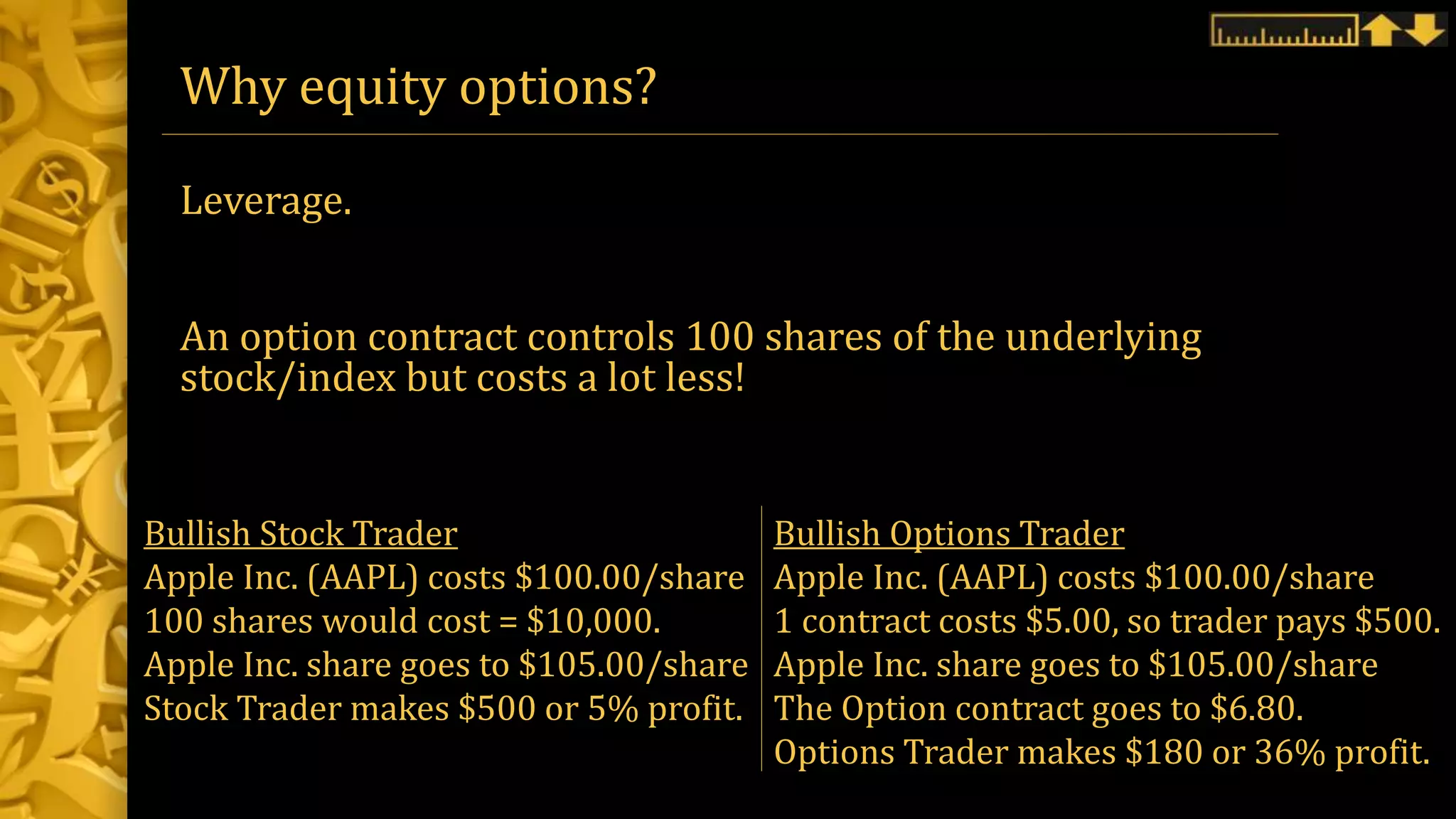

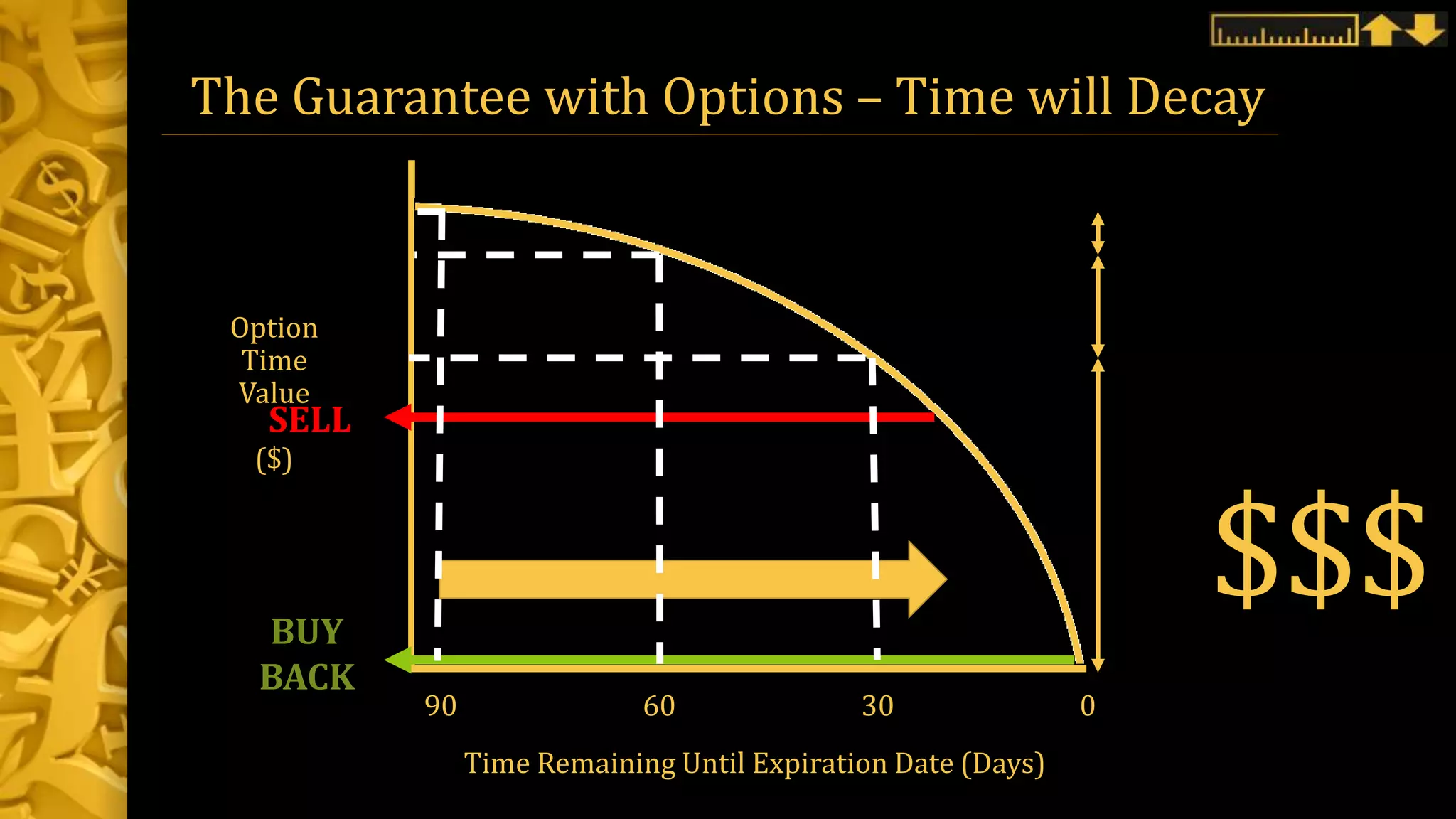

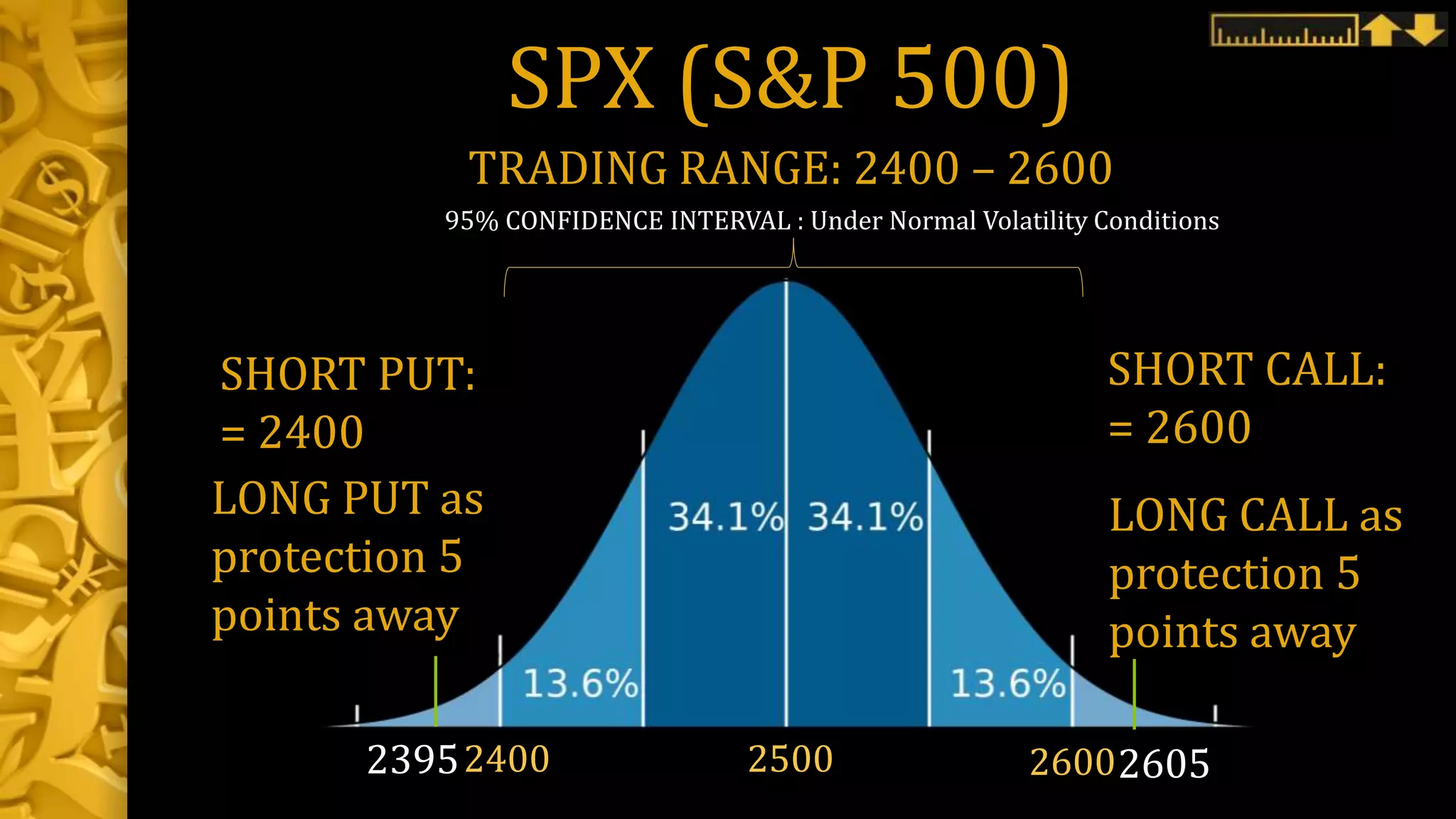

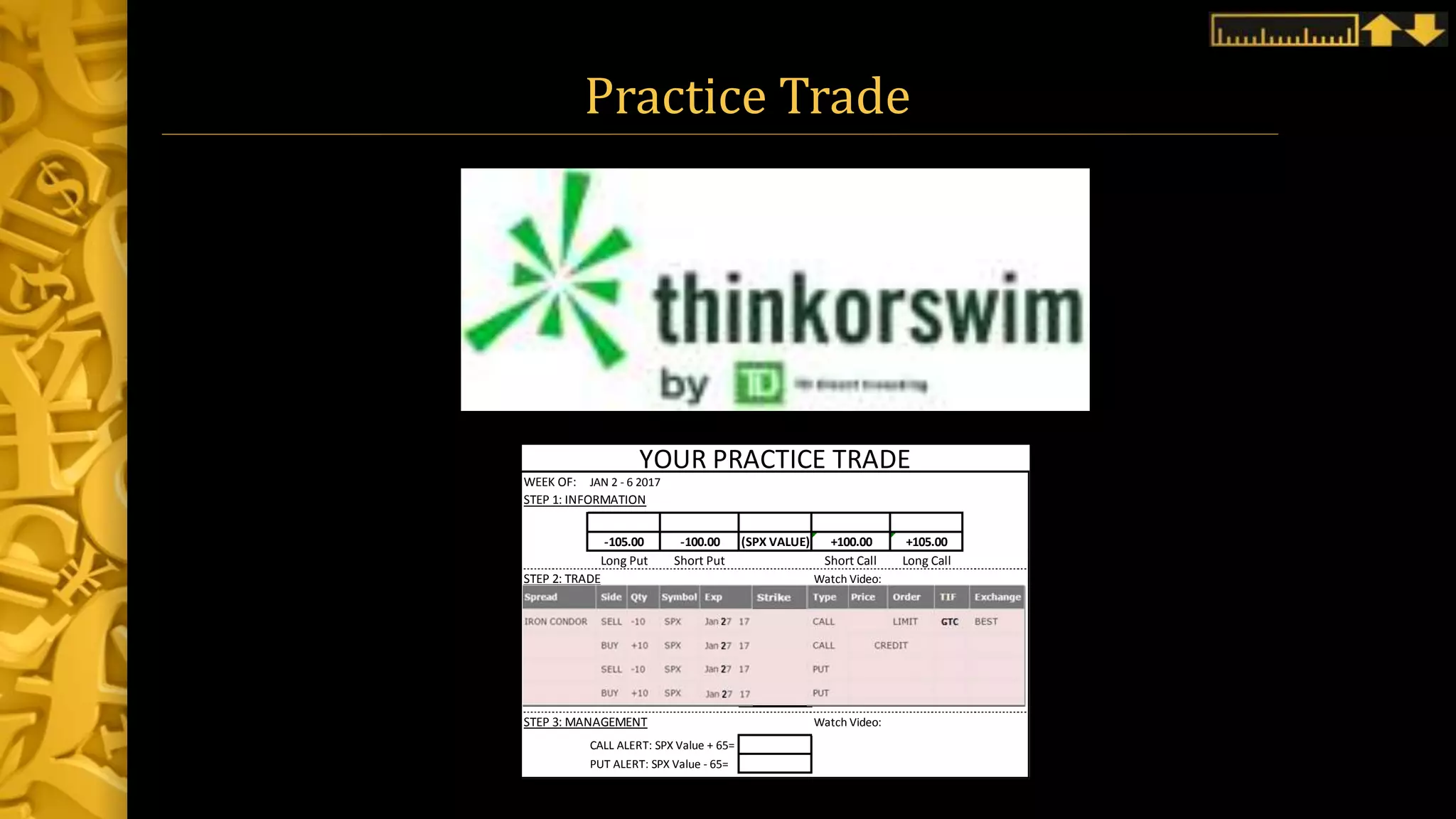

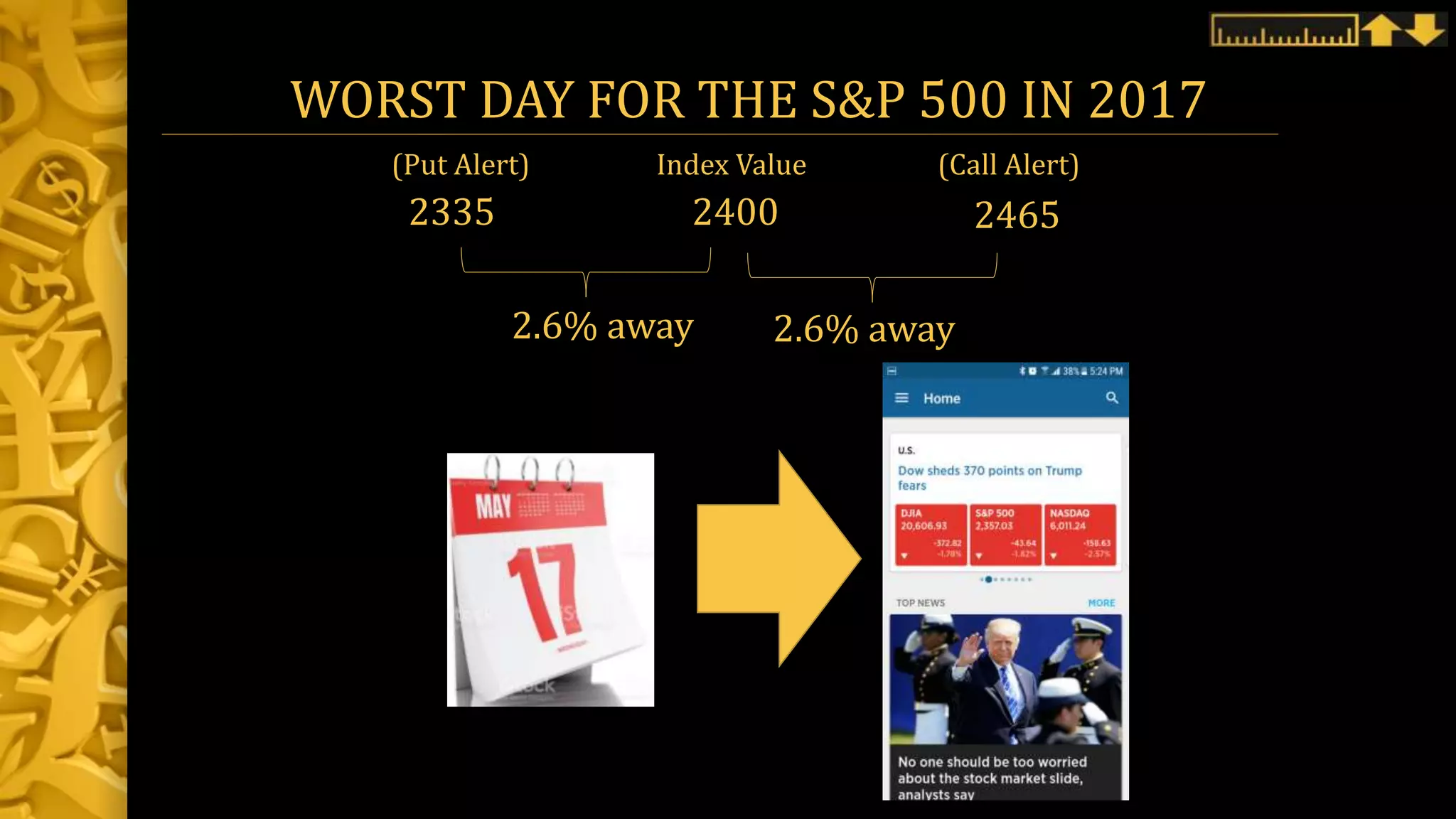

This document provides an agenda for a meetup on disciplined trading. It includes an introduction to who the presenters are, what disciplined trading means, a practice non-directional options trade on the S&P 500 index, and a discussion of equity options strategies. Key points covered are defining risk before trades, cutting losses without hesitation, and using money management to make consistent profits. Disclaimers note that the content is for education only and not investment advice.