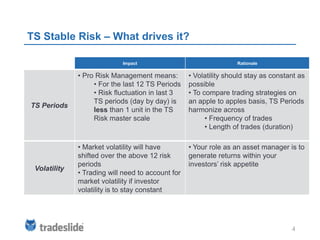

The document discusses the Tradeslide Stable Risk badge. It defines stable risk as a measure of how stable the risk of a trading strategy is over time, and whether risk fluctuates or remains consistent. It notes that stable risk does not necessarily mean low risk or high risk. The document provides information on how stable risk is calculated in Tradeslide and discusses why stable risk is an important consideration for traders and investors.