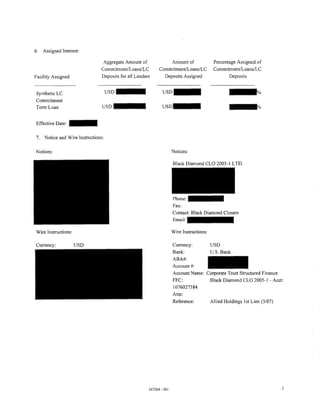

With a copy to:

Attention:

Telecopier:

Wire Instructions:

Bank Name:

ABA/Routing No.:

Account Name:

Account No.:

FFC Account Name:

FFC Account No.:

Attention:

Reference:

347264-001

�The terms set forth in this Assignment are hereby agreed to:

ASSIGNOR:

[NAME OF ASSIGNOR]

By: _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

![UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

·--···-----·----·----- -------·--·---·--·-·---·--·-··X

In re:

Chapter 11

ALLIED SYSTEMS HOLDINGS, INC.,

Case No. 11-.._[_ __,] ([_])

Alleged Debtor.

·----------------------·--·------·-·X

In re:

Chapter 11

ALLIED SYSTEMS, LTD. (L.P.),

Case No. 11-[_ __.] ([_j)

Alleged Debtor.

------·····--·--·-··-···-··--x

AFFIDAVIT OF RICHARD EHRLICH ON BEHALF OF

BLACK DIAMOND CLO 2005-1 LTD. PURSUANT

TO FEDERAL RULE OF BANKRUPTCY PROCEDURE 1003

STATE OF CONNECTICUT)

) ss:

COUNTY OF FAIRFIELD )

Richard Ehrlich being duly sworn, deposes and states:

1. I make this affidavit on behalf of Black Diamond CLO 2005-1 Ltd. ("Black

Diamond"), a petitioning creditor in the above-captioned involuntary chapter 11 cases (the

"Bankruptcy Cases") filed by Black Diamond and other petitioning creditors against (i) Allied

Systems Holdings, Inc., and (ii) Allied Systems, Ltd. (L.P.) (together, the "Debtors"). I am fully

familiar with the facts set forth herein either through my own personal knowledge or through a

review of documents related to Black Diamond's claims against the Debtors. If called to testify

in connection with the Bankruptcy Cases, the following would constitute my testimony.](https://image.slidesharecdn.com/10000000007-121112185838-phpapp02/75/10000000007-1-2048.jpg)