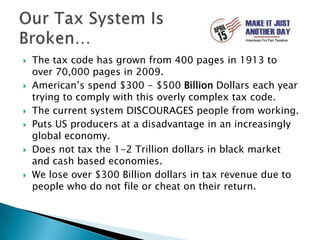

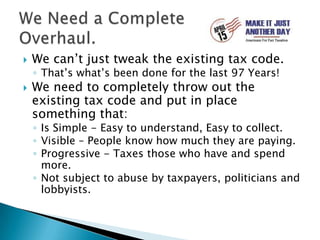

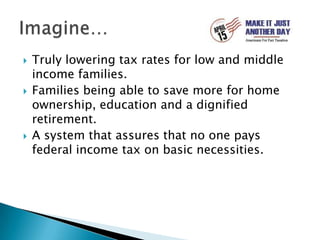

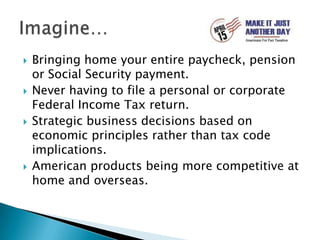

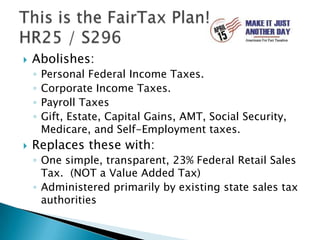

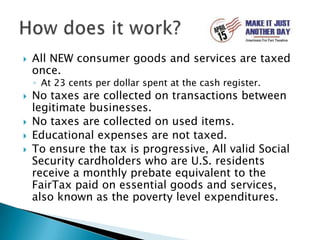

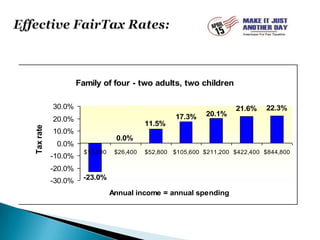

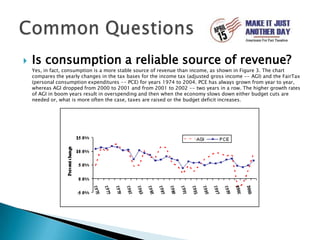

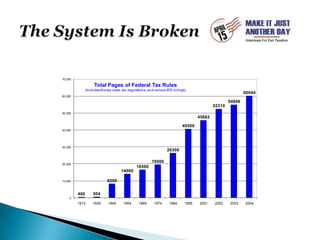

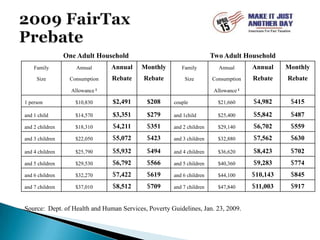

This document summarizes and advocates for the FairTax plan, which would abolish all federal income taxes and replace them with a 23% national sales tax. It argues that the current tax system is overly complex, discourages work and economic growth. The FairTax would be simple, transparent and visible to taxpayers. It would tax consumption and ensure low-income households pay no taxes on basic necessities through a monthly tax rebate. Supporters believe the FairTax would boost the economy, make U.S. products more competitive, and generate the same tax revenue as the current system in a more efficient manner.