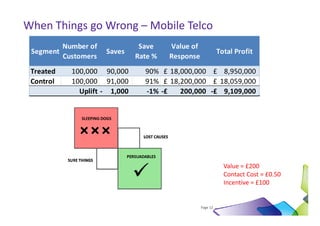

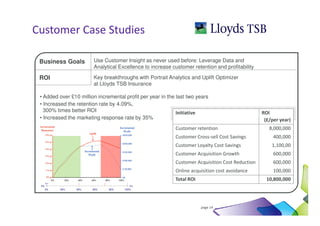

Using incremental marketing techniques can maximize customer loyalty while minimizing costs. A typical customer lifecycle involves acquiring new customers and then building, saving, cross-selling and up-selling existing customers to prevent churn. Sophisticated retention strategies involve micro-segmenting customers based on their value and propensity to churn, and targeting the most valuable at-risk customers. Measurement of retention campaign effectiveness requires comparing response rates to a control group. Retention efforts can backfire and actually increase churn if not carefully targeted to the right customer segments.