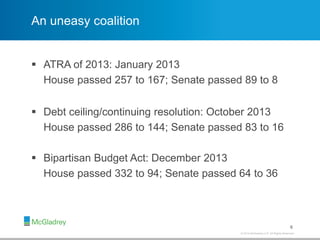

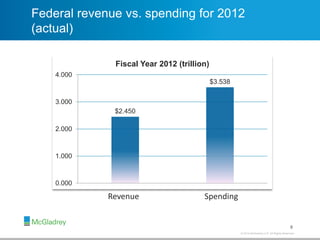

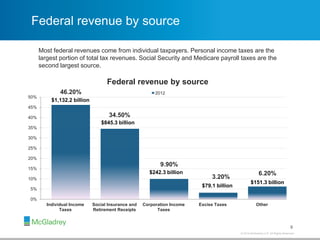

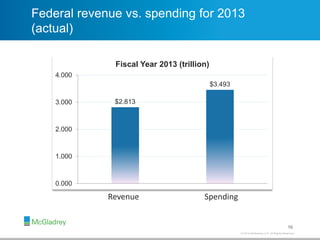

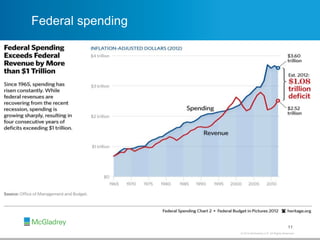

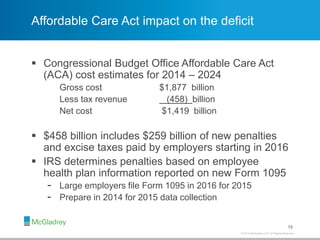

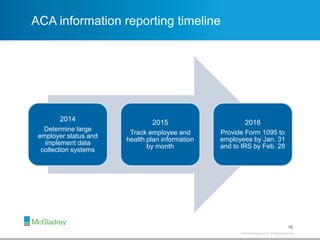

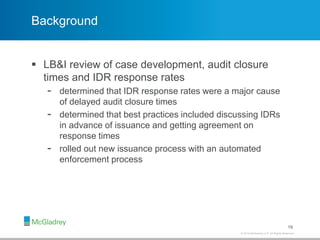

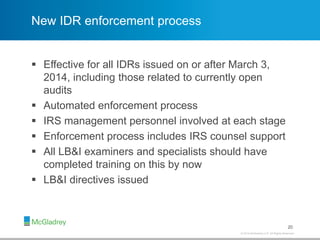

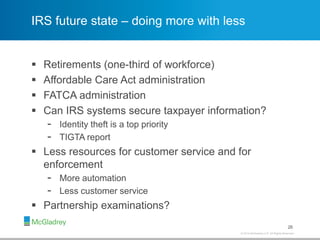

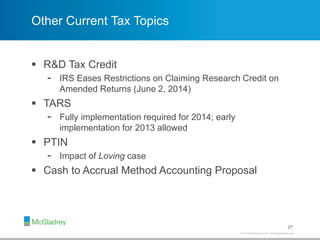

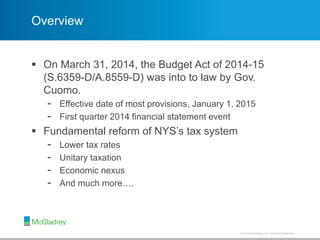

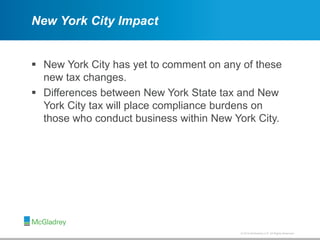

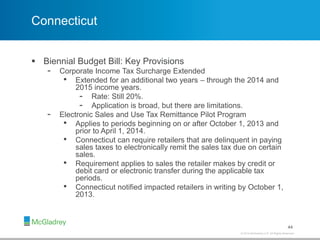

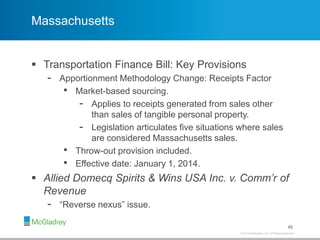

The document outlines the 5th annual tax update by Harlan J. Kwiatek, focusing on federal and state tax changes including updates on tax controversy, the Affordable Care Act, federal revenue vs. spending, and New York state tax reform. It highlights the impact of these changes, such as lower tax rates for corporations and new nexus standards for tax purposes. The update emphasizes the need for open communication regarding IRS enforcement and procedural changes affecting audits and taxpayer compliance.