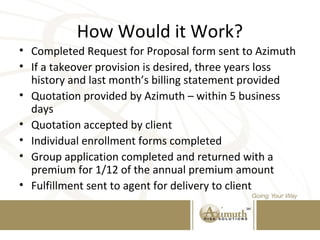

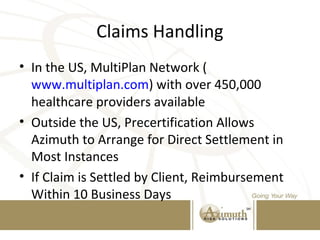

This document describes the Contour Group Medical Insurance Plan, an international group health insurance product. It is provided by Lloyd's of London through their managing general underwriter Azimuth Risk Solutions. The plan offers comprehensive health benefits for groups of 3 or more employees located both inside and outside the US. Agents are encouraged to sell the plan due to the large market potential, high quality of coverage, and stability of the insurer. The claims process involves networks of providers in the US and precertification of services outside the US to arrange direct settlement when possible.