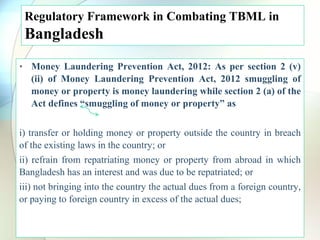

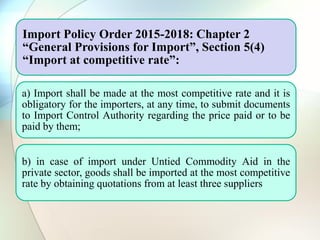

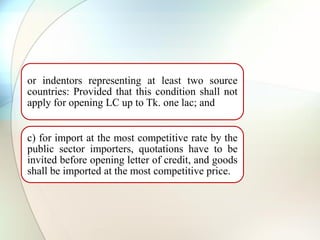

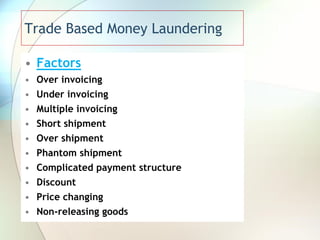

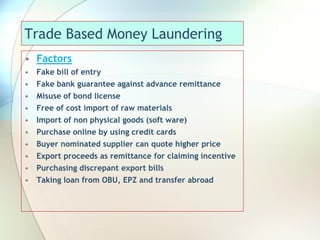

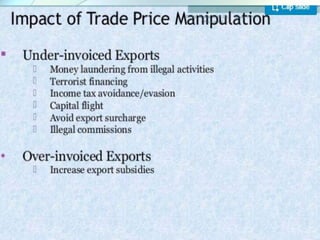

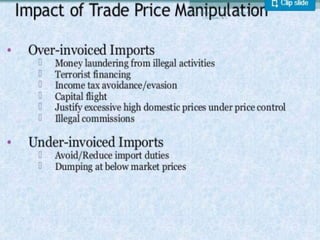

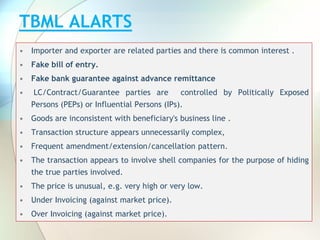

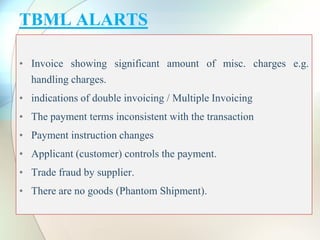

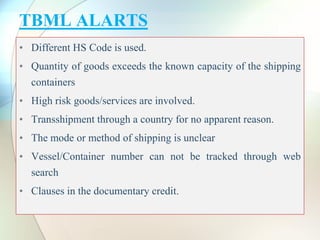

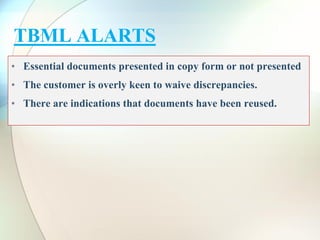

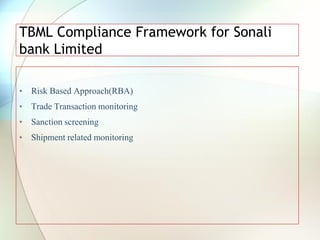

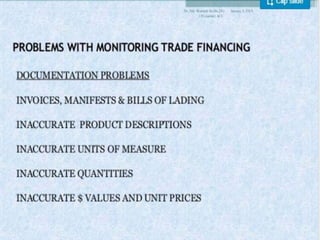

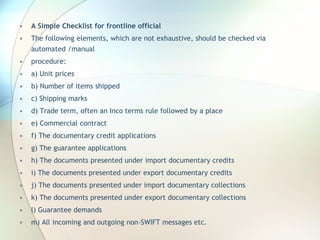

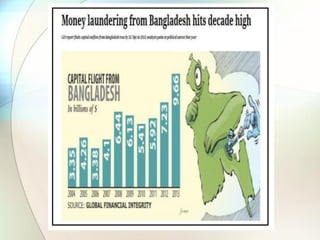

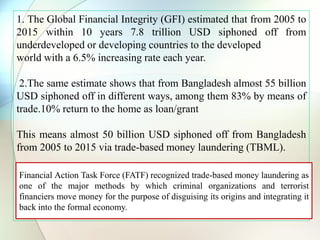

The document discusses trade-based money laundering (TBML) and the regulatory framework in Bangladesh to combat it. It notes that the Financial Action Task Force recognized TBML as a major method for criminal groups to launder money. It then summarizes that an estimate found nearly $50 billion was siphoned out of Bangladesh via TBML from 2005-2015, according to Global Financial Integrity. The document outlines various TBML risks and red flags that banks like Sonali Bank should be aware of to help prevent TBML and illicit financial outflows.

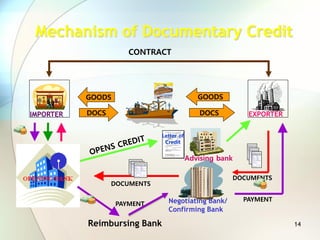

![Trade Payment Methods

• Cash in Advance

• Open Account

• Documentary Collection

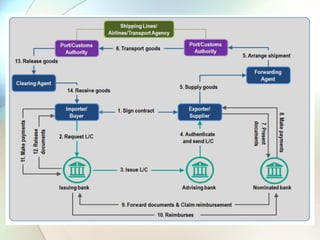

• Documentary Credit [LC]](https://image.slidesharecdn.com/14-230625200541-f377a5b0/85/Trade-Based-Money-Laundering-8-320.jpg)