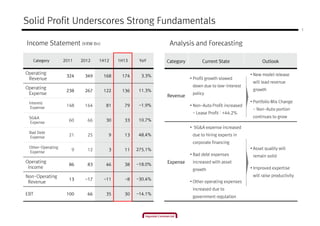

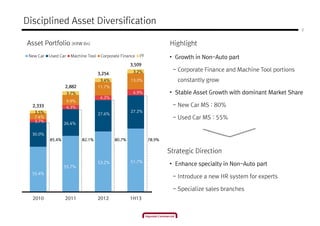

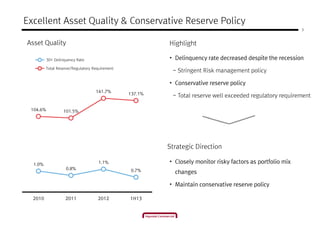

Hyundai Commercial's financial results have remained solid despite slowing profit growth. Revenue increased 3.3% in the first half of 2013 driven by growth in non-auto profits such as leasing. Expenses also increased due to hiring experts and increased regulation. Asset quality remains excellent with delinquency rates decreasing and reserves exceeding requirements. The company aims to enhance its non-auto business and maintain a conservative financial profile.

![[Appendix] Fact Sheet - HCI

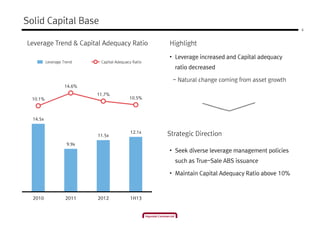

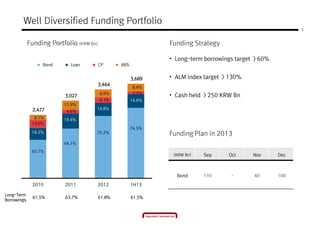

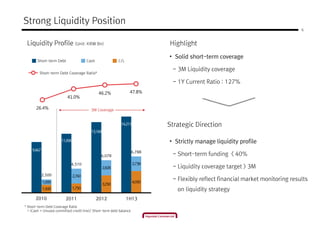

(Unit : KRW Bn) 2008 2009 2010 2011 2012 1H13

Domestic

Sales of

Commercial

Vehicles

Sum(unit) 20,152 19,795 21,479 18,842 15,620 8,389

HMC/KMC M/S 54.0% 60.1% 64.2% 65.8% 62.3% 66.6%

Asset

Portfolio

Total 1,050 1,439 2,333 2,882 3,254 3,509

Auto Sector 77.8% 86.4% 85.4% 82.1% 80.7% 78.9%

Others 22.2% 13.6% 14.6% 17.9% 19.3% 21.1%

Asset

Quality

Substandard &

Below

1.2% 0.7% 0.9% 1.2% 1.5% 1.0%

NPL 1.2% 0.6% 0.6% 1.0% 1.0% 1.0%

30+ Delinquency 2.1% 0.9% 1.0% 0.8% 1.1% 0.7%

NPL Coverage ratio 140.8% 224.7% 172.5% 84.1% 114.8% 129.4%

Profitability Operating Income 14.1 27.6 57.5 86.4 82.8 37.6

Asset &

Capital Adequacy

Ratio

7.8% 9.3% 10.1% 14.6% 11.7% 10.5%

Leverage Borrowing Leverage 15.3X 15.0X 14.5X 9.9X 11.5X 12.1X

Funding

Portfolio

Bond / Loan 91.1% 80.9% 78.9% 83.5% 85.0% 88.9%

CP 8.9% 19.1% 13.0% 4.6% 6.1% 2.7%

ABS - - 8.1% 11.9% 8.9% 8.4%

Total 998 1,481 2,477 3,026 3,464 3, 689

CP Coverage 124.1% 34.2% 77.4% 322.1% 289.4% 673.0%

Debt

Maturity

Debt Maturity - 1.37Y 1.69Y 1.79Y 1.66Y 1.70Y

Maturity 2013 2014 2015 2016 2017 2018~

Volume 676 1,305 774 601 120 213](https://image.slidesharecdn.com/1h13hcieng-130911200900-phpapp01/85/1-h13-hci_eng-8-320.jpg)