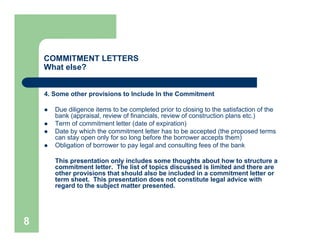

(1) Commitment letters outline the basic terms of a proposed loan between a lender and borrower, such as the loan amount, interest rate, fees, collateral requirements, and conditions that must be met for funding.

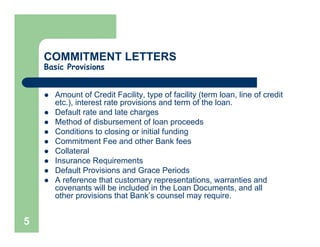

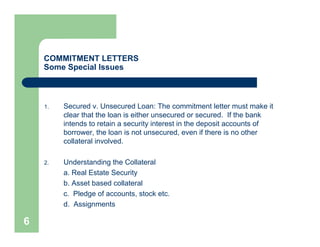

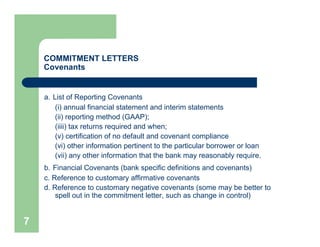

(2) Key terms that should be included are the loan amount and type, interest rate provisions, fees, collateral, insurance requirements, default provisions, and customary representations and warranties.

(3) The commitment letter establishes the lender's agreement to provide financing upon satisfaction of due diligence conditions and typically includes an expiration date by which the borrower must accept the proposed terms.