This document provides information about completing a Business Activity Statement (BAS) for the New Tax System commencing July 1, 2000. It outlines key elements of the BAS including reporting Goods and Services Tax (GST), Pay As You Go (PAYG) Withholding, PAYG Instalments, Fringe Benefits Tax, and other taxes. It defines important terms like entities, Australian Business Numbers, and GST registration. The document is intended to raise awareness of how the new BAS reporting system may impact businesses and other organizations.

![Business Activity Statement Adviser Education Programme

8

TAX REFORM

GOVERNMENT ASSISTANCE INITIATIVES

The role of the Australian Taxation Office

The Australian Taxation Office [ATO] has the role of providing guidance and assistance

with technical changes that will arise from the introduction of The New Tax System.

The assistance provided by the ATO includes a range of publications from general

purpose guides, to industry and sector specific publications directed at the specific issues

to be addressed by specific industries and community groups.

The ATO is also providing a wide range of seminars to assist with the introduction and

implementation of the changes.

To obtain details of publications, seminars and other assistance available from the ATO

the following options are available:

Website www.taxreform.ato.gov.au

The business Tax Reform Infoline 13 24 78

A fax from tax 13 28 60

By mail PO Box 9935 in capital cities

The GST Start-Up Assistance Office

To obtain further information visit the GST Start-Up Assistance Office website at

www.gststartup.gov.au or call their enquiry line on 02 6263 4490.

To enquire about, or register for, for the Adviser Education Programme phone 1800 351 754](https://image.slidesharecdn.com/basworkbook-150922061609-lva1-app6892/85/Bas-workbook-8-320.jpg)

![Business Activity Statement Adviser Education Programme

10

Australian Business Number

The Australian Business Number (ABN) is critical to the operation of the GST system, as

every entity that is registered for GST will have an ABN and this is the number that must

be quoted on all your tax invoices.

Even where an entity chooses not to register for GST, it may still wish to apply for an

ABN. The ABN registration form includes the option to register for GST.

The Australian Business Number (ABN) will enable organisations in Australia to deal

with the ATO and a range of government departments or agencies using the one number.

As a general rule organisations should register for an ABN even if they do not register for

GST. Where an enterprise fails to obtain an ABN there may be financial consequences.

If the organisation does not have an ABN, or does not provide that number to other

businesses to whom it supplies goods and services, those businesses ordinarily will be

required to deduct withholding tax from payments to that business. There are very limited

exceptions to the rule. This withholding tax is 48.5cents in the dollar.

An organisation will also need to show its ABN on the tax invoices it issues to its GST

registered clients.. If it doesn’t, the document will not constitute a tax invoice (even if so

described) and its registered customers would not be able to claim input tax credits.

The ABN will not replace a tax file number, so tax file information will still be protected

by the existing privacy guidelines.

The ABN will be replacing the Australian Company Number [ACN] over time, and from

1 July it will be allowable to quote the ABN in the place of the ACN](https://image.slidesharecdn.com/basworkbook-150922061609-lva1-app6892/85/Bas-workbook-10-320.jpg)

![Business Activity Statement Adviser Education Programme

14

Goods and Services Tax

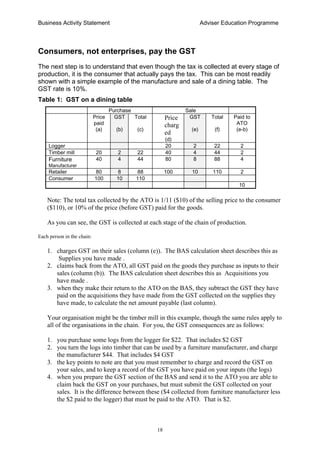

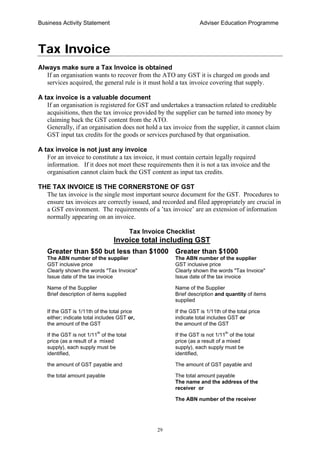

EXTRACT FROM THE BAS

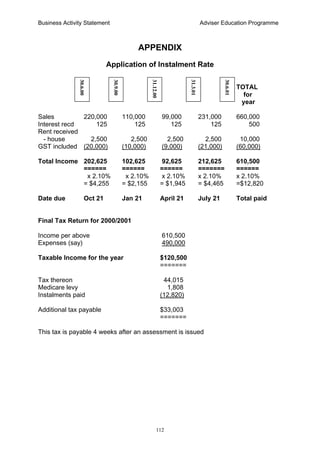

Boxes 1A and 1B plus G1 to G20 on the Business Activity Statement relate to the Goods

and Services Tax transactions for the relevant period, monthly or quarterly.

An Instalment Activity Statement will not have any GST boxes to complete. This is

because an IAS is only available to those taxpayers that are not registered for GST.

A brief overview of these items follows. It is necessary to accurately accumulate the

relevant information in your accounting records in order to establish your liability for GST

in respect of the current reporting period.

Supplies you have made

This section of the BAS determines the GST you have charged your customers [non cash

basis], or collected from your customers [cash basis]. The form takes all supplies made

by the organisation, deducts supplies not subject to GST, and divides the result by 11 to

arrive at the GST collected or charged. The boxes are as follows:

G1 Total sales and income and other supplies, regardless of whether they are subject to

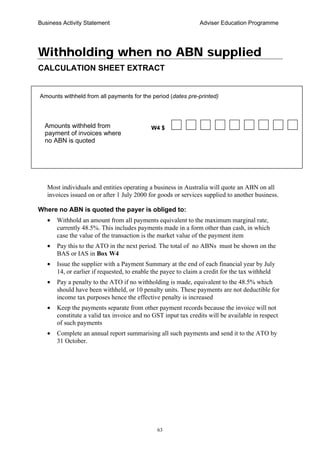

GST. Ensure that you include supplies made prior to 1 July 2000, on which you charged

GST

G2 Exports (GST-free). No GST is payable to the ATO on this figure.

G3 Other GST-free supplies. No GST is payable to the ATO on this figure.

G4 Input taxed sales and income and other supplies (other than exports and GST-free

supplies) on which you have not charged GST.

Add 1B+1D+1F+1G=2B $

Credit for goods and

services tax paid 1B $

Wine equalisation tax

refundable 1D $

Wine equalisation

tax payable 1C $

Luxury car

tax payable 1E $

Luxury car tax

refundable 1F $

Add 1A+1C+1E = 2A $

2A minus 2B

GST net amount 3$

Goods and services

tax payable 1A $

Credit for wholesale

sales tax 1G $](https://image.slidesharecdn.com/basworkbook-150922061609-lva1-app6892/85/Bas-workbook-14-320.jpg)

![Business Activity Statement Adviser Education Programme

16

Acquisitions you have made

The purpose of this section of the form is to identify the GST your customers have

charged you [non-cash basis] or that you have paid to your customers [cash basis] that you

are entitled to claim back from the ATO. This is achieved by taking the total of

acquisitions by the registered person, deducting all acquisitions on which no GST has

been charged, and dividing the result by 11 to obtain the GST that can be claimed

The boxes on the form are as follows:

G10 Capital acquisitions.

G11 All other acquisitions. Ensure that you include supplies on which you have paid GST

prior to 1 July 2000

G12 Add G10 and G11 to provide the total of all acquisitions for the period.

G13 Acquisitions for making input taxed supplies as well as other supplies in respect of

which GST credits are not claimable.

G14 Acquisitions with no GST in the price, therefore no credit available.

G15 Total of estimated private use of acquisitions as well as expenses which are not

deductible for income tax purposes — no credit available.

G16 Add G13+ G14 +G15 to provide the total of your non-creditable acquisitions on

which you may not claim any input tax credits.

G17 G12 minus G16 to provide the total of your creditable acquisitions for the period.

Input tax credits are claimable on this figure subject to any adjustments arising out of

transactions reported in a previous period.

G18 Adjustments to previously reported acquisitions you have made.

G19 Add G17 + G18 This is the total of your creditable acquisitions after adjustments.

G20 Divide G19 by 11 to provide the total GST credit available to you for the current

reporting period.

Transfer the figure in G20 to BAS Box 1B.](https://image.slidesharecdn.com/basworkbook-150922061609-lva1-app6892/85/Bas-workbook-16-320.jpg)

![Business Activity Statement Adviser Education Programme

26

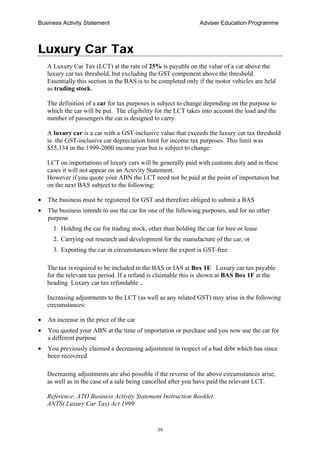

The Tax Fraction

The tax fraction can be important:

• In isolating the GST content of a transaction; and

• Identifying the true 'income' and 'expenditure' of the organisation.

Total price includes cost

Because 10% is added to the value of a taxable supply, the GST component of the GST

inclusive price is 1/11th of that price; the rest (10/11ths) is the value before GST.

In relation to that supply, that remaining 10/11ths of the price is the supplier’s real ’income’

as the GST collected must be remitted to the ATO.

Similarly for the acquirer of the supply, that remaining 10/11ths of the price is ordinarily

the true cost of the taxable supply as the GST content is recoverable from the ATO.

With any taxable supply you typically would find:

GST exclusive price $10 [10/11ths]

Plus GST 10% $ 1 [1/11th: The tax fraction]

GST inclusive price $11

Example

John Brown is registered for GST and sells 10 widgits to Ann Jones who also is registered

for GST. The value of the supply is $150.00 and John adds 10% GST [$15] and charges Ann

a price of $165.00.

When John completes the GST portion of the BAS he will disclose the total of his taxable

supplies for the tax period. He will calculate 1/11th [the tax fraction] of the total which

includes the price he charged Ann, so the 1/11th of that price [ie. $15] will be included in the

total GST on supplies made that he reports to the ATO, - in BAS Box G9.

The remaining 10/11ths of the price [$150.00] is the gross income that John receives from

the transaction.

When Ann completes the GST portion of the BAS she will disclose the total amount of her

acquisitions. She will calculate 1/11th [the tax fraction] of the total acquisitions which give

rise to input tax credits including the price she paid John in BAS Box G20. In this way she

will claim back from the ATO the $15 [1/11th of $165.00] GST she was charged by John.

The remaining 10/11ths [$150.00] is the actual acquisition cost of the item to Ann.](https://image.slidesharecdn.com/basworkbook-150922061609-lva1-app6892/85/Bas-workbook-26-320.jpg)

![Business Activity Statement Adviser Education Programme

33

The more accurate and detailed the source documents are, the more useful they become,

allowing more information to be held in one place. Where possible, source documents

should be cross-referenced to provide additional detail if required.

Examples of this may be a quote matched to the invoice, or alternatively a cheque number

written on an invoice when paid.

Tax Invoices

As we discussed earlier the tax invoice is the single most important source document in

any GST system. Procedures to ensure tax invoices are collected, issued and stored

appropriately are crucial in a GST environment. The requirements of a tax invoice are an

extension of information held on a normal invoice.

Cheque butts

Most payments that an organisation makes are made through a bank account using

cheques. The cheque butt provides an opportunity for the organisation to record

information about each payment made. The cheque number is also unique and provides a

good tool for cross-referencing the payment against the tax invoice held.

Details that you may wish to write on each cheque butt are:

• Date

• Supplier

• Cheque total

• Any GST content, and whether (any part of) the payment relates to a supply that is

GST-free or input taxed.

Cash Payments

It is desirable that actual cash payments, including petty cash, should be kept to a

minimum. The reason is to ensure that there is a permanent source document that can

easily be referred to. As mentioned, payments by cheque allow the cheque butt to be used

as the source document. An equivalent methodology needs to be put in place if cash

payments must be made to ensure that those outgoings are correctly accounted for.

Drawing a cheque on the business account and banking it as part of normal sales could

achieve this.

If the payment covers an item that costs not more than $50 [including GST] it will not be

necessary to obtain a formal tax invoice from the supplier. However, a suitable

transaction receipt is still required for GST purposes.

For the preparation of the BAS there are certain details that need to be shown. There needs

to be a split between,](https://image.slidesharecdn.com/basworkbook-150922061609-lva1-app6892/85/Bas-workbook-33-320.jpg)

![Business Activity Statement Adviser Education Programme

36

Because the various types of transactions need to be analysed into their GST effect there

need to be effective checks and balances in place.

At the end of any GST tax period, the balance in the GST accounts in the general ledger

[GST received from customers and GST paid to suppliers] should equal your GST refund,

or the total GST payable to the ATO, as disclosed by your workings on your BAS for the

period.

Checks and Balances

Every entity needs checks and balances to ensure everything is recorded accurately and in

the correct period. These are called controls. An essential control is the bank

reconciliation.

The bank reconciliation should be completed at least monthly and before any information

or reports are created. If the cashbook (or computer system) reconciles to the bank

statement then there is accurate information to generate reports on cash movements in the

entity. The cashbook will also give the information required for the BAS if the entity is

registered for GST on a cash basis. If the entity is registered for GST on a non cash basis,

then further information will be required.](https://image.slidesharecdn.com/basworkbook-150922061609-lva1-app6892/85/Bas-workbook-36-320.jpg)

![Business Activity Statement Adviser Education Programme

55

Contractors and Employees under

the New Tax System

When is an individual a contractor and not an employee ?

It is important for a payer to know whether a payee is classified as an employee or a

contractor for tax purposes. If the payee is an employee then the payer will be required to

deduct tax from the salary/wages at time of payment. Alternatively if the payee is a

contractor, tax will only be deducted at time of payment if the PAYEE fails to provide an

ABN. In this event tax will deducted at the rate of 48.5 cents in the dollar.

Who is an employee within the ordinary meaning of that expression?

There are definitions in the legislation and much case law but essentially there must be a

contractual relationship between an employer and an employee requiring the provision of

service on the part of the employee. This is a difficult area of tax law and is by no means

settled.

In essence this area of the law affects the contractor, and not the person using the

contractors services. Any individual holding themselves out as being a contractor should

familiarise themselves with the ATO s publications and rulings in this area. In particular

contractors should be familiar with Draft Ruling TR2000/D2, and the rulings relating to

entities [eg companies] that are interposed between the individual performing the services,

and the person who utilises those services.

Individuals who wish to operate as independent contractors would be advised to discuss

their individual situation with the ATO or their financial adviser.

Contractor or Employee?

ATO ruling

Control is a significant factor

If an employee — PAYG withholding

If a contractor — ABN required but no withholding

Organisations using the services of contractors, and not operating under a Voluntary

Agreement,[see page 56] will not be obliged to verify the status of people who hold

themselves out to be contractors. They should however ensure that they obtain an ABN if

no tax is deducted..](https://image.slidesharecdn.com/basworkbook-150922061609-lva1-app6892/85/Bas-workbook-55-320.jpg)

![Business Activity Statement Adviser Education Programme

58

Labour Hire Arrangements

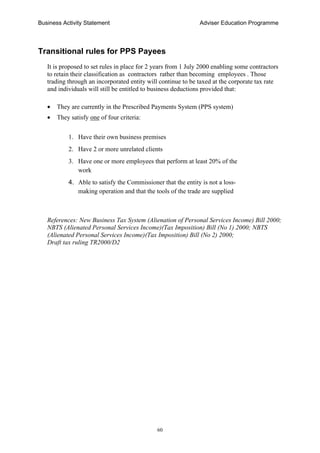

Labour hire arrangements involve 3 parties:

1. Labour Hire Firm

2. Client of the Labour Hire Firm

3. Worker (an individual) who is not an employee of either of the other 2 parties

They involve at least 2 contracts:

1. Between the Labour Hire Firm and the client [numbering not quite right

here]

2. Between the Labour Hire Firm and the worker

A Labour Hire Firm is any firm that wholly or partially arranges for individuals to perform

work or services for their clients. If this activity is only incidental to your business then

you do not fit into this definition. The following examples where withholding tax does not

apply help to illustrate this point:

Example 1: Incidental use of a third party for a client

A solicitor using the services of a barrister for a client will not be required to

withhold tax from payments to the barrister.

Example 2: Contractor using a subcontractor on a project

A contractor using a subcontractor on a project commissioned by a client will not be

required to withhold tax from the payments under the labour hire arrangement rules.

However, there may be an obligation to withhold due to some other circumstance

such as the subcontractor not providing an ABN.

Example 3: Staff recruitment agency

The agency recruits a new CEO for a client. There will be no withholding obligation

on the part of the agency. The client will have a PAYG withholding obligation in

respect of its new employee (and possibly in respect of its payment of commission to

the agency if it fails to supply an ABN).](https://image.slidesharecdn.com/basworkbook-150922061609-lva1-app6892/85/Bas-workbook-58-320.jpg)

![Business Activity Statement Adviser Education Programme

115

Simplified GST Accounting Methods

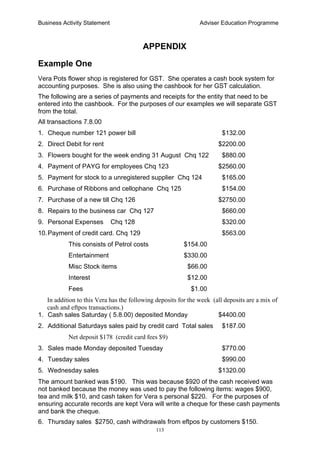

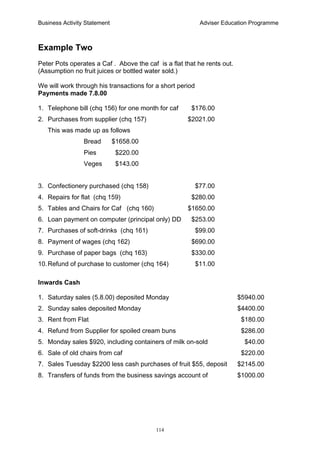

Hans operates a hot bread shop. He has registered for GST on a cash basis. The annual

turnover is approximately $350 000. He has not upgraded his till and is conscious that his

GST-free supplies and taxable supplies made will need to be recorded. What are his

options?

Under the Simplified GST Accounting method there are three options;

Example for Period

Total sales $160,000

Total stock purchases $55,000

Other acquisitions including GST $12,000

1. Business norm method

The ATO business norms for a hot bread shop are GST free sales 50%., GST free

purchases of stock 75%.

GST-free sales GST-free stock purchases

Business norms hot bread

shop

50% 75%

Implications for Hans $160,000*50% $55,000*75%

GST-free supplies $80,000 [sales] $41,250 [purchases]

Taxable supplies $80,000 [sales] $13,750 [purchases]

Taxable supplies made $80,000 Taxable acquisitions made Stock $13,750

Other $12,000

$25,750

2. Snapshot method

For the two weeks 1 June to 14 June Hans kept a detailed account of sales for the

period. The proportion of GST-free sales were 43.65% of total supplies made in that

time.

For the four weeks 1 June to 28 June Hans also kept a close record of all GST-free

purchases. These were 83.5% of all stock acquisitions.

Using the snapshot method

Total supplies made for period (as above $160,000)

GST-free supplies 160,000*43.65% equals $69,840.

Taxable supplies 160,000-69840 equals $90,160.

Total supplies acquired for period, Stock $55,000, Other acquisitions including GST

$12,000

GST-free stock acquisitions $55,000*83.5 equals $45,925

Taxable stock acquisitions $55,000-45,925 equals $9,075

Total taxable acquisitions $9,075 + $12,000 equals $21,075](https://image.slidesharecdn.com/basworkbook-150922061609-lva1-app6892/85/Bas-workbook-115-320.jpg)