Weekly Newsletter

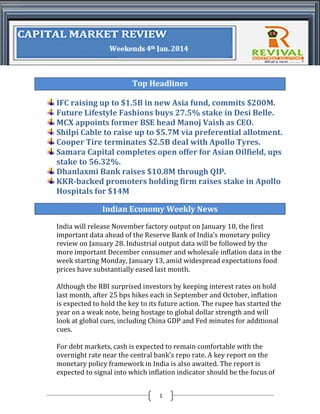

- 1. Top Headlines IFC raising up to $1.5B in new Asia fund, commits $200M. Future Lifestyle Fashions buys 27.5% stake in Desi Belle. MCX appoints former BSE head Manoj Vaish as CEO. Shilpi Cable to raise up to $5.7M via preferential allotment. Cooper Tire terminates $2.5B deal with Apollo Tyres. Samara Capital completes open offer for Asian Oilfield, ups stake to 56.32%. Dhanlaxmi Bank raises $10.8M through QIP. KKR-backed promoters holding firm raises stake in Apollo Hospitals for $14M Indian Economy Weekly News India will release November factory output on January 10, the first important data ahead of the Reserve Bank of India's monetary policy review on January 28. Industrial output data will be followed by the more important December consumer and wholesale inflation data in the week starting Monday, January 13, amid widespread expectations food prices have substantially eased last month. Although the RBI surprised investors by keeping interest rates on hold last month, after 25 bps hikes each in September and October, inflation is expected to hold the key to its future action. The rupee has started the year on a weak note, being hostage to global dollar strength and will look at global cues, including China GDP and Fed minutes for additional cues. For debt markets, cash is expected to remain comfortable with the overnight rate near the central bank's repo rate. A key report on the monetary policy framework in India is also awaited. The report is expected to signal into which inflation indicator should be the focus of 1

- 2. The monetary policy, the objectives for the central bank, and its liquidity management, among other factors. The benchmark Sensex fell for the third straight day and dropped 37 points even as value buying and gains in tech shares helped to trim early losses. Rising European stocks and sustained foreign fund inflows also helped in the recovery. Larsen & Toubro, Reliance Industries and Tata Motors fell as 19 Sensex shares declined. With a drop of 342 points this week, it was the worst performance for the Sensex since the period ended November 8. Inside The Story IFC raising up to $1.5B in new Asia fund, commits $200M International Finance Corporation, the private sector lending arm of the World Bank, plans to float $1-1.5 billion IFC Asia Fund to invest in East Asia and Pacific region, a statement said.The fund will be managed by IFC Asset Management Company LLC, which mobilises and manages third party funds for investment in developing and frontier markets. IFC AMC was created in 2009 to expand the supply of long-term capital to these markets.The multilateral funding agency will bring 20 per cent of the total corpus of the fund, subject to an overall cap of $200 million. Future Lifestyle Fashions buys 27.5% stake in Desi Belle. Future Lifestyle Fashions (FLF), the fashion apparel, accessories and associated products arm of Kishore Biyani-led Future Group, has picked up 27.5 per cent stake in Resource World Exim Pvt Ltd, a company engaged in women’s fashion apparel business under the brand 'Desi Belle' in India, as per a stock market disclosure. The firm did not disclose the deal value.Desi his is the second fresh investment by FLF after it was spun off and listed as a separate firm on the stock exchange three months ago. 2

- 3. MCX appoints former BSE head Manoj Vaish as CEO The country’s largest commodity bourse Multi-Commodity Exchange (MCX) has appointed former BSE head Manoj Vaish as managing director and CEO of the company for three years, as per a stock market disclosure.An MBA from FMS, Delhi, who later completed a PhD in Venture Capital, Vaish started his career with ANZ Grindlays Bank. After a short stint at Deutsche Bank, he joined BSE as an executive director and worked for six years till 2004. After BSE, he joined Dun & Bradstreet India as president and CEO. Since 2010, he has been serving as managing director and CEO of NSDL Database Management Ltd.The appointment comes after Shreekant Javalgekar stepped down as the MD and CEO of MCX last October amidst a probe related to the scam in group firm NSEL. Shilpi Cable to raise up to $5.7M via preferential allotment. Shilpi Cable Technologies Ltd is raising around Rs 35.4 crore ($5.7 million) through a preferential allotment of shares to a group of foreign institutional investors (FIIs), the company said in a filing to the stock exchanges.The firm has sought shareholders’ nod for the issue of up to 11.8 million shares at an issue price of Rs 30. It is looking to allot the shares to Leman Diversified Fund, Davos International Fund, Aspire Emerging Fund and Highbluesky Emerging Market Fund.None of the shareholders currently owns any stake in the company but would together own 23.94 per cent after the issue. Leman Diversified Fund, Davos International Fund and Aspire Emerging Fund will hold 4.79 per cent stake each in the company while Highbluesky Emerging Market will have a stake of 9.57 per cent. 3

- 4. Cooper Tire terminates $2.5B deal with Apollo Tyres. American tyre maker Cooper Tire has formally terminated its proposed acquisition by Onkar Kanwar-led Apollo Tyres. The fate of the $2.5 billion deal, which could have created the world’s seventh-largest tyre maker, was doomed and would have expired on Tuesday as Apollo Tyres sought cut in deal price in light of labour union troubles in the US and threat of the Chinese venture splitting up.Apollo is disappointed that Cooper has prematurely attempted to terminate our merger agreement. Cooper's actions leave Apollo no choice but to pursue legal remedies for Cooper's detrimental conduct," Apollo Tyres said.Early this month a US court had dismissed Cooper’s bid to force Apollo Tyres to complete its pending $2.5 billion deal to buy out the American tyre maker. This, in effect, allowed the Indian firm to walk away from the transaction, which was seen as negative by its investors in terms of impact on its balance sheet. Samara Capital completes open offer for Asian Oilfield, ups stake to 56.32%. Private equity firm Samara Capital Partners has increased its stakeholding in Asian Oilfield Services Ltd to 56.32 per cent, after completing an open offer. The open offer did not find many takers and the PE investor could buy just 0.03 per cent stake from the public.Earlier in September, Samara had announced its plan to increase its shareholding in mineral exploration and seismic services firm via a preferential allotment which triggered the mandatory open offer to buy up to 26 per cent more.In the open offer, Samara had offered Rs 21.50 per share to buy up to 5.8 million equity shares from the public shareholders of Asian Oilfield. However, it could manage to buy only 5,900 equity shares or 0.03 per cent stake from the shareholders. 4

- 5. Dhanlaxmi Bank raises $10.8M through QIP. Kerala-based Dhanlaxmi Bank has raised Rs 67.2 crore ($10.8 million) by allotting 17.5 million equity shares at Rs 38.25 per share to qualified institutional buyers (QIB), it disclosed to the stock markets. With this the firm has raised around Rs 168 crore this year through two rounds of QIP and a preferential allotment.Early this year, Dhanlaxmi Bank said it plans to raise growth capital of up to Rs 200 crore to augment capital base. The capital requirement of Indian banks has accelerated as Basel III kicked in on April 1 this year.Two years ago, the bank failed to see through a proposed Rs 290 crore funding from Mount Kellet Capital, Wolfensohn Capital, Multiples PE and Jay Sidhu’s Customers Bancorp. Customers Bancorp later sealed a deal with Religare to buy a small stake in the firm as it applied for a new banking license. KKR-backed promoters holding firm raises stake in Apollo Hospitals for $14M PCR Investments, the holding company for India’s largest healthcare services company Apollo Hospitals Enterprise Ltd, has increased its shareholding in the company by acquiring 1 million shares representing around 0.7 per cent stake via an open market transaction on NSE.PCR Investments acquired these shares at an average price of Rs 876.67 a unit, valuing the transaction at around Rs 87.67 crore ($14 million).The Reddys—the promoter family of Apollo Hospitals—held around 34.35 per cent stake in the company, of which 18.42 per cent stake was held by PCR Investments while the rest is with individual family members, as of September 30, 2013. With the latest deal, PCR’s holding has moved to 19.14 per cent while the promoter’s stake has pushed beyond 35 per cent. 5

- 6. 6