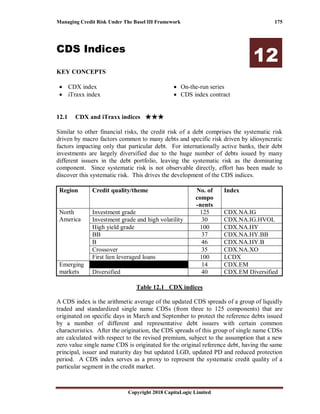

This document discusses credit default swap (CDS) indices, which are used as proxies to represent the systematic credit quality of segments in the credit markets. It describes the two main families of CDS indices - the CDX family covering North America and emerging markets, and the iTraxx family covering Europe, Asia, and countries. The indices are composed of liquidly traded single-name CDS contracts from representative debt issuers with common characteristics, and track the average CDS spreads across the component contracts. The two most popular indices are CDX and iTraxx.