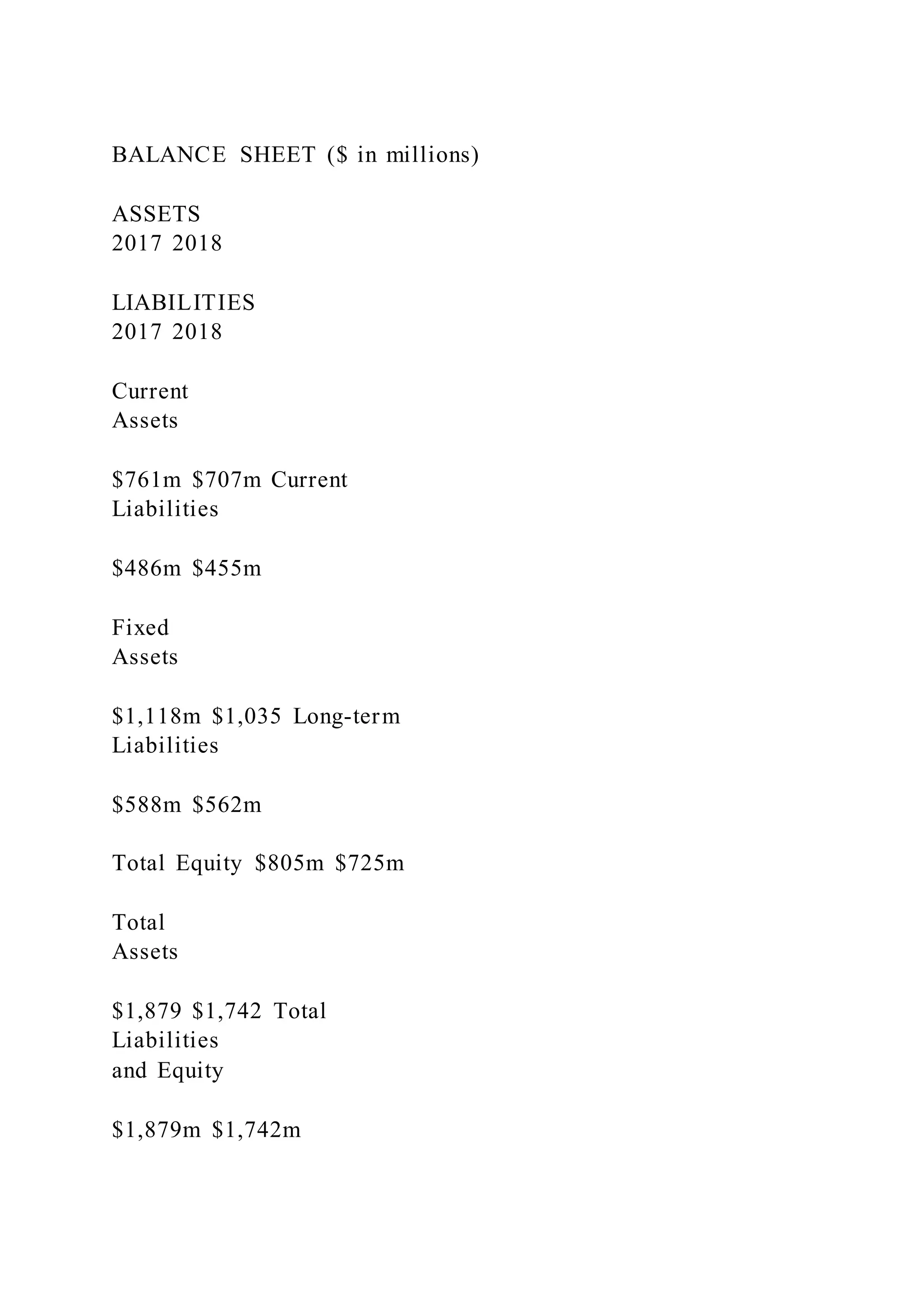

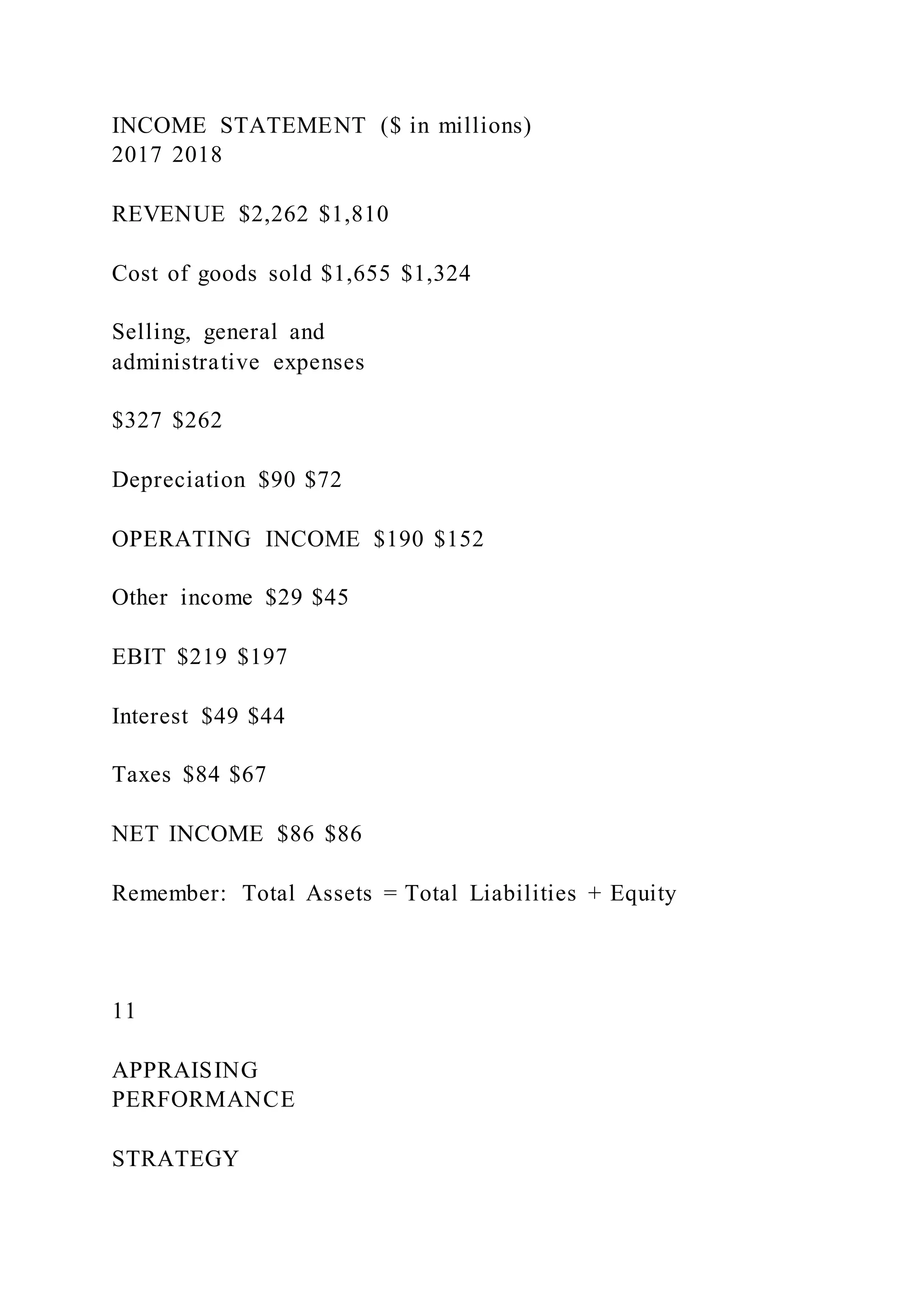

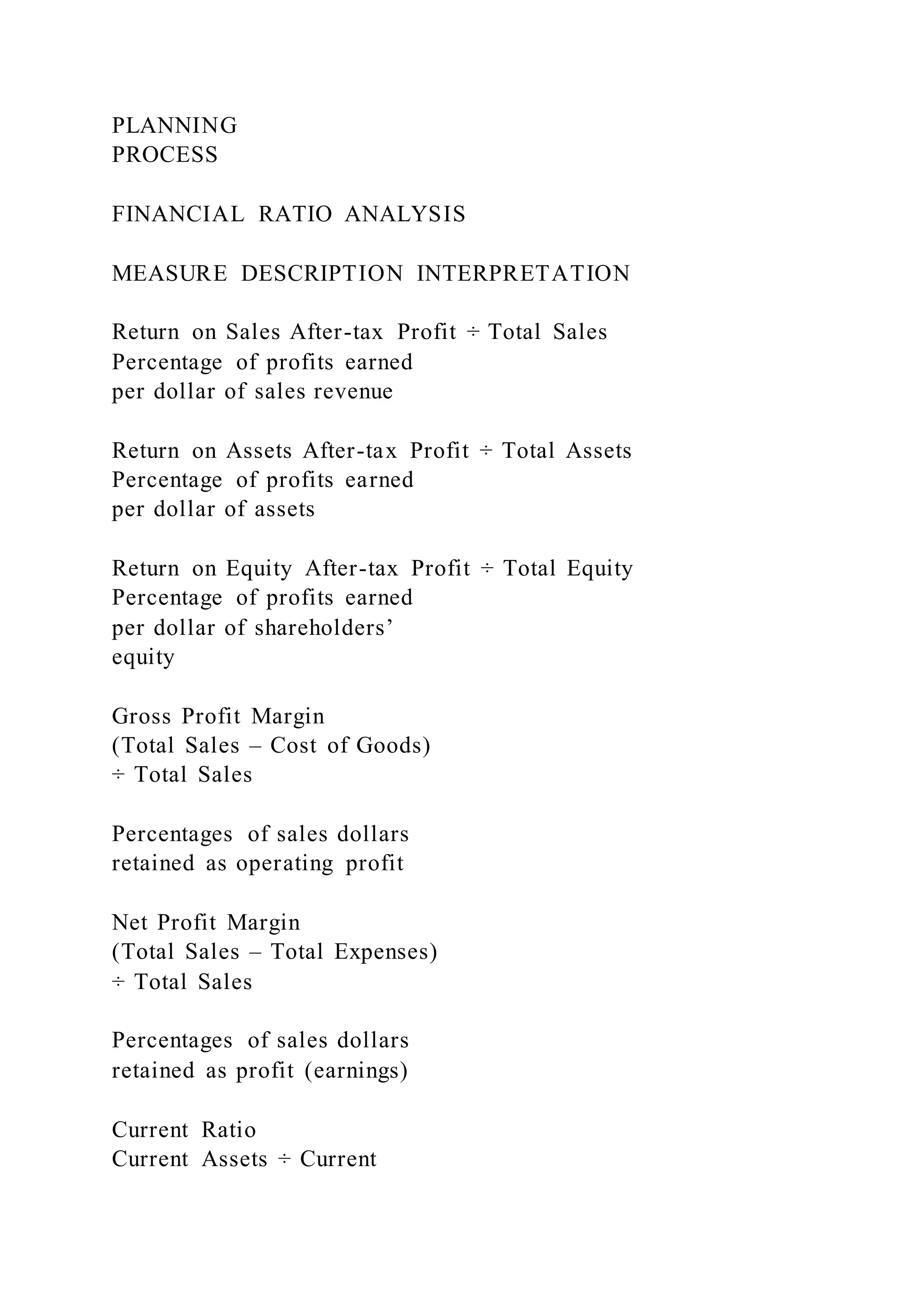

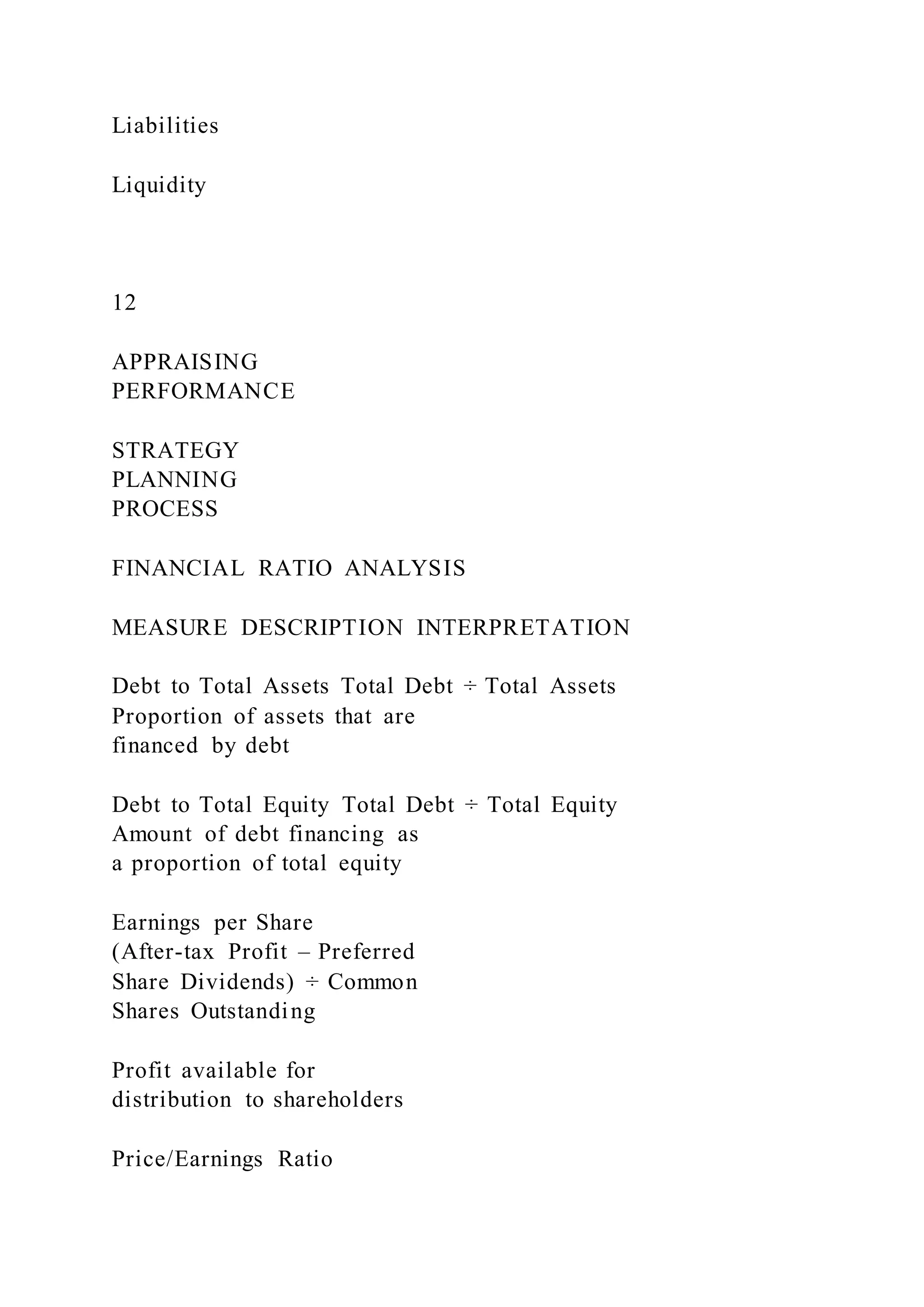

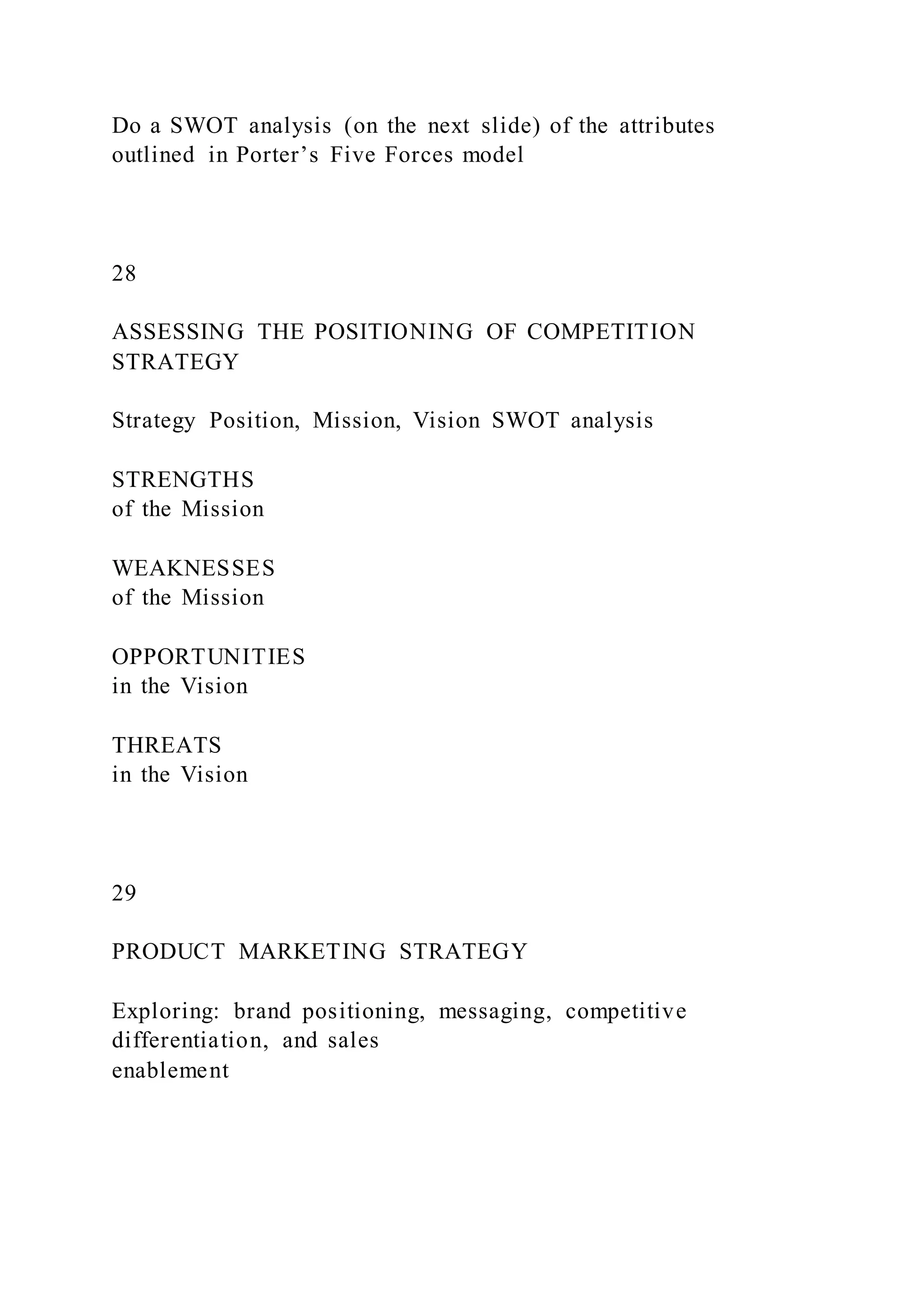

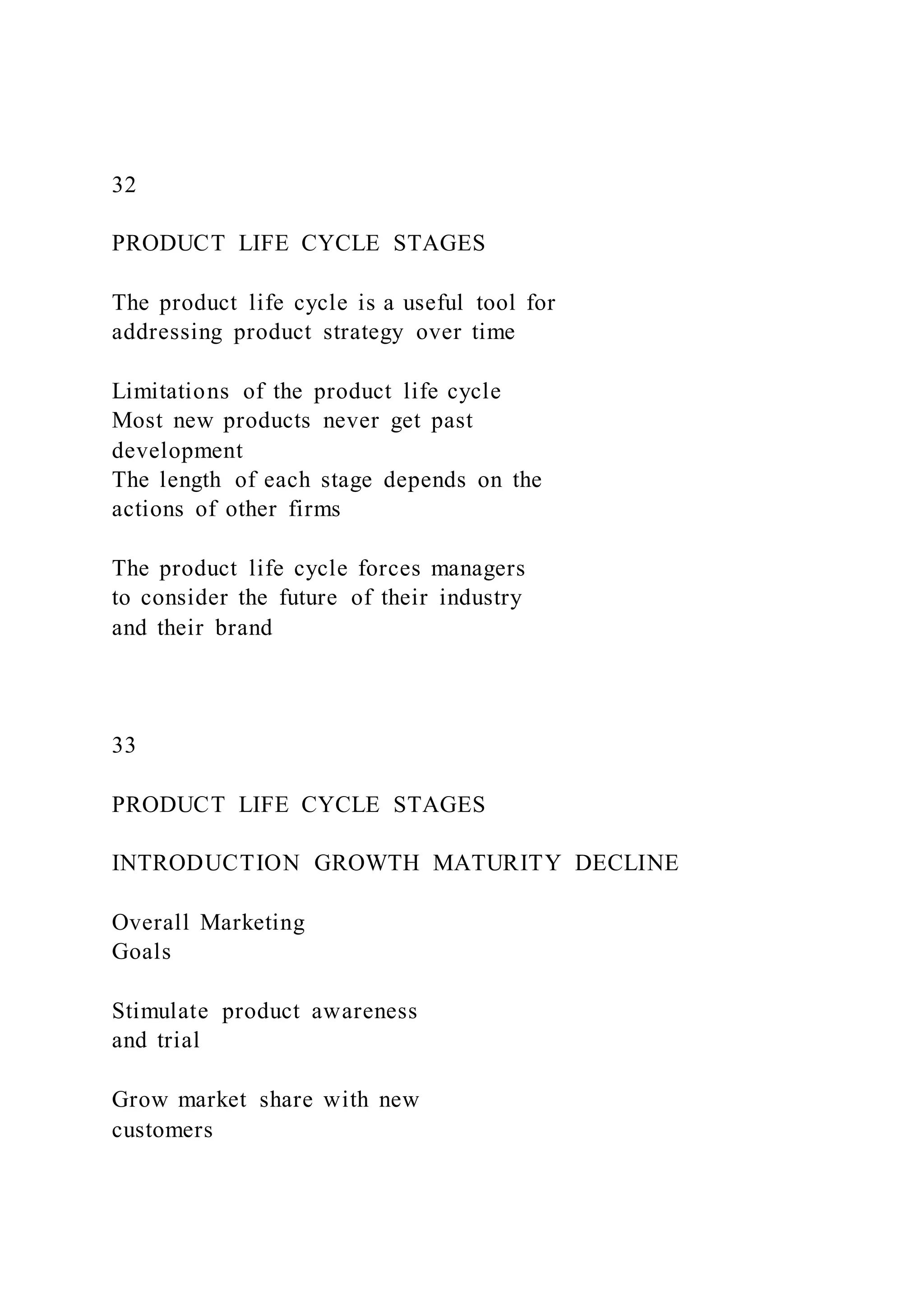

The document outlines the learning objectives and content for Week 4 of an MBA course, focusing on appraising performance and strategy through financial stability and management practices. Key concepts include financial ratio analysis, cash conversion cycles, and the impact of competition on a firm's ability to attract investment. Students are encouraged to apply their knowledge in real-world contexts and engage in workshops for comparative analysis and problem-solving.