Compliance list(esi act)

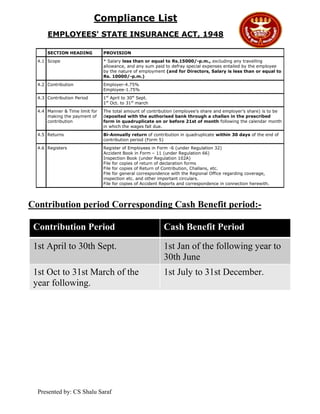

- 1. Compliance List EMPLOYEES' STATE INSURANCE ACT, 1948 SECTION HEADING PROVISION 4.1 Scope * Salary less than or equal to Rs.15000/-p.m., excluding any travelling allowance, and any sum paid to defray special expenses entailed by the employee by the nature of employment (and for Directors, Salary is less than or equal to Rs. 10000/-p.m.) 4.2 Contribution Employer-4.75% Employee-1.75% 4.3 Contribution Period 1st April to 30st Sept. 1st Oct. to 31st march 4.4 Manner & Time limit for making the payment of contribution The total amount of contribution (employee’s share and employer’s share) is to be deposited with the authorised bank through a challan in the prescribed form in quadruplicate on or before 21st of month following the calendar month in which the wages fall due. 4.5 Returns Bi-Annually return of contribution in quadruplicate within 30 days of the end of contribution period (Form 5) 4.6 Registers Register of Employees in Form -6 (under Regulation 32) Accident Book in Form – 11 (under Regulation 66) Inspection Book (under Regulation 102A) File for copies of return of declaration forms File for copies of Return of Contribution, Challans, etc. File for general correspondence with the Regional Office regarding coverage, inspection etc. and other important circulars. File for copies of Accident Reports and correspondence in connection herewith. Contribution period Corresponding Cash Benefit period:Contribution Period Cash Benefit Period 1st April to 30th Sept. 1st Jan of the following year to 30th June 1st Oct to 31st March of the year following. 1st July to 31st December. Presented by: CS Shalu Saraf

- 2. Adjudication of dispute & claims Month-wise Compliance:Month Date Which Compliance? January 21 Deposit ESI Contribution State Bank of India/Any other authorized bank (to be enclosed with Form-5 (half yearly return)) January 31 Annual information Form 01A: about Regulation 10C Factory/Establishment covered Regional Office (RO) or Sub. RO or Divisional Office February 21 Deposit ESI Contribution Challans State Bank of India/Any other authorized bank (to be enclosed with Form-5 (half yearly return)) March 21 Deposit ESI Contribution Challans State Bank of India/Any other authorized bank (to be enclosed with Form-5 (half yearly return)) April 21 Deposit ESI Contribution Challans State Bank of India/Any other authorized bank (to be enclosed with Form-5 (half yearly return)) May 12 Quadruplicate along Form 5: Section Concerned Branch Office Presented by: CS Shalu Saraf In which Form? Whom / where to send?

- 3. with Challans half yearly Return 44: Regulation 26 May 21 Deposit ESI Contribution Challans State Bank of India/Any other authorized bank (to be enclosed with Form-5 (half yearly return)) June 21 Deposit ESI Contribution Challans State Bank of India/Any other authorized bank (to be enclosed with Form-5 (half yearly return)) July 21 Deposit ESI Contribution Challans State Bank of India/Any other authorized bank (to be enclosed with Form-5 (half yearly return)) August 21 Deposit ESI Contribution Challans State Bank of India/Any other authorized bank (to be enclosed with Form-5 (half yearly return)) September 21 Deposit ESI Contribution Challans State Bank of India/Any other authorized bank (to be enclosed with Form-5 (half yearly return)) October 21 Deposit ESI Contribution Challans State Bank of India/Any other authorized bank (to be enclosed with Form-5 (half yearly return)) November 21 Deposit ESI Contribution Challans State Bank of India/Any other authorized bank (to be enclosed with Form-5 (half yearly return)) November 11 Return of contribution along with triplicate copy of Challans half yearly return for the period ending April to September Form 5 : Section 44 : Regulation 26 Concerned Branch Office December 21 Deposit ESI Contribution Challans State Bank of India/Any other authorized bank (to be enclosed with Form-5 (half yearly return)) Presented by: CS Shalu Saraf

- 4. Office of ESIC Rajasthan:Employees State Insurance Commission Panchdeep Bhawan Bhawani Singh Marg, Jaipur Rajasthan PIN-302001 Fax: 0141-2385776 E-Mail: rd-rajsthan@esic.nic.in Website www.esicrajasthan.com Branch Office:- (Jaipur) Branch Office, ESI Corporation, “Panchdeep 1. Bhawan”,Kamdhenu Complex, Ajmer Road, Jaipur 01412224726 Branch Office, ESI Corporation, “Panchdeep 2. Bhawan”,Road No. 9, Near 32 Shops, V.K.I. Area, Jaipur 01412331556 Branch Office, ESI Corporation, “Panchdeep Bhawan”,Nehru Palace, Tonk Road, Jaipur 01412742712 3. Branch Office, ESI Corporation, 67/167, Near 01414. ESI Disp, Pratap Nagar, Housing Board, 2790341 Sanganer, JAIPUR Presented by: CS Shalu Saraf