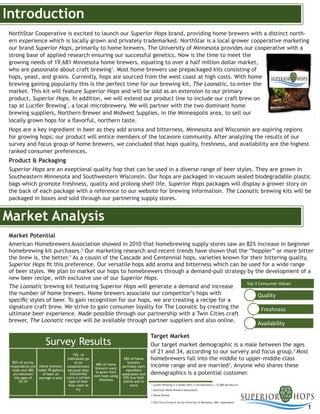

NorthStar Cooperative is launching a new hop brand called Superior Hops to sell to home brewers. They will package and sell their locally grown hops in individual packages and brewing kits. Their target market is male home brewers aged 21-34 in the Midwest. They have developed a signature brewing kit called The Loonatic using only their Superior Hops. Their goals are to partner with local homebrew suppliers to sell the kits and increase brand awareness of Superior Hops over three years as they expand their market regionally.