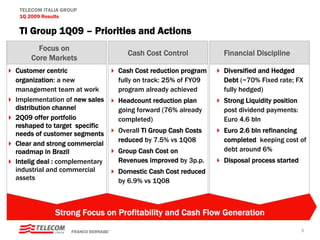

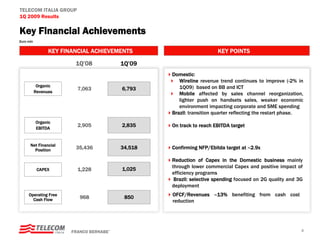

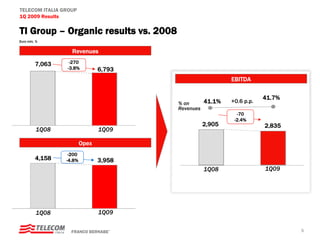

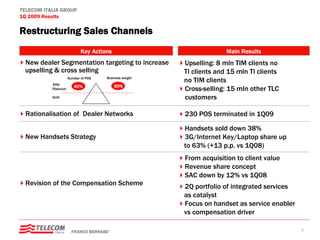

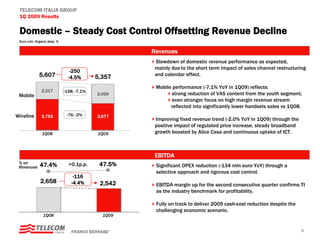

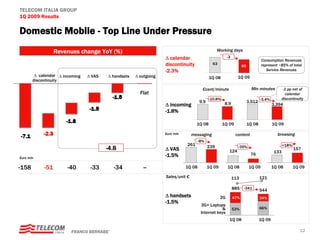

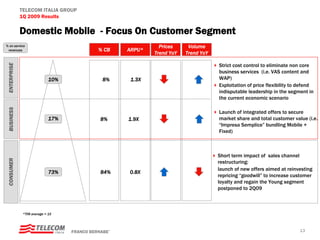

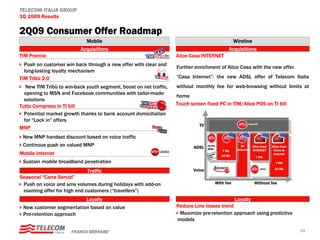

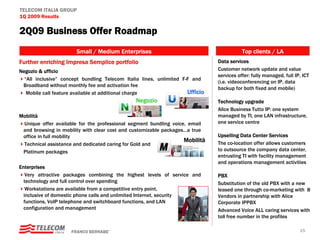

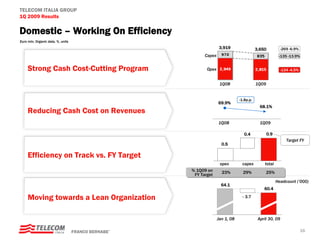

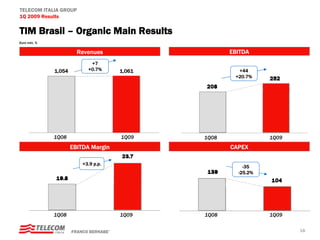

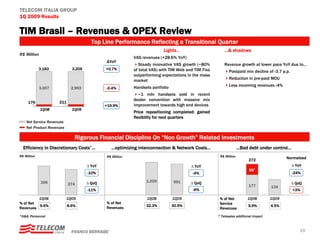

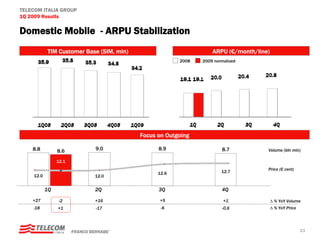

Telecom Italia Group reported its 1Q09 results, focusing on cost control and cash flow generation. Revenues declined 3.8% organically due to challenges in the domestic market from channel restructuring and the economy. However, EBITDA was largely stable as cash costs fell 7.5%. Looking ahead, Telecom Italia will continue restructuring sales channels and controlling costs while implementing new offers to boost revenues in key segments.