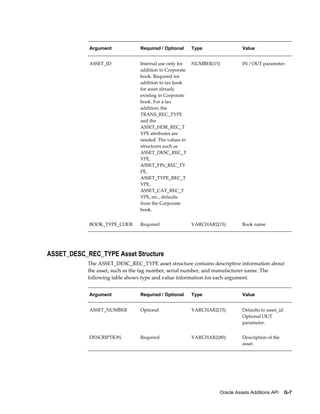

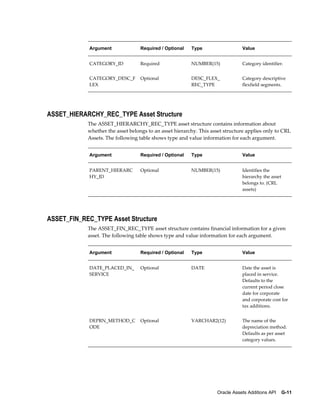

This document is the user guide for Oracle Assets Release 12. It describes how to setup and maintain assets in the Oracle Assets application. Key sections include adding assets individually or in bulk via the mass additions process, defining asset details and depreciation rules, performing adjustments, and adding assets in short tax years. The guide provides instructions for common asset management tasks in Oracle Assets.

![Accounting 6-43

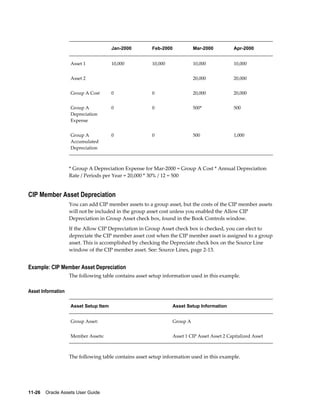

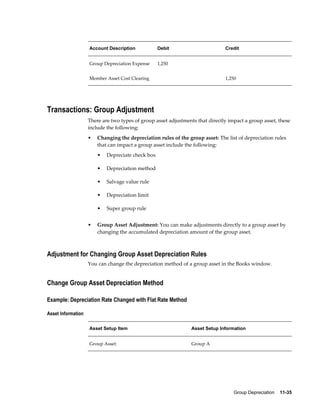

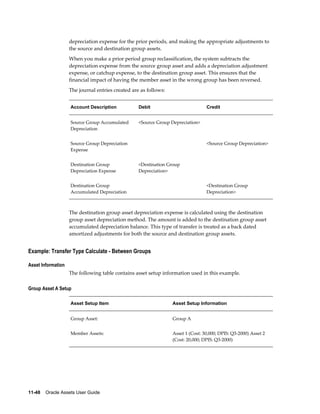

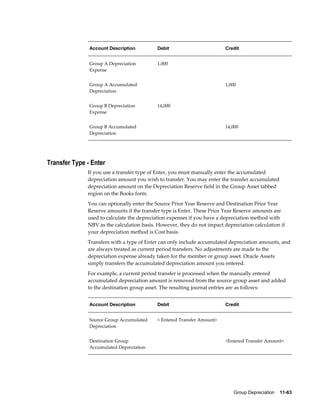

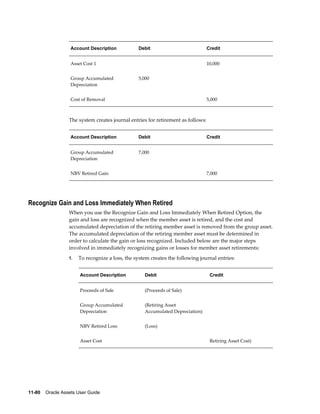

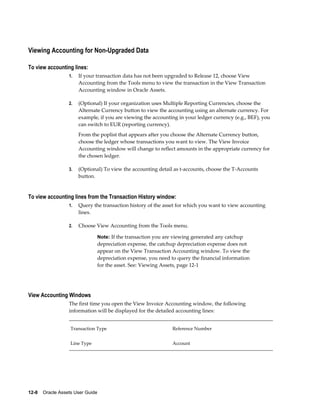

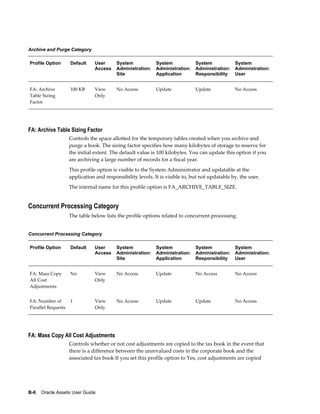

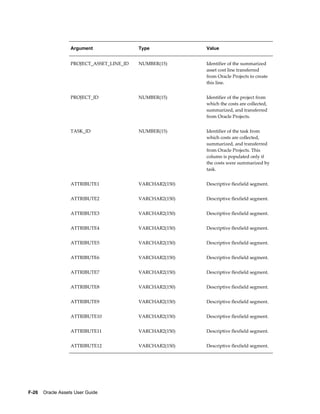

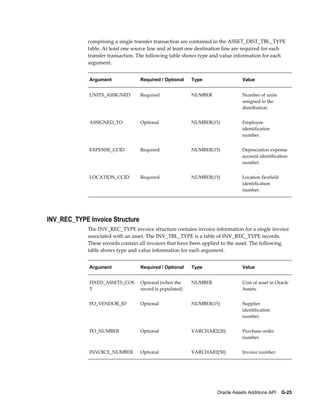

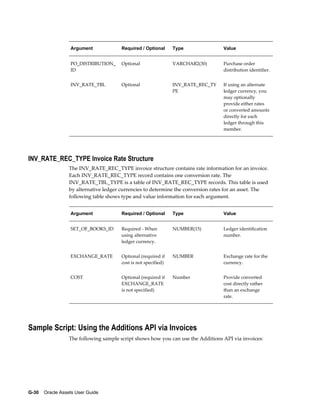

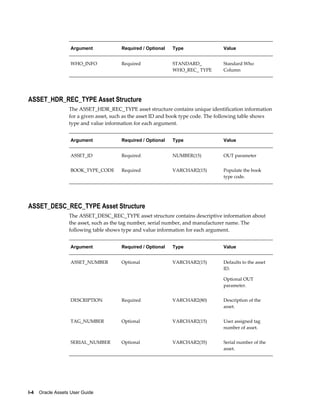

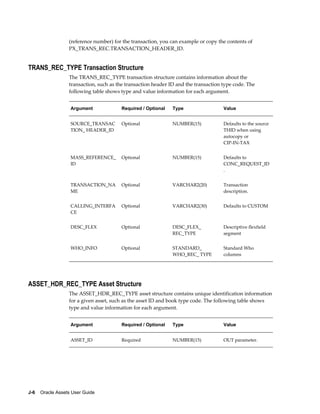

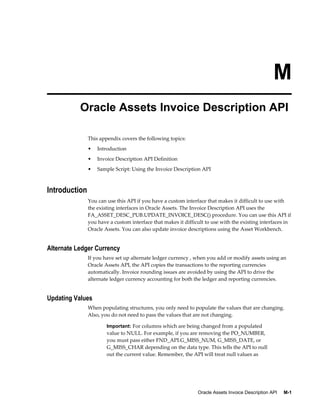

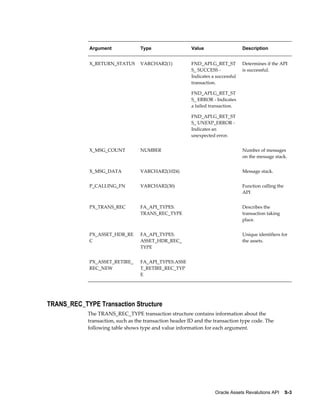

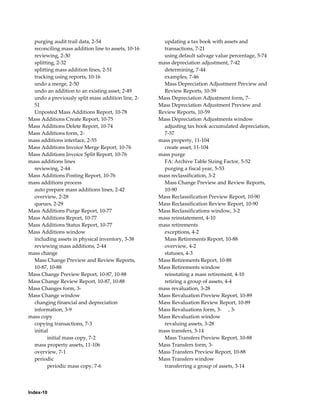

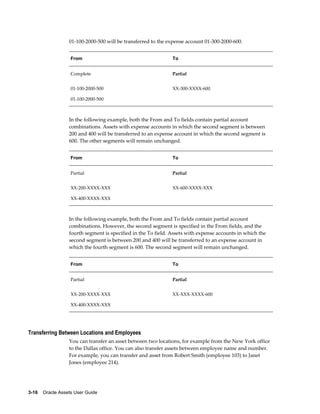

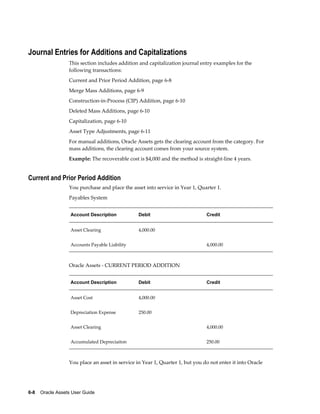

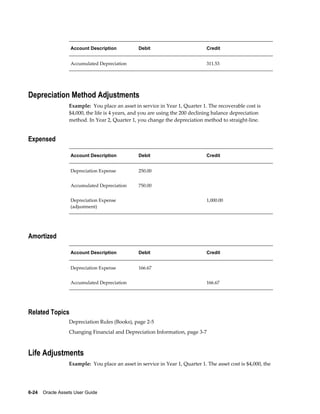

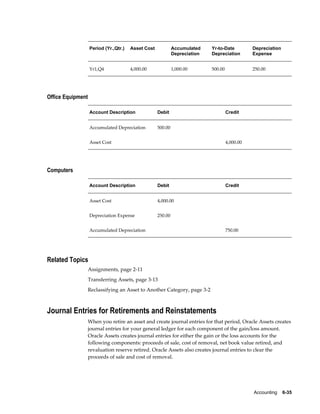

Period (Yr, Qtr.) Asset Cost Deprn. Expense Accum. Deprn. Reval. Reserve

Yr2,Q4 10,500.00 525.00 4,200.00 400.00

Yr3,Q1 10,500.00 525.00 4,725.00 400.00

Yr3,Q2 10,500.00 525.00 5,250.00 400.00

Yr3,Q3 10,500.00 525.00 5,775.00 400.00

Yr3,Q4 10,500.00 525.00 6,300.00 400.00

Reval. 2 -10% 9,450.00 0.00 *5,670.00 **-20.00

Yr4,Q1 9,450.00 472.50 6,142.50 -20.00

Yr4,Q2 9,450.00 472.50 6,615.00 -20.00

Yr4,Q3 9,450.00 472.50 7,087.50 -20.00

Yr4,Q4 9,450.00 472.50 7,560.00 -20.00

Yr5,Q1 9,450.00 472.50 8,032.50 -20.00

Yr5,Q2 9,450.00 472.50 8,505.00 -20.00

Yr5,Q3 9,450.00 472.50 8,977.50 -20.00

Yr5,Q4 9,450.00 472.50 9,450.00 -20.00

Retire 0.00 0.00 0.00 -20.00

REVALUATION 1

Year 2, Quarter 1, 5% revaluation

*Accumulated Depreciation = Existing Accumulated Depreciation + [Existing

Accumulated Depreciation x (Revaluation Rate / 100)]

2,000 + [2,000 X (5/100)] = 2,100](https://image.slidesharecdn.com/120faug-140313204117-phpapp01/85/120faug-347-320.jpg)

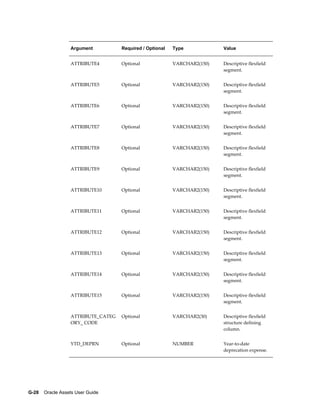

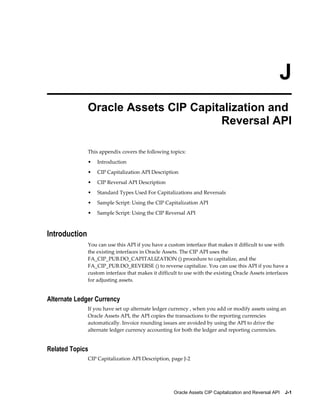

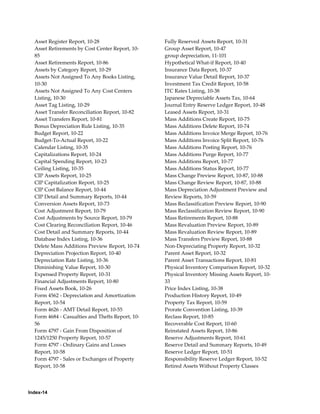

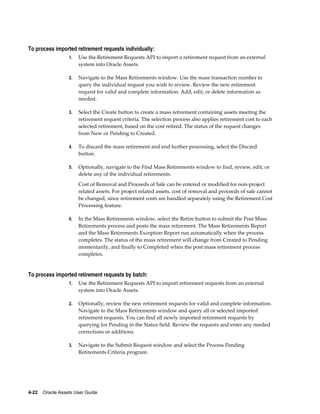

![9-86 Oracle Assets User Guide

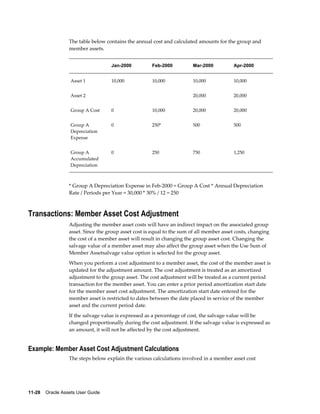

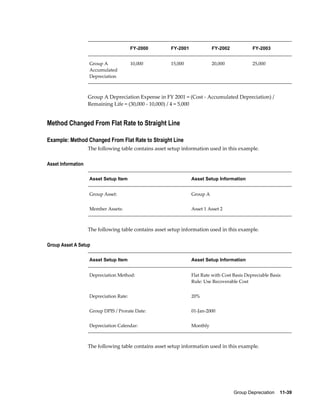

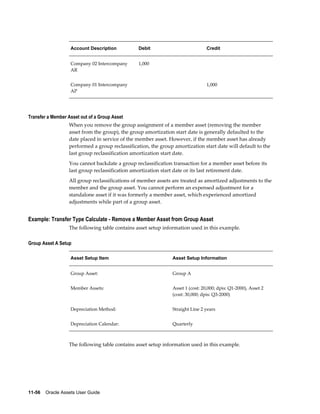

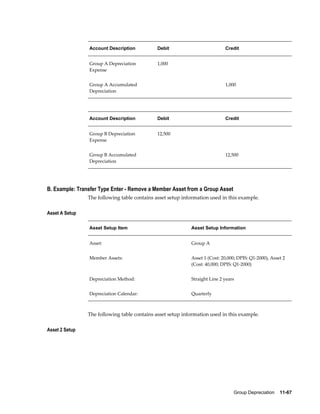

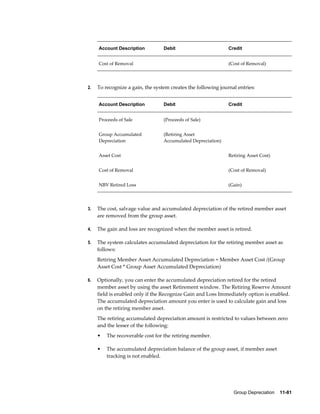

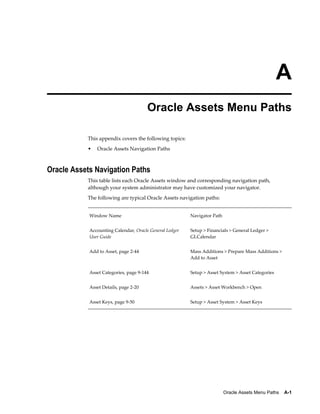

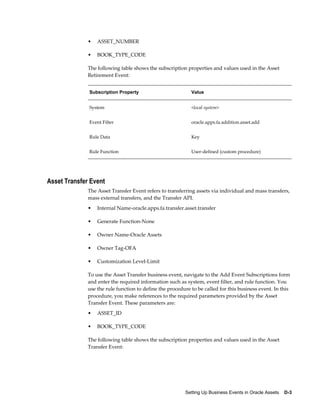

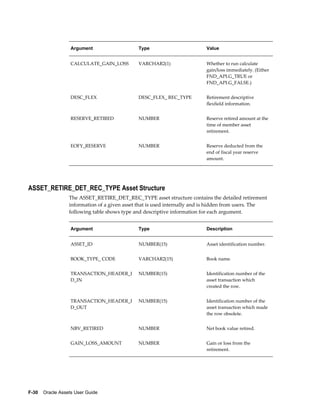

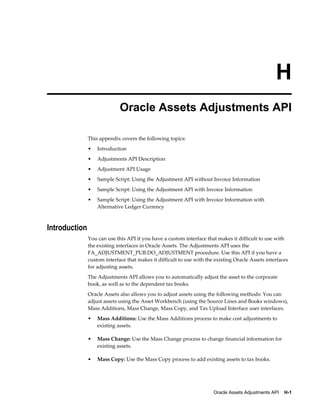

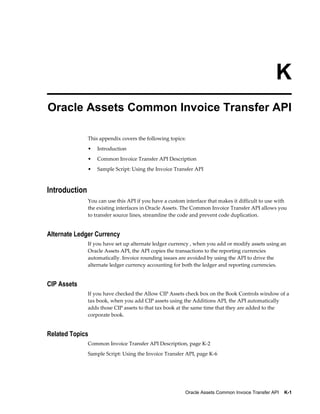

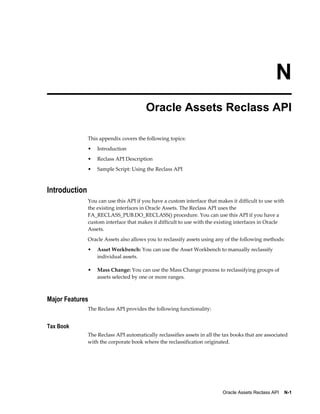

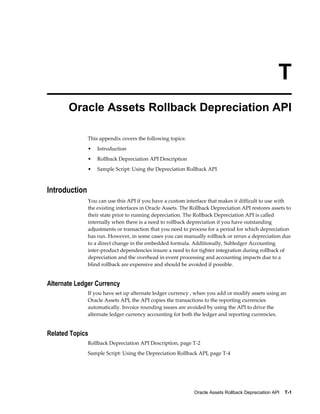

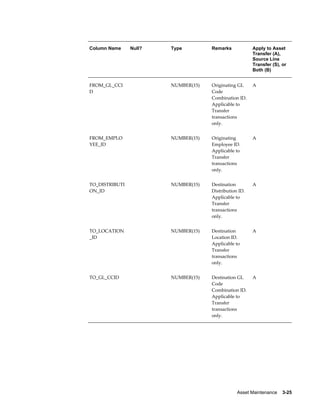

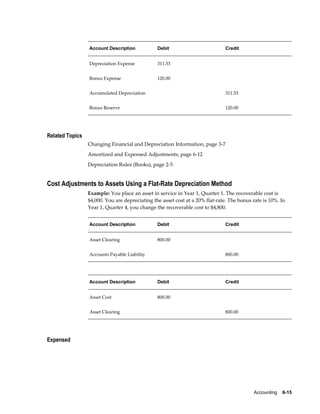

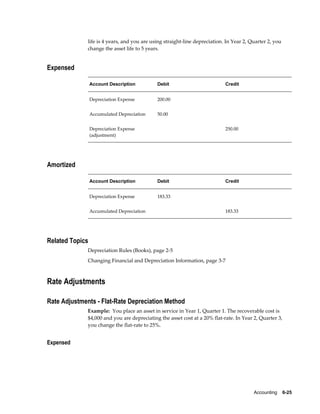

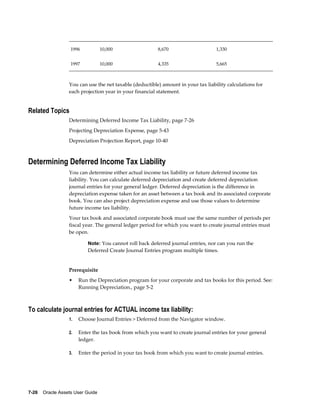

Asset Setup Item Asset Setup Information

Cost 1,000,000

Activity Amortized Adjustment: Method Change

Amortization Start Date: 01-JAN-2000

(Q1-2000)

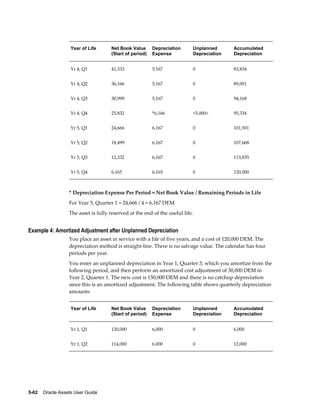

The table below illustrates depreciation calculated after the adjustment.

Period Cost Depreciable

Basis

Depreciation

Expense

Accumulated

Depreciation

Q4-1998 1,000,000 1,000,000 50,000 200,000

Q1-1999 1,000,000 800,000 40,000 240,000

Q2-1999 1,000,000 800,000 40,000 280,000

Q3-1999 1,000,000 800,000 40,000 320,000

Q4-1999 1,000,000 800,000 40,000 360,000

Q1-2000 1,000,000 540,000 33,750 393,750

Q2-2000 1,000,000 540,000 33,750 427,500

Q3-2000 1,000,000 540,000 33,750 461,250

Q4-2000 1,000,000 540,000 33,750 495,000

Q1-2001 1,000,000 540,000 33,750 528,750

Q2-2001 1,000,000 540,000 33,750 562,500

Q3-2001 1,000,000 540,000 33,750 596,250

Q4-2001 1,000,000 540,000 33,750 630,000

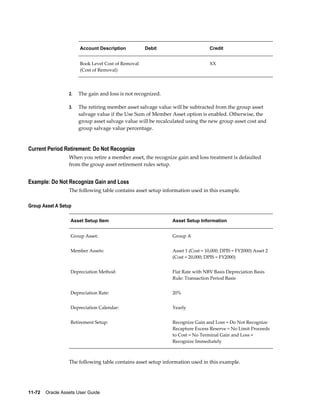

The following are calculations for the period Q1-2000:

• [Depreciable Basis] = (1,000,000 - [Salvage Value]) - [Accumulated Depreciation] +](https://image.slidesharecdn.com/120faug-140313204117-phpapp01/85/120faug-518-320.jpg)

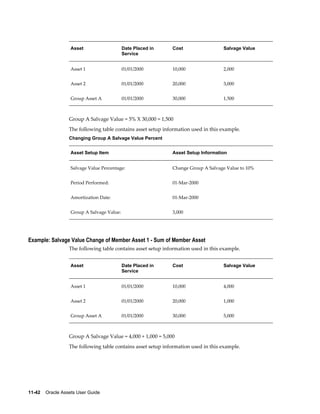

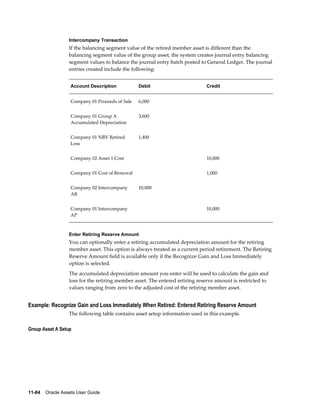

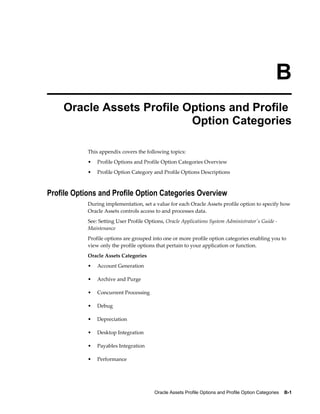

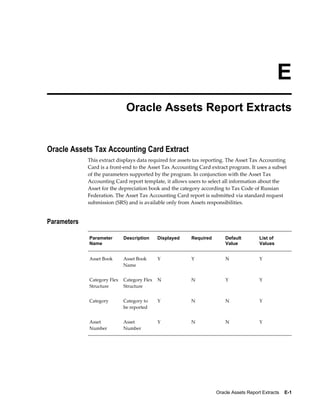

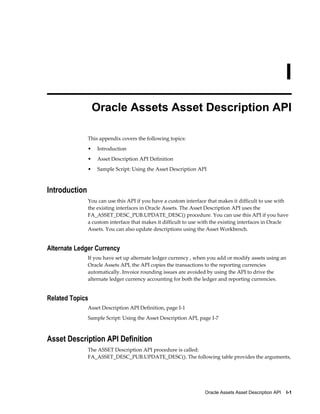

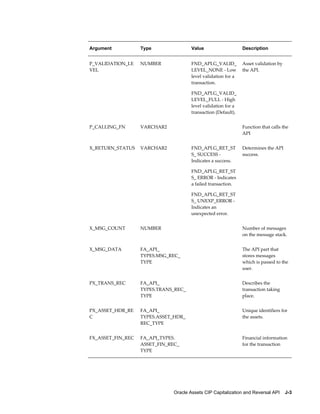

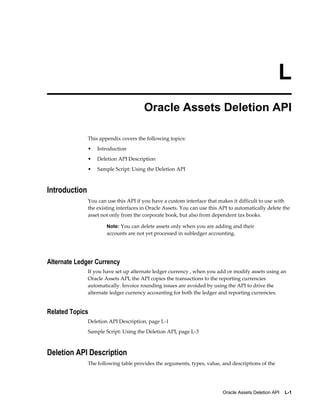

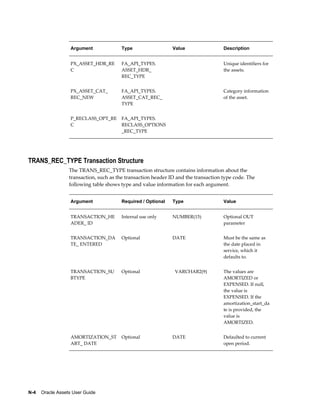

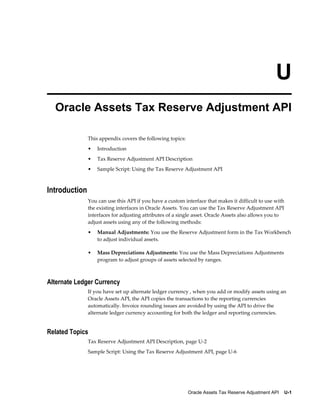

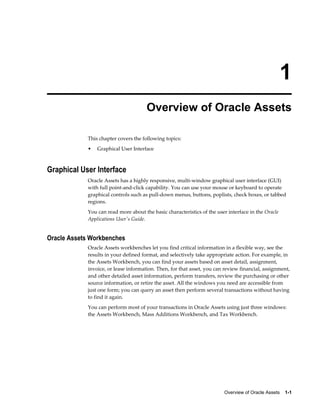

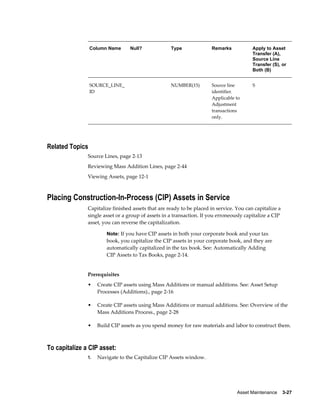

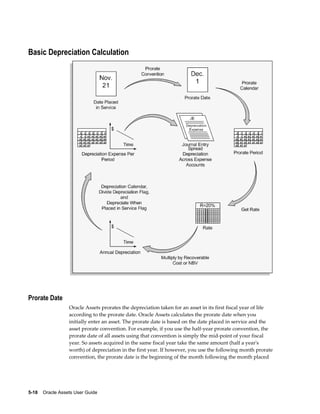

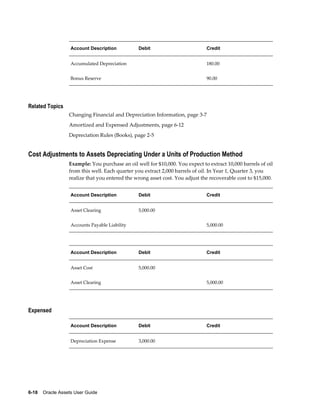

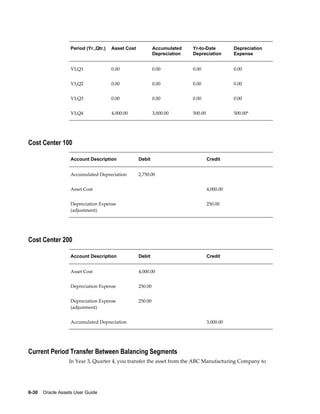

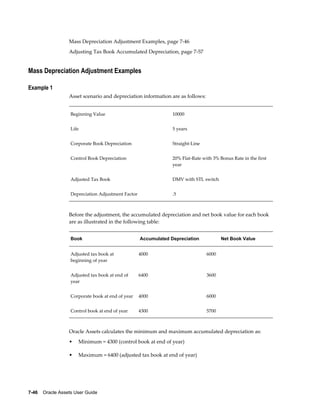

![System Setup 9-87

[YTD Depreciation]

= (1,000,000 - 1,000,000*10%) - 360,000 - 0 = 540,000

• [Depreciation Expense] = [Depreciable Basis] * [Rate] * (1/ [Period])

= 540,000 * 0.25 * (1/4) = 33,750

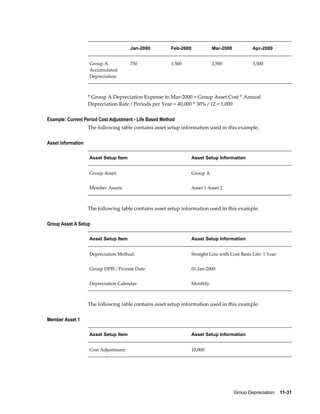

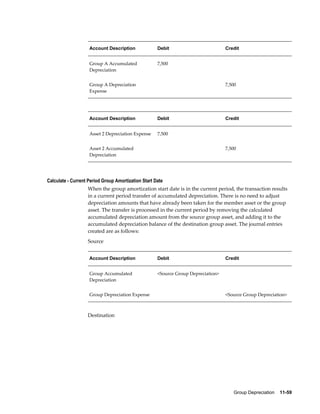

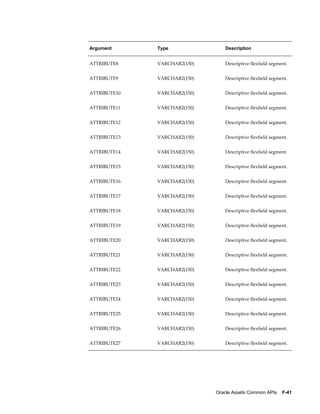

Period End Balance Rule

When the Period End Balance rule is used, current period depreciation is calculated as

follows:

Current Period Depreciation Expense for Period End Balance = (Group Asset Balance at

Period End * Annual Depreciation Rate) / Periods Per Year

Example: Period End Balance

The following table contains asset setup information used in this example.

Asset Setup Item Asset Setup Information

Group Asset: Group A

Member Assets: Asset 1 Asset 2

Depreciation Method: Flat Rate with Cost Basis Depreciable Basis

Rule: Period End Balance

Depreciation Rate: 30%

Depreciation Calendar: Monthly

Group Asset DPIS / Prorate Date: 01-JAN-2000

The following table contains asset setup information used in this example.

Asset 1 - Current Period Cost Adjustment

Asset Setup Item Asset Setup Information

Cost Adjustment: 10,000

Period Performed: Mar-2000](https://image.slidesharecdn.com/120faug-140313204117-phpapp01/85/120faug-519-320.jpg)