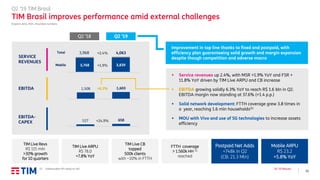

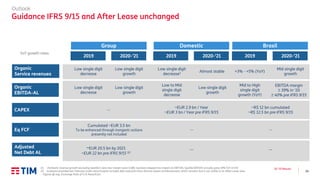

In Q2 2019:

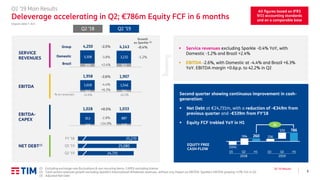

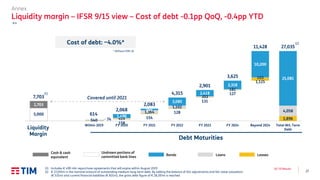

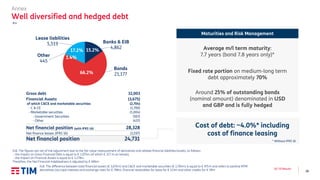

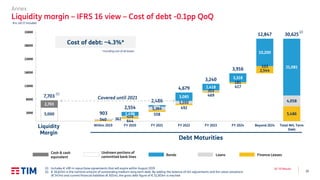

- Net debt was reduced by €349M from the previous quarter to €24.7B total, through strong cash generation.

- Equity free cash flow trebled year-over-year in the first half of 2019 to €786M.

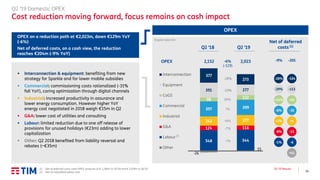

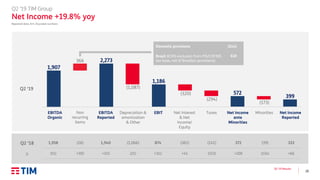

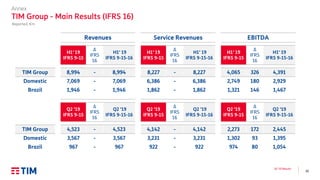

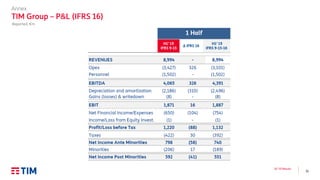

- EBITDA declined 2.6% year-over-year due to a 4.4% drop in the Domestic segment, but grew 6.3% in Brazil.

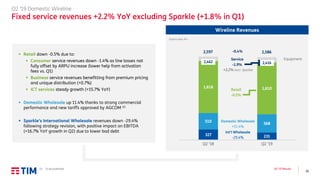

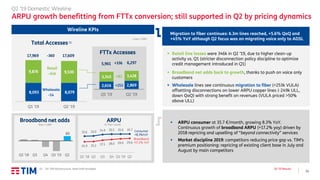

- Mobile revenues declined 8.7% year-over-year due to lower handset sales, while fixed service revenues grew 2.2% excluding Sparkle.