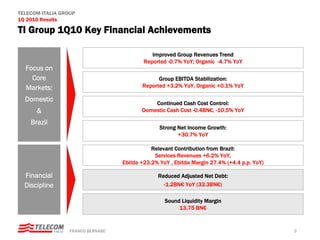

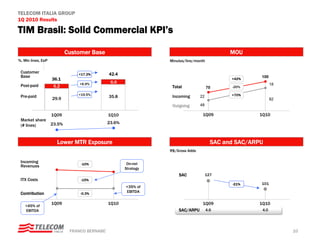

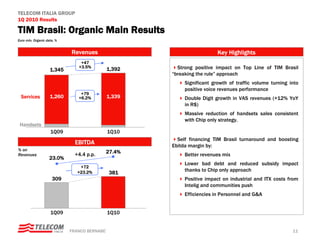

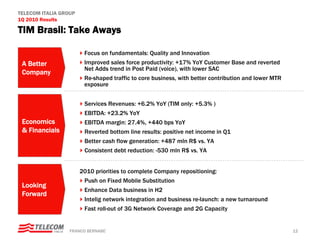

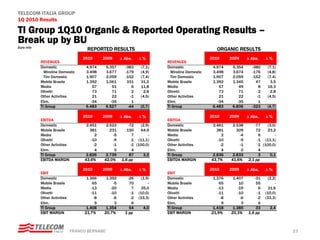

Telecom Italia reported its 1Q 2010 results. Key highlights include:

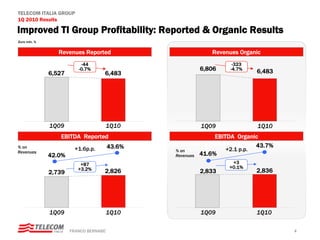

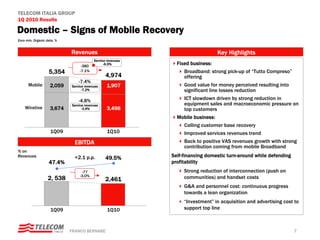

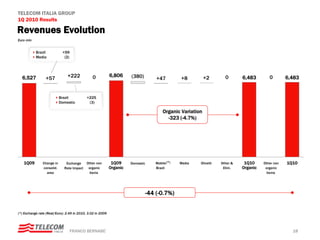

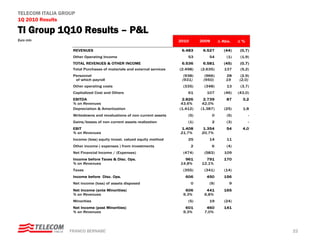

- Group revenues declined 0.7% year-over-year reported but organic revenues declined 4.7% due to currency impacts.

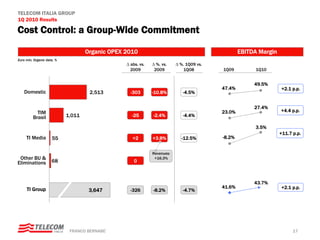

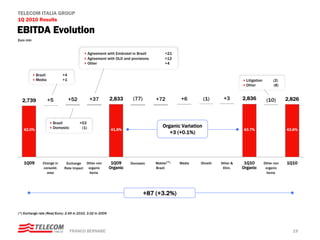

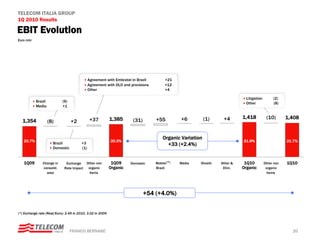

- Group EBITDA increased 3.2% reported and was stable year-over-year on an organic basis.

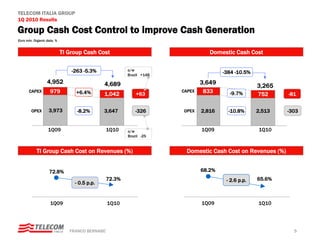

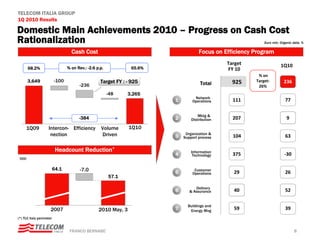

- Cash costs were reduced through focus on the domestic and Brazilian markets, with domestic cash costs declining 10.5% year-over-year.

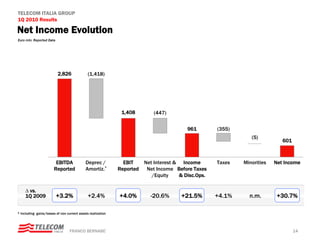

- Net income grew 30.7% year-over-year due to cost controls and contributions from the Brazilian business.