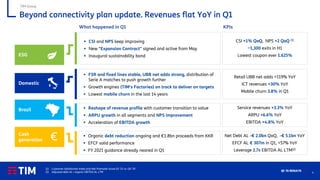

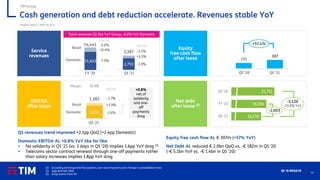

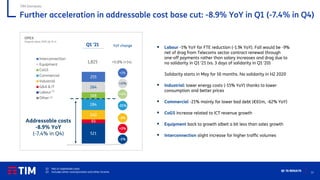

- TIM Group reported Q1 2021 results with revenues flat YoY and accelerating cash generation and debt reduction. Net debt was reduced by €2.0bn in Q1.

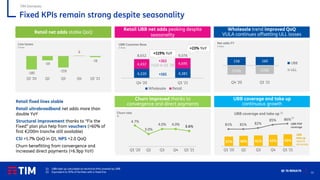

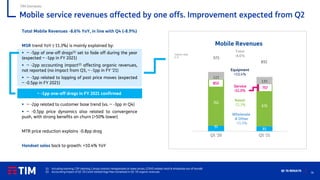

- For TIM Domestic, fixed service revenues stabilized YoY while mobile service revenues declined slightly. UBB coverage and take up continued to grow.

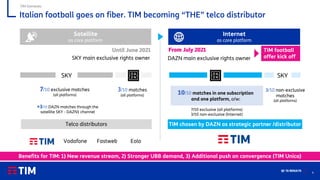

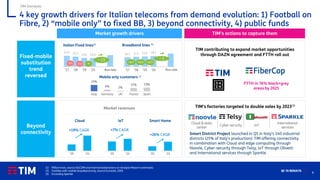

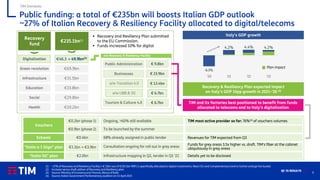

- Key growth drivers for TIM include the distribution of Italian football exclusively on fiber networks beginning in July 2021, capturing the shift from mobile-only to fixed broadband, leveraging opportunities in beyond connectivity areas, and benefitting from public funds being allocated to Italy's digitalization.