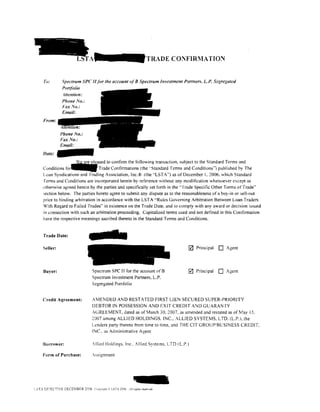

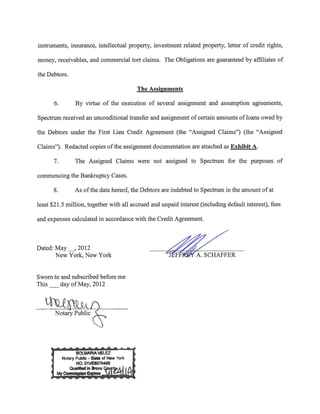

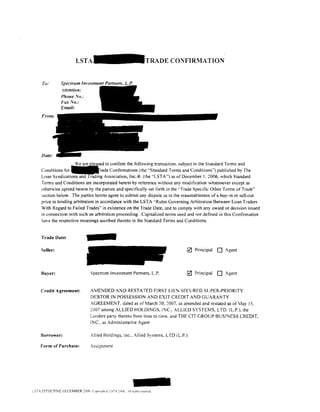

This affidavit provides testimony in support of an involuntary bankruptcy petition filed by Spectrum Investment Partners LP and other petitioning creditors against Allied Systems Holdings, Inc. and Allied Systems, Ltd. (L.P.). [1] Jeffrey Schaffer, the Managing Member of Spectrum Group Management LLC, which is the investment manager of Spectrum, states that [2] Spectrum is a creditor of the alleged debtors based on loans made under a 2007 first lien credit agreement, and is owed over $21.5 million. [3] The affidavit attaches documentation of assignments establishing Spectrum's status and claims as a creditor with standing to file the involuntary bankruptcy petition.

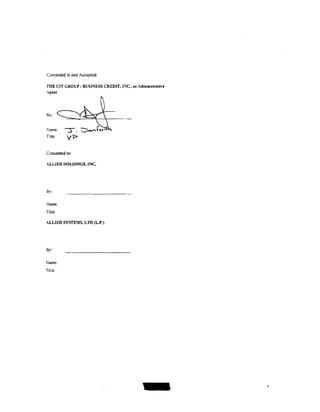

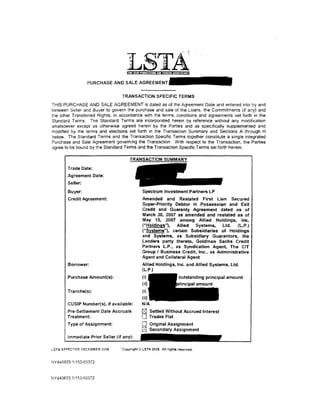

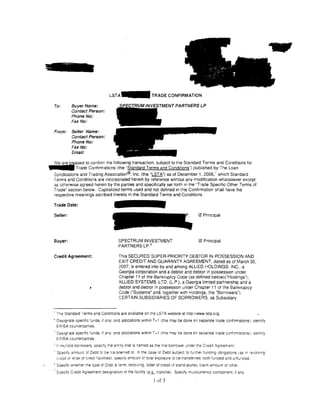

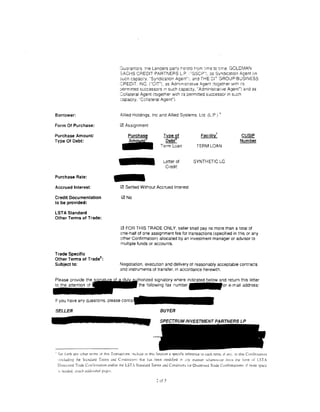

![UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

·------------------------------------------------------------------------------------------X

In re:

Chapter 11

ALLIED SYSTEMS HOLDINGS, INC.,

Case No. 11-._[_ _,] ([_])

Alleged Debtor.

.---------------..----------------· -------------------------------------------------------·X

In re:

Chapter 11

ALLIED SYSTEMS, LTD. (L.P.),

Case No. 11-.._[_ ____.] ([_j)

Alleged Debtor.

·-----------------------------------------------------------------------------------------·X

AFFIDAVIT OF JEFFREY A. SCHAFFER

PURSUANT TO FEDERAL RULE OF BANKRUPTCY PROCEDURE 1003

STATE OF NEW YORK )

) ss:

COUNTY OF NEW YORK )

Jeffrey A. Schaffer being duly sworn, deposes and states:

1. I make this affidavit on behalf of Spectrum Investment Partners LP ("Spectrum"),

a petitioning creditor in the above-captioned involuntary chapter 11 cases (the "Bankruptcy

Cases") filed by Spectrum and other petitioning creditors against (i) Allied Systems Holdings,

Inc., and (ii) Allied Systems, Ltd. (L.P.) (together, the "Debtors"). I am fully familiar with the

facts set forth herein either through my own personal knowledge or through a review of

documents related to Spectrum's claims against the Debtors. If called to testify in connection

with the Bankruptcy Cases, the following would constitute my testimony.](https://image.slidesharecdn.com/10000000008-121112185847-phpapp01/75/10000000008-1-2048.jpg)

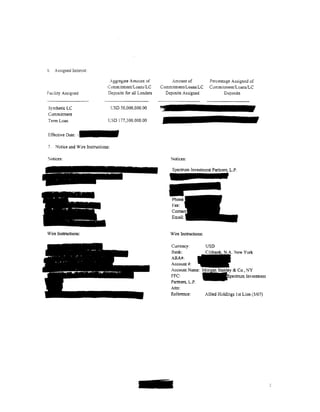

![TRANSACTION SUMMARY

Netting Arrangements: Yes 0 No 0

Yes 0

1

Flip Representations: No 0

1

Step-Up Provisions: Yes0 No0

2

Shift Oate : Not Applicable

3

Transfer Notice: Yes0 No0

A. DEFINITIONS

Capitalized terms used in this Agreement shall have the respective meanings ascnbed thereto in Section

1 of the Standard Terms, as suppiemented by Section A of the Transaction Specific Terms and as

otherwise may be provided in other provisions of this Agreement Terms defined in the Credit Agreement

and not otherwise defined in this Agreement shall have the same meanings in this Agreement as 1n the

Credit Agreement. Except as otherwise expressly set forth herein, each reference herein to "the

Agreement." "this Agreement," ''herein," "hereunder" or "hereof shall be deemed a reference to this

Agreement. If there is any inconsistency between the Transaction Specific Terms and the Standard

Terms, the Transaction Specific Terms shall govern and control.

In this Agreement:

'Agenr means The CIT Group I Business Credit, Inc .. as Administrative Agent.

"Assignment• means the Assignment and Assumption Agreement that is in the form specified in the

Credit Agreement for an assignment of the Loans and Commrtments (If any) and any Required Consents

to such assignment.

·'Bankruptcy Case" select one:

[8J none.

0 means [the case under the Bankruptcy Code pending before the Bankruptcy Court in which

Borrower is a debtor, In re , No. ----.J

"Bankruptcy Court• select one:

[8J none.

0 means [the United States Bankruptcy Court for the -::-:----District of _ _ _ _ (and, 1f

appropriate, the United States District Court for that District)].

'Bar Date" select one:

[2J not applicable.

1

The Parties cannot specify "Yes' to both "Flip Representations· and "Step-Up Provisions" unless they set forth

appropriate modifications in Section H. Neither "Flip Representations" nor "Step-Up Provisions" applies to original

assignments.

2

Specify a Shift Date only if "Yes" is specified opposite "Step.Up Provisions· and if the second box is selected in the

defimtion of Covered Prior Seller. The Shift Date is the date that the Parties agree is the closest possible

approximation for when the market convention for transferring the Loans and Commitments (if any) shifted from a

par/near par documentation basis to a distressed documentation basis. In consulting as to the appropriate date. the

Parties may refer to published results of an anonymous LSTA poll of disinterested deale~ as to such dealers' v1ews

regarding the Shift Date or. if results have not been published with respect to the Credit Agreement. either Party may

request in wntlng that the LSTA endeavor to conduct such a poll. To initiate a poll. send a request that includes the

name of Borrower and etther the CUSIP number (if available) or the name and date of the Credit Agreement to the

LSTA at istashtftdatepollslCDista.org. The results of such LSTA polls are available to facilitate discussions between

the Parties and have no binding effect

3

"Yes" can be elected only if "Yes" is specified opposite "Borrower in Bankruptcy" in the Transact;on Summary.

2

NY 440402 3/153-03372](https://image.slidesharecdn.com/10000000008-121112185847-phpapp01/85/10000000008-16-320.jpg)

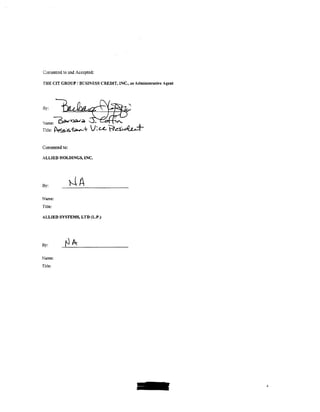

![0 none has been set

[] means [specify applicable date. 1f any].

'Buver Purchase Price" select one:

[SJ not applicable.

0 means the purchase price payable by Buyer to Original Buyer pursuant to the Netting Letter (this

applies if there are three (3) parties involved in the netting arrangement).

0 means the purchase price payable by Buyer to Penultimate Buyer pursuant to the Netttng Letter

(this applies if there are four (4) or more parties involved in the netting arrangement).

·commitments• select one:

0 none.

0 means Synthetic LC Commitment in the principal amount which is funded

as an LC Deposit

'Covered Prior Seller" select one:

0 not applicable.

0 means each Prior Seller that transferred the Loans 5and Commitments (if any) 4 on or after the Shift

Date bbut prior to the date on which transferred such Loans and Commitments (if

any)].

'Filing Date• select one:

[8J none.

0 means [identity date on which Borrower filed Bankruptcy Case).

"Netting Letter" select one:

0 not applicable.

0 means that certain Multilateral Netting Agreement in the form currently published by the LSTA

dated on or as of the Agreement Date among Seller, Buyer [and) (,] Original Buyer [, Penultimate

Buyer] and [describe any other parties to the Netting LetterJ].

"Original Buyer" select one:

[8J not applicable.

0 means [specify original buyer in the netting arrangement].

"Penultimate Buyer" select one:

[2J not applicable.

0 none ("none" is applicable if there are only three (3) parties mvolved in the netting arrangement).

0 means r J.

"Required Consents" means the consent of the Agent.

'Seller Purchase Price" select one:

0 not applicable.

4

If applicable to only a portion of the Loans and Commitments (if any), specify the portion that applies, §UL, "each

Prior Seller that transferred the [Name of applicable Covered Prior Seller} Loans (as defined in Sect1on 1 of the

Annex)."

; Specify the first Entity that transferred the Loans and Commitments (if any) on a distressed documentation bas1s

on or after the Shift Date.

6

The bracketed language applies where the relevant Predecessor Transfer Documents include a distressed trade

that settled after the par/near par trade wh1ch settled on or after the Shift Date.

3

NY 440402.3/153-033 72](https://image.slidesharecdn.com/10000000008-121112185847-phpapp01/85/10000000008-17-320.jpg)

![0 means the purchase pnce payable by Original Buyer to Seller pursuant to the Netting Letter.

"Transfer Fee·· means the $0 00 transfer or other similar fee payable to the Agent 1n connection with the

Assignment

'Unfunded Commitments" means that part of the Commitments that has not been funded in the form of

loans. advances, letter of credtt disbursements or otherwise under the Credit Agreement, which is 1n the

pnncipal amount of $0.00.

B. SECTION 4 (SELLER'S REPRESENTATIONS AND WARRANTIES)

The following specified terms shall apply to the sections referenced in this Section 8:

Flat Re2resentation Flie Reeresentatlon Stee-UI! ReQresentation

1 If "No' is specified opposite If "Yes· is specified opposite If "Yes· is specified oppos1te

~ both "Flip Representations· "Flip Representations' in the "Step-Up Provisions" in the

and "Step-Up Provisions· in Transaction Summary, the Transaction Summary, the

the Transaction Summary, the following subsections of following subsections of

following subsections of Section 4 shall apply: Sect•on 4 shall apply:

Section 4 shall apply:

I

Section 4 1(d) (Title) Section 4.1 (d)(i) Section 4.1 (d)(ii) SeCtion 4.1(d)(i)

Section 4.1(e) (Proceedings) Section 4.1(e)(i) Sect1on 4.1(e)(i)

I

I

Section 4.1(e)(ii)

Section 4.1 (f) (Principal Section 4.1 f)(i) Sectton 4.1 (f)(ii) Sect1on 4.1(f)(i)

1 Amount)

I i

I Section 4.1 (g) (Future Funding) Section 4.1(g)(i) Section 4.1 (g)(ii) Section 4.1(g}(iii)

I Section 4.1 (h)(il

Section 4.1 (h) !Acts and Section 4.1(h)(i) Section 4 1(h){ii)

Omissions)

l

' Section 4.1 (i) (Performance of

I SectiOn 4.1 (i)(i) Section 4.1 (i)(i) Section 4.1 (i)(ii)

Obligations) I I

f Section 4.1(1) (Setoff) I

!

i

Section 4.1 (I)( I)

I Sect1on 4.1 (l)(1)

I

Seclton 4.1 (l)(ii)

Section 4.1 (t)(i) '

1

Section 4.1 (t) (Consents and

Waivers>

i

I

Section 4 1(t)(i) Section 4. 1(t)(ii)

I

Section 4.1(u) <Other Section4.1(u)(i) Section 4.1(u)(1) Section 4.1(u)(ii)

1

Documents) I

I I !

I Section 4.1 (v) (Proof of Claim) Section 4.1 (v)(i) I Section 4.1 (v)(ii)

I Section 4.1 (vl(i)

Section 4.1 (k} (Purchase Price); Netting Arrangements.

If "Yes" is specified opposite Netting Arrangements in the Transaction Summary, Section 4.1 (k)

shall be amended in tis entirety as follows:

7

(k) [intentionally omrtted]."

Seller should add, and Buyer should cause Original Buyer or Penultimate Buyer, as applicable. to add. a

comparable representation to the Netting Letter in lieu of this representation.

4

NY 440402.3/153-03372](https://image.slidesharecdn.com/10000000008-121112185847-phpapp01/85/10000000008-18-320.jpg)

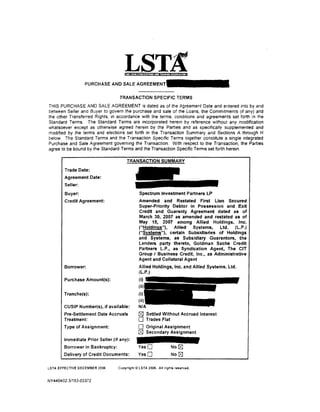

![Section 4 1(r) (Predecessor Transfer Agreements).

0 Seller acquired the Transferred Rights from Immediate Prior Seller pursuant to Predecessor

Transfer Agreements relating to par/near par loans.

2] Seller acquired the Transferred Rights from Immediate Prior Seller pursuant to Predecessor

T'ansfer Agreements relating to distressed loans.

[] Seller acquired the Transferred Rights from Immediate Prior Seller pursuant to Predecessor

T'ansfer Agreements relatrng to both par/near par loans and distressed loans.

Section 4.1 (u) (Other Documents).

[J None.

0 The following: _ _ __

Section 4. 1(v) (Proof of Claim). N/A

0 The Proof of Claim was duly and timely filed, on or pnor to the Bar Date, by

0 the Agent on behalf of the lenders.

0 Seller or a Prior Seller.

0 The Bar Date specified in the Transaction Specific Terms has been set in the Bankruptcy

Case and no Proof of Claim has been filed.

0 No Bar Date has been set in the Bankruptcy Case and no Proof of Claim has been filed.

C. SECTION 5 (BUYER'S REPRESENTATIONS AND WARRANTIES)

C.1 Section 5.1(n) (Buyer Status). [Specify Buyer's status for purposes of determining Required

Consents, mrnimum assignment amount requirements or Transfer Fee requirements.]

0 Buyer is not a lender.

[8J Buyer is a lender.

0 Buyer is an Affiliate (as defined in the Credit Agreement) of a Lender.

0 Buyer is an Approved Fund [substitute Credit Agreement defined term if different] of a lender.

C.2 If "Yes· is specified opposite "Delivery of Credit Documents" in the Transaction Summary, Buyer

represents and warrants that it (i) was not a Lender on the Trade Date and (ii) requested copies of the

Credit Documents from Seller on or prior to the Trade Date.

D. SECTION 6 (INDEMNIFICATION)

Section 6.1 (Seller's Indemnities); Step-Up Indemnities.

(i) If "Yes" is specified opposite "Step-Up Provisions" in the Transaction Summary, Seller's

indemnities contained in Section 6.1(b) shall apply (and the alternate indemnities contained in Section

6. 1(a) shall not apply).

(ii) If "No" is specified opposite 'Step-Up Provisions" in the Transaction Summary, Seller's

indemnities contained in Section 6.1(a) shall apply (and the alternate indemmtles contatned in Section

6.1(b) shall not apply).

E. SECTION 7 !COSTS AND EXPENSES)

0 The Transfer Fee shall be paid by Seller to the Agent and the Purchase Price shall be 1ncreased by

an amount equal to

0 one-half thereof.

0 other relevant fraction or percentage, _ _ , thereof.

0 The Transfer Fee shall be paid by Buyer to the Agent and Buyer shall recerve a credit to the

Purchase Prrce equal to

0 one-half thereof.

0 other relevant fraction or percentage. _ _ . thereof.

5

NY¥0402.3/153-03372](https://image.slidesharecdn.com/10000000008-121112185847-phpapp01/85/10000000008-19-320.jpg)

![ANNEX TO PURCHASE AND SALE AGREEMENT

If "Secondary .A.ss1gnment" is specified opposite 'Type of Assignment" in the Transact1on

1

Summary, list of Predecessor Transfer Agreements and pnncioal amount, as of the settlement

]ate w1th respect thereto, of the port1on of the Loans and Commitments (If any) thereunder

assigned hereby for purposes of Section 4.1(r) and Section 5.1 (k)(i) hereof, and designation as to

'Nhether such Predecessor Transfer Agreements relate to par/near par loans or distressed loans.

2. List of Credit Agreement and any other Credit Documents delivered pursuant to Section 4.1 (s}

hereof.

N/A

3. Description of Proof of Claim (if any}.

N/A

4. Description of Adequate Protection Order (if any).

N/A

5. List any exceptions to Section 4. 1(w) (Notice of Impairment}.

None.

6. The amount of any PIK Interest that accreted to the principal amount of the Loans after the Trade

Date but on or pnor to the Settlement Date IS $0.00.

· List fi) any Predecessor Transfer Agreement to which Seller is a party. (ii) any Predecessor Transfer Agreement of

Prior Sellers relating to cans delivered to Seller by Immediate Prior Seller and (i1i) any Predecessor

Transfer Agreement of Prior Sellers relating to par loans listed in any Predecessor Transfer Agreement descnbed in

the preced1ng clause (ii).

Annex-1

NY440402 3/153-03372](https://image.slidesharecdn.com/10000000008-121112185847-phpapp01/85/10000000008-24-320.jpg)

![pemntted successors 1n sucr1 capac1ty. "Adr'ilrHstrat:ve Ager~l") ar1u a:;

Co! lateral Agent (together 'Nilh :ts permitted successor 1n sucn

capac1ty, "Cct!at~ra1 Agent").

Borrower: Allied Ho:d1ngs, Inc and A!l1ed Systems, Ud. (L.P.) ~

Form Of Purchase:

Purchase Amount/

Type Of Debt: ..,..

0 Assignment

Purchase Type ~f

Debt

Term Loan

Facility 7

TERM LOAN

CUSIP

Number

Letter of SYNTHETIC LC

-

Cred1t

Purchase Rate:

Accrued Interest: 0 Settled Without Accrued Interest

Credit Documentation 2l No

to be provided:

LST A Standard

Other Terms of Trade:

0 FOR THIS TRADE ONLY, seller shall pay no more than a total of

one-half of one assignment fee for transactions (specrfied 1n tris or any

other Confirmation) allocated by an investment manager or advisor to

multiple funds or accounts.

Trade Specific

Other Terms of Trade 8.:

Subject to: Negotiation, execution and delivery of reasonably acceptable contracts

and instruments of transfer, 'M accordance herewith.

It you have any questions. please contact

SELLER BUYER

SPECTRUM INVESTMENT PARTNERS LP

" 'Set forth any other tcml.. . llt Lh!~ fr.111 ,...u:t!on: u:clude :n th1o... Sccuon a ·~rccJJk n:-ft;T~nce to t'ac:, term. tf any. ;n thl' C: ~nfirmauon

, illCUcilng the Sta11danl Tenn' and Condition.'' that h:" heen modtCtd in anv manner wh:JtstWcor ,·rom the L>nn of LST'

•••aTrade Conlirmation and/or the LST. St:mdard Term> and Conditions for II [ Trade Conlirrnatlons: if more q1ace

i, ']Ceded, allach JcJdittOnaJ pa~cs.

2 or 3](https://image.slidesharecdn.com/10000000008-121112185847-phpapp01/85/10000000008-27-320.jpg)

![TRANSACTION SUMMARY

Netting Arrangements: Yes0 No~

No~

1

Flip Representations: Yes0

1

Step-Up Provisions: Yes0 No~

2

Shift Date : Not Applicable

3

Transfer Notice: Yes0 No~

A. DEFINITIONS

Capitalized terms used in this Agreement shall have the respective meanings ascribed thereto in Section

1 of the Standard Terms. as supplemented by Section A of the Transaction Spec1fic Terms and as

otherwise may be provided in other provisions of this Agreement. Terms defined in the Credit Agreement

and not otherwise defined in this Agreement shall have the same meanings in this Agreement as in the

Credit Agreement Except as otherwise expressly set forth herein. each reference herein to "the

Agreement," "this Agreement: "herein," "hereunder" or "hereor shall be deemed a reference to this

Agreement. If there is any inconsistency between the Transaction Specific Terms and the Standard

Terms, the Transaction Specific Terms shall govern and control.

In this Agreement:

"Agent" means The CIT Group I Business Credit. Inc .. as Administrative Agent.

"Assignment" means the Assignment and Assumption Agreement that is in the form specified in the

Credit Agreement for an assignment of the Loans and Commitments (if any) and any Required Consents

to such assignment.

"Bankruptcy Case· select one:

r2J none.

0 means [the case under the Bankruptcy Code pending before the Bankruptcy Court in which

Borrower is a debtor. In re , No. _ _ _ ____,

"Bankruptcy Court" select one:

r2J none.

0 means [the United States Bankruptcy Court for the -:-:----District o f - - - - - (and, 1f

appropriate, the United States District Court for that District)].

·Bar Date" select one:

r2J not applicable.

' The Parties cannot specify "Yes" to both 'Flip Representations" and "Step-Up Provisions" unless they set forth

appropriate modifications in Section H. Neither "Flip Representations" nor ··step-Up Provisions· applies to original

ass1gnments.

2

SpecifY a Shift Date only if "Yes" is specified opposite "Step-Up Provisions" and if the second box is selected in the

definition of Covered Prior Seller. The Shift Date is the date that the Parties agree is the closest possible

approximation for when the market convention for transferring the Loans and Commitments (if any} shifted from a

par/near par documentation basis to a distressed documentation basis. In consulting as to the appropriate date. the

Parties may refer to published results of an anonymous LSTA poll of dismterested dealers as to such dealers' views

regarding the Shift Date or. if results have not been published with respect to the Credit Agreement, either Party may

request in writing that the LSTA endeavor to conduct such a poll. To initiate a poll. send a request that includes the

name of Borrower and either the CUSIP number (if available) or the name and date of the Credit Agreement to the

LSTA at lstashiftdatepolls(Ollsta.org. The results of such LSTA polls are available to facilitate discuss1ons oetween

the Parties and have no binding effect.

'"Yes" can be elected only 1f "Yes" is specified opposite "Borrower in Bankruptcy· in the Transaction Summary.

2

NY446468.1/153-034 tO](https://image.slidesharecdn.com/10000000008-121112185847-phpapp01/85/10000000008-31-320.jpg)

![0 none has been set.

0 means [specify applicable date, 1f any].

·suyer Purchase Price· select one:

0 not applicable.

0 means the purchase pnce payable by Buyer to Original Buyer pursuant to the Netting Letter (this

applies if there are three (3) parties involved in the netting arrangement).

0 means the purchase price payable by Buyer to Penultimate Buyer pursuant to the Netting Letter

(this applies if there are four (4) or more parties involved in the netting arrangement).

"Commitments" select one:

0 none.

@ means LC Commitment in the principal amount o f - · all of which is funded as an LC

Deposit.

·covered Prior Seller" select one:

0 not applicable.

0 means each Prior Seller that transferred the Loans 5and Commitments (if any)4 on or after the Shift

Date bbut prior to the date on which transferred such Loans and Comm1tments (if

any)).

"Filing Date" select one:

0 none.

0 means [Identify date on which Borrower filed Bankruptcy Case].

"Loans" means. collectively, Term in the outstanding principal amount o~d LC

Deposits in the principal amount

"Netting Letter" select one:

0 not applicable.

0 means that certain Multilateral Netting Agreement in the form currently published by the LSTA

dated on or as of the Agreement Date among Seller, Buyer [and] [,] Original Buyer [. Penultimate

Buyer] and [describe any other parties to the Netting Letter]].

"Original Buyer" select one:

0 not applicable.

0 means [specify original buyer in the netting arrangement].

"Penultimate Buyer" select one:

[8;] not applicable.

0 none ("none" is applicable if there are only three (3) parties involved in the netting arrangement).

0 means { ].

"Required Consents" means the consent of the Agent.

"Seller Purchase Price" select one:

0 not applicable.

• If applicable to only a portion of the Loans and Commitments (if any), specify the portion that applies. fLQ., "each

Prior Seller that transferred the [Name of applicable Covered Prior Seller] Loans (as defined in Section 1 of the

Annex)."

5

Specify the first Entity that transferred the Loans and Commitments (if any) on a distressed documentation bas1s

on or after the Shift Date.

6

The bracketed language applies where the relevant Predecessor Transfer Documents include a distressed trade

that settled after the par/near par trade which settled on or after the Shift Date.

3

NY 446468.11153-03410](https://image.slidesharecdn.com/10000000008-121112185847-phpapp01/85/10000000008-32-320.jpg)

![~ means the purchase pnce payable by Original Buyer to Seller pursuant to the Netting Letter.

'Transfer Fee· means the $0.00 transfer or other s1milar fee payable to the Agent 1n connection with the

Assignment.

"Unfunded Commitments" means that part of the Commitments that has not been funded in the form of

loans, advances, letter of credit disbursements or otherwise under the Credit Agreement. 'Nhich is tn the

principal amount of $0.00.

B. SECTION 4 (SELLER'S REPRESENTATIONS AND WARRANTIES)

The followmg spec1fied terms shall apply to the sections referenced in this Section B:

Flat Representation Flip Representation Step-Up Representation

I

f If "No" is speofied opposite tf ·yes· is specified opposite If "Yes" is specified opposite I

i both 'Flip Representations·

and "Step.Up Provisions· in

the Transaction Summary, the

"Flip Representations" in the "Step-Up Provisions· in the

Transaction Summary, the Transaction Summary, the

following subsections of . following subsections of

I

following subsections of Section 4 shall apply: i Section 4 shall apply:

Section 4 shall apply: I I

I I Section 4.1(d)(i) Section 4.1(d)(ii) I Section 4.11d){i)

1 Section4.1(d)(Title) I

I I i

I Section 4.1(e) !Proceedings) Section 4.1(e){i) Section 4.1(e)(i) I

Section 4.1(e){ii)

I

f Section 4.1(f) (Pnncipal Section 4.1(t)(i) Section 4.1(fXu) Section 4.1(f)(i)

I Amount)

'I

I

I

I

; Section 4.1(9) (Future Funding) I

I Section 4.1(g){i) Section 4.1(g)(ii) Section 4.1(g)(iii)

i

I Section4.1(h)~ Section 4.1(h)(i) Section 4.1(h)(i) Section 4.1 (h)(ii)

I

Omissions)

I

i Section 4.1(1) (Performance of Section 4.1(i)(i) Section 4.1(i)(i) I Section 4.1(i)(ii)

Obligations) I

[ Section 4.1(1) (SetoiD

I

Section 4.1(1)(i) Section 4.1(1)(i)

I Sect1on 4.1(1)(ii)

'

i !

Section 4.1(t)(i)

I I

1

Section 4.1(1) (Consents and

!

Section 4.1(t)(i)

I Section 4.1(t)(ii)

I

,--->

I Wa1vers

I

i Section 4.1(u) !Other Section 4.1(u)(i) Section 4.1(u)(i) Section 4.1(u)(ii)

I Documents)

I

I Section 4.1(v) ;Proof of Claim) Section 4.1(v)(i) Section 4.1(v)(ii) Section 4.1(v)(J)

Section 4.1(k) (Purchase Price); Netting Arrangements.

If "Yes" is specified opposite Netting Arrangements in the Transaction Summary, Section 4.1 (k)

shall be amended in its entirety as follows:

7

'(k) [intentionally omitted]."

7

Seller should add, and Buyer should cause Original Buyer or Penultimate Buyer. as applicable, to add, a

comparable representation to the Netting Letter in lieu of this representation.

4

NY446468.1/153-03410](https://image.slidesharecdn.com/10000000008-121112185847-phpapp01/85/10000000008-33-320.jpg)

![Section 4 Hr) (Predecessor Transfer Agreements).

Seller acquired the Transferred Rights from Immediate Prior Seller pursuant to Predecessor

Transfer Agreements relating to parmear par loans.

u Seller acqUired the Transferred Rights from Immediate Prior Seller pursuant to Predecessor

Transfer Agreements relating to distressed loans.

0 Seller acquired the Transferred Rights from Immediate Prior Seller pursuant to Predecessor

Transfer Agreements relating to both parinear par loans and distressed loans.

Section 4.1 (u) (Other Documents).

0 None.

0 The following: _ _ __

Section 4.1{v) (Proof of Claim). NfA

0 The Proof of Claim was duly and timely filed, on or prior to the Bar Date, by

0 the Agent on behalf of the Lenders.

0 Seller or a Prior Seller.

0 The Bar Date specified in the Transaction Specific Terms has been set in the Bankruptcy

Case and no Proof of Claim has been filed.

0 No Bar Date has been set in the Bankruptcy Case and no Proof of Claim has been filed.

C. SECTION 5 (BUYER'S REPRESENTATIONS AND WARRANTIES)

C.1 Section 5.1 (n) (Buyer Status). [Specify Buyer's status for purposes of determining Required

Consents, minimum assignment amount requirements or Transfer Fee requirements.]

0 Buyer is not a Lender.

[81 Buyer is a Lender.

0 Buyer is an Affiliate (as defined in the Credit Agreement) of a Lender.

0 Buyer is an Approved Fund [substitute Credit Agreement defined term if different] of a lender.

C.2 If "Yes· is specified opposite "Delivery of Credit Documents• in the Transaction Summary, Buyer

represents and warrants that it (i) was not a Lender on the Trade Date and (ii) requested copies of the

Credit Documents from Seller on or prior to the Trade Date.

D. SECTION 6 (INDEMNIFICATION)

Section 6.1 (Seller's lndemnities); Step:Up Indemnities.

(i) If "Yes· is specified opposite "Step-Up Provisions· in the Transaction Summary, Seller's

indemnities contained in Section 6.1(b) shall apply (and the alternate indemnities contained in Section

6.1 (a) shall not apply).

(ii) if "No" is specified opposite "Step-Up Provisions· in the Transaction Summary, Seller's

indemnities contained in Section 6.1(a) shall apply (and the alternate indemnities contained in Section

6.1(b) shall not apply).

E. SECTION 7 !COSTS AND EXPENSES)

0 The Transfer Fee shall be paid by Seller to the Agent and the Purchase Pnce shall be 1ncreased by

an amount equal to

0 one-half thereof.

0 other relevant fraction or percentage, _ _. thereof.

0 The Transfer Fee shall be paid by Buyer to the Agent and Buyer shall rece1ve a cred1t to the

Purchase Price equal to

0 one-half thereof.

0 other relevant fraction or percentage, _ _ , thereof.

5

NY446468.1/153-03410](https://image.slidesharecdn.com/10000000008-121112185847-phpapp01/85/10000000008-34-320.jpg)

![,SSIGNMENT A]';D ASSU1PTION AGREEME]';T

!his Assignment and Assumption Agreement (the ··Assignment'") is dated as of the Effective Date set forth below and

is entered into by and between (the "Assignor"} and Spectrum SPC II for the account

egregated Portfolio (the "Assignee''). Capitalized terms used but not defined

hert!in shall have the meanings given to them in the Amended and Restated First Lien Senior Secured Super-Priority

Debtor-in-Possession and Exit Credit and Guaranty Agreement identified below tas it may be amended. supplemented or

otherwise modi tied from time to time, the .. Credit Agreement"), receipt of a copy of which is hereby acknowledged by the

.ssignee. The Standard Terms and Conditions set forth in Annex l attached hereto are hereby agreed to and incorporated

herein by reference and made a part of this Assignment as if set torth herein in full.

For an agreed consideration. the Assignor hereby in·evocably sells and assigns to the Assignee, and the Assignee

hereby irrevocably purchases and assumes from the Assignor. subject to and in accordance with the Standard T.:rms and

Conditions and the Credit Agreement. as of the Effective Date inserted by the Administrative Agent as contemplated

below. the interest in and to all of the Assignor's rights and obligations under the Credit Agreement and any other

Jocuments or instruments delivered pursuant thereto that represents the amount and percentage interest identified below of

all of the Assignor's outstanding rights and obligations under the respective facilities identitied below (including, to the extent

included in any such facilities. letters of credit LC Deposits and swingline loans) (the "Assigned Interest"). Such sale and

assignment is without recourse to the Assignor and, except as expressly provided in this Assignment and the Credit

Agreement, without representation or warranty by the Assignor.

I. Assignor:

Assignee: Spectrum SPC II for the account of B Spectrum Investment Partners. L.P.

Segregated Portfolio

3. Borrower(s): Allied Holdings. Inc., Allied Systems, LTD (L.P.)

4. Administrative Agent: The CIT Group! Business Credit. Inc., as the administrative agent under the Credit

Agreement

5, Credit Agreement: The S265,000.000.00 Credit Agreement dated as of May 15, 2007 among Allied

Holdings, Inc. (.. Holdings"). Allied Systems, Ltd. (L.P.) ('"Systems"). certain

Subsidiaries of Holdings and Systems, as Guarantors. the Lenders parties thereto.

Goldman Sachs Credit Partners L.P .. as Administrative Agent, The CIT

Group/Business Credit, Inc .. as Administrative Agent and Collateral Agent and the

other agents parties thereto](https://image.slidesharecdn.com/10000000008-121112185847-phpapp01/85/10000000008-44-320.jpg)

![none.

means [the United States Bankruptcy Court for the _____ District of _____ (and. if

appropriate, the United States Distnct Court for that Distnct)J.

·sar Date" select one:

l3;l not applicable.

0 none has been set.

0 means [specify applicable date, 1f any].

'Buyer Purchase Price" select one:

~ not applicable.

0 means the purchase price payable by Buyer to Original Buyer pursuant to the Netting letter (this

applies if there are three (3) parties involved 1n the netting arrangement).

0 means the purchase price payable by Buyer to Penultimate Buyer pursuant to the Netting Letter

(this applies if there are four (4) or more parties involved in the netting arrangement).

"Commitments" select one:

0 none.

[ZJ means Synthetic LC Commitment in the principal amount of $918.434.29, all of which is funded

as an LC Deposit.

"Covered Prior Seller'' select one:

[ZJ not applicable.

0 means each Prior Seller that transferred the Loans 5and Commitments (if any)4 on or after the Shift

Date ~but pnor to the date on which transferred such Loans and Commitments (if

any)}.

"Filing Date" select one:

0 none.

0 means (identify date on which Borrower filed Bankruptcy Case}.

"Loans" means, collectively, Term Loans in t~rincipal amount of

Synthetic LC Deposits in the principal amount o f - -

"Netting Letter" select one:

0 not applicable.

0 means that certain Multilateral Netting Agreement in the form currently published by the LSTA

dated on or as of the Agreement Date among Seller. Buyer [and] [.] Original Buyer [, Penultimate

Buyer] and [describe any other parties to the Netting Letterj].

"Original Buyer" select one:

0 not applicable.

0 means (specify original buyer in the netting arrangement].

• if applicable to only a portion of the Loans and Commitments (if any), specify the portion that applies, !tlt.. 'each

Prior Seller that transferred the [Name of applicable Covered Prior Seller] loans (as defined in Section 1 of the

Annex)."

5

Specify the first Entity that transferred the Loans and Commitments (if any) on a distressed documentation basis

on or after the Shift Date.

5

The bracketed language applies where the relevant Predecessor Transfer Documents include a distressed trade

that settled after the par/near par trade which settled on or after the Shift Date.

3

NY440633.11153-03372

NY440633.1i153-03372](https://image.slidesharecdn.com/10000000008-121112185847-phpapp01/85/10000000008-53-320.jpg)

![B. SECTION 4 (SELLER'S REPRESENTATIONS AND WARRANTIES)

The following spec1fied terms shall apply to the sections referenced in this Sect1on 8:

: Flat Regresentation F!ie Reeresentation

i Stee·Ue Reeresentation

i If "No" is specified opposite

I

I If "Yes· is specfted opposite If "Yes" is specified oppostte

'i

!

both "Flip Representations·

' '"' ·s~<p-u, '"''"M'. '"

! the Transaction Summary. the

following subsections of

I

1 "Flip Representat:ons· in the

r~''"~ subsections the

following

s,~,~. of

Section 4 shall aoply:

"Step-Up Provisions" in the

Transaction Summary, the

following subsecnons

Section 4 shall apply:

of

Section 4 shall apply:

I

I

Section 4 1(d) (Title) Section 4.1{d)(i) Section 4.1(d)(ii) Secbon 4.1(d)(i)

I

Section 4.1(e) !Proceedings) i Section 4.1(e)(i) Section 4.1 (e l(i) !

Section 4.1(e)(li)

I I

I

Section 4.1(f} (Principal

' Amount)

Section 4.1 (f)(i)

I Section 4.1(f)(ii) Section 4.1(f)(l)

I I

Section 4.1 (g)(i)

·section 4.1 (g) (Future Funding)

I Section 4.1 (gXii)

I

Section 4.1 (g)(lii)

Section 4.1(h) (Acts and Section 4.1(h)(i) Section 4.1 (h)(i) Section 4.1(h)(ii)

Omissions) I

i

Section 4.1(1)(i)

Section 4.1 (i) (Performance of

Obligations)

I Section 4.1(i)(i) Secbon 4.1 (i)(ii}

I

Section 4.1(1) (Setoff) ! Section 4.1(1)(1) Section 4.1(1)(1) Section 4.1 (l)(ii)

Section 4.1(1) (Consents and Section 4.1(t)(i) Section 4.1(1)(1) Section 4.1(t)(ii)

Waiver5)

Section 4.1(u) !Other

I Section 4.1(u)(i) Section 4.1(u)(i)

Documents)

! Section 4.1(u)(ii)

!

I

Section 4.1 (vi (Proof of Claim) Section 4.1 (v)(i) Section 4.1 (v)(ii) Section 4.1(v)(l)

j

Section 4.1 (k) (Purchase Price); Netting Arrangements.

If "Yes" is specified oppos1te Netting Arrangements in the Transaction Summary, Section 4.1 (k)

shall be amended in its entirety as follows:

7

"(k) [intentionally omitted]."

7

Seller should add, and Buyer should cause Original Buyer or Penultimate Buyer. as applicable, to add, a

comparable representation to the Netting Letter in lieu of this representation.

5

NY440633.1/153-03372

NY 440633.1/153-033 72](https://image.slidesharecdn.com/10000000008-121112185847-phpapp01/85/10000000008-55-320.jpg)

![Section 4 1(r) (Predecessor Transfer Agreements).

Seller acquired the Transferred Rights from Immediate Prior Seller pursuant to Predecessor

Transfer Agreements relating to par/near par loans.

(SJ Seller acquired the Transferred Rights from Immediate Prior Seller pursu<ml to Predecessor

Transfer Agreements relating to d1stressed loans.

0 Seller acqUJred the Transferred Rights from Immediate Prior Seller pursuant to Predecessor

Tr·ansfer Agreements relating to both par/near par loans and distressed loans.

Section 4.1 (u) (Other Documents).

0 None.

0 The following: _ _ __

Section 4.1 (v) (Proof of Claim). N/A

0 The Proof of Claim was duly and timely filed, on or pnor to the Bar Date, by

0 the Agent on behalf of the Lenders.

0 Seller or a Prior Seller.

0 The Bar Date specified in the Transaction Specific Terms has been set in the Bankruptcy

Case and no Proof of Claim has been filed.

0 No Bar Date has been set in the Bankruptcy Case and no Proof of Claim has been filed.

C. SECTION 5 (BUYER'S REPRESENTATIONS AND WARRANTIES)

C.1 Section 5.1 (n) (Buyer Status). (Specify Buyer's status for purposes of determining Required

Consents, minimum ass1gnment amount requirements or Transfer Fee requirements.]

0 Buyer is not a Lender.

0 Buyer is a Lender.

0 Buyer is an Affiliate (as defined in the Credit Agreement) of a Lender.

0 Buyer is an Approved Fund [substitute Credit Agreement defined term if different] of a Lender.

C.2 If "Yes" is specified opposite "Delivery of Credit Documents" in the Transaction Summary, Buyer

represents and warrants that it (i) was not a Lender on the Trade Date and (ii) requested copies of the

Credit Documents from Seller on or prior to the Trade Date.

D. SECTION 6 (INDEMNIFICATION)

Section 6.1 (Seller's Indemnities); Step-Up Indemnities.

(i) If "Yes" is specified opposite "Step-Up Provisions" in the Transaction Summary, Seller's

indemnities conta1ned in Section 6.1 (b) shall apply (and the alternate indemnities contained in Section

6.1 (a) shall not apply).

(ii) If "No" is specified opposite "Step-Up Provisions" in the Transaction Summary, Seller's

indemnities contained in Section 6.1 (a) shall apply (and the alternate indemnities contained in Section

6.1(b) shall not apply).

E. SECTION 7 (COSTS AND EXPENSES)

0 The Transfer Fee shall be paid by Seller to the Agent and the Purchase Price shall be increased by

an amount equal to

0 one-half thereof.

0 other relevant fraction or percentage, _ _, thereof.

6

NY440633.1/153-03372

NY440633.1/153-03372](https://image.slidesharecdn.com/10000000008-121112185847-phpapp01/85/10000000008-56-320.jpg)

![TRANSACTION SUMMARY

Borrower in Bankruptcy: Yes 0 No~

Delivery of Credit Documents: YesO No (8]

Netting Arrangements: YesO No~

1

Flip Representations: Yes 0 No [8J

1

Step-Up Provisions: Yes0 No [8J

Shift Date 2 : Not Applicable

3

Transfer Notice: Yes0 No [8J

A. DEFINITIONS

Capitalized terms used in this Agreement shall have the respective meanings ascribed thereto in Section

1 of the Standard Terms. as supplemented by Section A of the Transaction Specific Terms and as

otherwise may be provided in other provisions of this Agreement. Terms defined in the Credit Agreement

and not otherw1se defined in this Agreement shall have the same meanings in this Agreement as in the

Credit Agreement. Except as otherwise expressly set forth herein, each reference herein to "the

Agreement," "this Agreement," "herein." "hereunder" or "hereof' shall be deemed a reference to this

Agreement. If there is any inconsistency between the Transaction Specific Terms and the Standard

Terms, the Transaction Specific Terms shall govern and control.

In this Agreement:

"Agent" means The CIT Group I Business Credit, Inc.• as Administrative Agent.

"Assignmenr. means the Assignment and Assumption Agreement that is in the form specified· in th.e

Credit Agreement for an assignment of the Loans and Commitments (if any) and any Require<LConsents·

to such assignment. , ,,

"Bankruptcy Case" select one:

, (81 none.

0 means [the case under the Bankruptcy Code pending before the Bankruptcy Court in which

Borrower is a debtor, In re - - - - - · No. _ _ _ __.

"Bankruptcy Court" select one:

1

The Parties cannot specify "Yes· to both "Flip Representations" and "Step-Up Provisions" unless they set forth

appropriate modifications in Section H. Neither "Flip Representations· nor "Step-Up Provisions• applies to original

assignments.

2

Specify a Shift Date only if "Yes· is specified opposite "Step-Up Provisions" and if the second box is selected in the

definition of Covered Prior Seller. The Shift Date is the date that the Parties agree is the closest possible

approximation for when the market convention for transferring the Loans and Commitments (if any) shifted from a

par/near par documentation basis to a distressed documentation basis. In consulting as to the appropriate date, the

Parties may refer to published results of an anonymous LSTA poll of disinterested dealers as· to such dealers' views

regarding the Shift Date or. if results have not been published with respect to the Credit Agreement, either Party may

request in writing that the LSTA endeavor to conduct such a poll. To initiate a poil, send a request that includes the

name of Borrower and either the CUSIP number (if available) or the name and date of the Credit Aoreement to the

LSTA at lstashiftsfajepolls@lsta.ora. The results of such LSTA polls are available to facilitate discussions between

the Parties and have no binding effect.

3

"Yes" can be elected only if "Yes" is specified opposite "Borrower in Bankruptcy" in the Transaction Summary.

2

NY437534.3/153-07942

NY437534 3/153-07942](https://image.slidesharecdn.com/10000000008-121112185847-phpapp01/85/10000000008-82-320.jpg)

![U none.

0 means (the United States Bankruptcy Court for the _____ Distnct of _____ (and, if

appropriate. the United States District Court for that District)).

"Bar Date" select one:

lS.l not applicable.

0 none has been set.

0 means [specify applicable date, if any].

"Buyer Purchase Price" select one:

[81 not applicable.

0 means the purchase price payable by Buyer to Original Buyer pursuant to the Netting Letter (this

applies if there are three (3) parties involved in the netting arrangement).

0 means the purchase price payable by Buyer to Penultimate Buyer pursuant to the Netting letter

(this applies if there are four (4) or more parties involved in the netting arrangement).

"Commitments" select one:

0 none.

0 means Synthetic lC Commitment in the principal amount of $434,782.61. all of which is funded

as an LC Deposit.

"Covered Prior Seller" select one:

0 not applicable.

0 means each Prior Seller that transferred the loans 5and Commitments (if any)~ on or after the Shift

Date lhut prior to the date on which transferred such Loans and Commitments (if

any)}.

-"Filing Date" select one:

0 none.·

0 means pdentify date on which Borrower filed Bankruptcy Casej.

"Loans" means, collectively, Term Loans in ~rincipal amount

Synthetic LC Deposits in the principal amount~

"Netting Letter" select one:

r8j not applicable.

0 means that certain Multilateral Netting Agreement in the form currently published by the LSTA

dated on or as of the Agreement Date among Seller. Buyer [and} [,] Original Buyer[, Penultimate

Buyer] and [describe any other parties to the Netting Letter]].

"Original Buyer" select one:

0 not applicable.

0 means (specify original buyer in the netting arrangement].

• If applicable to only a portion of the loans and Commitments (if any), specify the portion that applies. ~. "each

Prior Seller that transferred the [Name of applicable Covered Prior Seller) Loans (as defined in Section 1 of the

Annex).'

5

Specify the first Entity that transferred the Loans and Commitments (if any) on a distressed documentation basis

on or after the Shift Date.

5

The bracketed language applies where the relevant Predecessor Transfer Documents indude a distressed trade

that settled after the par/near par trade which settled on or after the Shift Date.

3

NY437534.3/153-07942

NY437534.31153-07942](https://image.slidesharecdn.com/10000000008-121112185847-phpapp01/85/10000000008-83-320.jpg)

![Section 4.1 (r) (Predecessor Transfer Agreements).

0 Seller acquired the Transferred Rights from Immediate Prior Seller oursuant :o Predecessor

Transfer Agreements relating to par/near par loans.

0 Seller acquired the Transferred Rights from Immediate Prior Seller pursuant :o Predecessor

Transfer Agreements relating to distressed loans.

0 Seller acquired the Transferred Rights from Immediate Prior Seller pursuant to Predecessor

Transfer Agreements relating to both par/near par loans and distressed loans.

Section 4.1 (u) (Other Documents).

0 None.

0 The following:

Section 4.1(v) (Proof of Claim). N/A

0 The Proof of Claim was duly and timely filed. on or prior to the Bar Date, by

0 the Agent on behalf of the Lenders.

0 Seller or a Prior Seller.

0 The Bar Date specified in the Transaction Specific Terms has been set in the Bankruptcy

Case and no Proof of Claim has been filed.

0 No Bar Date has been set in the Bankruptcy Case and no Proof of Claim has been filed.

C. SECTION 5 (BUYER'S REPRESENTATIONS AND WARRANTIES)

C.1 Section 5.1 (n) (Buyer Status). [Specify Buyer's status for purposes of determining Required

Consents, minimum assignment amount requirements or Transfer Fee requirements.]

0 Buyer is not a Lender.

0 Buyer is a Lender.

[8J Buyer is an Affiliate (as defined in the Credit Agreement) of a Lender.

0 Buyer is an Approved Fund [substitute Credit Agreement defined term if different] of a Lender.

C.2 If "Yesff is specified opposite "Delivery of Credit Documents" in the Transaction Summary, Buyer

represents and warrants that it (i) was not a Lender on the Trade Date and (ii) requested copies of the

Credit Documents from Seller on or prior to the Trade Date.

D. SECTION 6 (INDEMNIFICATION)

Section 6.1 (Seller's Indemnities); Step-Up Indemnities.

(i) If "Yes" is specified opposite "Step-Up Provisions" in the Transaction Summary, Seller's

indemnities contained in Section 6.1(b) shall apply (and the alternate indemnities contained in Section

6.1(a) shall not apply).

(ii) If "No" is specified opposite "Step-Up Provisions" in the Transaction Summary, Seller's

indemnities contained in Section 6.1(a) shall apply (and the alternate indemnities contained in Section

6.1 (b) shall not apply).

E. SECTION 7 (COSTS AND EXPENSES)

0 The Transfer Fee shall be paid by Seller to the Agent and the Purchase Price shall be increased by

an amount equal to

0 one-half thereof.

0 other relevant fraction or percentage, _ _ , thereof.

6

NY437534.3/153-07942

NY 437534.3/153-07942](https://image.slidesharecdn.com/10000000008-121112185847-phpapp01/85/10000000008-86-320.jpg)