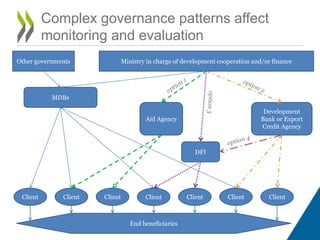

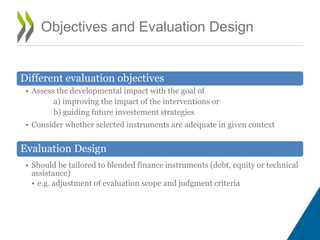

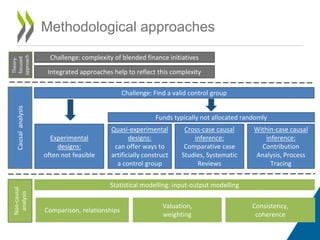

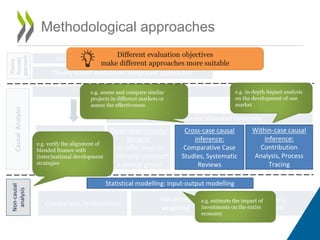

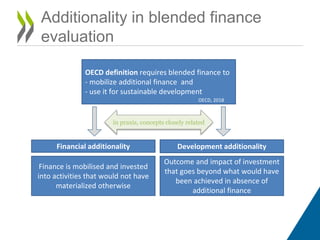

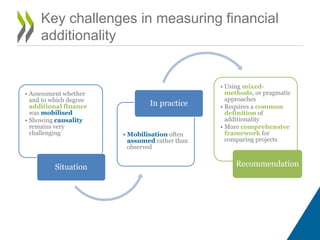

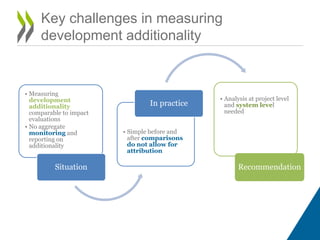

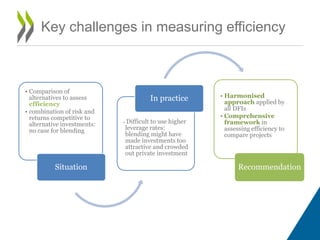

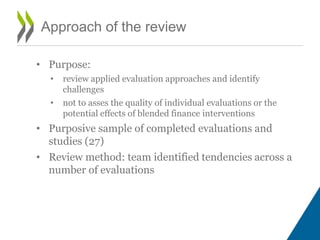

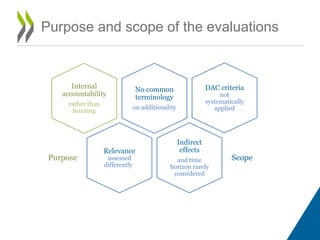

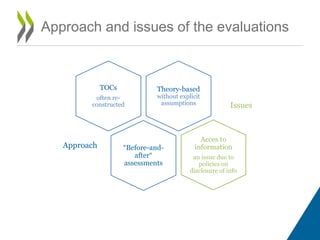

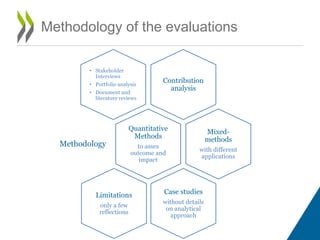

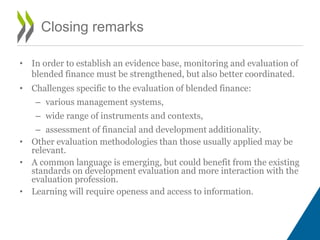

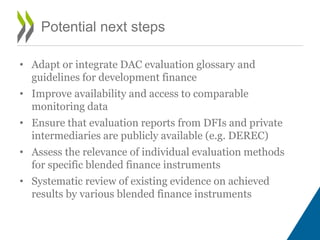

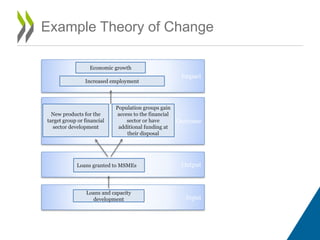

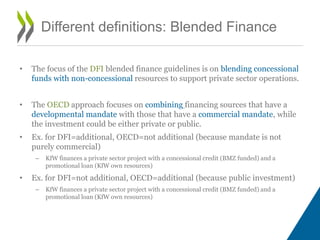

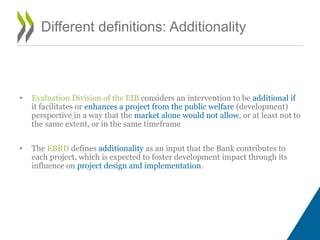

The document discusses the challenges of evaluating blended finance, including management and organizational diversity, methodological difficulties, and the need for stronger coordination in monitoring and evaluation practices. It highlights the necessity of definitions for additionality, as well as the varying approaches to evaluation among different financial institutions. The authors recommend enhancing access to data, adopting new methodologies, and fostering collaboration between stakeholders to improve the effectiveness of blended finance evaluations.