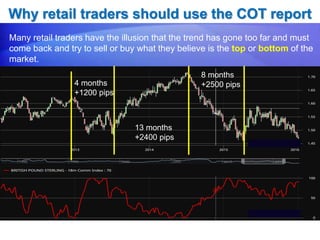

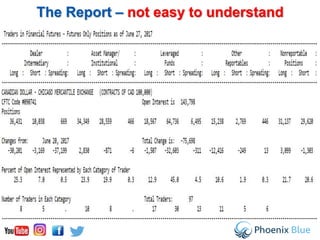

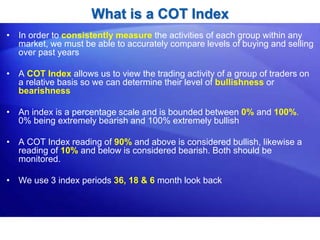

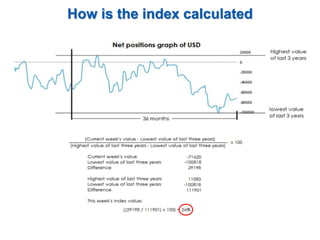

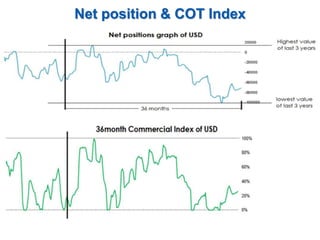

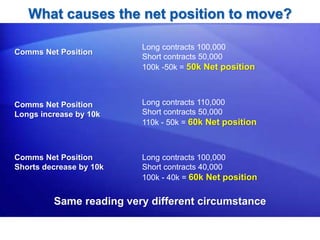

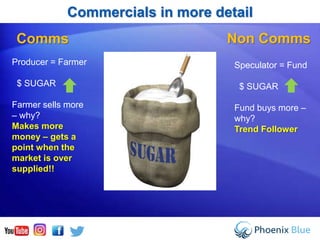

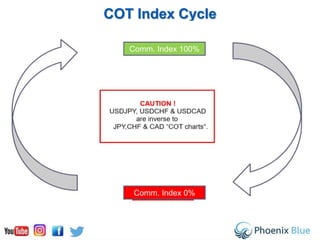

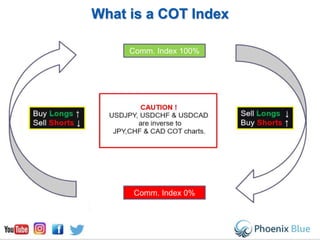

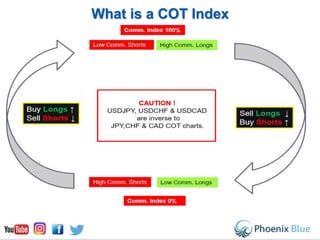

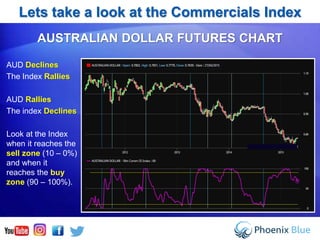

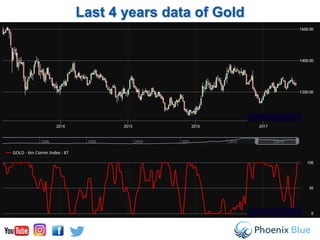

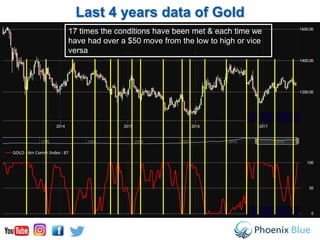

The document discusses how the Commitments of Traders (COT) report can be used to help determine when a market trend is ending and a new trend is starting. It explains that the COT report details the long and short positions of different trader types, including commercial traders, who are trend starters and enders, and non-commercial traders, who are trend followers. It describes how the positions of commercial traders in particular can provide clues about future market direction. The document illustrates how to interpret COT data through the use of indices and provides examples of how analyzing the COT report has successfully identified trend changes in currencies like the Australian dollar and commodities like gold in the past.