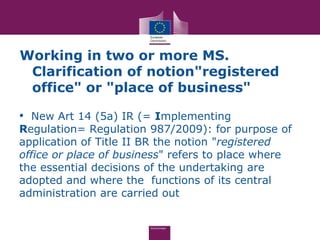

The document summarizes recent developments in EU legislation regarding social security coordination. It discusses the change in the legal basis for coordination rules under the Lisbon Treaty, allowing for qualified majority voting. It also outlines key changes proposed in 2010 to Regulation 883/2004 and 987/2009, including provisions related to posted workers, aircrew members, working in multiple countries, and unemployment benefits for self-employed people. Administrative and judicial developments are also mentioned.