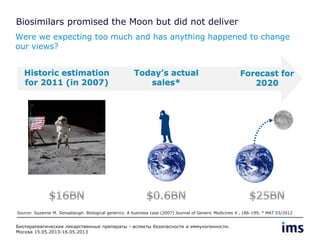

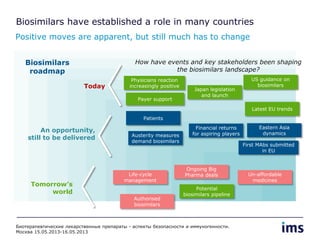

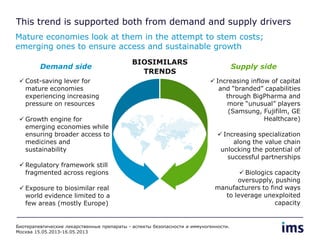

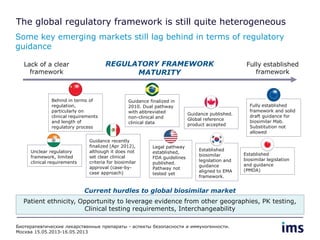

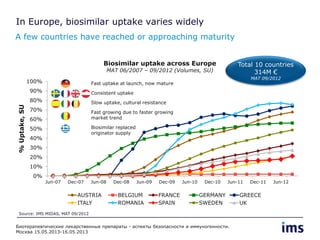

The document discusses the evolving landscape of biosimilars, highlighting their potential in reducing healthcare costs and increasing drug accessibility, particularly in emerging economies. It outlines the fragmented global regulatory framework and the mixed uptake of biosimilars across different regions, emphasizing both challenges and opportunities for stakeholders in the biosimilar market. Overall, while biosimilars have gained traction, significant hurdles remain in achieving broader acceptance and regulatory clarity.