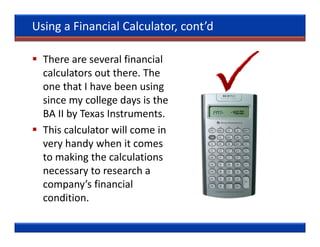

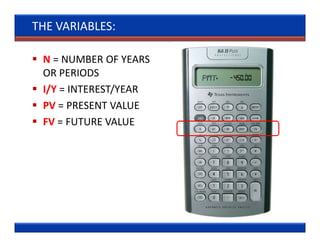

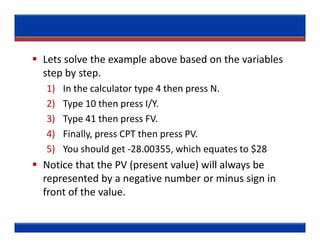

This document discusses how to use a financial calculator to analyze investments. It explains that financial calculators allow professionals to calculate annual rates of return, present value, and future value. The TI BA II is recommended as it can compute values like the present price of a stock given its desired future value, interest rate, and time period. Key variables in calculations include number of periods (N), interest rate (I/Y), present value (PV), and future value (FV). An example calculates the present value of a stock projected to be worth $41 in 4 years with a 10% annual interest rate.