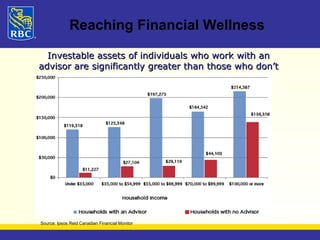

This document outlines an agenda for a presentation on banking topics including the evolution of banking technology, budgeting and cash flow management, financial wellness, types of credit products, and borrowing options. Key discussion points are the changes in how people access money compared to past years, steps to create a budget including establishing spending goals, and different types of credit products like credit cards, lines of credit, loans, and mortgages. Financial advisors are highlighted as helping clients build greater investable assets than those without advisors.