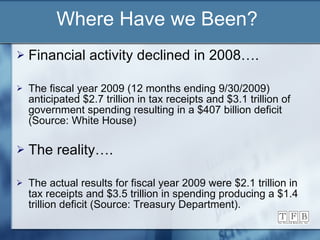

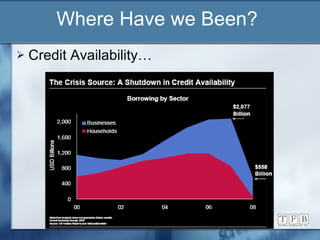

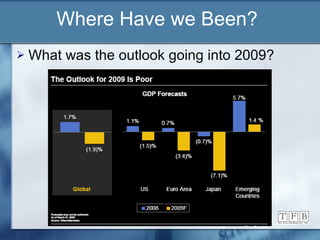

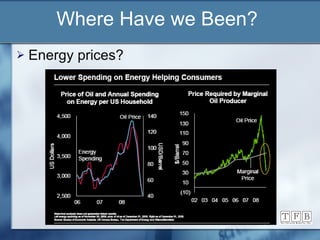

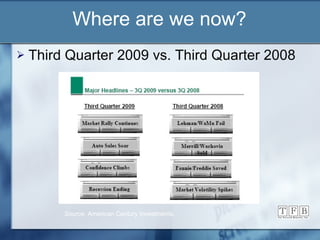

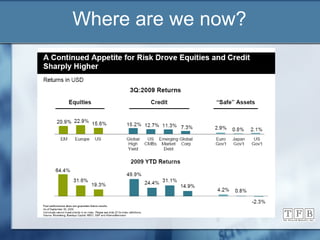

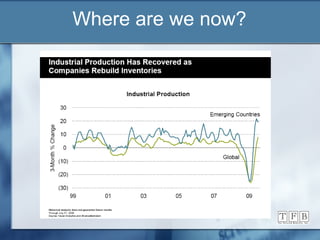

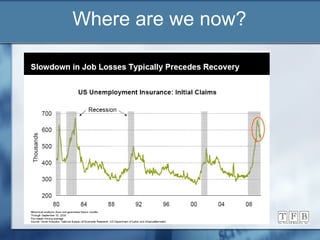

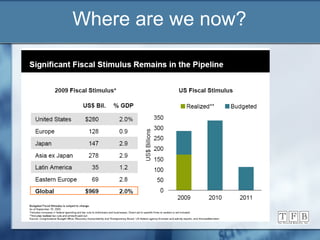

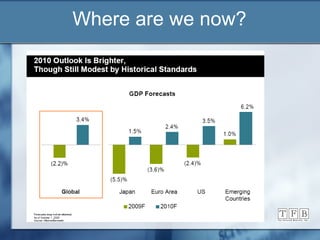

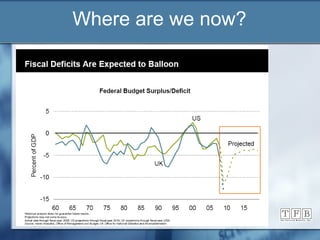

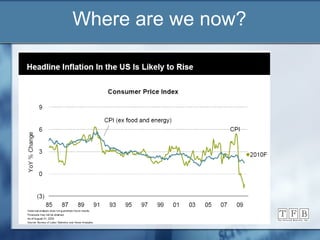

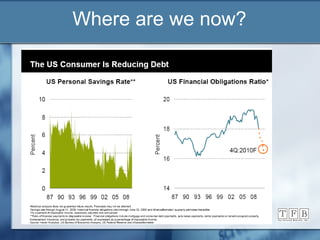

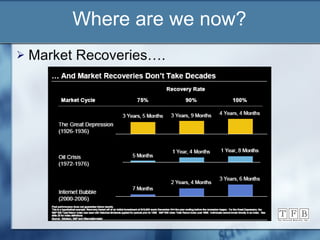

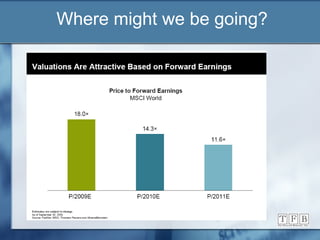

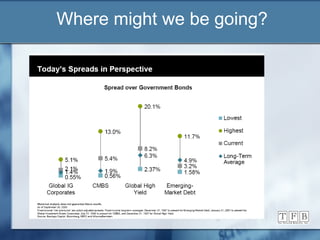

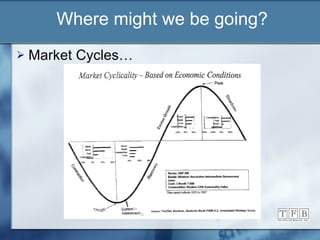

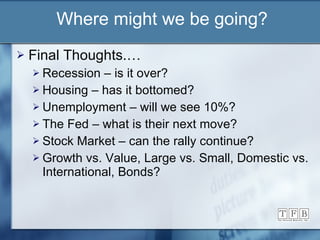

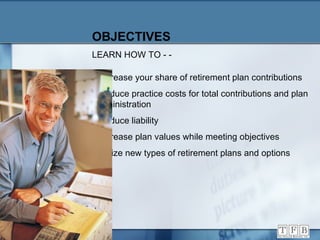

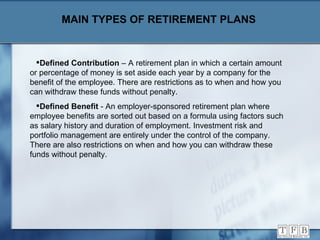

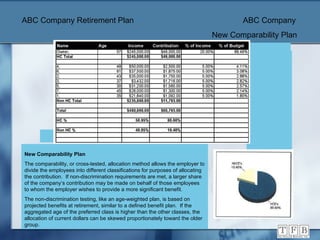

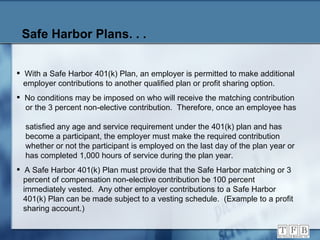

The document provides an overview and summary of a presentation on successful retirement planning. It discusses the current economic environment and where the economy has been, where it is now, and where it may be going. It also discusses employer-sponsored retirement plans and how they can fit different practices. The presentation was given by Tim Gaigals and covered topics like different types of retirement plans that are commonly used, when each type is best utilized, and how to design an effective retirement plan.

![Insight into the Successful Retirement Retirement Planning is still one of the most important things you can do to ensure financial stability during the later years of life. This presentation will discuss two topics to successful retirement planning the topics will include: * The Current economic and investment environment, where have we been? Where are we now and where might we be going? *Employer sponsored retirement plans and how they can fit your practice. Presented by Tim Gaigals of Tax Favored Benefits. You may contact Tim at (800) 683-3440 or [email_address] Below is Tim’s biography. TIMOTHY J. GAIGALS, CFP ® Graduate of the University of Kansas with a B.S. in Business Administration. CERTIFIED FINANCIAL PLANNER™ The CFP® marks help identify a practitioner who has met rigorous standards of competency and ethics, thus differentiating a practitioner in the profession. Securities Series 7, 63, 65 Licensed. More than 8 years experience trading commodity futures and options. Formerly a Director of Trading at a nationally known energy company. Works with dental practices as well as other businesses on their qualified retirement plans. Member of the National Association of Insurance and Financial Advisors. [email_address]](https://image.slidesharecdn.com/kdace11-6-09final1-091109104111-phpapp02/85/Tax-Favored-Benefits-CE-Presentation-2-320.jpg)

![Investing for retirement is like boarding an ocean liner for a long trip. No one reasonably expects the seas to remain calm for the entire voyage. When storms do threaten, the worst thing a person can do is jump ship. The best approach is to stay calm and keep moving toward the ultimate goal. Like nervous ship passengers, novice investors respond best to open discussions about how they can minimize damage, should markets turn turbulent, rather than scare tactics. It should be pointed out that participants have several "life boats" to weather a market storm. First, they have very long time horizons. Investors with a decade or more left before retirement can afford to ignore the day-to-day ups and downs in share prices. Questions? Contact Tim Gaigals at 800-683-3440. [email_address] Bon Voyage — Investing in Retirement Plans](https://image.slidesharecdn.com/kdace11-6-09final1-091109104111-phpapp02/85/Tax-Favored-Benefits-CE-Presentation-76-320.jpg)