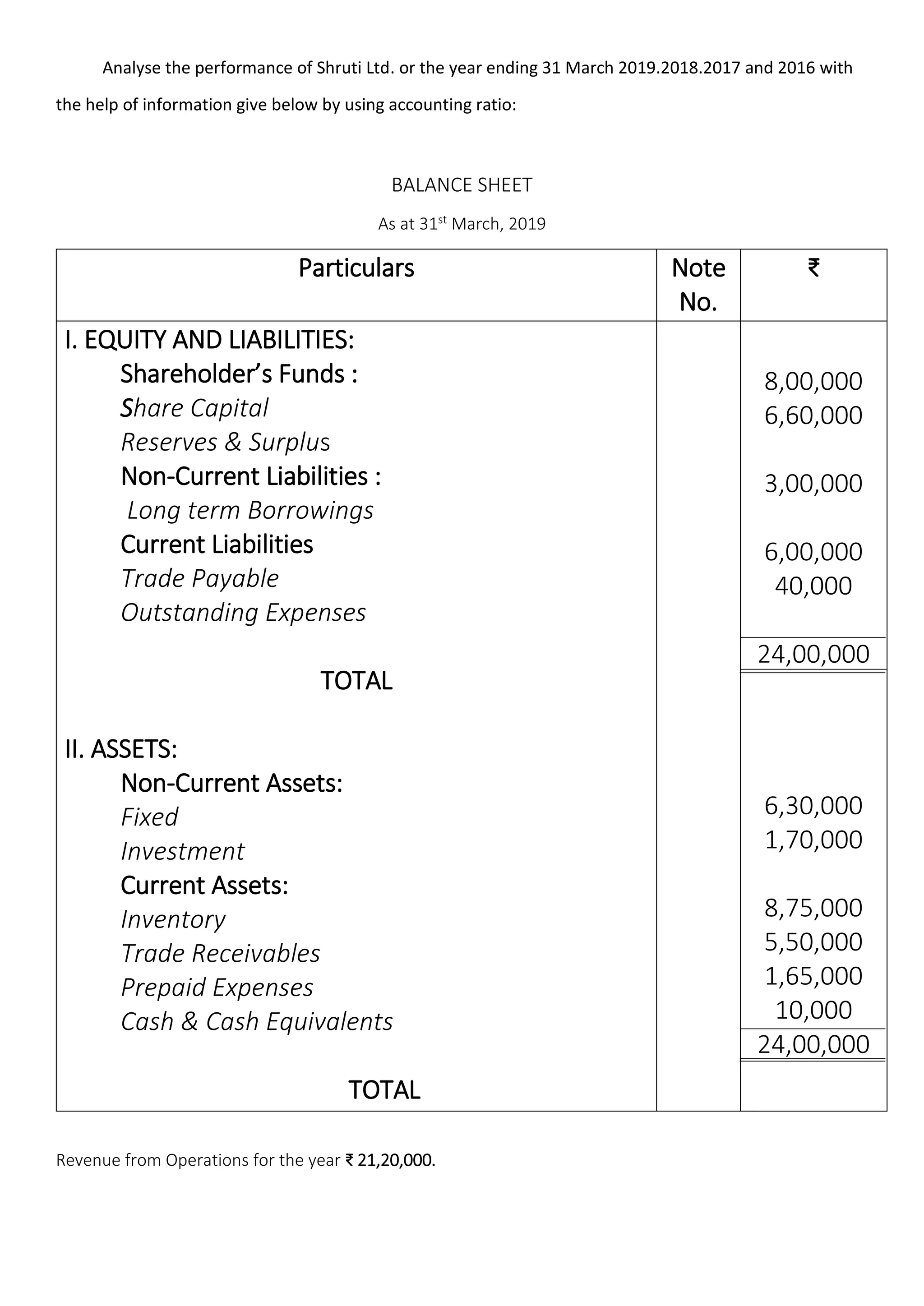

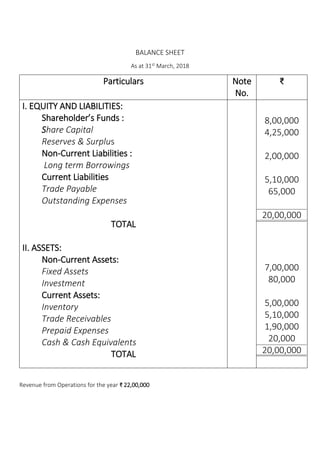

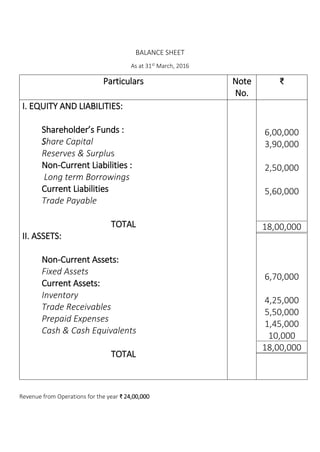

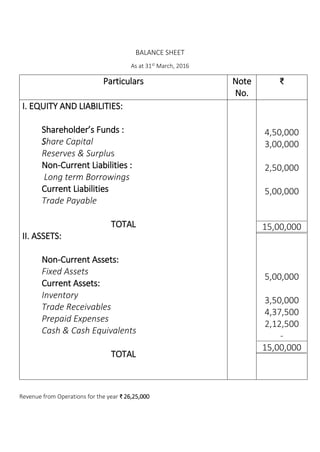

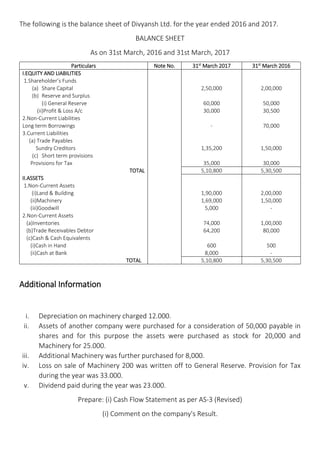

The document analyzes the financial performance of Shruti Ltd. and Divyansh Ltd. for the years ending March 31 between 2016 and 2019 using accounting ratios and balance sheets. It includes specific figures for equity, liabilities, assets, revenue from operations, and depreciation, while also providing additional context such as dividend payments and machinery purchases. The final request is to prepare a cash flow statement and comment on the results.