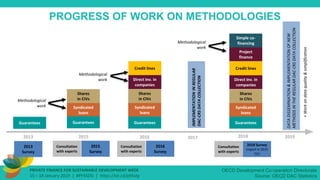

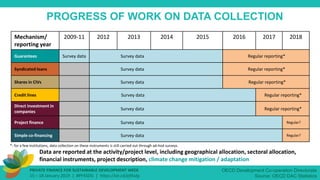

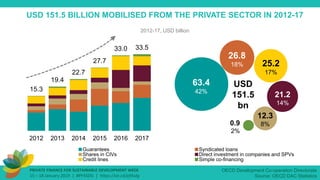

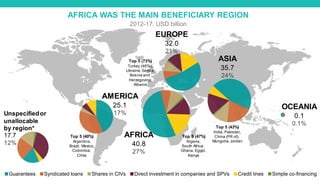

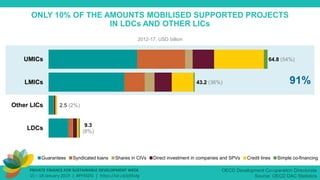

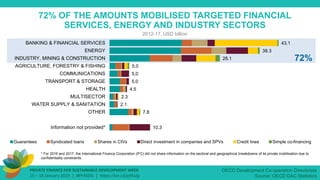

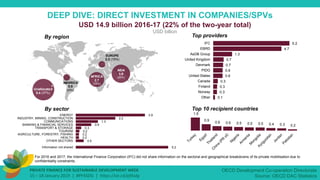

The document discusses work by the OECD Development Co-operation Directorate to develop an international standard for measuring private finance mobilized by official development finance interventions. So far, the work has focused on measuring direct mobilization, rather than broader catalytic impacts. Data is collected through surveys and the DAC reporting system, showing that over $150 billion was mobilized from the private sector from 2012-2017, primarily in financial services, energy, and industry sectors in Africa and Asia. Further efforts are needed to better measure impacts in least developed countries.