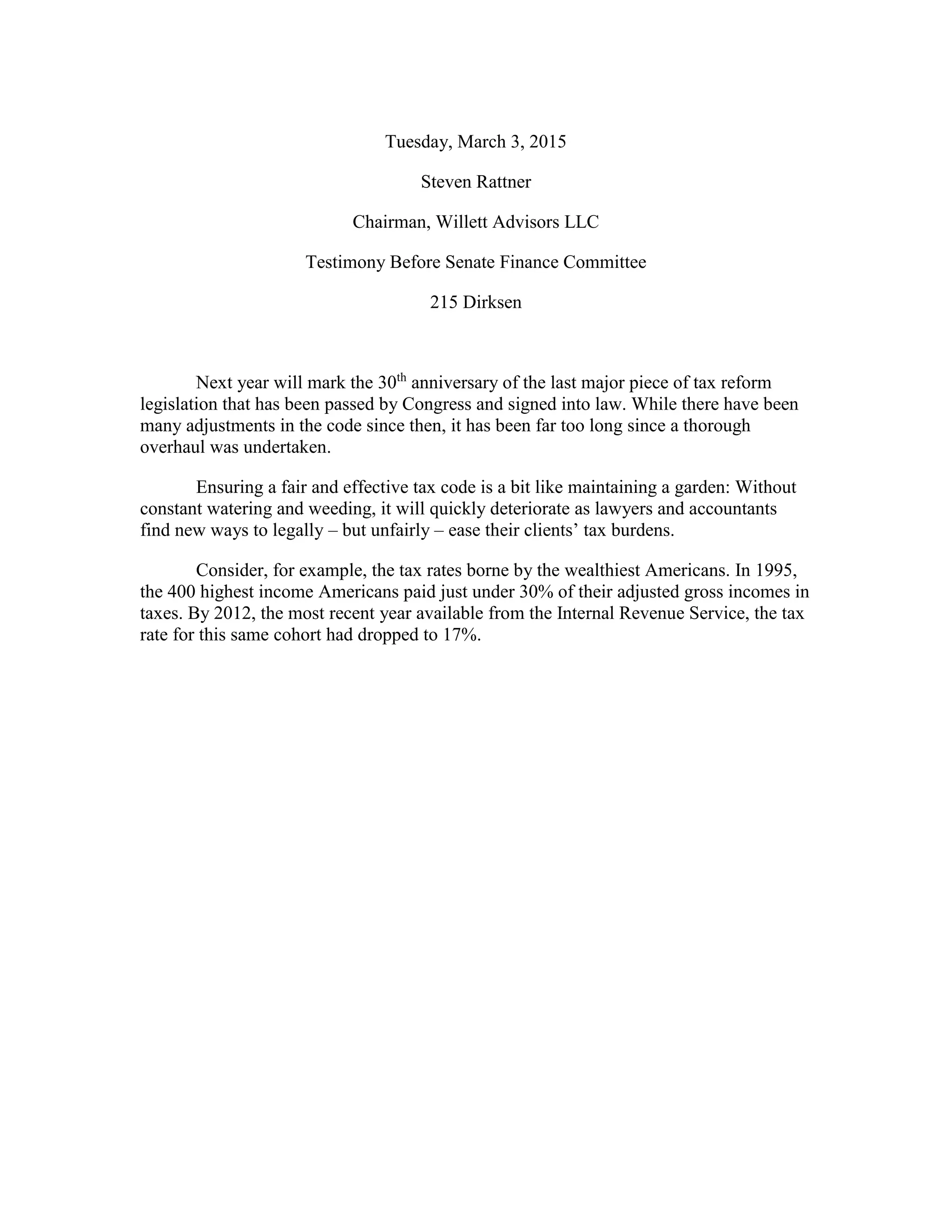

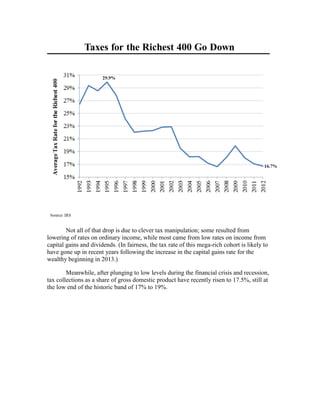

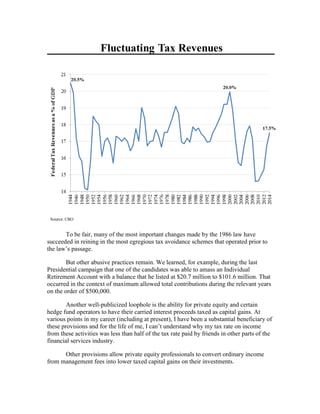

Steven Rattner testified before the Senate Finance Committee on the need for tax reform. He argued that the tax code has deteriorated without reform in over 30 years, allowing lawyers and accountants to legally ease tax burdens for their wealthy clients. For example, the 400 highest income Americans saw their tax rate drop from 30% to 17% from 1995 to 2012 due largely to low capital gains and dividend rates. Rattner advocated achieving greater fairness and revenue by reducing the number of tax rates, eliminating special treatment of capital gains and dividends, and reducing loopholes that disproportionately benefit the wealthy.