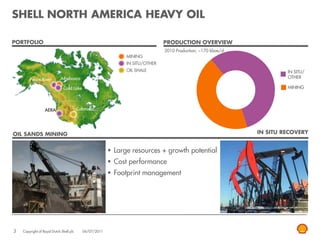

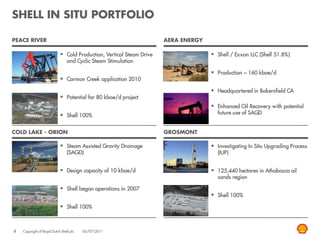

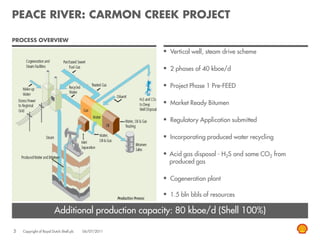

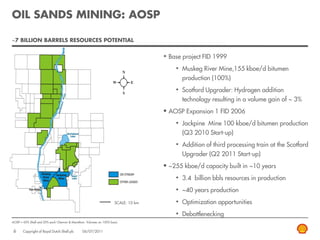

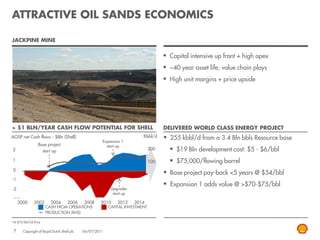

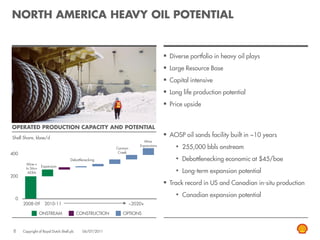

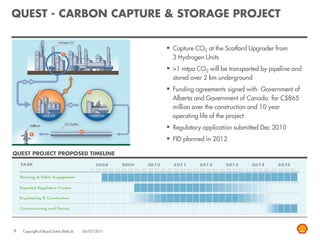

The document is a presentation by Royal Dutch Shell's Executive Vice President John Abbott at the TD Securities Unconventional Energy Conference, focusing on the company's heavy oil production and resources as of July 2011. It outlines definitions of reserves and resources, discusses the company's investments in North American oil sands, and highlights the Quest carbon capture and storage project. Additionally, it includes forward-looking statements regarding Shell's operational expectations and risks associated with market conditions and regulatory developments.