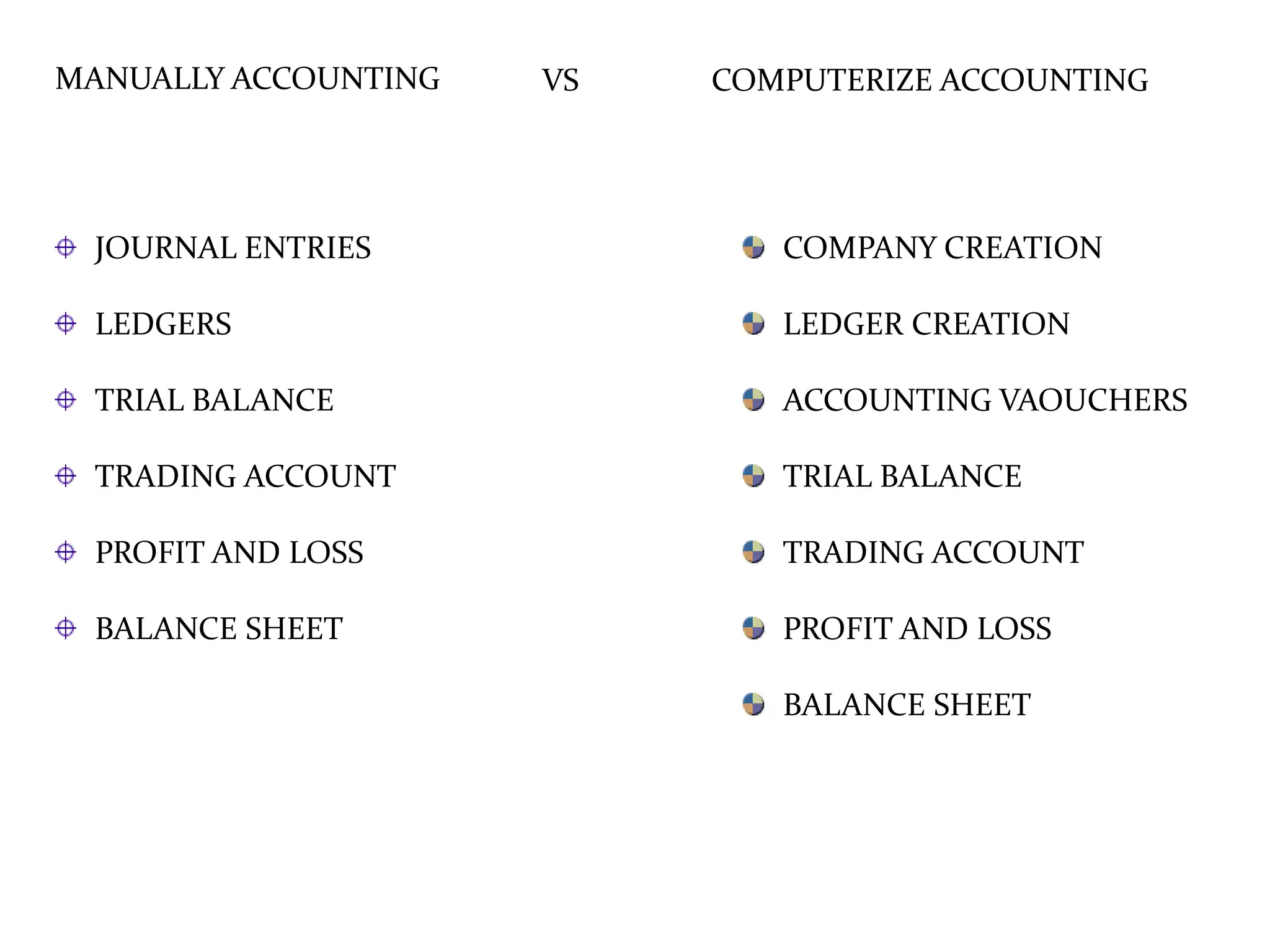

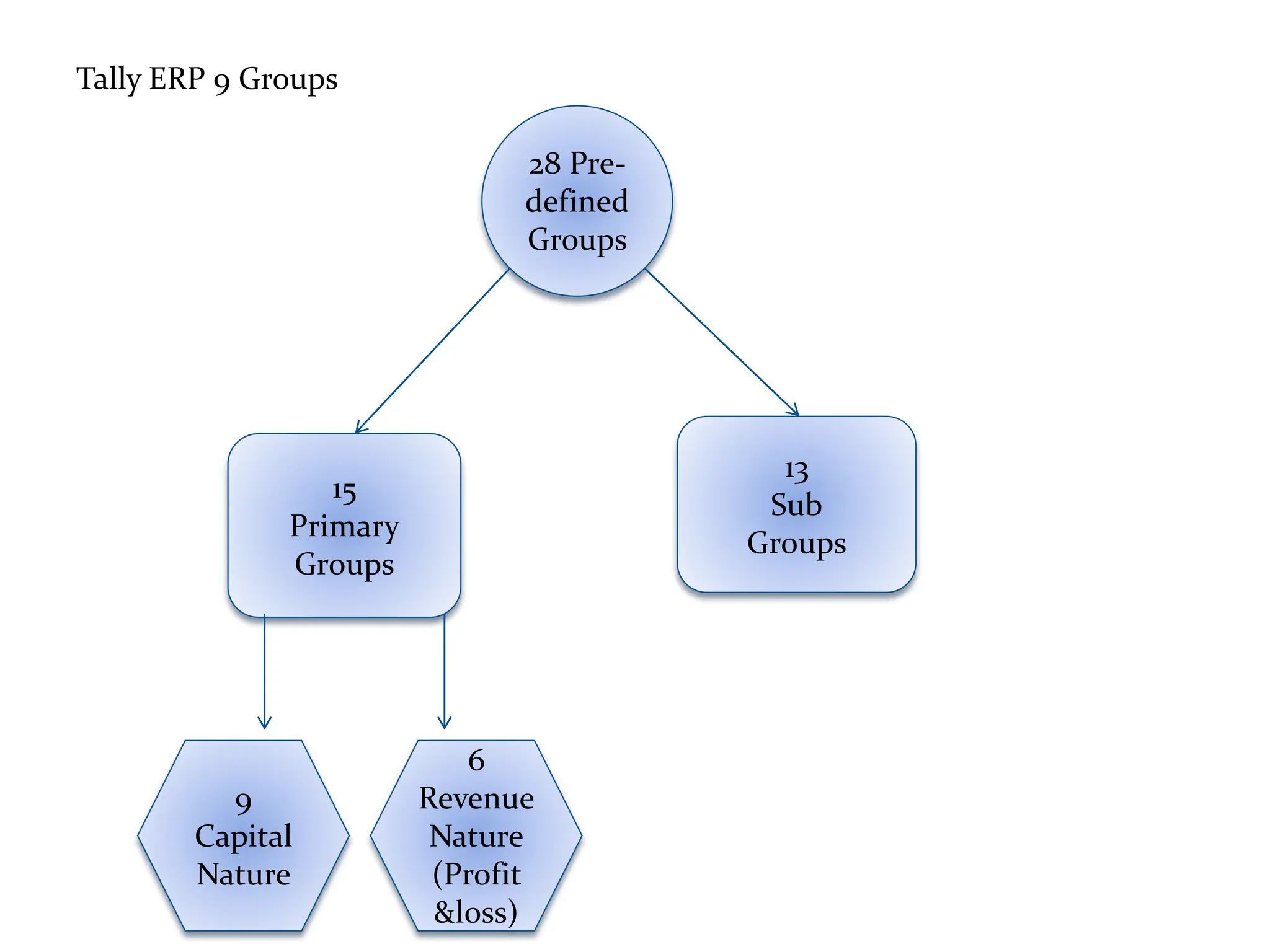

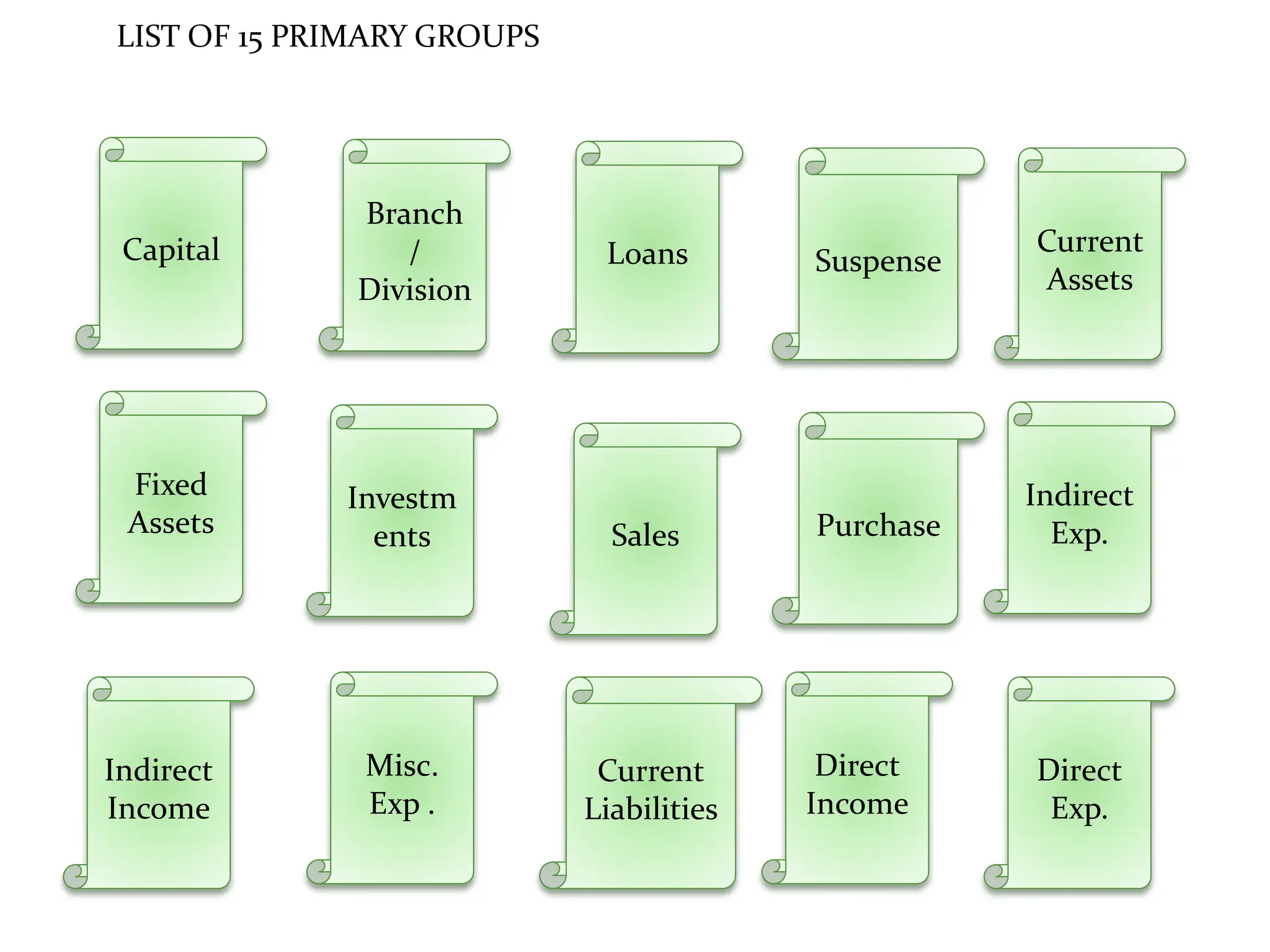

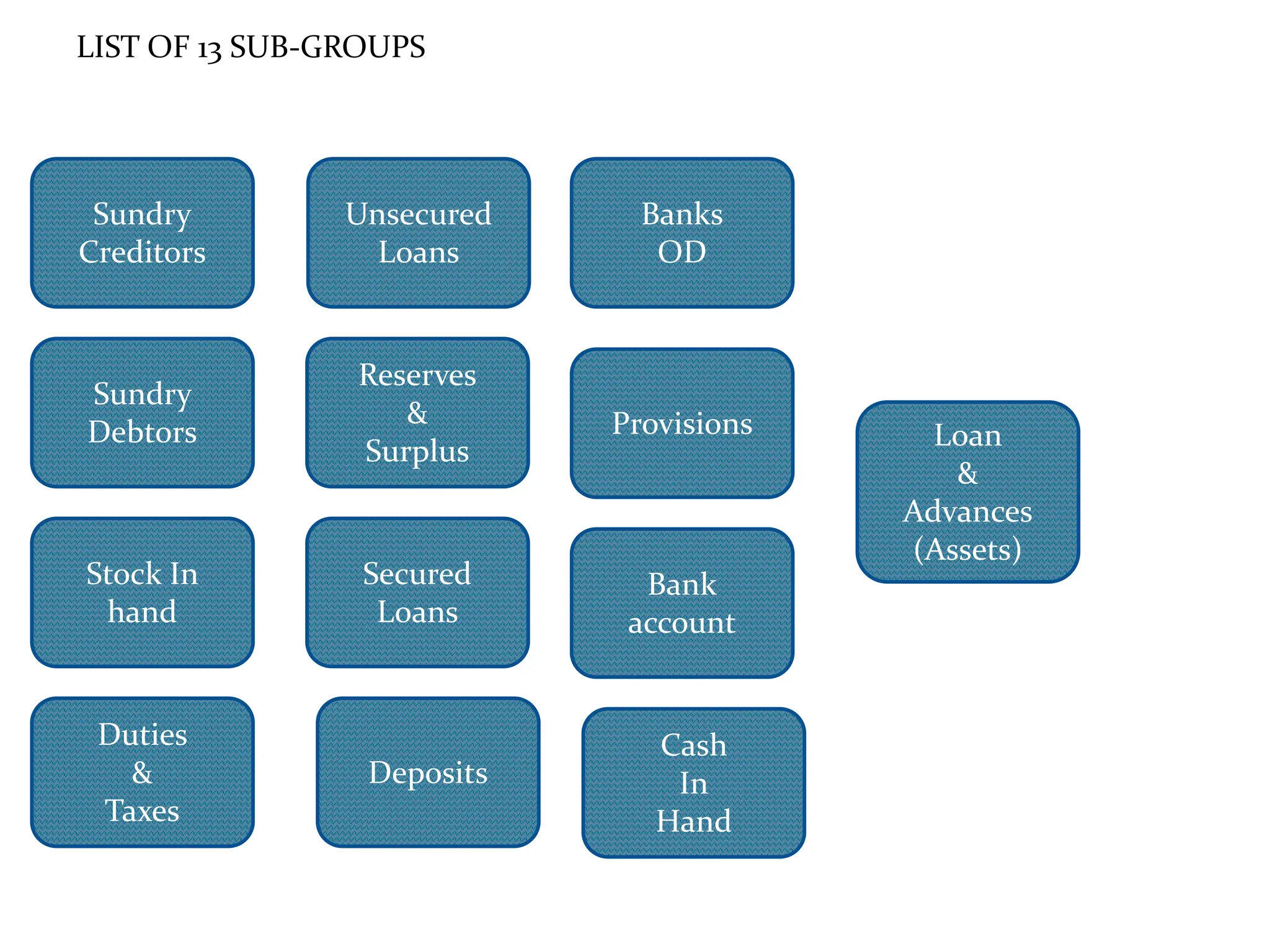

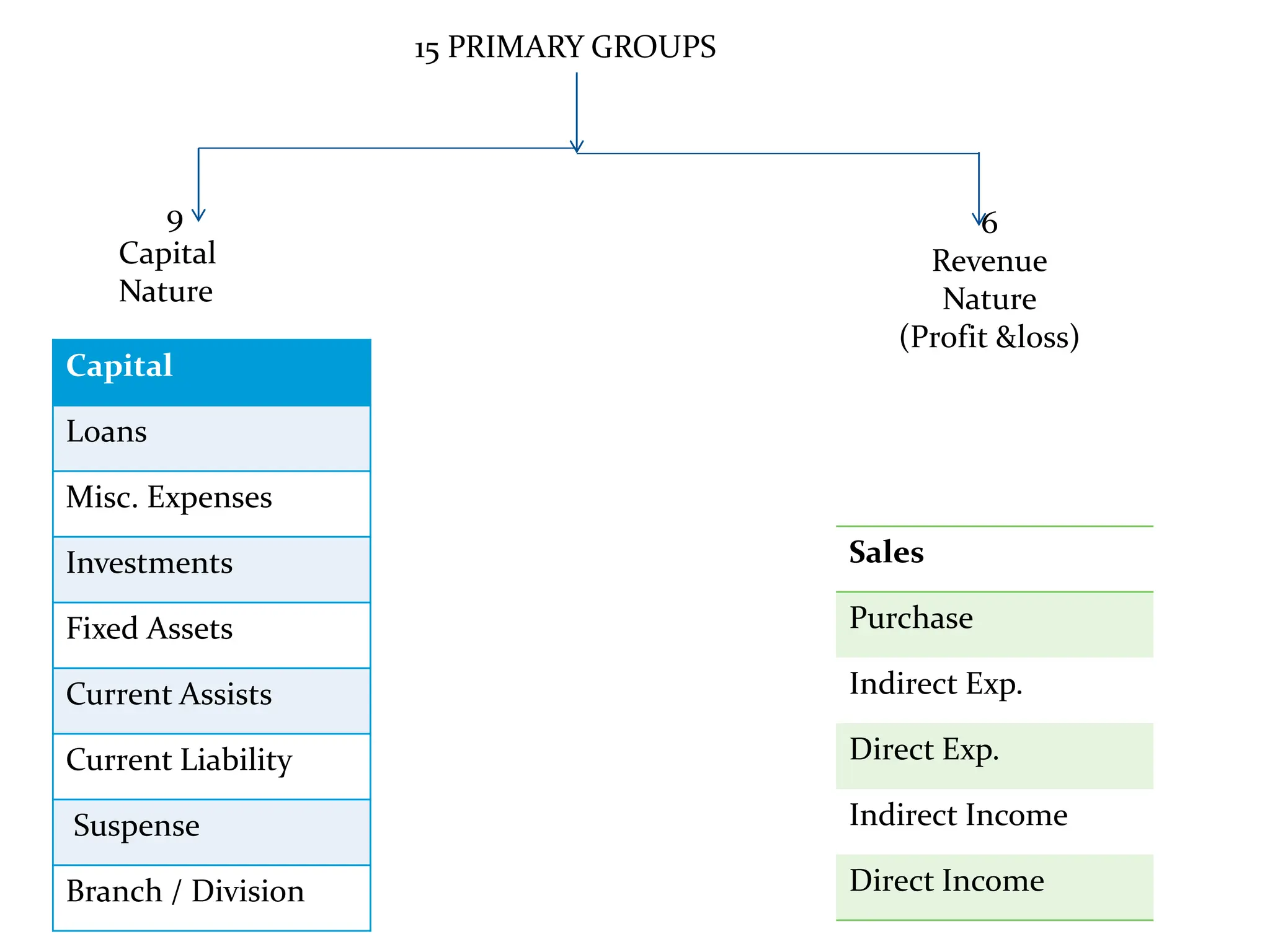

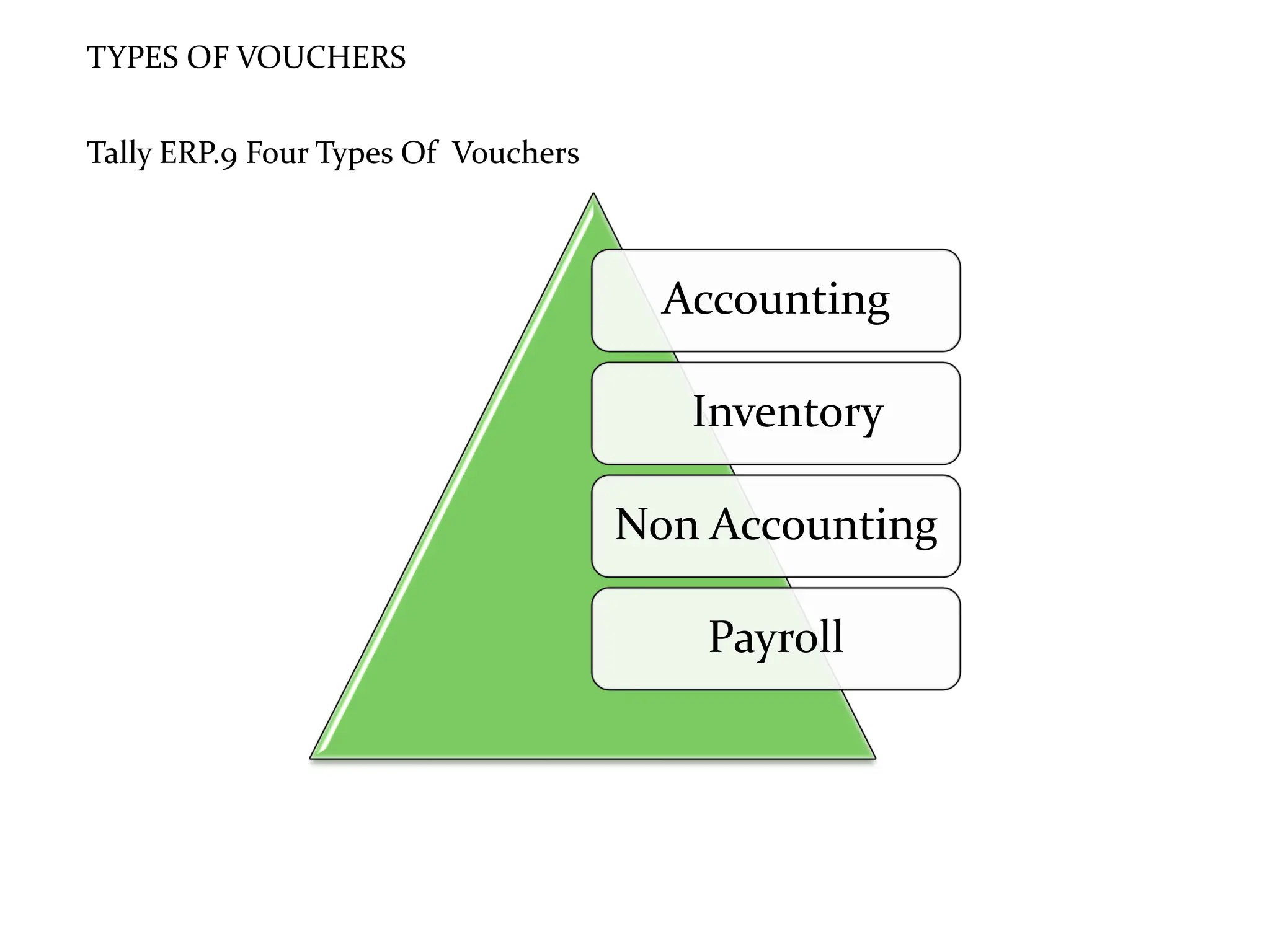

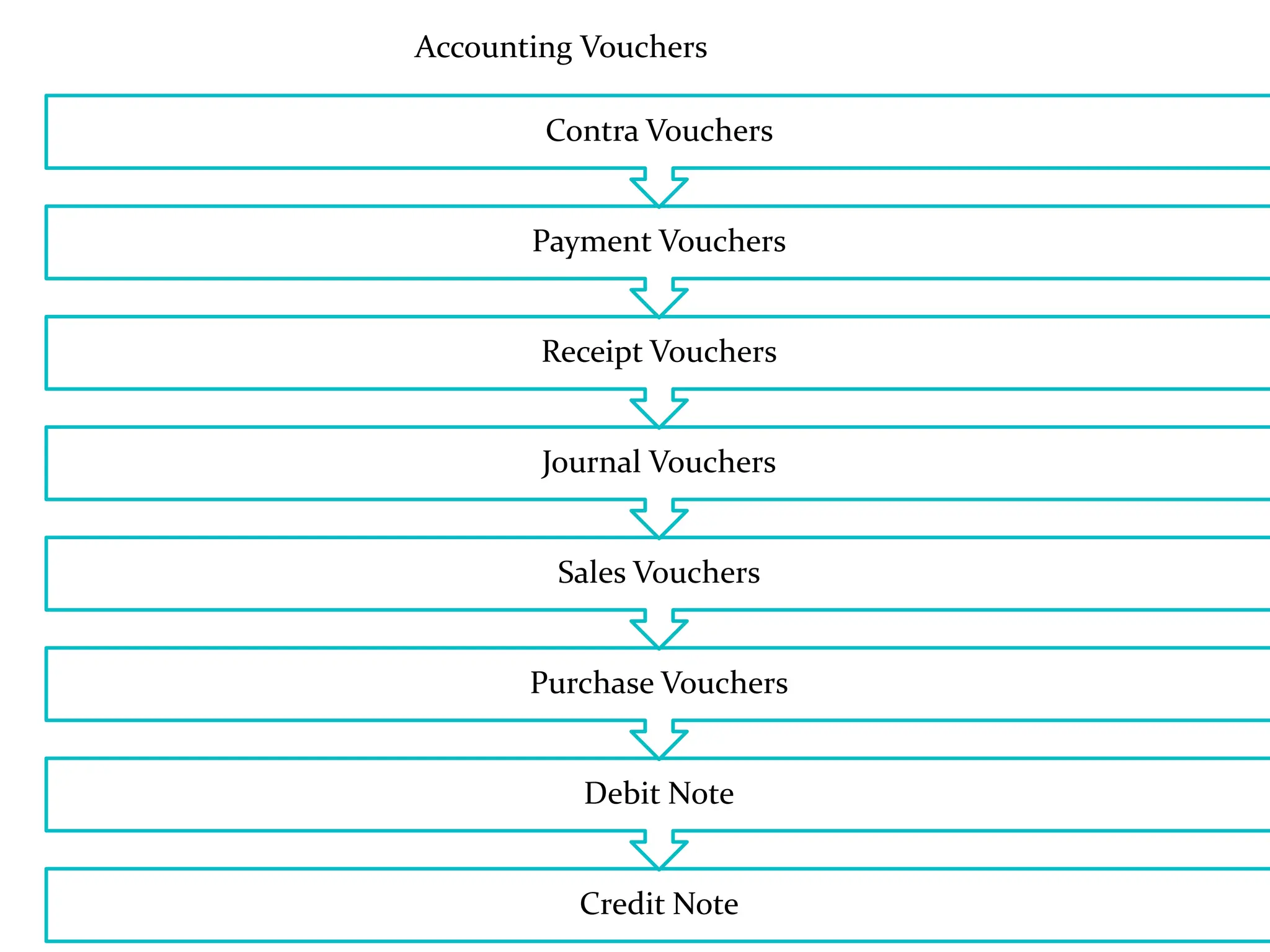

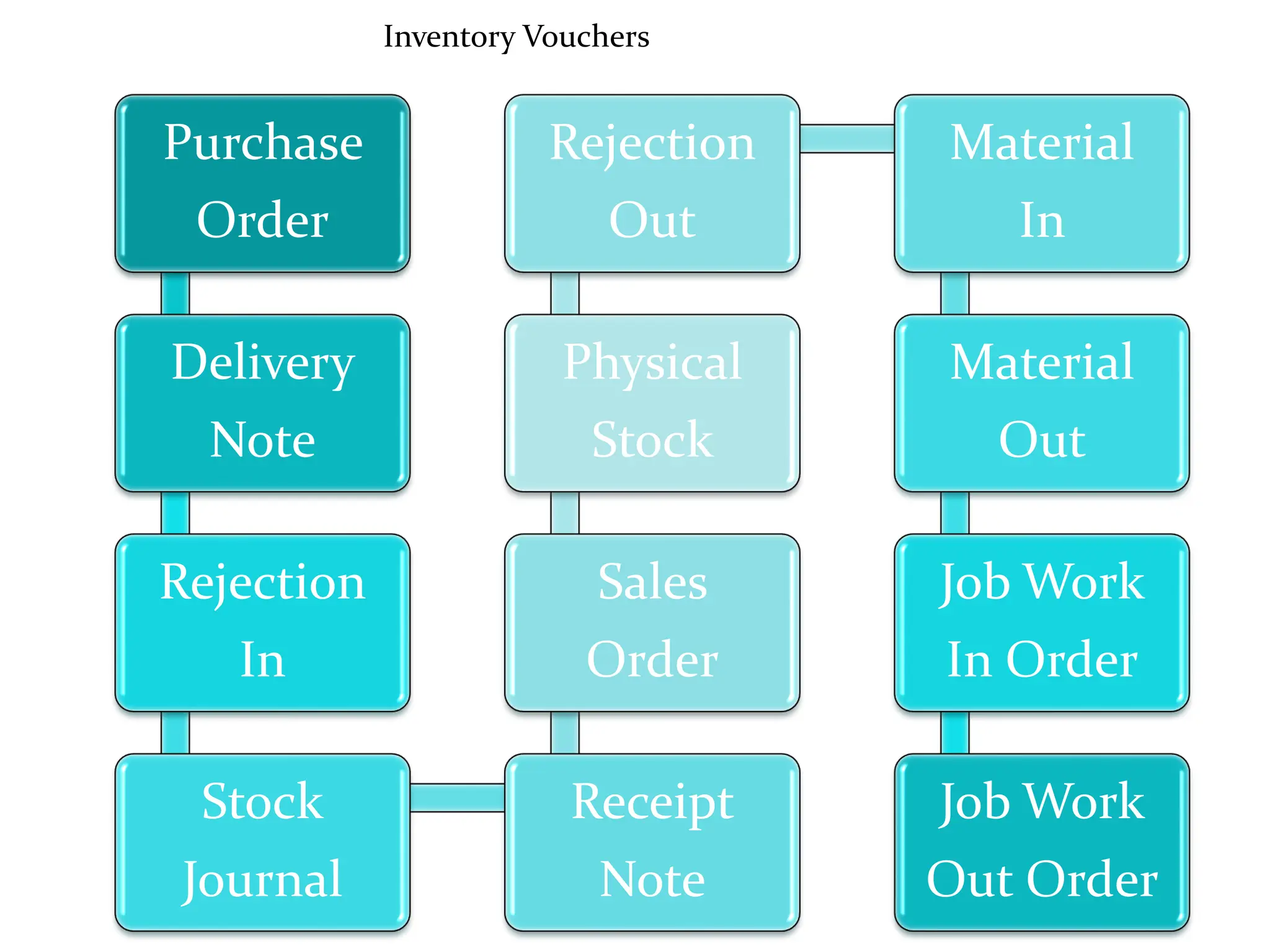

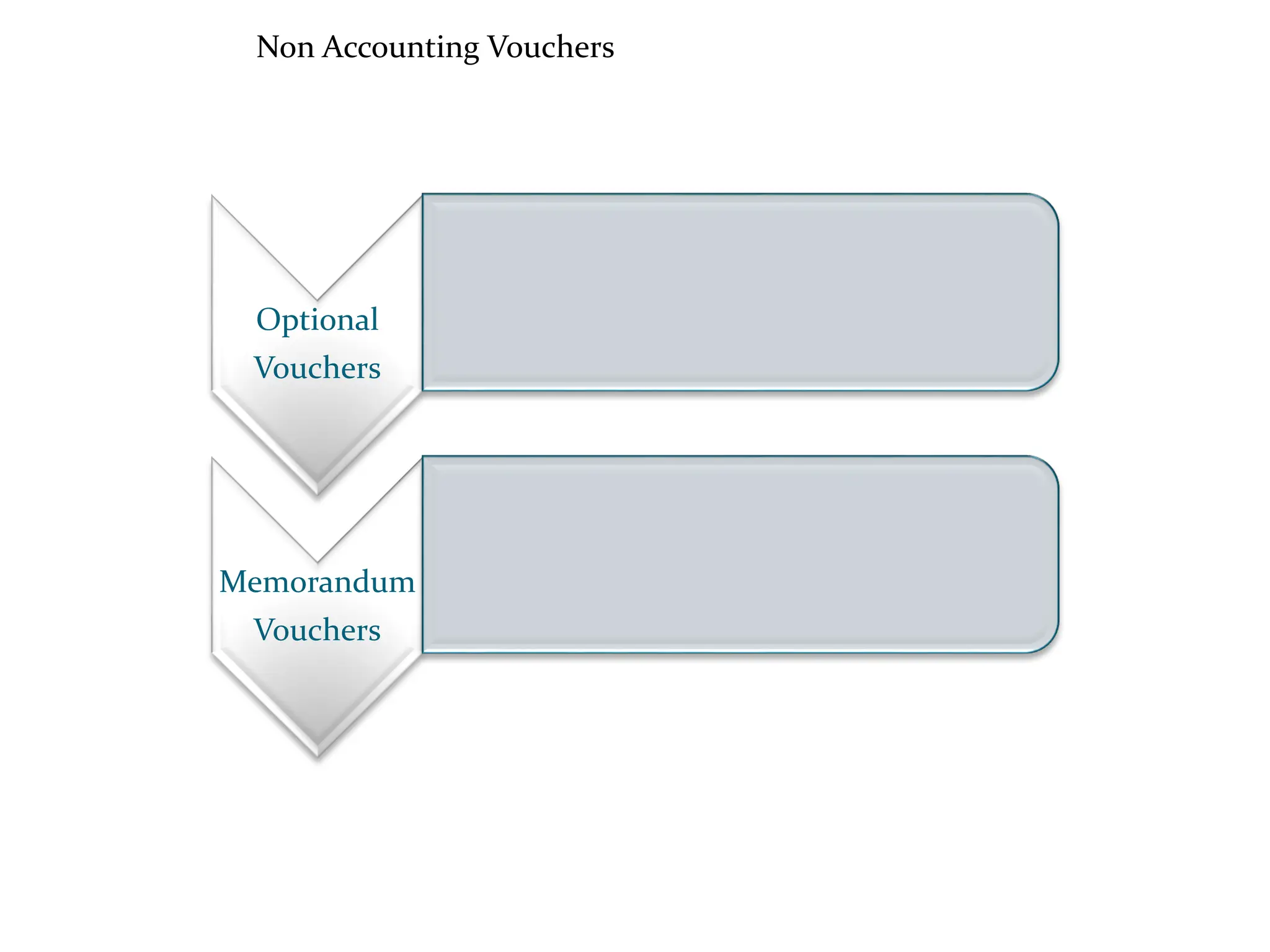

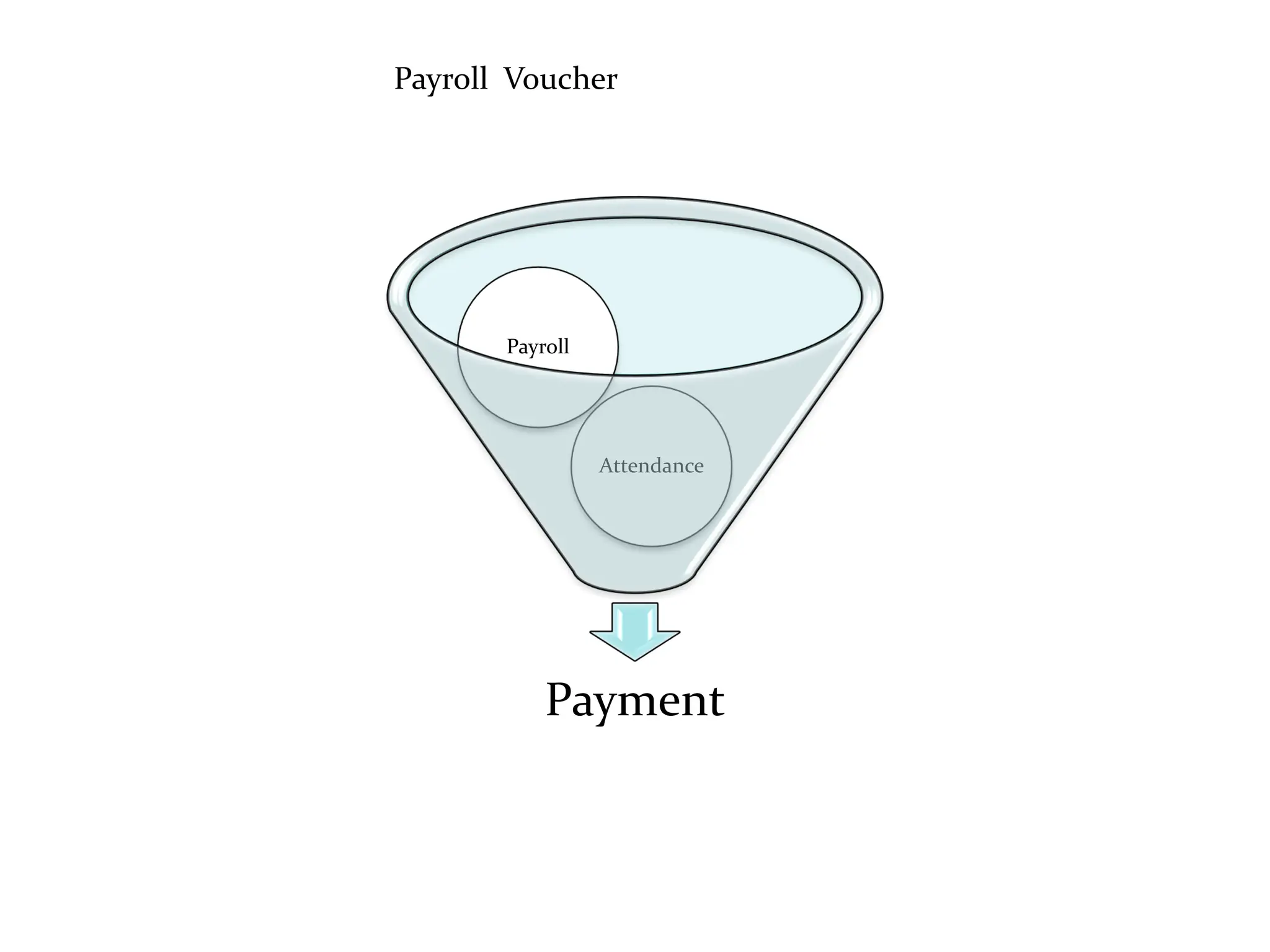

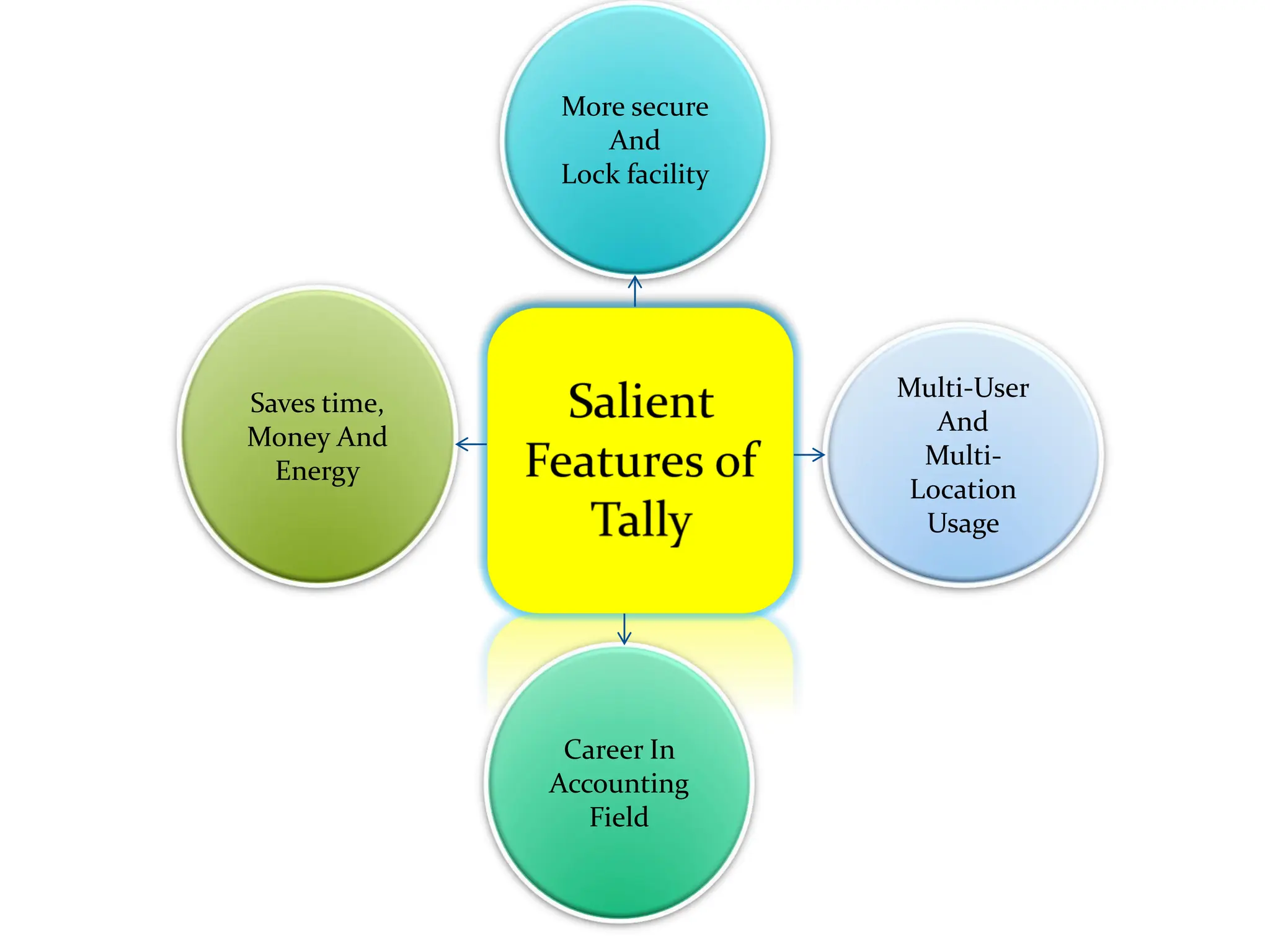

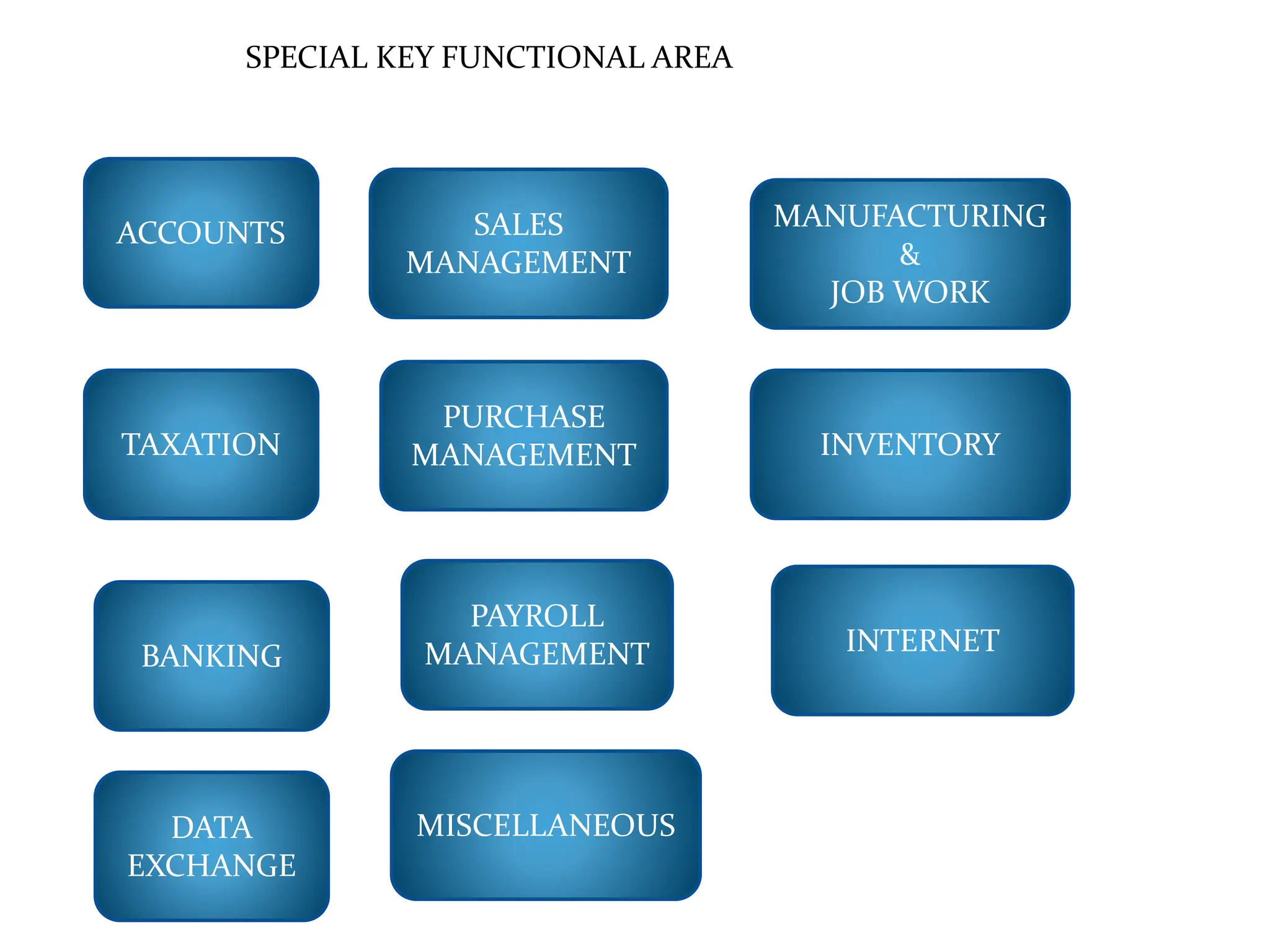

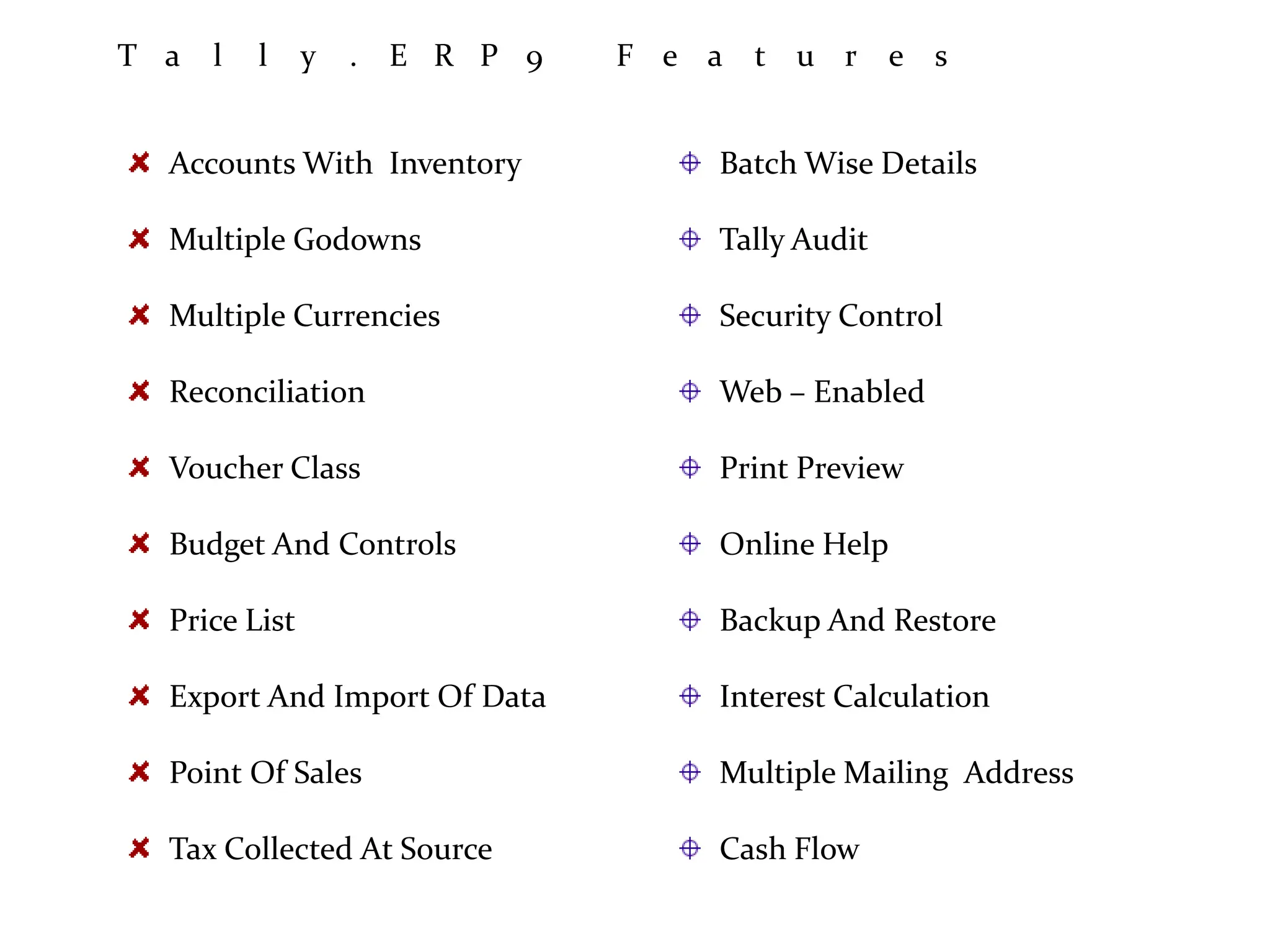

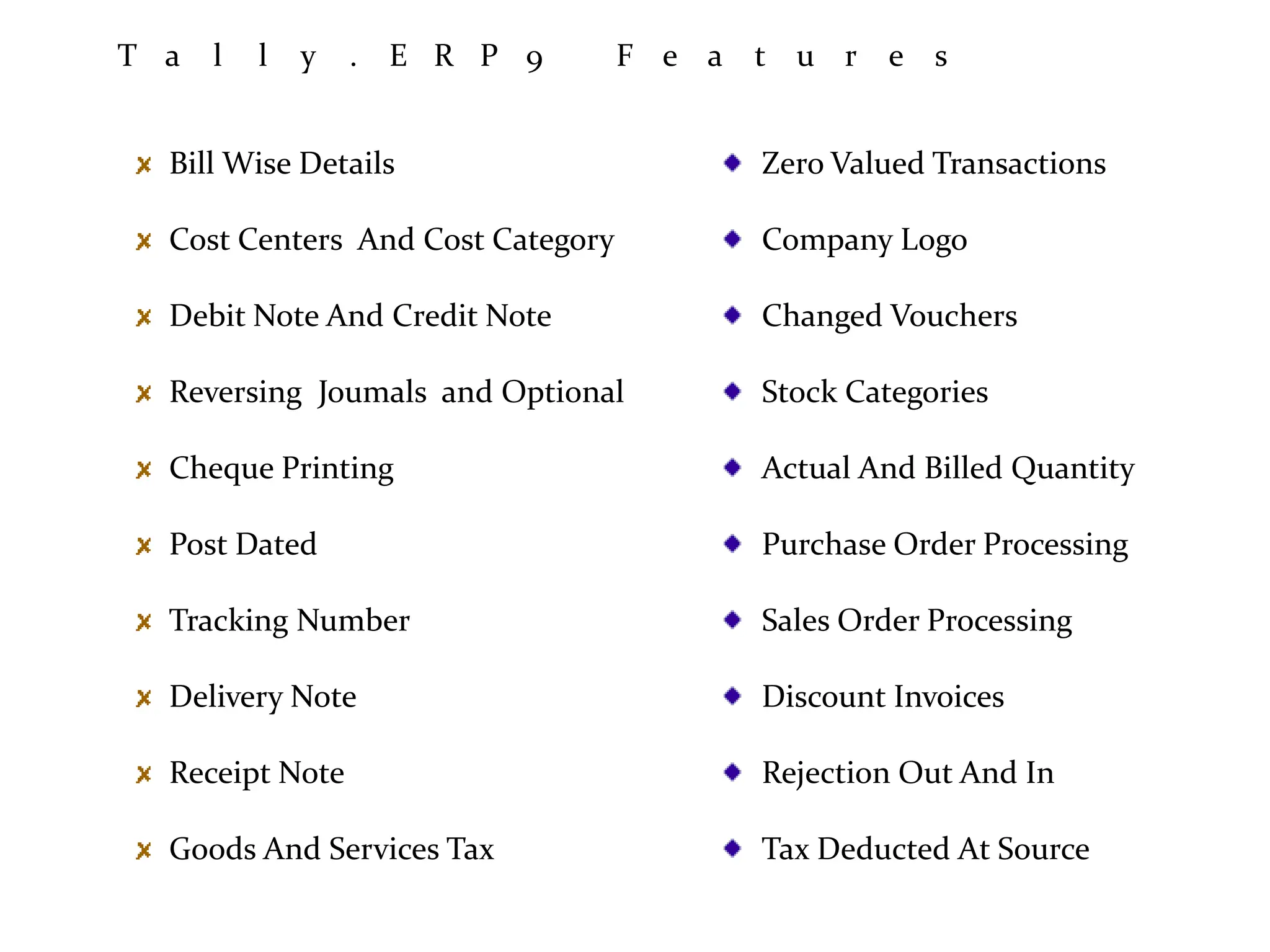

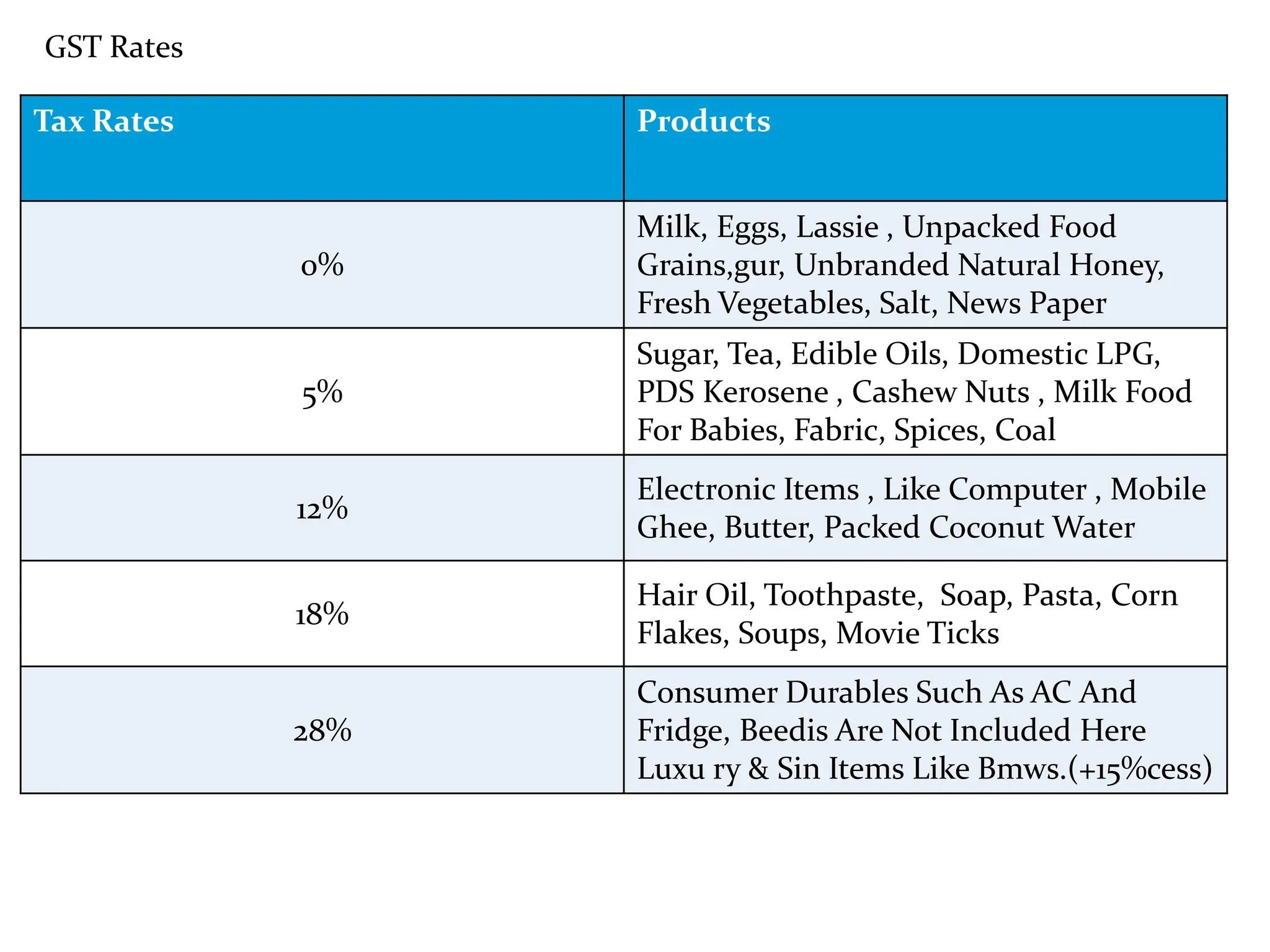

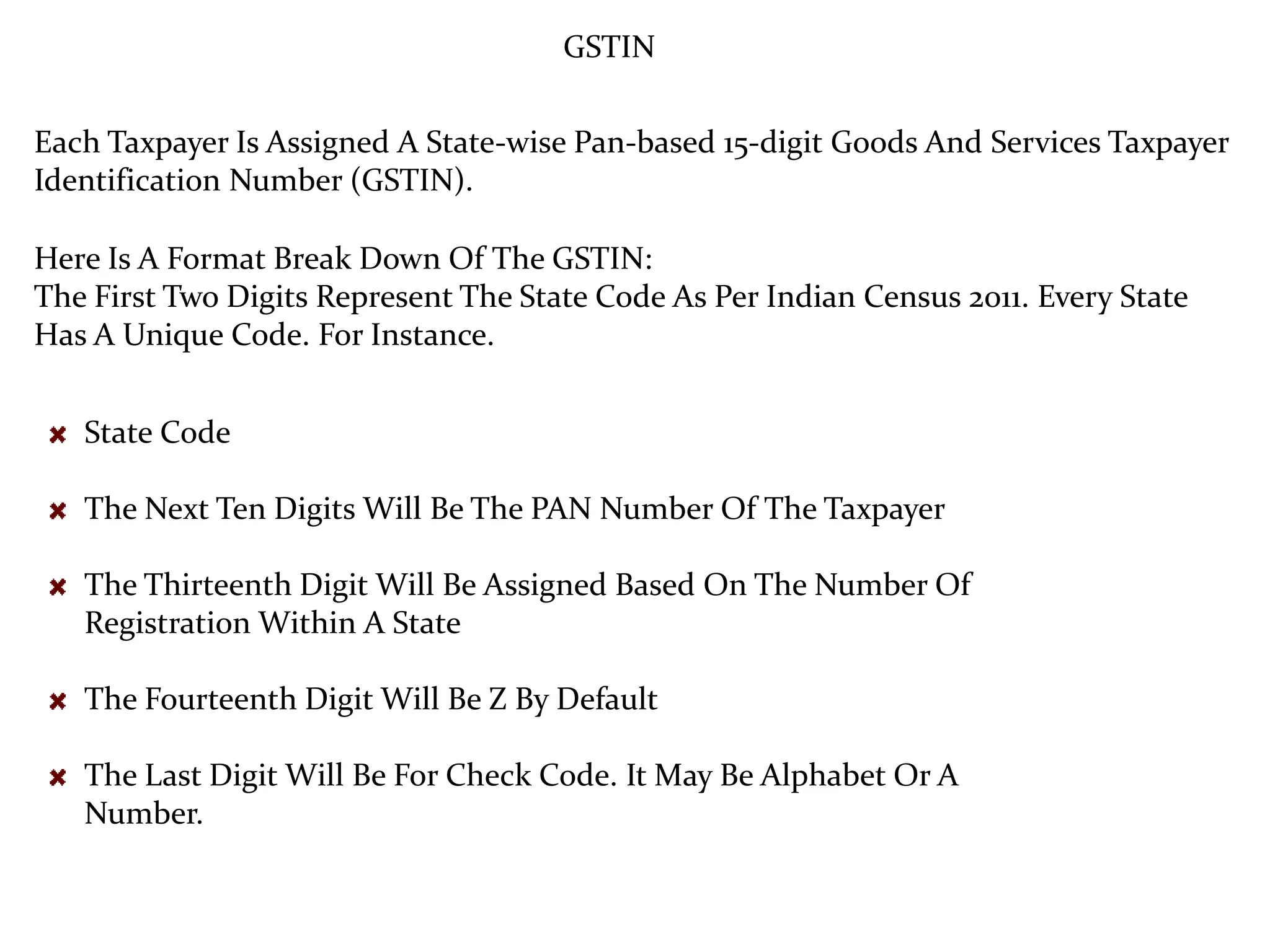

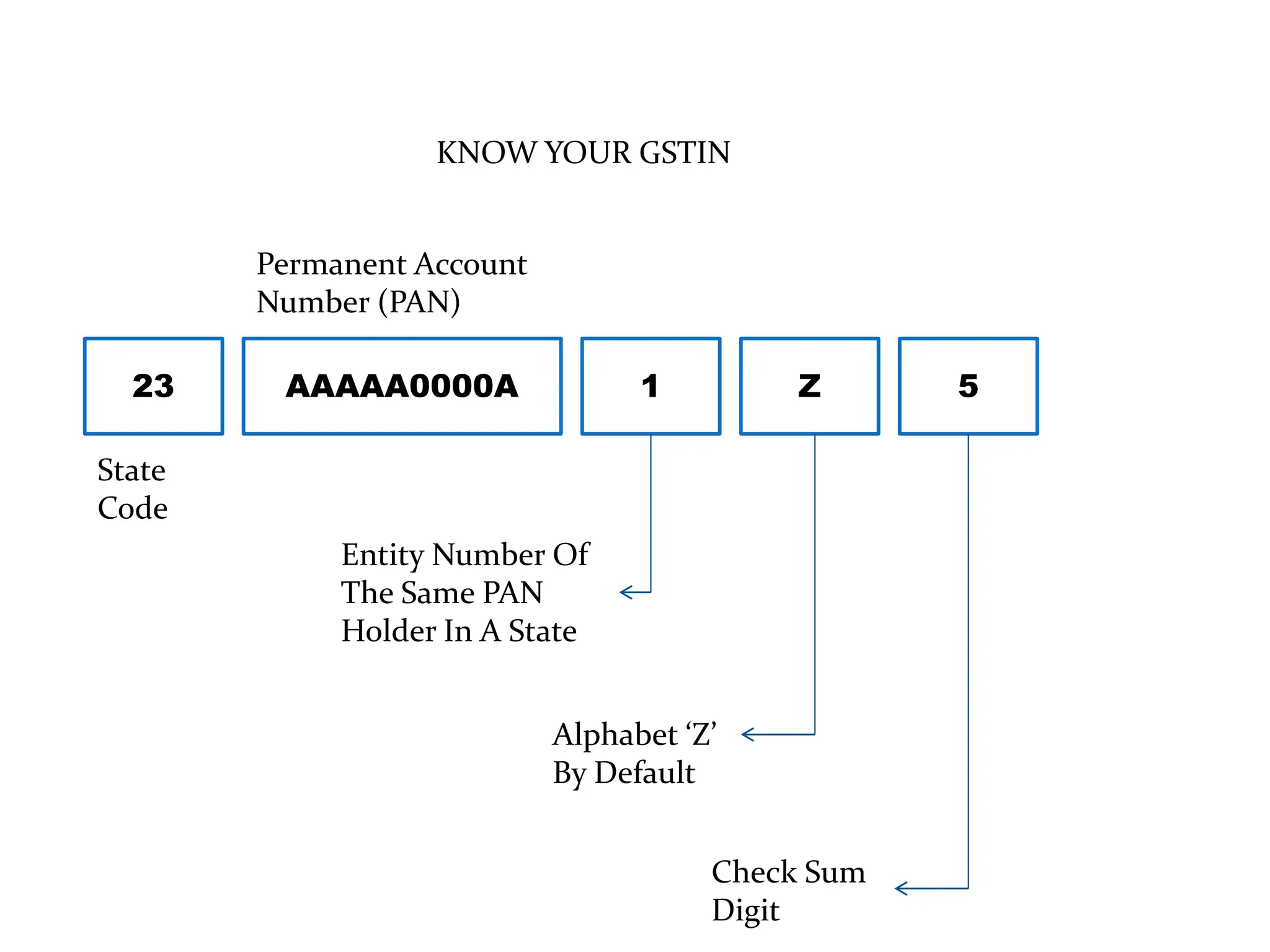

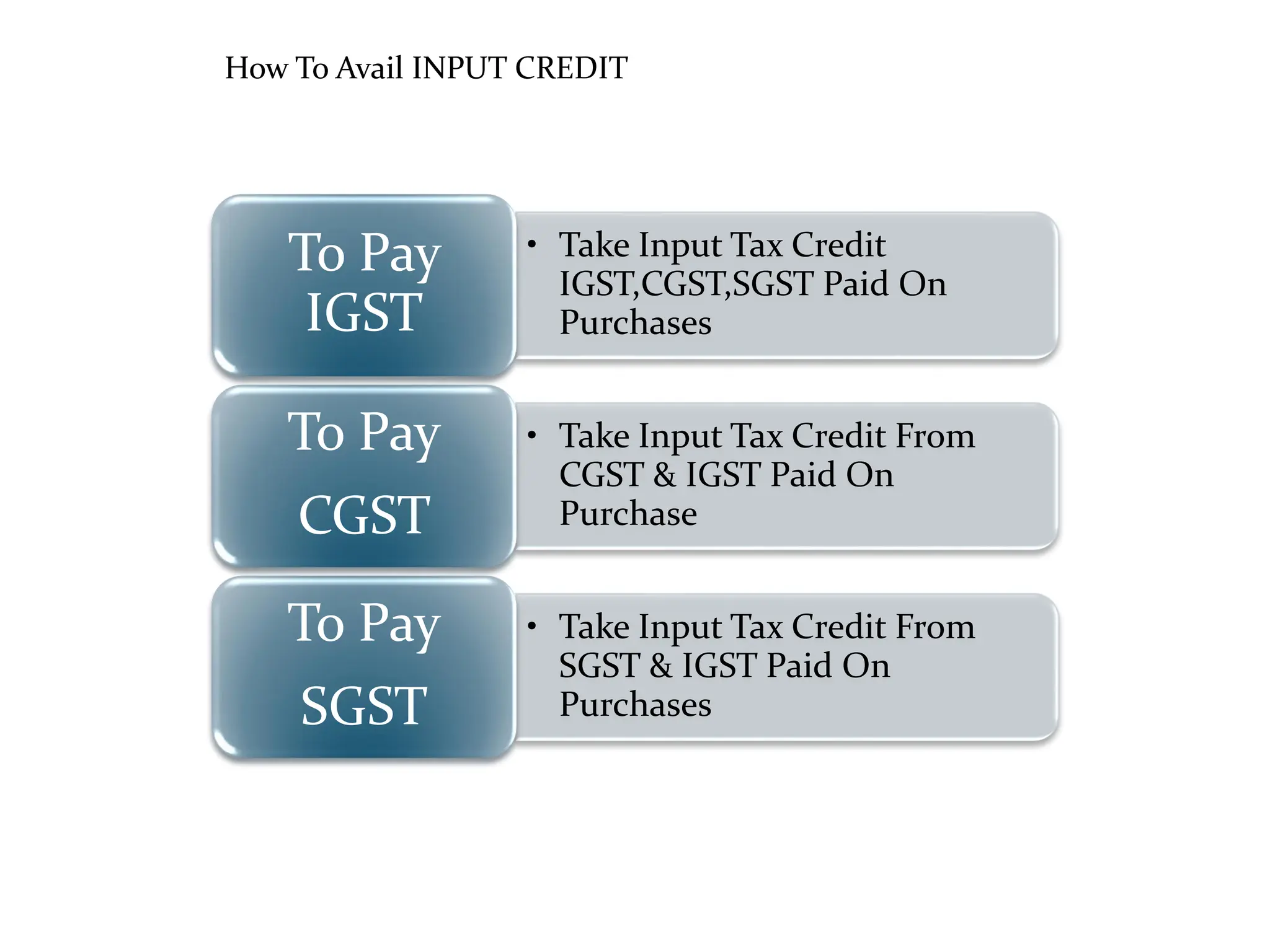

Tally is accounting software that helps businesses manage their finances. It provides features like accounting vouchers, inventory management, payroll, taxation compliance, and financial reports. Tally can be accessed remotely and supports multiple users across locations. It has predefined groups and accounts to easily organize financial transactions. Tally also helps businesses comply with Goods and Services Tax requirements in India through features like generating GSTIN numbers and claiming input tax credits.