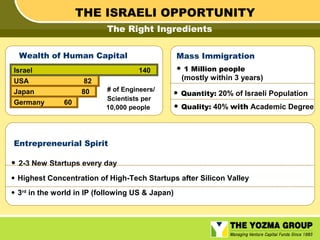

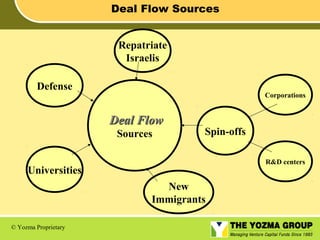

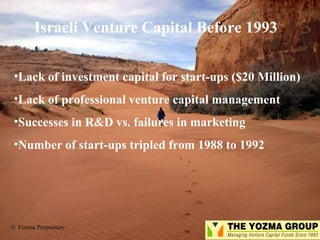

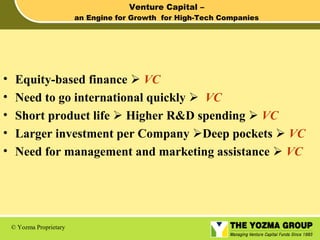

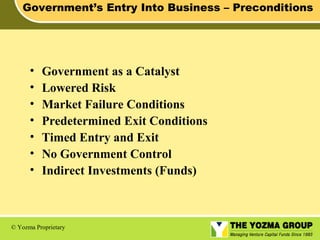

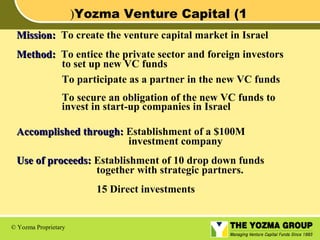

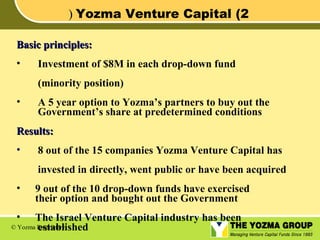

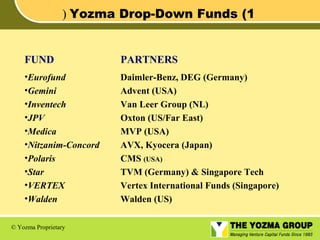

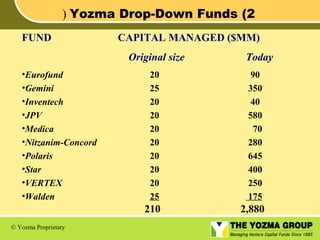

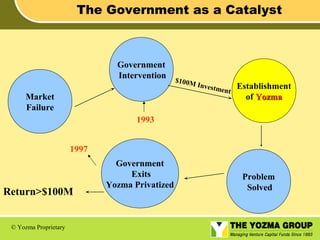

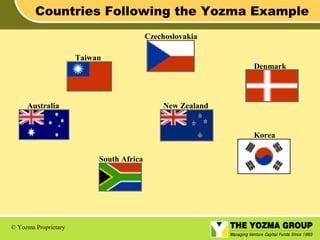

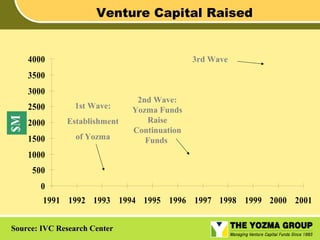

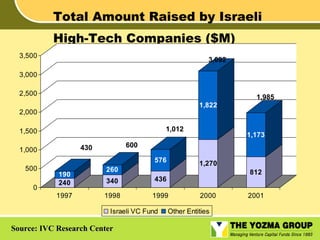

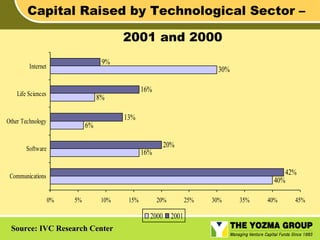

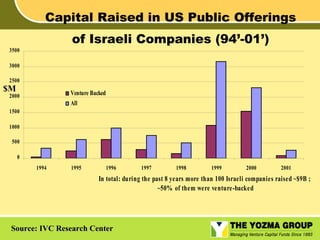

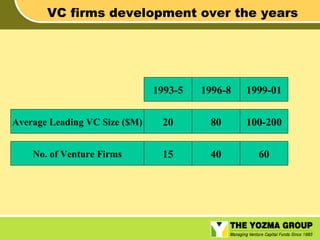

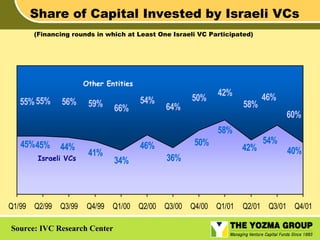

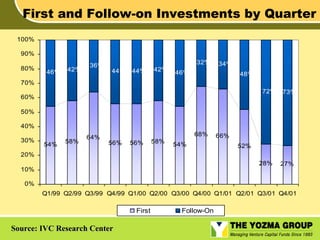

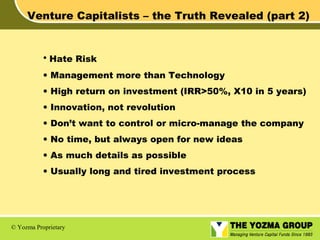

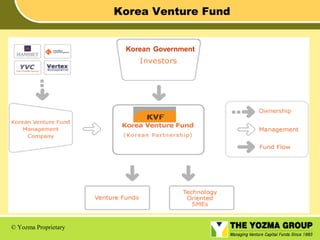

The document summarizes the success of Israel's Yozma program in establishing a venture capital industry. It discusses factors that contributed to Israel's startup ecosystem like high human capital. The Yozma program enticed private funds to invest in Israeli startups by partnering with them and guaranteeing investments. This helped grow Israel's venture capital industry from $20M to billions. Other countries emulated Yozma's model to spur high-tech growth. The program succeeded in catalyzing long-term private sector involvement in venture capital after the government's predetermined exit.