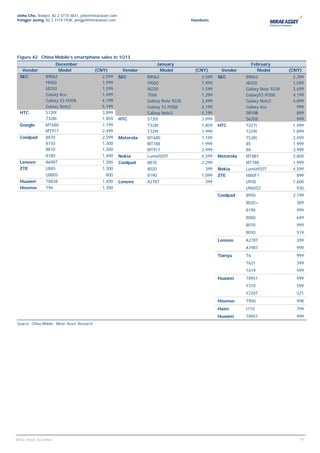

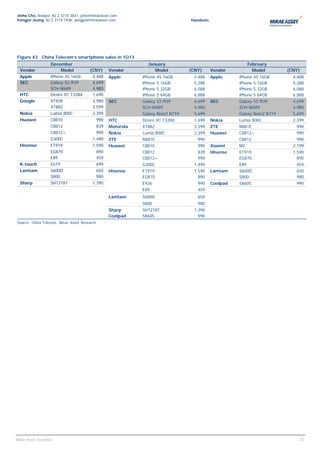

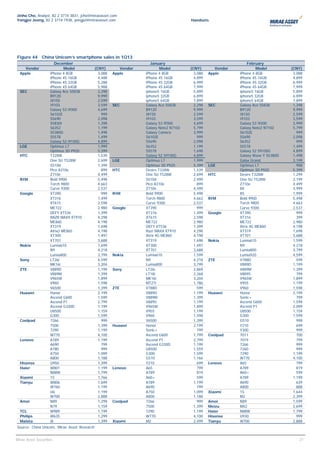

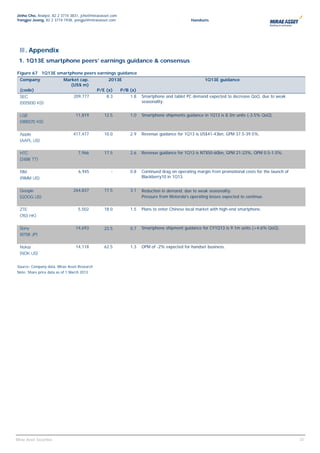

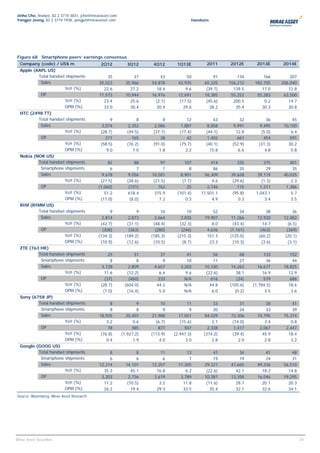

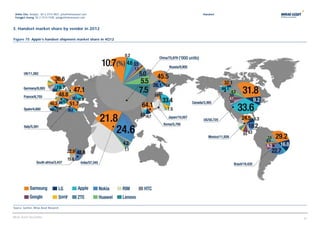

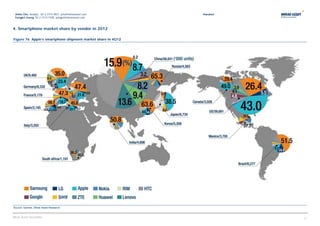

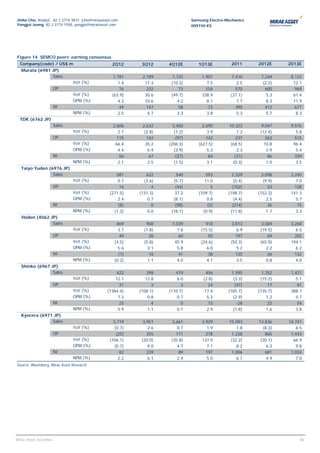

- Smartphone demand growth in 2013 will be driven by emerging markets like China, where demand is expected to increase by 56% year-over-year.

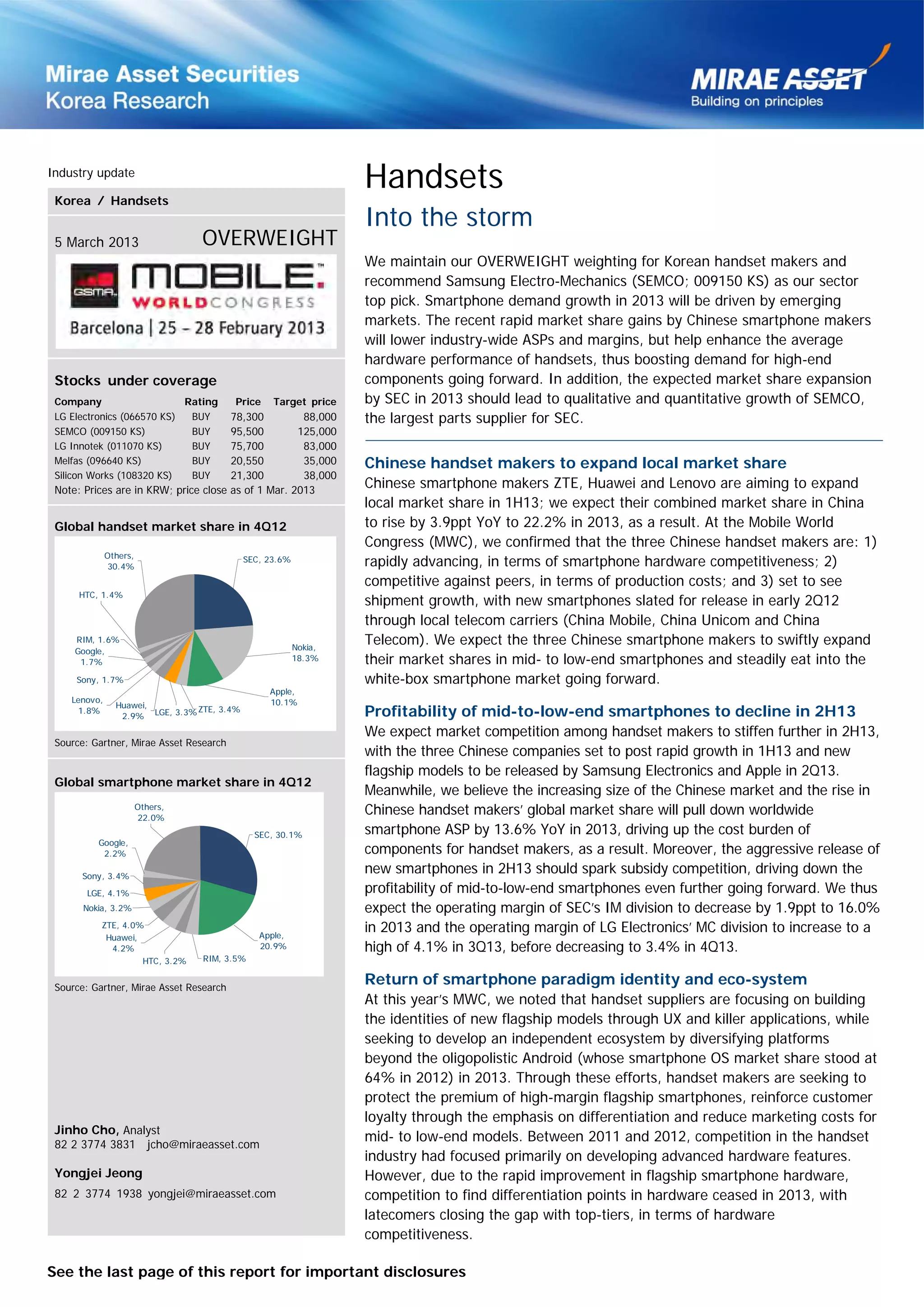

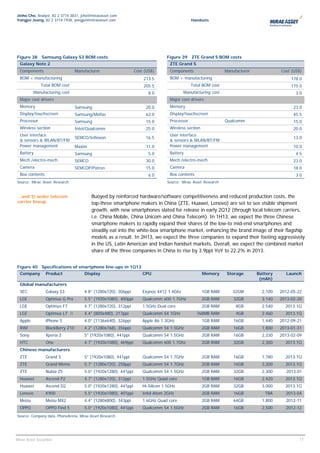

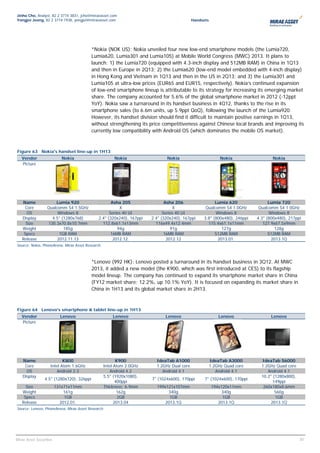

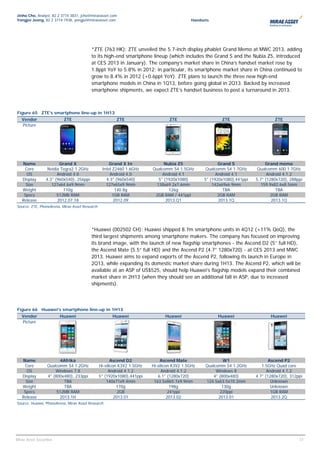

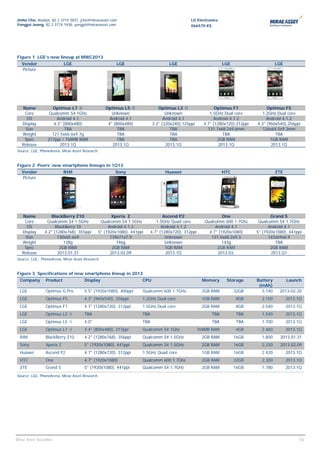

- Top Chinese smartphone makers ZTE, Huawei, and Lenovo aim to expand their combined market share in China to 22.2% in 2013 through new smartphone releases.

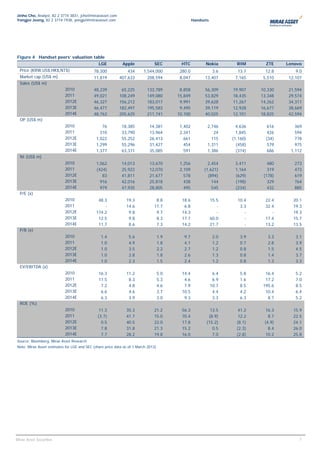

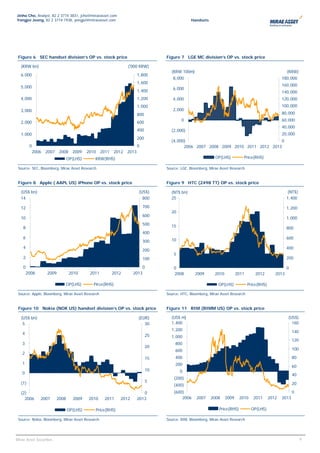

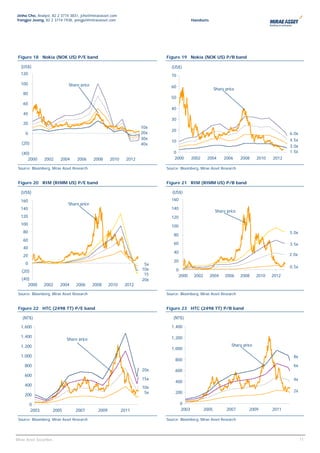

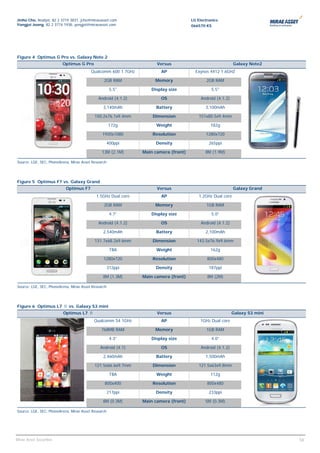

- Competition in the handset industry will intensify in the second half of 2013, lowering industry ASPs and margins as Chinese makers expand globally. However, Samsung Electronics is expected to outperform peers due to its supply chain and cost competitiveness.

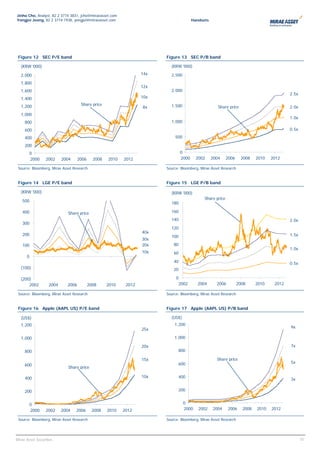

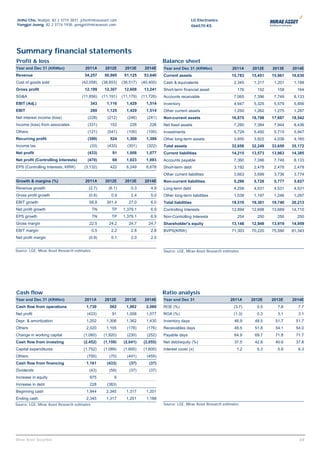

- The report recommends Samsung Electro-Mechanics as its top pick, expecting continued growth in Samsung's smartphone shipments to drive up

![Jinho Cho, Analyst, 82 2 3774 3831, jcho@miraeasset.com Handset

Yongjei Jeong, 82 2 3774 1938, yongjei@miraeasset.com

Recommendations

By stock (12 months) By industry

Buy: A target price + 10% or more above the current price, Overweight: over +10% of the current industry index

Hold: Target price within - 10% to +10% of the current price Neutral: -10% to +10% of the current industry index

Reduce: A target price of –10% or less below the current price Underweight: -10% or less than the current industry index

Compliance Notice

This report is distributed to our clients only, and none of the report material may be copied or distributed to any other party. While Mirae Asset Securities have taken all

reasonable care to ensure its reliability, we do not guarantee that it is accurate or complete. Therefore, Mirae Asset Securities shall not be liable for any result from the

use of this report. This report has never been provided to any institutional investor or third party. This report has been prepared without any undue external influence or

interference, and accurately reflects the personal views of the analyst on the company herein. [Analyst: Jinho Cho, Yongjei Jeong]

Securities Held by the Analyst Holdings of Participation

Involvement Treasury

Number of Purchase Purchase share of in Issuance of

Stock Analyst Type with Affiliates Stock Held

Shares Price Date over 1% Securities

REMARK: Korean analyst is responsible for Korean securities and relevant sectors only.

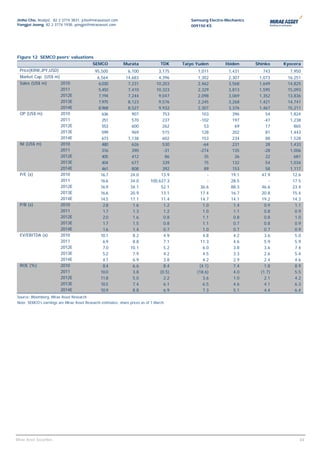

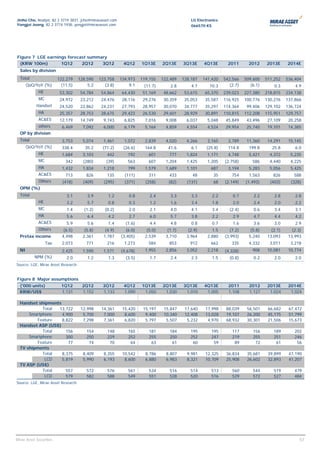

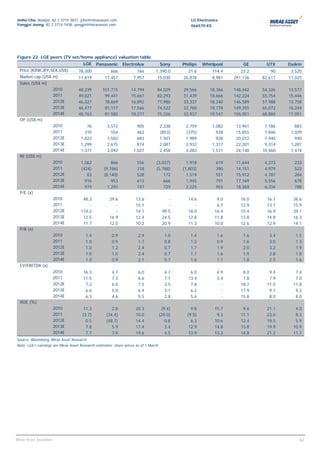

Target Price and Recommendation Chart

Stock Price & Target Price TrendStock PriceTarget Price Samsung Electro-Mechanics (009150 KS)

■ B - Buy■ H - Hold■ R - Reduce

12M target price

Date Recommendation

(KRW)

2012-11-28 BUY (Initiate) 125,000

140000 B 2013-01-03 BUY 125,000

2013-02-01 BUY 125,000

120000 2013-02-14 BUY 125,000

2013-03-05 BUY 125,000

100000

80000

60000

40000

20000

0

Feb-12 Aug-12 Feb-13

Stock Price & Target Price TrendStock PriceTarget Price LG Electronics (066570 KS)

■ B - Buy■ H - Hold■ R - Reduce

12M target price

Date Recommendation

(KRW)

100000 B

2012-11-28 HOLD (Initiate) 79,000

90000 2012-12-07 HOLD 79,000

2013-01-03 HOLD 79,000

80000

2013-01-31 HOLD 79,000

70000 2013-02-21 BUY 88,000(Up)

2013-03-05 BUY 88,000

60000

50000

40000

30000 H

20000

10000

0

Dec-11 Jun-12 Dec-12

2

Mirae Asset Securities](https://image.slidesharecdn.com/130305miraehandsets-intothestorm2-130322002943-phpapp01/85/130305-mirae-handsets-into-the-storm-70-320.jpg)