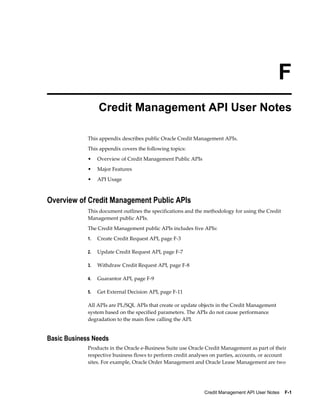

- The document is the Oracle Credit Management User Guide, which contains instructions for using Oracle's credit management software. It provides an overview of the credit review process and how the software automates various steps.

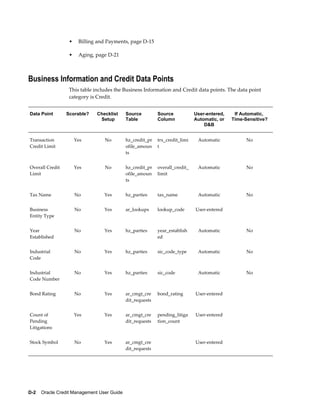

- The guide describes how to set up the credit management system by defining credit analysts, maintaining customer data, populating transaction data, and configuring system options, lookups, and customer profile classes. It also explains how to set up credit policies including credit data points, checklists, scoring models, automation rules, and credit recommendations.

- The document provides instructions for using the software to process credit reviews, collect and analyze credit data, make recommendations, and implement decisions. It also discusses periodic credit review programs and integrating credit