The following representations and warranties of Seller shall apply as specified in the Transaction Specific Terms, and if no election is made in the Transaction Specific Terms, then all of the following representations and warranties shall apply:

(a) (i) Seller owns and has good and marketable title to the Loans which are being transferred hereunder and the assignment to Buyer constitutes a valid sale, transfer and assignment of such Loans, free and clear of any lien, encumbrance or other security interest, (ii) Seller owns and has good and marketable title to the Commitments which are being transferred hereunder and the assignment to Buyer constitutes a valid sale, transfer and assignment of such Commitments, free and clear of

![UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

-------------·--------------·--··------------X

In re:

Chapter 11

ALLIED SYSTEMS HOLDINGS, INC.,

Case No. 11-.._[_ _,] ([_])

Alleged Debtor.

-------- - ·- ·-·-- ·-·--------···-···-·-------------------------X

In re:

Chapter 11

ALLIED SYSTEMS, LTD. (L.P.),

Case No. 11-[_ ___.] (LJ)

Alleged Debtor.

---------------------------------------------x

AFFIDAVIT OF RICHARD EHRLICH ON BEHALF OF

BDCM OPPORTUNITY FUND II, LP PURSUANT

TO FEDERAL RULE OF BANKRUPTCY PROCEDURE 1003

STATE OF CONNECTICUT)

) ss:

COUNTY OF FAIRFIELD )

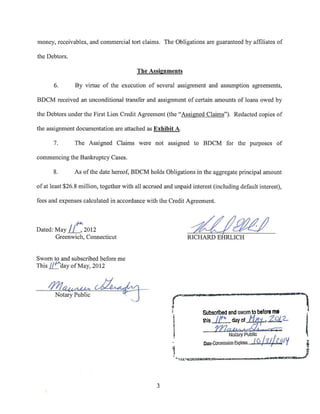

Richard Ehrlich being duly sworn, deposes and states:

1. I make this affidavit on behalf of BDCM Opportunity Fund II, LP ("BDCM"), a

petitioning creditor in the above-captioned involuntary chapter 11 cases (the "Bankruptcy

Cases") filed by BDCM and other petitioning creditors against (i) Allied Systems Holdings, Inc.,

and (ii) Allied Systems, Ltd. (L.P.) (together, the "Debtors")- I am fully familiar with the facts

set forth herein either through my own personal knowledge or through a review of documents

related to BCDM's claims against the Debtors. If called to testify in connection with the

Bankruptcy Cases, the following would constitute my testimony.](https://image.slidesharecdn.com/10000000006-121112185835-phpapp02/75/10000000006-1-2048.jpg)

![L

PURCHASE AND SALE AGREEMENT

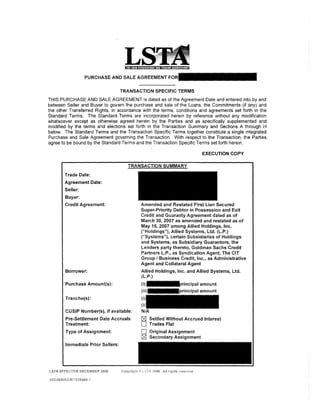

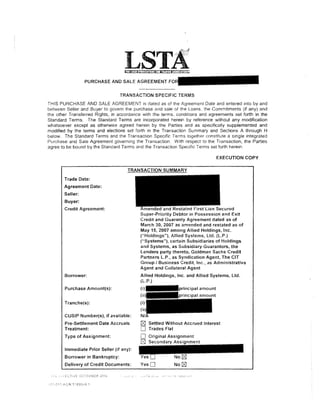

TRANSACTION SPECIFIC TERMS

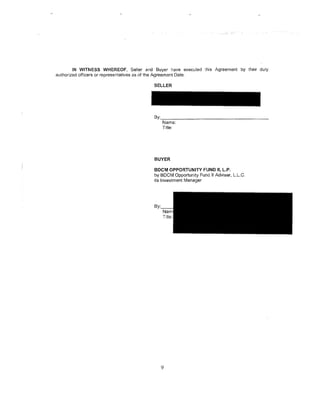

THIS PURCHASE AND SALE AGREEMENT F s dated as of the Agreement

Date and entered into by and between Seller and Buyer to govern purchase and sale of the Loans,

the Commitments (if any) and the other Transferred Rights, in accordance with the terms, conditions and

.agreemleln.ts.seltlflorlth in the LSTA Standard Terms and Conditions for Purchase and Sale Agreement for

1 published by the LSTA as of I the "Standard Terms"). The

Standard Terms are incorporated herein by reference any cation whatsoever except as

otherwise agreed herein by the Parties and as specifically supplemented and modified by the terms and

elections set forth in the Transaction Summary and Sections A through H below. The Standard Terms

and the Transaction Specific Terms together constitute a single integrated Purchase and Sale Agreement

fo overning the Transaction. With respect to the Transaction, the Parties agree to be

bound by the Standard Terms and the Transaction Specific Terms set forth herein.

Trade Date:

Agreement Date:

Seller:

Seller MEl:

Buyer:

Buyer MEl:

Credit Agreement: Lien Secured

Super-Priority Debtor In Possession and Exit

Credit and Guaranty Agreement dated as of

March 30, 2007, and amended and restated as of

May 15, 2007, among Allied Systems Holdings,

Inc. (as successor by merger to Allied Holdings,

Inc.), Allied Systems, Ltd. (L.P.), certain

Subsidiaries of Holdings and Systems, as

Guarantors, the Lenders parties thereto from

time to time, Goldman Sachs Credit Partners

L.P., as Lead Arranger and Syndication Agent,

The CIT Group/Business Credit, Inc., as

Administrative Agent and Collateral Agent and

the other agents parties thereto

Borrower: Allied Systems Holdings, Inc., Allied Systems,

Ltd. (L.P.)

Purchase Amount(s): (1 pal amount of LC Deposits

(2 cipal amount of Term Loans

Tranche(s): (1

(2

CUSIP Number(s), if available: Not Applicable

Pre-Settlement Date Accruals 0 Settled Without Accrued Interest

Treatment: ~ Trades Flat

Type of Assignment: ~ Original Assignment

LSTA EFFECTIVE SoptambrH 9, 20·11 Col>yri]ht 1) LSTA 2011. All rights reserved.](https://image.slidesharecdn.com/10000000006-121112185835-phpapp02/85/10000000006-5-320.jpg)

![0 Secondary Assignment

Borrower In Bankruptcy: YesO No~

Delivery of Credit Documents: YesO No~

Netting Arrangements: Yes~ NoD

Flip Representations: YesO No~

Step-Up Provisions: YesO No~

Shift Date: Not Applicable

Transfer Notice YesO No~

DEFINITIONS

Capitalized terms used in this Agreement shall have the respective meanings ascribed thereto in Section

1 of the Standard Terms, as supplemented by Section A of the Transaction Specific Terms and as

otherwise may be provided in other provisions of this Agreement. Terms defined in the Credit Agreement

and not otherwise defined in this Agreement shall have the same rreanings in 1t1is Agreement as in the

Credit Agreement. Except as otherwise expressly set forth herein, each reference herein to "the

Agreement," "this Agreement," "herein," "hereunder" or "hereof" shall be deemed a reference to this

Agreement. If there is any inconsistency between the Transaction Specific Terms and the Standard

Terms, the Transaction Spec1f1c Terms shall govern and control

In this Agreement:

"8gent" means THE CIT GHOUP I Business Credit, Inc. as Administrative Agent under the Credit

Agreement.

"Assignment" means an Assignment and Assumption Agree1nent that is in the form specified in the Credit

Agreement for an assignment of the Loans and Commitments (if any) and any Required Consents to

such assignment

"Bankruptcy Case" select one:

~ none.

0 means [the case under the Bankruptcy Code pending before the Bankruptcy Court in which

Borrower Is a debtor, In re _____ , No. _ _ __].

"Bankruptcy Court" select one:

l8J none.

0 means [the United States Bankruptcy Court for the _ _ _ _ District of _ _ _ _ _ (and, if

appropriate, the United States District Court for that District)].

"Bar Date" select one:

·-·~ot applicable.

0 none has been set.

0 means [specify applicable date, if any].

"Buyer Purchase Price'' select one:

0 not applicable.

0 means the purchase price payable by Buyer to Original Buyer pursuant to the Netting Letter (this

applies if there are three (3) parties involved in the netting arrangement).

0 means the purchase price payable by Buyer to Penultimate Buyer pursuant to the Netting Letter

(this applies if there are four (4) or more parties involved in the netting arrangement).

2](https://image.slidesharecdn.com/10000000006-121112185835-phpapp02/85/10000000006-6-320.jpg)

!["Commitments" select one:

--~ none.

0 means [identify applicable commitment tranche(s) using Credit Agreement definitions] in H1e

principal amount of $1£1€_______ [in each case specify the aggregate amount of the Loans, the

Unfunded Commitments and the portion, if any, of the Commitments that is irrevocably "frozen" (L_s,

that ts not subject to future drawing)].

"Covered Prior Seller" select one:

[g) not applicable.

0 means each Prior Seller that transferred the Loans and Commitments (if any) on or after t11e Shift

Date [but prior to the transfer pursuant to which transferred such Loans and

Commtments (if any) on a distressed documentation basis pursuant to the Purchase and Sale

Agreement for Distressed Trades dated as of , as set forth in the Annex].

"Filing Datr( select one:

!81 none.

0 means [identify date on which Borrower filed Bankruptcy Case].

"Loans'' means (i} LC Deposits in ipal amount or.lllllllland (ii} Term Loans in

the outstanding principal amount o f l • •

"Nettin_q Letter" select one:

0 not applicable.

!81 means that certain Multilateral Netting Agreement in the form currently published by the LSTA

dated on or as of the Agreement Date among Seller, Buyer and Original Buyer.

"9riginal Buyer" select one:

0

!81 notap]p.licialbllel.llllllllllll

meanSJ

"Penultimate Buyer" select one:

0 not applicable.

[g) none ("none'' is applicable if there are only three (3) parties tnvolved in the netting arrangement).

0 means _ _j.

''Required Consents" means notice to the Borrowers and the Agent and the acceptance and recordation

of the Assignment by the Agent.

"Seiler Purchase Price" select one;

0 not applicable.

t2J means the purchase price payable by Original Buyer to Seller pursuant to the Netting Letter.

"Transfer Fee".llllllllll

"Unfunded Q.Qmmitments" means none.

3](https://image.slidesharecdn.com/10000000006-121112185835-phpapp02/85/10000000006-7-320.jpg)

![SECTION 4 (SELLER'S REPRESENTATIONS AND WARRANTIES}

r

The following specified terms shall apply to the sections referenced in this Section 8:

Flat Representafion Flip Representation-- Step-Up ~----,

Representation

-------L:--~-;:--,--~-=

i If "No" is specified If "Yes" is specified If "Yes" is specified

j opposite both "Flip opposite "Flip opposite "Step-Up

Representations" and Representations"

·'Step-Up Provisions" in the

the Transaction Summary,

in

Transaction

the

I Provisions" in

Transaction Summary,

the

the

following

, Summary, the following • following subsections

. subsections of Section

1 subsections of Section 4 of Section 4 shall I' 4 shall apply:

shall apply: j 1 apply: .

1--, s-=-e-c"""·ti_o_r_l4--:-_...,.ic-(dc-}c: (T=itc-1~,. .} · --~---section 4-.-I{d)(i) L-Secticm 4.1 (d}(ii) l Section 4 1(d)(i}

~

Soct~o 4. 1{e)

I(Proceedings) = t s o c t i o o 4. 1{e){l)

I

Section 4. 1(e}(i) __ ,_ Secti0n-·4~1(e}(ii)

1

I I

1-::::--:-:-· · -

Section 4. 1(1) (Principal

Amount)

-·-· ----

' Section 4.i(f)(i) Section ,f"f(i)(-ii)-- --- seciiori4.1(t)(i)-

.___ __

,

-I

~

· SectiOn4. 1(g) (Future- --- Section 4.1 (g)(i) Section 4.1(g)(ii) Section 4.1 (g)(iii)

Funding)

--·-·-··· -~~- ..

Section 4. 1(h) (Acts ancr~·-

-·~-

Section 4.1(h)(i) Section 4.1 (h)(i) Section 4. 1(h)(ii)

, QmJ§E!lons)

l

I

~--·W-•••·-·----··•·

1 Section 4. 1(i)

.. . ... --1 ·~-~

Section 4.1 (i)(i)

--- Section 4.1 (i)(i): : - - -·-·section4T(i)(ii) ·~

-;

1 (performance of

Obligations)

_______ ____._

Section 4 1(l)(iy--

~~--

Section 4.1 (I) (Setoff) -- Section 4.1 (l)(i) Section 4.1 (l)(ii)

Section 4.1 (t) (Con sa~

r----------::c··---···------·

Section 4.1 (t)(i}

------ - ; -Section-4.1·(t)(ii)

Section 4.1 (t)(i)

· -..- - - · · - -

and Waivers)

~- ............. --,.,...-

Section 4.1 (u) (Other section 4:1(u)(i) Section 4.1 (u)(i) ........ sectiof1-,:rf(u)(iiT'

Documents)

. ----

-sectfon 4.1 (v) (Proof of --~

Section 4.1 (v)(i} Section 4.1(v)(ii) Section 4.1 (v)(i)

Claim)

. j

Section 4. 1(k) (Purchase Price); NS?.tting Arrangements.

If "Yes" is specified opposite Netting Arrangements in the Transaction Summary, Section 4. 1(k)

shall be amended in its entirety as follows:

'(k) [intentionally omitted]."

4](https://image.slidesharecdn.com/10000000006-121112185835-phpapp02/85/10000000006-8-320.jpg)

![Section 4.1(r) (Predecessor Transfer Agreements).

0 Seller acquired the Transferred Rights from Immediate Prior Seller pursuant to Predecessor

Transfer Agreements relating to par/near par loans.

0 Seller acquired the Transferred Rights from Immediate Pnor Seller pursuant to Predecessor

Transfer Agreements relating to distressed loans.

0 Seller acquired the Transferred Rights from Immediate Prior Seller pursuant to Predecessor

Transfer Agreements relating to both par/near par loans and distressed loans.

[8:1 Not applicable.

Section 4.1 (u) (Other Documents).

[8:1 None.

0 The following: _ _ _ __

Section 4.1 (v) (Proof of Claim).

0 The Proof of Claim was duly and Umely filed, on or prior to the Bar Date, by

0 the Agent on behalf of the Lenders.

0 Seller or a Prior Seller.

The Bar Date specified in the Transaction Specific Terms has been set in the Bankruptcy

Case and no Proof of Claim has been filed.

0 No Bar Date has been set in the Bankruptcy Case and no Proof of Claim has been filed.

0 Not applicable.

SECTION 5 (BUYER'S REPRESENTATIONS AND WARRANTIES

Section 5.1 (n) (Buyer Status).

0 Buyer is not a Lender.

[8:1 Buyer is a Lender.

0 Buyer is an Affiliate [substitute Credit Agreement defined term if different] (as defined in the

Credit Agreement) of a Lender.

0 Buyer is an Approved Fund {substitute Credit Agreement defined term if different] of a Lender.

If "Yes" is specified opposite "Delivery of Credit Documents" in the Transaction Summary, Buyer

represents and warrants that it (i) was not a Lender on the Trade Date and (ii) requested copies of the

Credit Documents from Seller on or prior to tne Trade Date.

SECTION 6 (INDEMNIFICATION)

Section 6,1 (Seller's lnderonities); Step-Up Indemnities.

(i) If "Yes" is specified opposite "Step-Up Provisions" in the Transaction Summary, Seller's

indemnities contained in Section 6 1(b) shall apply (and the alternate indemnities contained in Section

6.1 (a) shall not apply).

(ii) If "No" is specified opposite ''Step ..Up Provisions" in the Transaction Summary, Seller's

indemnities contained in Section 6.1(a) sr,all apply (and the alternate indemnities contained in Section

6.1 (b) shall not apply).

SECTION 7 (COSTS AND EXPENSES)

0 The Transfer Fee shall be paid by Seller to the Agent and the Purchase Price sl1all be increased by

an amount equal to

0 one-half thereof.

0 other relevant fraction or percentage, _ _ , thereof.

5](https://image.slidesharecdn.com/10000000006-121112185835-phpapp02/85/10000000006-9-320.jpg)

![0 Secondary Assignment

Borrower in Bankruptcy: YesO No [gJ

Delivery of Credit Documents: YesO No [gJ

Netting Arrangements: Yes [gJ NoD

Flip Representations: YesO No~

Step-Up Provisions: YesO No~

Shift Date: Not Applicable

Transfer Notice YesO No~

DEFINITIONS

Capitalized terms used in this Agreement shall have the respective meanings ascribed thereto in Section

1 of the Standard Terms, as supplemented by Section A of the Transaction Specific Terms and as

otherwise may be provided in other provisions of this Agreement. Terms defined in the Credit Agreement

and not otherwise defined in this Agreement shall have the same meanings in this Agreement as in the

Credit Agreement. Except as otherwise expressly set forth herein, each reference herein to "the

Agreement," "this Agreement," "herein," "hereunder" or "hereof" shall be deemed a reference lo this

Agreement. If there is any inconsistency between the Transaction Specific Terms and the Standard

Terms, the Transaction Specific Terms shall govern and control.

In this Agreement:

"Agent" means THE CIT GROUP I Business Credit, Inc. as Administrative Agent under the Credit

Agreement.

"Assignment" means an Assignment and Assumption Agreement tMt is in the form specified in the Credit

Agreement for an assignment of the Loans and Commitments (if any) and any Required Consents to

such assignment.

"Bankruptcy Case" select one:

[gJ none.

0 means [the case under the Bankruptcy Code pending before the Bankruptcy Court in which

Borrower is a debtor, In re _____ , No. - - - - - '

"Bankruptcy Court" select one:

~ none.

0 means [the United States Bankruptcy Court for the _____ District of _ _ _ _ (and, if

appropriate, the United States District Court for that District)].

"Bar Date" select one:

[gj not applicable.

0 none has been set

0 means [specify applicable date, if any].

"lildYer Purchase Price" select one:

0 not applicable.

~ means the purchase price payable by Buyer to Original Buyer pt1rsuant to the Netting Letter (this

applies if there are three (3) parties involved in the netting arrangement),

0 means the purchase price payable by Buyer to Penultimate Buyer pursuant to the Netting Letter

(this applies if there are four (4) or more parties involved in the netting arrangement).

2](https://image.slidesharecdn.com/10000000006-121112185835-phpapp02/85/10000000006-27-320.jpg)

!["Commitments" select one:

-~-~;;;);;~-

o means [identify applicable commitment tranche(s) using Credit Agreement definitions] in the

principal amount of $/£/€ {in each case specify the aggregate amount of the Loans, the

Unfunded Commitments and the portion, if any, of the Commitments thai is irrevocably "frozen" (i.e ..

that is not subject to future drawing)].

'Covered Prior Seller" select one:

0 not applicable.

D means each Prior Seller that transferred the Loans and Commitments (if any} on or after the Shift

Date [but prior to the transfer pursuant to which transferred such Loans and

Commitments (if any) on a distressed documentation basis pursuant to the Purchase and Sale

Agreement for Distressed Trades dated as of , as set forth in the Annex].

"Filing Oat§" select one:

0 none.

D means [identify date on which Borrower filed Bankruptcy Case].

"1.9...illl.§." means (i) LC Deposits in t;iheilclultsltalnldlinlglllplrincipal amount ot~nd (il) Term Loans in

the outstar'lding principal amount ot 1 1 1

"Netting Letter" select one:

0 not applicable.

0 means that certain Multilateral Netting Agreement in the form currently published by the LSTA

dated on or as of the Agreement Date among Seller, Buyer ar1d Original Buyer.

"Original Bum" select one:

0 not applicable.

0 meantlllillii•••••••

"Penultimate Buyer" select one:

0 not applicable.

0 none ("none" is applicable if there are only three (3) parties involved in the netting arrangement).

0 means ~-.-_ __ J

"8__~guired Consents" means notice to the Borrowers and the Agent and the acceptance and recordation

of the Assignment by the Agent.

"Seller Purchase Price" select one:

0 not applicable.

0 means the purchase price payable by Original Buyer to Seller pursuant to the Netting Letter.

"Transfer F e e · -

"Unfunded Commitm§mt;( means none.

3](https://image.slidesharecdn.com/10000000006-121112185835-phpapp02/85/10000000006-28-320.jpg)

![SECTION 4 {SELLER'S REPRESENTATIONS AND WARRANTIES}

Tl1e following specified terms shall apply to the sections referenced in this Section B:

---------- ·•··· ·-----,~--,-~;;;:-:;-_;:;:~--e~-resen-tafron I Flip Representation- --------Step-Up

Representation

f------------l If "No" is -s-p-ec-,if;:-ie-d+l""f-c,:::-,Y:-e·S"iSSpecified 1{-;,;;/es"is

specified

opposite both "Flip opposite 'Flip opposite "Step-Up

Representations" and Representations" in Provisions" in the

"Step-Up Provisions'' in the Transaction Transaction Summary,

the Transaction Summary, the the following

Summary, the following following subsections I subsections of Section

subsections of Section 4 of Section 4 shall I 4 shall apply:

·,---=----1' shall apply:

-secifon-·4'1(Cil (Title) sf;)ction 4.1 (d)(i)

· .. :~~S~~e:_c

..tr'on 4 i(d)('ir')

.

I'! --Sectr·on--4.1(-d---)-(r·)-·

Section--4·-nei ____________ ----sec-,tio--n-4 _-:-17

7 (ec-:)(:::-i)--+

1--::s::-e-ct""io-n--4 . 7

7 1(:-e:-:)(::-i)-----=s-ec-:cuc--o---:n 4~-i'{e)(~-)-!

(Proceedings) 1 I

Section 4. 1(f) (Principal Section 4. i (f)(i) --- ---=s:-e-ct.,.io_n_4-.1-:-(--:::f)-cc(ii,_)--l----=s-ec_t.,..io_n_4__1""(t"")(=i)---~

Amount)

i

Section 4.1(g) (Future Section 4. 1(g)(i) Section 4.1 (g)(iii)

Funding)

Section 4.1(h) (Acts and Section 4. 1(h)(i) ·----section 4.1 (h)(i) -- · section 4.1 (h)(ii)

Omissions)

··section 4.1 (i) -·~----1f---s:.-e-ct,...io_n_4c-_1:-:(-:'Ci)c::(i)___ '··· ... ·--····--·--·---------..---------..!I

Section 4,1 (i)(i) Section 4.1 (i)('i)

(Performance of

Obligations) I

f-::--,----,-~------·--·------ --~;:::---:-;---;-;-;;-;-;;-:--· --- _._... ~,-------1----,---·-- ..........---1

Section 4.1 (I) (Setoff) Section 4. 1(l)(i) Section 4.1 (l)(i) Section 4. 1(l)(ii) ·

Section 4.1 (t) (Consents 1 Section 4.1 (t)(i) I Section 4.1 (t)(i) SeCtion 4.1 (t)(ii)

and Waivers) 1

1

: Section 4.1 (u) (oiiler·--j -----Seciion-~f-1(u)(T)"'--- "'section 4.T(u)(if--l---=-s-ec-t.,-!o_n_4-.1-(_u__ __ _

){.ii"')

j Documents) i

I=" 4.1(~ (P,®I o( ••... -- Sectioo 41 1'1:1I::~:~1---- ~-S"11oo 41 l'ltilj

Section 4.1 (k) CE'..u.n;:hase Price); Netting Arrangements.

If "Yes" is specified opposite Netting Arrangements in the Transaction Summary, Section 4. 1(k)

shall be amended in its entirety as follows:

'(k) [intentionally omitted]."

4](https://image.slidesharecdn.com/10000000006-121112185835-phpapp02/85/10000000006-29-320.jpg)

![Section 4.1 (r) (Predecessor Transfer Agreements).

0 Seller acquired the Transferred Rights from Immediate Prior Sell"'r pursuant to Predecessor

Transfer Agreements relating to parinear par loans.

0 Seller acquired the Transferred Rights from Immediate Prior SelliBr pursuant to Predecessor

Transfer Agreements relating to distressed loans.

0 Seller acquired U1e Transferred Rights from Immediate Prior Sell(i:lr pmsuant to Predecessor

Transfer Agreements relating to both par/near par loans and distresses.'i loans.

[81 Not applicable.

Section 4.1 (u) (Other Documents).

[81 None.

LJ The following: - - - - ·

Section 4.1(v) (Proof of Claim).

0 The Proof of Claim was duly and timely filed, on or prior to the Bar Date. by

[] the Agent on behalf of the Lenders.

[] Seller or a Prior Seller.

0 The Bar Date specified in the Transaction Specific Terms has been set in the Bankruptcy

Case and no Proof of Claim has been filed.

D No Bar Date has been set in the Bankruptcy Case and no Proof 0'5 Claim l1as been filed.

[81 Not applicable.

SECTION 5 (BUYER'S REPRESENTATIONS AND WARRANTIES)

Section 5.1(n) (Buyer Status).

0 Buyer is not a Lender.

[81 Buyer is a Lender.

0 Buyer is an Affiliate (substitute Credit Agreement defined term if different] (as defined in the

Credit Agreement) of a Lender.

0 Buyer is an Approved Fund [substitute Credit Agreement defined ~erm if different] of a Lender.

If "Yes" is specified opposite "Delivery of Credit Documents" in the Transaction Summary, Buyer

represents and warrants that it (i) was not a Lender on the Trade Oate and· (ii) requested copies of the

Credit Documents from Seller on or prior to the Trade Date.

SECTION 6 (INDEMNIFICATIOlli

Section 6.1 (Seller's Indemnities); Ste..Q-Up Indemnities.

(i) If "Yes" is specified opposite "Step-Up Provisions" i•n the Tn,,msaction Summary, Seller's

indemnities contained in Section 6.1 (b) shall apply (and the alternate indemnities contained in Section

6. 1(a} shall not apply).

(ii) If "No" is specified opposite "Step-Up Provisions" in the Tramsaction Summary, Se!ler's

indemnities contained in Section 6.1 (a) shall apply (and the alternate indemnities contained in Section

6.1 (b) shall not apply).

SECTION 7 (COSTS AND EXPENSES}

0 Tl1e Transfer Fee shall be paid by Seller to the Agent and the !Purchase Price shall be increased by

an amount equal to

0 one-half thereof.

[] other relevant fraction or percentage, _ _ , thereof.

5](https://image.slidesharecdn.com/10000000006-121112185835-phpapp02/85/10000000006-30-320.jpg)

![0 Secondary Assignment

Borrower in Bankruptcy: YesO No [8J

Delivery of Credit Documents: YesO No [8J

Netting Arrangements: Yes 18] NoD

Flip Representations: YesO No !S]

Step-Up Provisions: YesO No [8J

Shift Date: Not Applicable

Transfer Notice YesO No [8J

DEFINITIONS

Capitalized terms used in this Agreement shall have tf1e respective meanings ascribed thereto in Section

1 :>f the Standard Terms, as supplemented by Section A of the Transaction Specific Terms and as

otr,erwise may be provided in other provisions of this Agreement. Terms defined in the Credit Agreement

and not other.vise defined in this Agreement shall rave the same meanings in this Agreement as in the

Credit Agreement. Except as othetwise expressly set forth herein, each reference herein to "the

Agreement," "this Agreement," "herein," "hereunder" or "hereof" shall be deemed a reference to this

Agreement. If there is any inconsistency between the Transaction Specific Terms and the Standard

Terms, tile Transaction Specific Terms shall govern and control.

In this Agreement:

"~gent" means THE CIT GROUP I Business Credit. Inc. as Administrative Agent under the Credit

Agreement.

"Assignment" means an Assignment and Assumption Agreement that is in the form specified in the Credit

Agreement for an assignment of the Loans and Commitments (if any) and any Requirea Consents :o

such assignment.

··s smkruptcv Case" select one:

t2l none.

0 means [the case under the Bankruptcy Code pending before the Bankruptcy Court in which

Borrower is a debtor. In re , No. _ _ _ __,

"8 3nkruptcy Court" select one:

[8J none.

0 means [the United States Bankruptcy Court for the ______ District of _ _ _ _ (and, if

aprropriato, the United States District Court for that District)].

"Bar Date" select one:

-- ~ not applicable.

0 none has been set.

0 means [specify applicable date, if any].

"8 •Jyer Purchase Price" select one:

0 not applicable.

~ means the purchase price payable by Buyer to Original Buyer pursuant to the Netting Letter (this

applies if there are three (3) parties involved in the netting arrangement).

0 means the purchase price payable by Buyer to Penultimate Buyer pursuant to the Netting Letter

(this appl;es if there are four (4) or more parties involved in the netting arrangement).

2](https://image.slidesharecdn.com/10000000006-121112185835-phpapp02/85/10000000006-48-320.jpg)

!["Commitments" select one:

. l8'l none.

0 means [identify applicable commitment tranche(s) using Credit Agreement definitions] in the

principal amount of $/£/€ [in each case specify the aggregate amount of the Loans, the

Unfunded Commitments and the portion, if any, of the Commitments that is irrevocably "frozen" (LiL,

that is not subject to future drawing)].

"Covered Prior Seller" select one:

(gJ not applicable.

0 means each Prior Seller that transferred the Loans and Commitments (if any) on or after the Shift

Date [but prior to the transfer pursuant to which transferred such Loans and

Commitments (if any) on a distressed documentation basis pursuant to the Purchase and Sale

Agreement for Distressed Trades dated as of , as set forth in the Annex].

"Fiiing_Q§JJJ'l" select one:

(gJ none.

0 means [identify date on which Borrower filed Bankruptcy Case].

"Loans" means (i) LC Deposits in amount of·····~nd (ii) Term Loans in

the outstanding principal amount

"N~tting Letter" select one:

0 not applicable.

0 means that certain Multilateral Netting Agreement in the form currently published by the LSTA

dated on or as of the Agreement Date among Seller, Buyer and Original Buyer.

"Original Buyer" select one:

0 not i

QSl mean .

"Penultimate Buyer" select one:

0 not applicable.

0 none ("none" is applicable if there are only three (3) parties involved in the netting arrangement).

1.] means r .

"Required Consents" means notice to the Borrowers and the Agent and the acceptance and recordation

of the Assignment by the Agent

''Seller Purchase Price" select one:

0 not applicable.

t:SJ means the purchase price payable by Original Buyer to Seller pursuant to the Netting Letter.

"Transfer Fee" means none.

3](https://image.slidesharecdn.com/10000000006-121112185835-phpapp02/85/10000000006-49-320.jpg)

![SECTION 4 (SELLER'S REPRESENTATIONS AND WARRANTIES)

Tile following specified terms shaH apply to the sections referenced in this Section B:

-.

--~Flat Representation Flip Representation ---Step-Ug ---·-

- . Representation

If "No" is specified-~ if "Yes" is specified If "YeS'~ecif(e((

i oppos1te both "Flip : opposite "Flip opposite "Step-Up

Representations" and Representations" in , Provisions'' in the

"Step-Up Provisions" in the Transactio n Transaction Summary,

the Transaction Summary, th e the following

• Summary, the following following subsection s subsections of Section

l subsections of Section 4 of Section 4 sll all 4 shall apply:

I I shall apply: apply:

Ect

i

ion 4.1(d) (Title)

Sect1·on 4.1(e)

·- Section 4. 1(d)(i)

·-section 4.1 (e)(i)

----

-- Seci1on4.1(d)(ii)

... ~·-

Section 4.1 (e)(i)

i____ .~ection 4.1 (d)-~)--J

Section 4.1 (e)(ii) 1

(Proc,eedings)

Section 4. 1(f) {Principal

Amo unt)

~--~

Section 4.1(f)(i)

·-····-·

SeCtion 4.1 (f)(ii)

..

----- Section 4. 1(f)(ij'-~l

I

Sect ion 4:1 (g) (Future Section 4.1 (g)(i) Section 4.1(g)(H)

i Funding) I

Sect i0n4..1(11J.(Acts and---~ Section 4.1 (h)(i)

···-~-- ----

Section 4.1 (t1)(i) Section 4.1 (1~

Om is sions)

-~----··---··-~~~------··"'

i ____ ,,._ ..

Sect ion 4.1(1) Section 4.1 (i)(i) s·ection 4.1 (i)(i) Section..4~ 1(i)(ii)

1 (Performance of

I Obio ations)

'''"""--~---~-------

ion 4.1(1) (Setoff) Section 4. 1(l)(i)

l

~ect

Section 4.1 (l)(i) Section 4.1N(ii)

Sect ion 4.1(!)-(Consents Section 4. 1(t)(i)

-- ---- section 4.1 (t)(ij. Section-4.1(!~

ndWaivers)

Sect ion 4.1 (u) (Other Section 4.1 (u)(i)

·-·

Section 4.1 (u)(i)

--·· Section 4.1 (u)(ii)

!

Qpcu_ _)

ments

I

f---::;:S-ec--ct-:-io-n--4::--.7 (;-v:--)(';;P;:-r-oo-;f,-o7f --+----;:;s:-e-ct""'io-n-4 .7 (-:-v-;-:)(;;;:i)--1

1 7

1 --Section 4. 1(v )( ii) Section 4. 1(v)(i)

I QJ9~~~----------j_ __

Section 4.1 (k) (E'urqh?~. Price); Netting Arrangements.

If "Yes" is specified opposite Netting Arrangements in the Transaction Summary, Section 4.1 (k)

sllall be amended in its entirety as follows:

"(k) [intentionally omitted]."

4](https://image.slidesharecdn.com/10000000006-121112185835-phpapp02/85/10000000006-50-320.jpg)

![Section 4.1 (r) (Predecessor Transfer Agr.©£lments).

0 Seller acquired the Transferred Rights from Immediate Prior Seller pursuant to Predecessor

Transfer Agreements relating to par/near par loans.

0 Seller acquired the Transferred R1ghts from Immediate Prior Seller pursuant to Predecessor

Transfer Agreements relating to distressed loans.

D Seller acquired the Transferred Rights from Immediate Prior Seller pursuant to Predecessor

Transfer Agreements relating to both par/near par loans and d·1stressed loans.

tZl Not applicable.

Section 4.1 (u) (Other Documents).

tZl None.

D The following:

Section 4.1 (V) (Proof of Claim).

0 The Proof of Claim was duly and timely filed, on or prior to the Bar Date, by

D the Agent on behalf of the Lenders.

0 Seller or a Prior Seller.

0 The Bar Date specified in the Transaction Specific Terms has been set in the Bankruptcy

Case and no Proof of Claim l1as been filed.

D No Bar Date has been set in the Bankruptcy Case and no Proof of Claim has been filed.

tZl Not applicable.

~ECTION 5 (BUYER'S REPRESENTATIONS AND WARRANTIES)

Section 5.1 (n) (Buyer Status).

D Buyer is not a Lender.

tZlBuyer is a Lender.

0 Buyer is an Affiliate [substitute Credit Agreement defined term if different] (as defmed in the

Credit Agreement) of a Lender.

0 Buyer is an Approved Fund [substitute Credit Agreement defined term if different] of a Lender.

If "Yes" is specified opposite "Delivery of Credit Documents" in the Transaction Summary, Buyer

represents and warrants that it (i) was not a Lender on the Trade Date and (ii) requested copies of the

Credit Documents from Seller on or prior to the Trade Date.

SECTION 6 (INDEMNIFICATION)

Section 6.1 (Seller's lndemniti~..§); §J~P.:!dP.JJ1de_f!1J:Iltles.

(i) If "Yes" is specified opposite "Step-Up Provisions" in the Transaction Summary, Seiler's

indemnities contained 1n Section 6.1 (b) shall apply (and the alternate indemnities contained in Section

6.1 (a) shall not apply).

(ii) if "No" is specified opposite "Step-Up Provisions" in the Transaction Summary, Seller's

indemnities contained in Section 6.1(a) shall apply (and the alternate indemnities contained in Section

6.1 (b) shall not apply).

SECTION 7 (COSTS AND EXPENSES)

0 The Transfer Fee shall be paid by Seller to the Agent and the Purchase Price shall be increased by

an amount equal to

0 one..half thereof.

0 other relevant fraction or percentage, _ _ , thereof.

5](https://image.slidesharecdn.com/10000000006-121112185835-phpapp02/85/10000000006-51-320.jpg)

![0 The Transfer Fee shall be paid by Buyer to the Agent and Buyer shall receive a credit to the

Purchase Price equal to

0 one-half thereof.

0 other relevant fraction or percentage, _ _ , thereof.

[2] The Transfer Fee shall be paid and allocated in the manner specified in the Netting Letter.

0 The Transfer Fee has been waived by the Agent and, accordingly, no adjustment to the Purchase

Price shall be rna de in respect thereof.

0 There is no Transfer Fee and, accordingly, no adjustment to the Purchase Price shall be made in

respect thereof.

SECTION 8 (DISTRIBUTIONS; INTEREST AND FEES; PAYMENTSl

Section 8.2 (Distributions); Step-Up Distributions Covenant.

(i) If "Yes" is specified opposite "Step-Up Provisions" in the Transaction Summary, Seller's

covenants contained in Section 8.2(b) shall apply (and the alternate covenants contained in Section

8.2(a) shall not apply).

(ii) If "No" is specified opposite "Step-Up Provisions" in the Transaction Summary, Seller's

covenants contained in Section 8.2(a) shall apply (and the alternate covenants contained in Section

8.2(b) shall not apply).

Section 8.4 (Wire Instructions).

Seller's Wire Instructions:

.§.YYi:lr's Wire Instructions:

SECTION 9 (NOTICES)

Seller's Address for Notices and Delivery:

6](https://image.slidesharecdn.com/10000000006-121112185835-phpapp02/85/10000000006-52-320.jpg)

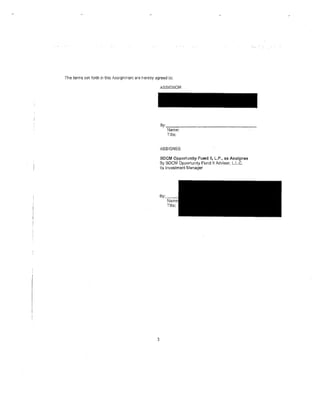

![Consented to and Accepted:

THE CIT GROUP I BUSINESS CREDIT, INC., as Administrative Agent

By: /l~j]w< r:J ;:~ 0-c())

- - ( ' _ _ _< _ _ __

Name 1?'/u·J! ,). :) ; lc 0u!J<.( ;>,

Title: s:,.,i<./to~- !),c,FrWrO=rti):;;;iut"

Consented to:

ALLIED HOLDINGS, INC.

By:

Name:

Title:

ALLIED SYSTEMS, LID (L.P.)

By:

Name:

Title:

G](https://image.slidesharecdn.com/10000000006-121112185835-phpapp02/85/10000000006-64-320.jpg)

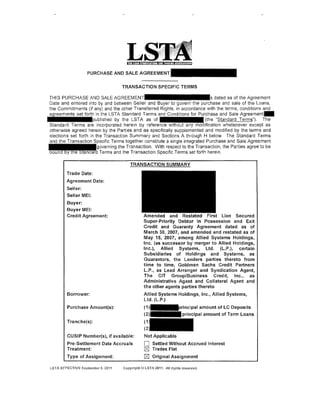

![TRANSACTION SUMMARY

Borrower in Bankruptcy: YesO No~

Delivery of Credit Documents: YesO No~

Netting Arrangements: YesO No~

1

Flip Representations: Yes0 No~

1

Step-Up Provisions: Yes0 No~

Shift Date2 : Not Applicable

3

Transfer Notice: Yes0 No~

A. DEFINITIONS

Capitalized terms used in this Agreement shall have the respective meanings ascribed thereto in Section

1 of the Standard Terms, as supplemented by Section A of the Transaction Specific Terms and as

otherwise may be provided in other provisions of this Agreement. Terms defined in the Credit Agreement

and not otherwise defined in this Agreement shall have the same meanings in this Agreement as in the

Credit Agreement. Except as otherwise expressly set forth herein, each reference herein to "the

Agreement," "this Agreement," "herein," "hereunder'' or "hereof' shall be deemed a reference to this

Agreement. If there is any inconsistency between the Transaction Specific Terms and the Standard

Terms, the Transaction Specific Terms shall govern and control.

In this Agreement:

"Agent" means The CIT Group I Business Credit, Inc., as Administrative Agent under the Credit

Agreement.

·'Assignment" means the Assignment and Assumption Agreement that is in the form specified in the

Credit Agreement for an assignment of the Loans and Commitments (if any} and any Required Consents

to such assignment.

"Bankruptcy Case" select one:

~ none.

0 means [the case under the Bankruptcy Code pending before the Bankruptcy Court in which

Borrower is a debtor, In re _____ , No. - - - - - '

·'Bankruptcy Court" select one:

~ none.

0 means [the United States Bankruptcy Court for the _ _ _ _District of _ _ _ _ (and, if

appropriate, the United States District Court for that District)].

1

The Parties cannot specify "Yes" to both "Flip Representations" and "Step-Up Provisions" unless they set forth

appropriate modifications in Section H. Neither "Flip Representations" nor "Step-Up Provisions" applies to original

assignments.

2

Specify a Shift Date only if "Yes" is specified opposite "Step-Up Provisions" and if the second box is selected in the

definition of Covered Prior Seller. The Shift Date is the date that the Parties agree 1s the closest possible

approximation for when the market convention for transferring the Loans and Commitments (if any) shifted from a

par/near par documentation basis to a distressed documentation basis. In consulting as to the appropriate date, the

Parties may refer to published results of an anonymous LSTA poll of disinterested dealers as to such dealers' views

regarding the Shift Date or, if results have not been published with respect to the Credit Agreement either Party may

request in writing that the LSTA endeavor to conduct such a poll. To initiate a poll, send a request that includes the

name of Borrower and either the CUSIP number (if available) or the name and date of the Credit Agreement to the

LSTA at lstashlftdatepolls;cvlsta.org. The results of such LSTA polls are available to facilitate discussions between

the Parties and have no binding effect

3

"Yes" can be elected only if "Yes" is specified opposite "Borrower in Bankruptcy" in the Transaction Summary.

2

453-055/AGR/1939464.1](https://image.slidesharecdn.com/10000000006-121112185835-phpapp02/85/10000000006-69-320.jpg)

!['Bar Date" select one:

0 not applicable.

0 none has been set.

0 means [specify applicable date, if any].

"Bu er Purchase Price" select one:

not applicable.

0 means the purchase price payable by Buyer to Original Buyer pursuant to the Netting Letter (this

applies if there are three (3) parties involved in the netting arrangement).

0 means the purchase price payable by Buyer to Penultimate Buyer pursuant to the Netting Letter

(this applies if there are four (4) or more parties involved in the netting arrangement).

"Commitments" select one:

0 none.

0 means LC Commitment in the principal amount o f · · · · · · all of which is funded as an LC

Deposit.

"Covered Prior Seller" select one:

0 not applicable.

0 means each Prior Seller that transferred the Loans 5and Commitments (if any)4 on or after the Shift

Date hbut prior to the date on which transferred such Loans and Commitments (if

any)].

"Filing Date" select one:

0 none.

0 means [identify date on which Borrower filed Bankruptcy Case].

"Loans" means collectively, Term Liolalnlslilnltlhe.o utstanding principal amount and LC

Deposits in the principal amount o.11

1 1

"Netting Letter" select one:

0 not applicable.

0 means that certain Multilateral Netting Agreement in the form currently published by the LSTA

dated on or as of the Agreement Date among Seller, Buyer [and] [,] Original Buyer [, Penultimate

Buyer] and [describe any other parties to the Netting Letter]].

"Original Buyer" select one:

0 not applicable.

0 means (specify original buyer in the netting arrangement].

"Penultimate Buyer" select one:

0 not applicable.

0 none ("none" is applicable if there are only three (3) parties involved in the netting arrangement).

0 means [ ].

"Required Consents" means notice to the Borrower and acceptance and recordation of the Assignment by

the Agent.

"Seller Purchase Price" select one:

4

If applicable to only a portion of the Loans and Commitments (if any), specify the portion that applies, .hf1., "each

Prior Seller that transferred the [Name of applicable Covered Prior Seller] Loans (as defined in Section 1 of the

Annex)."

5

Specify the first Entity that transferred the Loans and Commitments (if any) on a distressed documentation basis

on or after the Shift Date.

6

The bracketed language applies where the relevant Predecessor Transfer Documents include a distressed trade

that settled after the par/near par trade which settled on or after the Shift Date.

3

453-055/AGR/1939464 .1](https://image.slidesharecdn.com/10000000006-121112185835-phpapp02/85/10000000006-70-320.jpg)

![[SJ not applicable.

0 means the purchase price payable by Original Buyer to Seller pursuant to the Netting Letter.

"Transfer Fee" means th~ransfer or other similar fee payable to the Agent in connection with the

Assignment.

"Unfunded Commitments" means none.

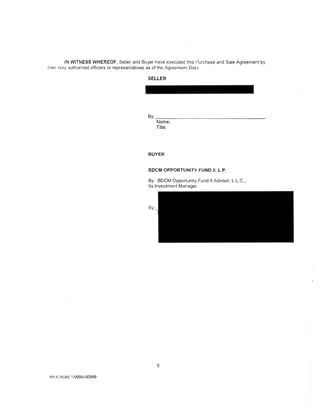

B. SECTION 4 (SELLER'S REPRESENTATIONS AND WARRANTIES)

The following specified terms shall apply to the sections referenced in this Section B:

Flat Re[!resentation Fll[! ReQresentation Stee-Ue Reeresentation

If "No" is specified opposite If "Yes" is specified opposite If "Yes" is specified opposite

both "Flip Representations" "Flip Representations" in the "Step-Up Provisions" in the

and "Step..Up Provisions" in Transaction· Summary, the Transaction Summary, the

the Transaction Summary, the following subsections of following subsections of

following subsections of Section 4 shall apply: Section 4 shall apply:

Section 4 shall apply:

Section 4.1(d) (Title) Section 4.1 (d)(i) Section 4.1 (d)(ii) Section 4.1 (d)(i)

Section 4.1(e) (Proceedings) Section 4.1 (e)(i) Section 4.1 (e)(i) Section 4.1 ( e)(ii)

Section 4.1(f) (Principal Section 4.1 (f}(i) Section 4.1 (f)(ii) Section 4.1 (f)(i)

Amount>

Section 4.1(g) (Future Funding) Section 4.1 (g)(i) Section 4.1(g)(ii) Section 4.1 (g)(iii)

Section 4.1(h) (Acts and Section 4.1 (h)(i) Section 4.1 (h)(i) Section 4.1 (h)(ii)

Omissions)

Section 4.1 (i) (Performance of Section 4.1 (i)(i) Section 4.1 (i)(i) Section 4.1 (i)(ii)

Obligations)

Section 4.1(1) (Setoff) Section 4.1(1)(i) Section 4.1 (l)(i) Section 4.1 (l)(ii)

Section 4.1 (t) (Consents and Section 4.1 (t)(i) Section 4.1 (t)(i) Section 4.1 (t)(ii)

Waivers)

Section 4.1 (u) (Other Section 4.1 (u)(i) Section 4.1 (u)(i) Section 4.1 (u)(ii)

Documents)

Section 4.1 (v) (Proof of Claim) Section 4.1 (v)(i) Section 4.1 (v)(ii) Section 4.1 (v)(i)

Section 4.1 (k) (Purchase Price); Netting Arrangements.

If "Yes" is specified opposite Netting Arrangements in the Transaction Summary, Section 4.1 (k)

shall be amended in its entirety as follows:

7

"(k) [intentionally omitted]."

7

Seller should add, and Buyer should cause Original Buyer or Penultimate Buyer, as applicable, to add, a

comparable representation to the Netting Letter in lieu of this representation.

4

453-055/AGR/1939464.1](https://image.slidesharecdn.com/10000000006-121112185835-phpapp02/85/10000000006-71-320.jpg)

![Section 4.1 (r) (Predecessor Transfer Agreements).

0 Seller acquired the Transferred Rights from Immediate Prior Seller pursuant to Predecessor

Transfer Agreements relating to par/near par loans.

~ Seller acquired the Transferred Rights from Immediate Prior Seller pursuant to Predecessor

Transfer Agreements relating to distressed loans.

0 Seller acquired the Transferred Rights from Immediate Prior Seller pursuant to Predecessor

Transfer Agreements relating to both par/near par loans and distressed loans.

Section 4.1 (u) (Other Documents).

~ None.

0 The following: _ _ __

Section 4.1 (v) (Proof of Claim). N/A

0 The Proof of Claim was duly and timely filed, on or prior to the Bar Date, by

0 the Agent on behalf of the Lenders.

0 Seller or a Prior Seller.

0 The Bar Date specified in the Transaction Specific Terms has been set in the Bankruptcy

Case and no Proof of Claim has been filed.

0 No Bar Date has been set in the Bankruptcy Case and no Proof of Claim has been filed.

C. SECTION 5 (BUYER'S REPRESENTATIONS AND WARRANTIES)

C.1 Section 5.1 (n) (Buyer Status). [Specify Buyer's status for purposes of determining Required

Consents, minimum assignment amount requirements or Transfer Fee requirements.]

0 Buyer is not a Lender.

~ Buyer is a Lender.

0 Buyer is an Affiliate [substitute Credit Agreement defined term if different] (as defined in the

Credit Agreement) of a Lender.

0 Buyer is an Approved F_!lnd [substitute Credit Agreement defined term if different] of a Lender.

C.2 If "Yes" is specified opposite "Delivery of Credit Documents" in the Transaction Summary, Buyer

represents and warrants that it (i) was not a Lender on the Trade Date and (ii) requested copies of the

Credit Documents from Seller on or prior to the Trade Date.

D. SECTION 6 (INDEMNIFICATION)

Section 6.1 (Seller's Indemnities); Step-Up Indemnities.

(i) If "Yes" is specified opposite "Step-Up Provisions" in the Transaction Summary, Seller's

indemnities contained in Section 6.1 (b) shall apply (and the alternate indemnities contained in Section

6.1 (a} shall not apply).

(ii) If "No" is specified opposite "Step-Up Provisions" in the Transaction Summary, Seller's

indemnities contained in Section 6.1 (a) shall apply (and the alternate indemnities contained in Section

6.1 (b) shall not apply).

E. SECTION 7 (COSTS AND EXPENSES)

0 The Transfer Fee shall be paid by Seller to the Agent and the Purchase Price shall be increased by

an amount equal to

0 one-half thereof.

0 other relevant fraction or percentage, _ _, thereof.

0 The Transfer Fee shall be paid by Buyer to the Agent and Buyer shall receive a credit to the

Purchase Price equal to

0 one-half thereof.

0 other relevant fraction or percentage, _ _, thereof.

5

453-055/AGR/1939464.1](https://image.slidesharecdn.com/10000000006-121112185835-phpapp02/85/10000000006-72-320.jpg)

![ANNEX TO PURCHASE AND SALE AGREEMENT

1. If "Secondary Assignment" is specified opposite 'Type of Assignment" in the Transaction

1

Summary, list of Predecessor Transfer Agreements and principal amount as of the settlement

date with respect thereto, of the portion of the Loans and Commitments (if any) thereunder

assigned hereby for purposes of Section 4.1 (r) and Section 5.1 (k)(i) hereof, and designation as to

whether such Predecessor Transfer Agreements relate to par/near par loans or distressed loans.

With respect to' principal amount of Term Loans and ] - •rincipal

amount of LC Deposits:

ent and Assumpti~

as seller, a n d - - - -

and Assumpti~

as seller, a n d - - - -

and Assumption Agreement, each

as seller, and I

List (i) any Predecessor Transfer Agreement to which Seller is a party, (ii) any Predecessor Transfer Agreement of

Prior Sellers relating to distressed loans delivered to Seller by Immediate Prior Seller and (iii) any Predecessor

Transfer Agreement of Prior Sellers relating to par loans listed in any Predecessor Transfer Agreement described in

the preceding clause (ii).

Annex-1

453-055/AGR/1939464.1](https://image.slidesharecdn.com/10000000006-121112185835-phpapp02/85/10000000006-77-320.jpg)

![andAssump~

as seller, a n d - - - -

That certain Assignment and Assumption Agreement dated

• • • • • • • • • • • • • • • as assignor, and

·assignee. [par/near par loans]

nment and Assumption Agreement, each

seller, and • • • • • • •

2. List of Credit Agreement and any other Credit Documents delivered pursuant to Section 4.1 (s)

hereof.

None.

3. Description of Proof of Claim (if any).

N/A

4. Description of Adequate Protection Order (if any).

N/A

5. List any exceptions to Section 4.1 (w) (Notice of Impairment}.

None.

6. The amount of any PIK Interest that ,;orr·r<>t<>t amount of the Loans after the Trade

Date but on or prior to the Settlement Date

Annex-1

453-055/AGR/1939464.1](https://image.slidesharecdn.com/10000000006-121112185835-phpapp02/85/10000000006-78-320.jpg)

![L

PURCHASE AND SALE AGREEMENT

TRANSACTION SPECIFIC TERM~i

THIS URCHASE AND SALE AGREEMENT is dated as of the Agreement Date and entered into by and

betwee Seller and Buyer to govern the purchase and sale of the Loans, the Commitments (if any) and

the oth r Transferred Rights, in accordance with the terms, conditions and agreements set forth in the

Standa d Terms. The Standard Terms are incorporated herein by reference without any modification

whatso ver except as otherwise agreed herein by the Parties and as specifically supplemented and

modifie by the terms and elections set forth in the Transaction S1..mmary and Sections A through H

below. i The Standard Terms and the Transaction Specific Terms together constitute a single integrated

Purcha~e and Sale Agreement governing the Transaction. With respect to the Transaction, the Parties

agree t~ be bound by the Standard Terms and the Transaction Specific Terms set forth herein.

Trade Date:

Agreement Date:

Seller:

Buyer:

Credit Agreement: Amended and Restahd First lien Secured

Super-Priority Debtor in Possession and Exit

Credit and Guaranty ~greement dated as of

March 30, 2007 as amEnded and restated as of

May 15, 2007 amon~1 Allied Holdings, Inc.

("Holdings"), Allied Systems, ltd. (l.P.)

("Systems"), certain Subsidiaries of Holdings

and Systems, as Sutsidiary Guarantors, the

lenders party thereto, Goldman Sachs Credit

Partners L.P., as Syndication Agent, The CIT

Group I Business Cred t, Inc., as Administrative

Agent and Collateral Agent

!Borrower: Allied Holdings, Inc. ancl Allied Systems, ltd.

(l.P.)

!Purchase Amount(s): (i) ~utstanding principal amount

"•""""'"'"' amount

i Tranche(s):

iCUSIP Number(s), if available: N/A

!Pre-Settlement Date Accruals r8] Settled Without Accl'ued Interest

lTreatment: D Trades Flat

'Type of Assignment: D Original Assignmen1

r8] Secondary Assignment

LSTA EFfECTIVE DECEMBER 2006 Copyright@ LSTA 2006. All rights reserved.

NY 474$0.1/9999-00999](https://image.slidesharecdn.com/10000000006-121112185835-phpapp02/85/10000000006-97-320.jpg)

![TRANSACTION SUMMARY

Immediate Prior Seller (if any):

Borrower in Bankruptcy: YesO No r8]

Delivery of Credit Documents: YesO No r8l

Netting Arrangements: YesO No r8]

1

Flip Representations: Yes0 No r8l

1

Step-Up Provisions: Yes0 No r8]

2

Shift Date : Not Applicable

3

Transfer Notice: Yes0 No r8]

A. DEFINITIONS

Capitalized terms used in this Agreement shall have the respective rr eanings ascribed thereto in Section

1 of t~e Standard Terms, as supplemented by Section A of the ··ransaction Specific Terms and as

otherw)se may be provided in other provisions of this Agreement Terms defined in the Credit Agreement

and n~t otherwise defined in this Agreement shall have the same mt~anings in this Agreement as in the

Credit IAgreement Except as otherwise expressly set forth here~in, each reference herein to "the

Agreery,ent," "this Agreement," "herein," "hereunder" or "hereof' shall be deemed a reference to this

Agreement If there is any inconsistency between the Transactior Specific Terms and the Standard

Terms! the Transaction Specific Terms shall govern and control.

In th1s Agreement:

·Agent! means The CIT Group I Business Credit, Inc , as Administrati11e Agent

'Assi ment" means the Assignment and Assumption Agreement :hat is in the form specified in the

Credit. greement for an assignment of the Loans and Commitments (if any) and any Required Consents

to sue~ assignment

·· Bankrtptcy Case" select one:

~.none.

C:::i

means [the case under the Bankruptcy Code pending before the Bankruptcy Court in which

Bcirrower is a debtor, In re _ _ _ _ _ , No. _ _ _ ___.

The Parties cannot specify "Yes" to both "Flip Representations" and "St•~p-Up Provisions" unless they set forth

approptiate modifications in Section H. Neither "Flip Representations" nor "Step-Up Provisions" applies to original

ass1gnrjlents.

:: Specfy a Shift Date only if "Yes" is specified opposite "Step-Up Provisions" and if the second box is selected in the

definitiqn of Covered Prior Seller. The Shift Date is the date that the Parties c gree is the closest possible

approximation for when the market convention for transferring the Loans and Commitments (if any) shifted from a

par/ne~r par documentation basis to a distressed documentation basis. In c:msulting as to the appropriate date, the

Parties! may refer to published results of an anonymous LSTA poll of disinterested dealers as to such dealers' views

regardipg the Shift Date or, if results have not been published with respect tc the Credit Agreement, either Party may

requesj in writing that the LSTA endeavor to conduct such a poll. To initiate a poll, send a request that includes the

name .~f Borrower and either the CUSIP number (if available) or the name and date of the Credit Agreement to the

LST A ;!t lstashiftdatepolls@lsta.org. The results of such LST A polls are available to facilitate discussions between

the Pa;Jties and have no binding effect.

3

"Yes'•can be elected only if"Yes" is specified opposite "Borrower in Bankruptcy" in the Transaction Summary.

2

NY 4 74 p80 1/9999-00999](https://image.slidesharecdn.com/10000000006-121112185835-phpapp02/85/10000000006-98-320.jpg)

!["Bankt tc Court" select one:

fS1none.

Ll means [the United States Bankruptcy Court for the _ __ District of _____ (and, if

appropriate. the United States District Court for that District)].

"Bar Drte" select one:

[gJ not applicable.

C: none has been set

[:! means {specify applicable date, if any].

'·Bu er· Purchase Price" select one:

rg: not applicable.

L! means the purchase price payable by Buyer to Original Buye- pursuant to the Netting Letter (this

applies if there are three (3) parties involved in the netting arrange•ment).

Li means the purchase price payable by Buyer to Penultimate 13uyer pursuant to the Netting Letter

(this applies if there are four (4) or more parties involved in the ne-:ting arrangement).

"Com~itments" select one:

C none.

1

~I means Synthetic LC Commitment in the principal amount of which is funded

asian LC Deposit

Tove1 d Prior Seller" select one:

[gl not applicable.

L means each Prior Seller that transferred the loans 5and Commitments (if any)4 on or after the Shift

D*e bbut prior to the date on which transferred such loans and Commitments (if

any)]

'Ftlin ate" select one

fS1 none.

Cl means (identify date on which Borrower filed Bankruptcy Case].

"Loan~" means, collectively, Term Loans in the outstanding principal amount

Synth~tic LC Deposits in the principal amount ot·• • • • • •

· Nettittq Letter" select one

f2:. not applicable.

L~ means that certain Multilateral Netting Agreement in the for-n currently published by the LSTA

dated on or as of the Agreement Date among Seller, Buyer [and] [,] Original Buyer [, Penultimate

Bu~er] and [describe any other parties to the Netting Letter]].

· Oriqmrl Buyer" select one:

cg:, not applicable.

C means [specify original buyer in the netting arrangement].

"Penuipmate Buyer" select one:

" If ap~licable to only a portion of the Loans and Commitments (if any), specify the portion that applies, ~. "each

Prior S~ller that transferred the (Name of applicable Covered Prior Seller] Loans (as defined in Section 1 of the

Annex)! ..

;, Speq1fy the first Entity that transferred the Loans and Commitments (if any) on a distressed documentation basis

on or atter the Shift Date.

tiThe pracketed language applies where the relevant Predecessor Transfer Documents include a distressed trade

that se~led after the par/near par trade which settled on or after the Shift DatE .

3

NY4 74{)80 .1/9999-00999](https://image.slidesharecdn.com/10000000006-121112185835-phpapp02/85/10000000006-99-320.jpg)

![Sectloq 4.1 (k) (Purchase Price); Netting Arrangements.

If "Yes" is specified opposite Netting Arrangements in the Tr:msaction Summary, Section 4.1 (k)

shall be amended in its entirety as follows:

7

"(k) [intentionally omittedJ."

Sectioq 4.1 (r) (Predecessor Transfer Agreements).

: D Seller acquired the Transferred Rights from Immediate Prior Seller pursuant to Predecessor

Transfer Agreements relating to par/near par loans.

(gJ Seller acquired the Transferred Rights from Immediate Prior Seller pursuant to Predecessor

Transfer Agreements relating to distressed loans.

D Seller acquired the Transferred Rights from Immediate Prior Seller pursuant to Predecessor

Transfer Agreements relating to both par/near par loans and distressed loans.

Sect1o~ 4.1 (u} (Other Documents).

• [gJ None.

D The following: _ _ __

Sectioq 4.1 (v) (Proof of Claim) N/A

· D The Proof of Claim was duly and timely filed, on or prior to the Bar Date, by

D the Agent on behalf of the Lenders.

D Seller or a Prior Seller.

D The Bar Date specified in the Transaction Specific Terms has been set in the Bankruptcy

Case and no Proof of Claim has been filed.

[s;] No Bar Date has been set in the Bankruptcy Case and no Proof of Claim has been filed.

C. SECTION 5 (BUYER'S REPRESENTATIONS AND WARRANTIES)

C.1 Sectton 5.1 (n) (Buyer Status). [Specify Buyer's status for purposes of determining Required

Conser)ts, minimum assignment amount requirements or Transfer Fee requirements.]

0 Buyer is not a Lender.

0 Buyer is a Lender.

D Buyer is an Affiliate (as defined in the Credit Agreement) of a Lender.

0 Buyer is an Approved Fund [substitute Credit Agreement c efined term if different] of a Lender.

C.2 If 'Yes" ts specified opposite "Delivery of Credit Documents" in the Transaction Summary, Buyer

repres~nts and warrants that it (i) was not a Lender on the Trade Date and (ii) requested copies of the

Credit ~Documents from Seller on or prior to the Trade Date.

D. SECTION 6 (INDEMNIFICATION)

Sectton 6.1 (Seller's Indemnities); Step-Up Indemnities.

(1) If "Yes" is specified opposite "Step-Up Provisions" in the Transaction Summary, Seller's

indemrtttles contained in Section 6.1 (b) shall apply (and the alternate indemnities contained in Section

6 1(a) lhall not apply)

(li) If "No" IS specified opposite "Step-Up Provisions" in the Transaction Summary, Seller's

indemriltles contatned in Section 6.1(a) shall apply (and the alterna1e indemnities contained in Section

6 1(b} 4hall not apply).

' Selle~ should add, and Buyer should cause Original Buyer or Penultimate Buyer, as applicable, to add, a

comparpble representation to the Netting Letter in lieu of this representation.

5

NY474i80 1/9999-00999](https://image.slidesharecdn.com/10000000006-121112185835-phpapp02/85/10000000006-101-320.jpg)

![E. SECTION 7 (COSTS AND EXPENSES}

0 The Transfer Fee shall be paid by Seller to the Agent and the Purchase Price shall be increased by

af! amount equal to

0 one-half thereof.

D other relevant fraction or percentage, _ _, thereof.

D Tpe Transfer Fee shall be paid by Buyer to the Agent and 3uyer shall receive a credit to the

Pi.Jrchase Price equal to

' D one-half thereof.

D other relevant fraction or percentage, _ _ , thereof.

D The Transfer Fee shall be paid and allocated in the manner specified in the Netting Letter,

D The Transfer Fee has been waived by the Agent and, accordingly, no adjustment to the Purchase

Phce shall be made in respect thereof.

[6] T~ere is no Transfer Fee and, accordingly, no adjustment to tre Purchase Price shall be made in

r~spect thereof.

F. SECTION 8 (DISTRIBUTIONS; INTEREST AND FEES; PAYMENTS)

F.1 Section 82 (Distributions); Step-Up Distributions Covenant

(iJ If "Yes" is specified opposite "Step-Up Provisions" in the Transaction Summary, Seller's

coven<lnts contained in Section 8,2(b) shall apply (and the alternate covenants contained in Section

82(a) ~hall not apply),

lli) If "No" 1s specified opposite "Step-Up Provisions" in the Transaction Summary, Seller's

coven4nts contained in Section 8,2(a) shall apply (and the alternc:te covenants contained in Section

82(bl ~hall not apply),

F.2 Section 8A (Wire Instructions),

Buyer'f Wire Instructions:

Bank JPMorgan Chase Bank

Seller'li Wire Instructions:

Bank Citibank, NA

6

NY 4 74~80, 1/9999-00999](https://image.slidesharecdn.com/10000000006-121112185835-phpapp02/85/10000000006-102-320.jpg)

![ANNEX TO PURCHASE AND SALE AGRI:EMENT

If ·Secondary Assignment" is specified opposite "Type of Assignment" in the Transaction

Summary, list of Predecessor Transfer Agreements 1 and principal amount, as of the settlement

date with respect thereto, of the portion of the Loans and Commitments (if any) thereunder

assigned hereby for purposes of Section 4.1(r) and Section 5.1(k)(i) hereof, and designation as to

whether such Predecessor Transfer Agreements relate to partnear par loans or distressed loans.

and the related Assignment and Assumption Agreement, each

dated as between Seller. as buyer. and Immediate Prior Seller, as seller.

With respect principal amount of Term Loans am-principal

amount of Synthetic LC Commitments:

Purchase and Sale ~he related Assignment and Assumption Agreement,

each dated o f - - - b e t w e e n Buyer as seller, and Seller, as Buyer

Purchase and Sale Agr<:>t:•m•::.nr

~ent, each dated as

- a s seller, and Buyer, as

Assignment and Assum

Buyer. as seller. and

par].

With respect to principal amount of Term Loans and

pnncipal amount mmitments:

Assignment and Assumption Agreement, d<:tted as of between

Buyer. as seller. and Seller, as buyer [par/near par].

2 L1st of Credit Agreement and any other Credit Documents delivered pursuant to Sect1on 4.1 (s)

hereof.

N/A

3 Description of Proof of Claim (if any).

N/A

4 Description of Adequate Protection Order (if any).

N/A

5 List any exceptions to Section 4.1 (w) (Notice of Impairment).

None

---------------------

' List (! any Predecessor Transfer Agreement to which Seller is a party, _(ii) any Predecessor Tr~nsfer Agreement of

Pnor Stllers relating to distressed loans delivered to Seller by lmmedtate Pnor Seller and (111) any Predecess?r

Transfer Agreement of Prior Sellers relating to par loans listed in any Prede< essor Transfer Agreement de sen bed m

the pre·~eding clause (i1)

Annex-1

NY 4 7 4 ~80 1/9999-00999](https://image.slidesharecdn.com/10000000006-121112185835-phpapp02/85/10000000006-106-320.jpg)

![TRANSACTION SUMMARY

Netting Arrangements: YesO No t:8']

1

Flip Representations: Yes0 No t:8']

Step-Up Provisions: YesO' No t:8']

2

Shift Date : Not Applicable

Transfer Notice: YesO"' No t:8']

A. DEFINITIONS

Capitalized terms used in this Agreement shall have the respective meanings ascribed thereto in Section

1 of the Standard Terms, as supplemented by Section A of the Transaction Specific Terms and as

otherwise may be provided in other provisions of this Agreement. Terms defined in the Credit Agreement

and not othervvise defined in this Agreement :;hail have the same meanings in this Agreement as in the

Credit Agreement. Except as otherwise expressly set forth herein. each reference herein to ''the

Agreement," "this Agreement," "herein." "hereunder'· or "hereof' shall be deemed a reference to this

Agreement. If there is any Inconsistency between the Transaction Specific Terms and the Standard

Terms. the Transaction Specific Terms shall govern and control.

In this Agreement:

"Agent" means The CIT Group I Business Credit, Inc., as Administrative Agent under the Credit

Agreement.

"Assignment" means the Assignment and Assumption Agreement that is in the form specified in the

Credit Agreement for an assignment of the Loans and Commitments (if any) and any Required Consents

to such assignment.

"Bankruptcy Case' select one:

0 none.

0 means [the case under the Bankruptcy Code pending before the Bankruptcy Court in which

Borrower is a debtor. In re ________ No. _____________ __,.

"Bankruptcy Court" select one:

0 none.

0 means [the United States Bankruptcy Court for the ______ District of _____ (and, if

appropriate, the United States District Court for that District)].

"Bar Date" select one:

0 not applicable.

0 none has been set.

The Parties cannot specify ·Yes· to both 'Flip Representailon~ an(! ·step-Up Provisions" unless they set forth

appropriate modifications tn Section H. Neither "Fitp Representations" nor '·Step-Up Provisions" applies to original

assignments.

2

Specify a Shift Date only tf "Yes" is specified opposite "Step-Up Provisions" and if the second box is selected in the

definition of Covered Prior Seller. The Shift Date is the date that the Partres agree is the closest possible

approximation for when the market convention for transferring the Loans and Commitments (if any) shifted from a

par/near par documentation basis to a distressed documentation basis. In consulting as to the appropriate date. the

Parties may refer to published results of an anonymous LSTA poll of rjisinterested dealers as to such dealers· views

regarding the Shift Date or. if results have not been publishea wtth respect to the Credit Agreement, either Party may

request in writing that the LSTA endeavor to conduct such a poll To initiate a poll, send a request that includes the

name of Borrower and either tr1e CUSIP number (if available) or the name and date of the Credit Agreement to the

LSTA at lstash!f!9Jl~Q!§.@I§Ja.Qm. The results of such LSTA polls are available to facilitate discussions between

the Parties and have no binding effect.

3

"Yes" can be elected only if "Yes" is specified opposite "Borrower in Bankruptcy" in the Transaction Summary.

2

453-011/AGR/1789544.1](https://image.slidesharecdn.com/10000000006-121112185835-phpapp02/85/10000000006-110-320.jpg)

![0 means [specify applicable date. if any].

''JltE,rer Purchase Price" select one:

[2?) not applicable.

0 means the purchase price payable by Buyer to Original Buyer pursuant to the Netting Letter (this

applies if there are three (3) parties involved in the netting arrangement).

0 means the purchase price payable by Buyer to Penultimate Buyer pursuant to the Netting Letter

(this applies if there are four (4) or more parties involved in the netting arrangement).

"Commitments" select one:

0 none.

[2?) means LC Commitment in the principal amount all of which is funded as an LC

Deposit.

"Covered Prior Seller" select one:

--[g] not applicable.

0 means each Prior Seller that transferred the Loans 5and Commitments (if any)4 on or after the Shift

Date ~but prior to the date on which-----·· _____ transferred such Loans and Commitments (if

any)].

"Filing Date" select one:

[;g) none.

0 means [identify date on which Borrower filed Bankruptcy Case].

"Loans" means collectively, Term g principal amount and LC

Deposits in the principal amount

"Netting Letter" select one:

[;g) not applicable

0 means lllat certain Multilateral Netting Agreement in the form currently published by the LSTA

dated on or as of the Agreement Date among Seller, Buyer [and] [.] Original Buyer [. Penultimate

Buyer] and [descnbe any other parties to the Netting LetterJ].

··original Buyer" select one:

[2?) not applicable.

0 means [spec1fy original buyer in the netting arrangement).

"Penultimate Buyer" select one:

[2?) not appl1cable.

0 none ("none" is applicable if there are only three (3) parties involved in the netting arrangement).

0 means L____]

"Required Consents" means notice to the Borrower and acceptance and recordation of the Ass1gnment by

the Agent.

"Seller Purchase Price" select one:

f2J not applicable.

0 means the purchase price payable by Original Buyer to Seller pursuant to the Nett1ng Letter .

•j If applicable to only a portion of the Loans and Commitments (if any). spec1fy the portion rhat applieS. g_g, ... each

Prior Seller that transferred the [Name of applicable Covered Prior Seiler] Loans (as defineo n1 Section · of the

!nnexj ·

5

Specify the first Entity that transferred the Loans and Commitments (if any) on a distressed documentation basis

on or after the Shift Date.

6

The bracketed language applies where the relevant Predecessor Transfer Documents include a distressed trade

that settled after the par/near par trade which settled on or after the Shift Date.

3

453-011iAGR!1789544.1](https://image.slidesharecdn.com/10000000006-121112185835-phpapp02/85/10000000006-111-320.jpg)

!["Transfer Fee" means th~ransfer or other stmtlar fee payable to the Agent in connection with the

Assignment.

"Unfunded Commitments'' means none.

8. SECTION 4 (SELLER'S REPRESENTATIONS AND WARRANTIES)

The following specified terms shall apply to the sections referenced in this Section B

i -----------~---Flat Representation---------------Flip Representation : --sfeP:uP Represefrtaiion-l

i '

I

i

following

·hf "No"

is specified oppositehr~:Yes" is specified opposite

subsections

Section 4 shall apply:

of Section 4 shall apply·

j

If "Yes" ;s specified opposite --j

j both ''Flip Representations· 'Flip Representations" in the "Step--Up Provisions" in the

1 and "Step-Up Provisions" in ; Transaction Summary, the

1.

Transaction Summary. the

I Ihe Transaction SumnBry. the fo!lowmg subsections of fo!!ov·.. !ng sub~cctior.s of ·

Section 4 shall apply:

i

I

I

.,

rsect1on :1.1 (d) {IUIQ) ---- ----~----- Section 4.fid)(;)- --------,, --- Section 4.1 (d)(ii) --

1

----S-ection 4- -1 (dJ(Ij- -,l' ---!

rsection4 i(e) (fo:i9i_e_&_<i.!_~)---- ~ Secllon4"i(e){ij' SeCtion4'1(ej(i)' I Section41(e)(i1) I

. Section 4.1 (f) (Princi2!!! ------+

~---------------

j Section 4.1 (f)(i)

-----·----- --------- (f)(ii)

Section 4.1

-----------------+-----------------------j

1 Section 4 1(f)(i)

I Amount) I I

1

I

~~Section 4"1[g)([;;iL;reFungin__gf+,- Section 4 1 (g)(if t

t

--Sect1on 4 1 (g)M---r---Sect1on 4

I

i(g-)(1~- --i

SectiOn 4' 1{ti)(Acts and---- 7

--+--·-s=-e-c"'t,-io-n-4:-.1("'h-:-)(::-:-i)___ : - - - Se--ction 4:'1(h)(i) . - ---+_'. Section 4. 1{h)( ii)

! Omi?.§.LQ£1?.) ~-- 1

I

''

-----------·~·--- ~--·"

lseciia·n-4Jti) ,F>f;'fo;,;.;~nr:e Section 4 1ii)li) l Sec:tinn 4 1 ~i)(ii)

I Obhgattons) I

1 . ______________________ j

h,ection 4-1(1) l~eloff)- ----- ----~-- --sect-io_n_4 i(l)(;l ·

__ I

I Section 4.1 (l)(ii)

v

I Secii,";~ 4ltii Consents and .-..

' Wa1vers)

r-

I

,

-··seclior14 -1ii)(;) Sect;on 4.1(1)(1) t

i

·· ·sechon l

4-1i!)(;0 _______

i -- ---------- ___________ j _________ - -------- _____ 11

;·section4.1(u)(Other______ ·------;-----------sectiOn 4.1(u)(1) ----

1 Documents)

Section4.1(u)(i) ! Section4.1(u)(i')

1(v) (f'_rool of CI<Ji(l!) Sect1on 4 1(v)iiJ

-------------- ---------------- 1(v)(ii) ·-- i-------- . . --------- ___________ _j!

Sect1on 4

---·----· 1 Sect1on 4 1(v)(i)

-· ___________ L_____________ ··-- ______________ j

Section 4 1(k) (Purchase Price); Netting Arrangements.

If "Yes is spectfied opposite Netting Arrangements in the Transaction Summary, Section 4.1 (k)

shall be amended in its entirety as follows:

(k) [intentionally omitted]."'

7

Seller should add. and Buyer should cause Original Buyer or Penultimate Buyer, as applicable, to add, a

comparable representation to the Netting Letter in lieu of this representation.

4

453-0111AGRI1789544 1](https://image.slidesharecdn.com/10000000006-121112185835-phpapp02/85/10000000006-112-320.jpg)

![Section 4 I (r) (Predecessor Transfer Agreements).

0 Seller acquired the Transferred Rights from Immediate Prior Seller pursuant to Predecessor

Transfer Agreements relating to par/near par loans.

C8J Seller acquired the Transferred Rights from Immediate Prior Seller pursuant to Predecessor

Transfer Agreements relating to distressed loans.

0 Seller acquired the Transferred R1ghts from Immediate Prior Seller pursuant to Predecessor

Transfer Agreements relating to both par/near par loans and distressed loans.

Section 4.1(u) (Other Documents).

C8J None.

0 The following: _ _ _ _ .

Section 4.1 (v) (Proof of Claim). N/A

0 The Proof of Claim was duly and timely filed, on or prior to the Bar Date, by

0 the Agent on behalf of the Lenders.

0 Seller or a Prior Seller.

0 The Bar Date specified in the Transaction Specific Terms has been set in the Bankruptcy

Case and no Proof of Claim has been filed.

0 No Bar Date has been set in the Bankruptcy Case and no Proof of Claim 11as been filed.

C. SECTION 5 (BUYER'S REPRESENTATIONS AND WARRANTIES}

C.1 Section 5.1 (n) (Buyer Status). [Specify Buyer's status for purposes of determining Reqwred

Consents, minimum assignment amount reqUirements or Transfer Fee requirements.]

0 Buyer is not a Lender.

0 Buyer is a Lender.

0 Buyer is an Affiliate [substitute Credit Agreement defined term 1f d1fferent] (as defined in the

Credit Agreement) of a Lender.

0 Buyer 1s an Approved Fund [substitute Credit Agreement defined term if different] of a Lender.

C.2 If "Yes" is specified opposite "Delivery of Credit Documents" in the Transaction Summary, Buyer

represents and warrants that it (i) was not a Lender on the Trade Date and (ii) requested copies of the

Cred1t Documents from Seller on or prior to the Trade Date.

D. SECTION 6 (INDEMNIFICATION)

Section 6.1 (Seller's Indemnities); Step-Up Indemnities.

(I) If ·'Yes" is specified opposite "Step-Up Provisions" in the Transaction Summary, Seller's

indemnities contained in Section 6.1(b) shall apply {and the alternate indernnit1es contained in Section

6.1 (a) shall not apply).

(ii) If "No" is specified opposite "Step-Up Provisions in the Transacllon Summary, Sellers

mdemnities contained in Section 6.1 (a) shall apply (and the alternate indemnities contained in Section

6.1 (b) shall not apply).

E. SECTION 7 (COSTS AND EXPENSES)

0 The Transfer Fee shall be paid by Seller to the Agent and the Purchase Price shall be increased by

an amount equal to

0 one-half thereof.