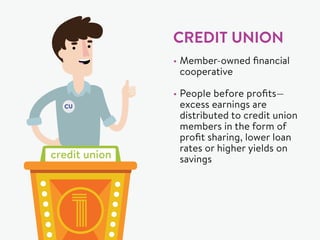

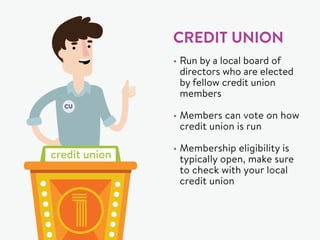

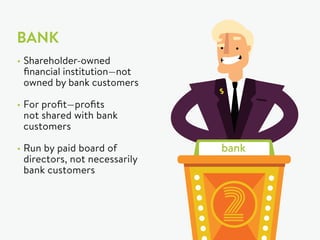

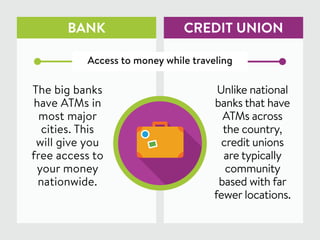

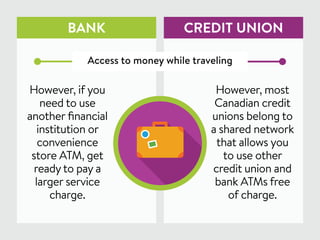

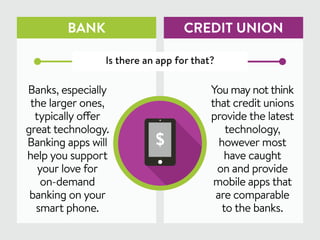

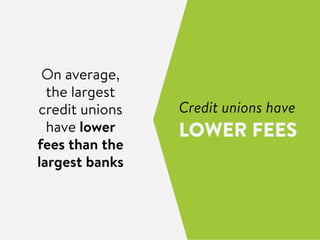

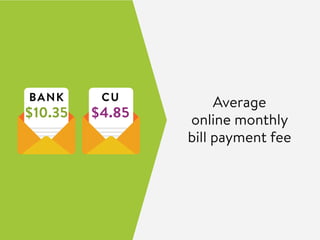

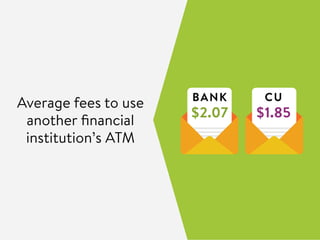

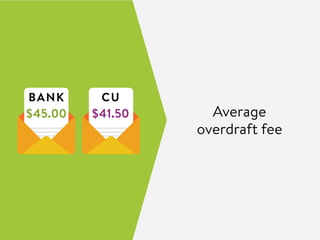

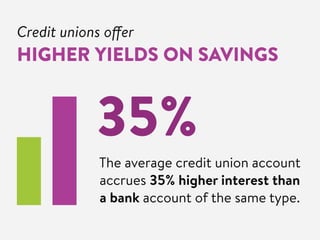

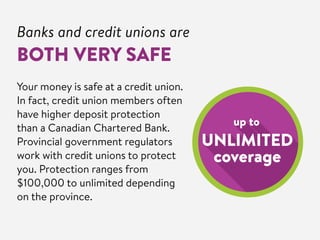

This document compares credit unions and banks, highlighting that credit unions are member-owned, offer lower fees, and have higher interest rates on savings. While banks provide widespread ATM access and advanced technology, credit unions typically excel in customer satisfaction and deposit protection. Overall, credit unions prioritize member benefits over profit, leading to better financial outcomes for their members.