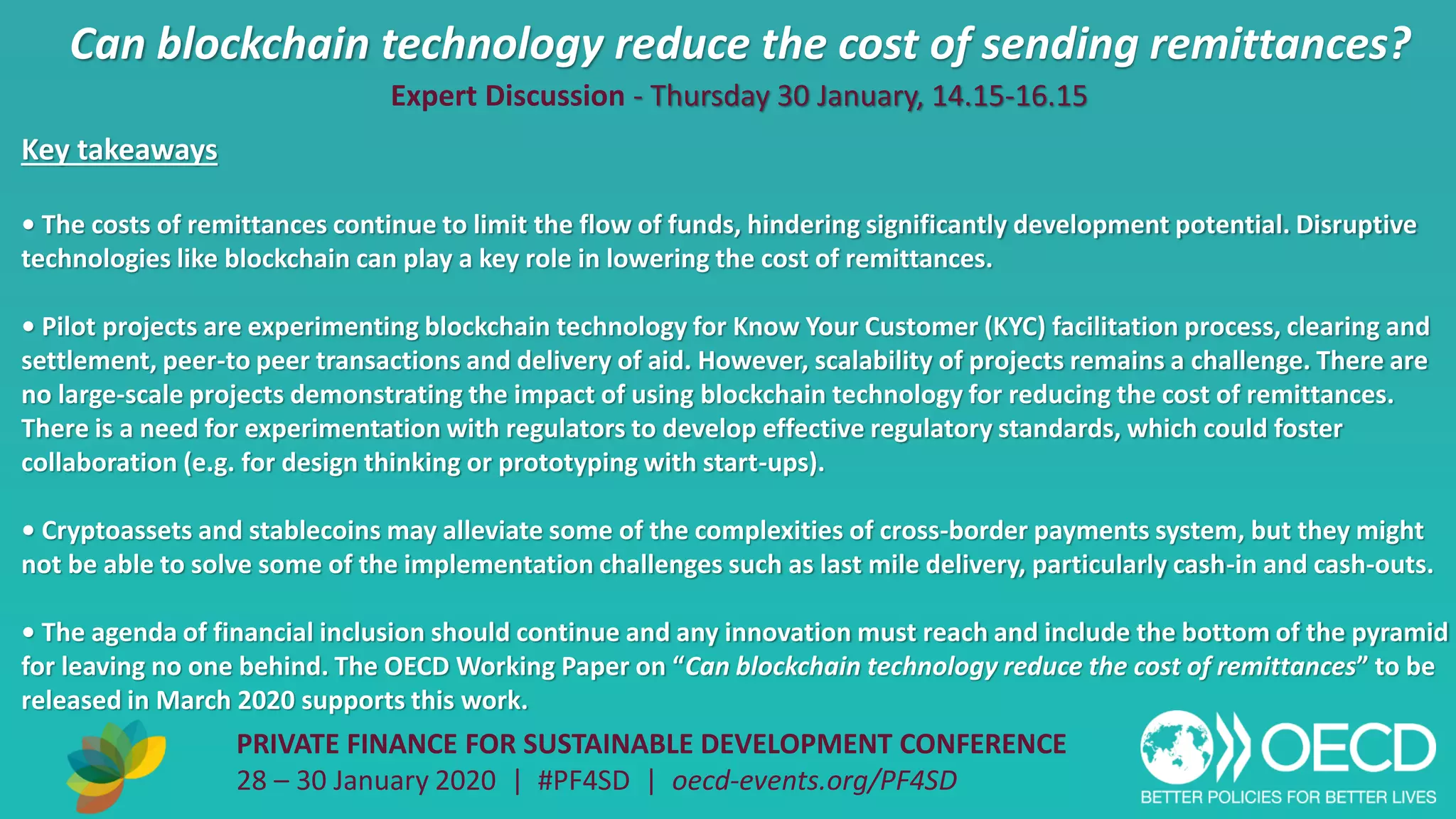

This document contains summaries from multiple expert discussions that took place at the Private Finance for Sustainable Development Conference from January 28-30, 2020. The discussions covered topics such as the role of international pension funds and domestic pension funds in financing sustainable development, the use of blended finance and impact measurement, aligning private finance with ocean conservation, and innovations to address foreign currency risks.