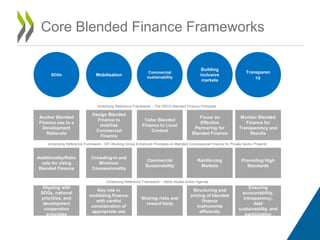

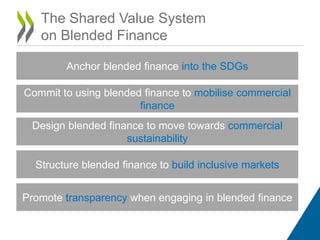

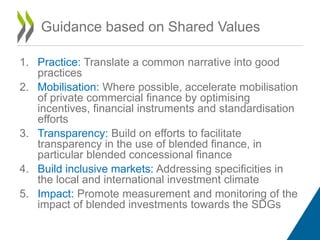

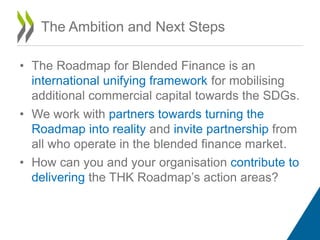

This document summarizes a panel discussion on the Tri Hita Karana Roadmap for Blended Finance. The roadmap aims to provide guidance for using blended finance to mobilize private investment towards sustainable development goals. It identifies five shared values: anchoring blended finance in SDGs; committing to mobilizing commercial finance; designing blended finance for commercial sustainability; structuring blended finance to build inclusive markets; and promoting transparency. The panel discussed next steps to implement the roadmap through good practices, accelerating private finance mobilization, increasing transparency, addressing local investment climates, and promoting impact measurement. The ambition is for the roadmap to provide an international framework for additional commercial capital towards the SDGs through partnership.