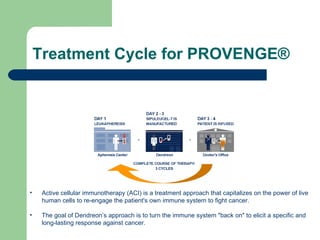

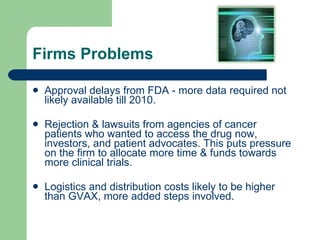

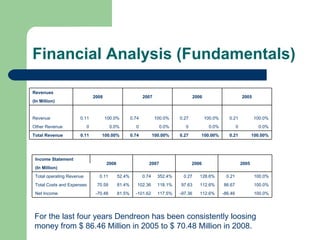

Dendreon Corporation is developing novel immunotherapies to treat cancer. It has one product, Provenge, approved for late-stage prostate cancer which works by re-engaging the immune system. While showing promise, Provenge faces challenges of high costs, lengthy approval delays, and lawsuits seeking earlier access. Dendreon needs to diversify its pipeline and pursue financing to support clinical trials and market expansion.