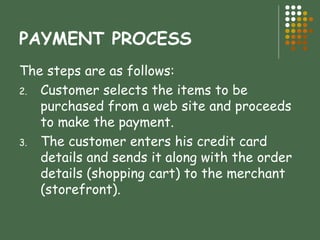

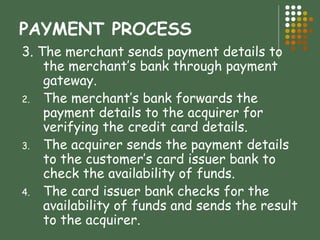

The document discusses electronic commerce (e-commerce), which involves buying and selling of products or services over electronic systems like the internet. It grew significantly with widespread internet usage. The document outlines the need for e-commerce and describes various business applications and types including B2B, B2C, C2B, and C2C. It also explains the online payment process between customers, merchants, and banks. E-commerce provides opportunities for direct sales and marketing but also faces constraints like delivery times and security issues.