More Related Content

Similar to Sf Residential Real Estate Market Report q42008 q42011

Similar to Sf Residential Real Estate Market Report q42008 q42011 (20)

More from Ronny Budiutama

More from Ronny Budiutama (20)

Sf Residential Real Estate Market Report q42008 q42011

- 1. Ronny Budiutama Intero Real Estate

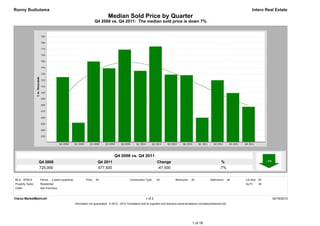

Median Sold Price by Quarter

Q4 2008 vs. Q4 2011: The median sold price is down 7%

Q4 2008 vs. Q4 2011

Q4 2008 Q4 2011 Change %

725,000 677,500 -47,500 -7%

MLS: SFMLS Period: 3 years (quarterly) Price: All Construction Type: All Bedrooms: All Bathrooms: All Lot Size: All

Property Types: Residential Sq Ft: All

Cities: San Francisco

Clarus MarketMetrics® 1 of 2 02/16/2012

Information not guaranteed. © 2012 - 2013 Terradatum and its suppliers and licensors (www.terradatum.com/about/licensors.td).

1 of 18

- 2. Ronny Budiutama Intero Real Estate

Median Sold Price by Quarter

Q4 2008 vs. Q4 2011: The median sold price is down 7%

Time Period Median Price # Units Average DOM

Q4 2011 677,500 656 58

Q3 2011 699,500 614 63

Q2 2011 720,000 680 62

Q1 2011 660,000 498 71

Q4 2010 728,000 615 60

Q3 2010 729,000 578 58

Q2 2010 774,000 672 54

Q1 2010 735,000 467 61

Q4 2009 769,000 649 57

Q3 2009 739,000 651 58

Q2 2009 750,000 557 65

Q1 2009 652,000 333 62

Q4 2008 725,000 481 57

Clarus MarketMetrics® 2 of 2 02/16/2012

Information not guaranteed. © 2012 - 2013 Terradatum and its suppliers and licensors (www.terradatum.com/about/licensors.td).

2 of 18

- 3. Ronny Budiutama Intero Real Estate

Median For Sale vs. Median Sold

Q4 08 vs. Q4 11: The median price of for sale properties is down 18% and the median price of sold properties is down 7%

Q4 2008 vs. Q4 2011 Q4 2008 vs. Q4 2011

Q4 2008 Q4 2011 Change % Q4 2008 Q4 2011 Change %

788,000 650,000 -138,000 -18% 725,000 677,500 -47,500 -7%

MLS: SFMLS Period: 3 years (quarterly) Price: All Construction Type: All Bedrooms: All Bathrooms: All Lot Size: All

Property Types: Residential Sq Ft: All

Cities: San Francisco

Clarus MarketMetrics® 1 of 2 02/16/2012

Information not guaranteed. © 2012 - 2013 Terradatum and its suppliers and licensors (www.terradatum.com/about/licensors.td).

3 of 18

- 4. Ronny Budiutama Intero Real Estate

Median For Sale vs. Median Sold

Q4 08 vs. Q4 11: The median price of for sale properties is down 18% and the median price of sold properties is down 7%

For Sale # Properties Sold # Properties Price

Time Period Median For Sale Median Sold Difference

Q4 2011 650,000 1,244 677,500 656 27,500

Q3 2011 680,000 1,665 699,500 614 19,500

Q2 2011 699,000 1,538 720,000 680 21,000

Q1 2011 678,000 1,387 660,000 498 -18,000

Q4 2010 699,000 1,448 728,000 615 29,000

Q3 2010 729,000 1,770 729,000 578 0

Q2 2010 749,000 1,658 774,000 672 25,000

Q1 2010 757,900 1,340 735,000 467 -22,900

Q4 2009 768,000 1,233 769,000 649 1,000

Q3 2009 795,000 1,552 739,000 651 -56,000

Q2 2009 799,000 1,594 750,000 557 -49,000

Q1 2009 788,000 1,336 652,000 333 -136,000

Q4 2008 788,000 1,336 725,000 481 -63,000

Clarus MarketMetrics® 2 of 2 02/16/2012

Information not guaranteed. © 2012 - 2013 Terradatum and its suppliers and licensors (www.terradatum.com/about/licensors.td).

4 of 18

- 5. Ronny Budiutama Intero Real Estate

Sold Properties by Quarter

Q4 2008 vs. Q4 2011: The number of Sold properties is up 36%

Q4 2008 vs. Q4 2011

Q4 2008 Q4 2011 Change %

481 656 175 +36%

MLS: SFMLS Period: 3 years (quarterly) Price: All Construction Type: All Bedrooms: All Bathrooms: All Lot Size: All

Property Types: Residential Sq Ft: All

Cities: San Francisco

Clarus MarketMetrics® 1 of 2 02/16/2012

Information not guaranteed. © 2012 - 2013 Terradatum and its suppliers and licensors (www.terradatum.com/about/licensors.td).

5 of 18

- 6. Ronny Budiutama Intero Real Estate

Sold Properties by Quarter

Q4 2008 vs. Q4 2011: The number of Sold properties is up 36%

Full Market Bank Properties Non-Bank Properties

Time Period # Properties Median Price Average DOM # Properties % Bank Median Price # Properties % Non-Bank Median Price

Q4 2011 656 677,500 58 114 17.4 450,000 542 82.6 749,500

Q3 2011 614 699,500 63 125 20.4 450,000 489 79.6 784,500

Q2 2011 680 720,000 62 131 19.3 450,000 549 80.7 782,500

Q1 2011 498 660,000 71 122 24.5 450,000 376 75.5 740,000

Q4 2010 615 728,000 60 95 15.4 480,000 520 84.5 785,000

Q3 2010 578 729,000 58 106 18.3 460,000 472 81.7 787,000

Q2 2010 672 774,000 54 124 18.4 520,000 548 81.5 837,500

Q1 2010 467 735,000 61 113 24.2 501,000 354 75.8 789,500

Q4 2009 649 769,000 57 111 17.1 485,000 538 82.9 819,250

Q3 2009 651 739,000 58 136 20.9 518,150 515 79.1 805,000

Q2 2009 557 750,000 65 104 18.7 467,500 453 81.3 805,000

Q1 2009 333 652,000 62 104 31.2 501,500 229 68.8 795,000

Q4 2008 481 725,000 57 87 18.1 508,800 394 81.9 798,250

Clarus MarketMetrics® 2 of 2 02/16/2012

Information not guaranteed. © 2012 - 2013 Terradatum and its suppliers and licensors (www.terradatum.com/about/licensors.td).

6 of 18

- 7. Ronny Budiutama Intero Real Estate

Under Contract Properties by Quarter

Q4 2008 vs. Q4 2011: The number of Under Contract properties is up 59%

Q4 2008 vs. Q4 2011

Q4 2008 Q4 2011 Change %

400 635 235 +59%

MLS: SFMLS Period: 3 years (quarterly) Price: All Construction Type: All Bedrooms: All Bathrooms: All Lot Size: All

Property Types: Residential Sq Ft: All

Cities: San Francisco

Clarus MarketMetrics® 1 of 2 02/16/2012

Information not guaranteed. © 2012 - 2013 Terradatum and its suppliers and licensors (www.terradatum.com/about/licensors.td).

7 of 18

- 8. Ronny Budiutama Intero Real Estate

Under Contract Properties by Quarter

Q4 2008 vs. Q4 2011: The number of Under Contract properties is up 59%

Full Market Bank Properties Non-Bank Properties

Time Period # Properties Median Price Average DOM # Properties % Bank Median Price # Properties % Non-Bank Median Price

Q4 2011 635 610,000 68 173 27.2 467,900 462 72.8 699,000

Q3 2011 664 679,000 59 133 20.0 438,355 531 80.0 750,000

Q2 2011 678 718,000 59 121 17.9 457,000 557 82.2 795,000

Q1 2011 573 695,000 71 156 27.2 446,600 417 72.8 790,000

Q4 2010 557 699,000 68 101 18.1 459,900 456 81.9 749,000

Q3 2010 590 719,250 60 113 19.1 468,000 477 80.8 779,000

Q2 2010 679 750,000 56 118 17.4 466,250 561 82.6 799,000

Q1 2010 543 750,000 53 116 21.4 461,610 427 78.6 799,000

Q4 2009 548 747,000 62 112 20.4 452,670 436 79.6 799,000

Q3 2009 633 718,000 56 125 19.8 499,900 508 80.2 799,000

Q2 2009 665 778,000 63 123 18.5 475,000 542 81.5 839,000

Q1 2009 413 688,000 68 118 28.6 473,700 295 71.4 785,000

Q4 2008 400 699,000 64 100 25.0 504,000 300 75.0 799,000

Clarus MarketMetrics® 2 of 2 02/16/2012

Information not guaranteed. © 2012 - 2013 Terradatum and its suppliers and licensors (www.terradatum.com/about/licensors.td).

8 of 18

- 9. Ronny Budiutama Intero Real Estate

New Properties by Quarter

Q4 2008 vs. Q4 2011: The number of New properties is down 14%

Q4 2008 vs. Q4 2011

Q4 2008 Q4 2011 Change %

616 527 -89 -14%

MLS: SFMLS Period: 3 years (quarterly) Price: All Construction Type: All Bedrooms: All Bathrooms: All Lot Size: All

Property Types: Residential Sq Ft: All

Cities: San Francisco

Clarus MarketMetrics® 1 of 2 02/16/2012

Information not guaranteed. © 2012 - 2013 Terradatum and its suppliers and licensors (www.terradatum.com/about/licensors.td).

9 of 18

- 10. Ronny Budiutama Intero Real Estate

New Properties by Quarter

Q4 2008 vs. Q4 2011: The number of New properties is down 14%

Full Market Bank Properties Non-Bank Properties

Time Period # Properties Median Price # Properties % Bank Median Price # Properties % Non-Bank Median Price

Q4 2011 527 649,000 136 25.8 456,400 391 74.2 699,000

Q3 2011 1,015 699,000 194 19.1 472,500 821 80.9 759,000

Q2 2011 921 699,880 186 20.2 436,678 735 79.8 799,000

Q1 2011 906 695,000 216 23.8 449,975 690 76.2 790,500

Q4 2010 621 679,000 154 24.8 456,950 467 75.2 768,000

Q3 2010 1,051 720,000 180 17.1 459,450 871 82.9 775,000

Q2 2010 1,050 749,000 190 18.1 461,700 860 81.9 799,000

Q1 2010 946 769,000 185 19.6 515,000 761 80.4 819,000

Q4 2009 592 729,000 149 25.2 450,000 443 74.8 799,000

Q3 2009 882 777,000 153 17.4 497,000 729 82.7 839,000

Q2 2009 927 785,000 186 20.1 498,950 741 79.9 879,000

Q1 2009 841 799,000 181 21.5 489,900 660 78.5 895,000

Q4 2008 616 759,500 153 24.8 499,900 463 75.2 890,000

Clarus MarketMetrics® 2 of 2 02/16/2012

Information not guaranteed. © 2012 - 2013 Terradatum and its suppliers and licensors (www.terradatum.com/about/licensors.td).

10 of 18

- 11. Ronny Budiutama Intero Real Estate

For Sale Properties by Quarter

Q4 2008 vs. Q4 2011: The number of For Sale properties is down 7%

Q4 2008 vs. Q4 2011

Q4 2008 Q4 2011 Change %

1,336 1,244 -92 -7%

MLS: SFMLS Period: 3 years (quarterly) Price: All Construction Type: All Bedrooms: All Bathrooms: All Lot Size: All

Property Types: Residential Sq Ft: All

Cities: San Francisco

Clarus MarketMetrics® 1 of 2 02/16/2012

Information not guaranteed. © 2012 - 2013 Terradatum and its suppliers and licensors (www.terradatum.com/about/licensors.td).

11 of 18

- 12. Ronny Budiutama Intero Real Estate

For Sale Properties by Quarter

Q4 2008 vs. Q4 2011: The number of For Sale properties is down 7%

Full Market Bank Properties Non-Bank Properties

Time Period # Properties Median Price Average DOM # Properties % Bank Median Price # Properties % Non-Bank Median Price

Q4 2011 1,244 650,000 82 320 25.7 469,884 924 74.3 748,550

Q3 2011 1,665 680,000 67 384 23.1 450,000 1,281 76.9 759,000

Q2 2011 1,538 699,000 68 356 23.1 448,944 1,182 76.8 796,444

Q1 2011 1,387 678,000 74 377 27.2 449,000 1,010 72.8 788,000

Q4 2010 1,448 699,000 87 322 22.2 450,000 1,126 77.8 775,000

Q3 2010 1,770 729,000 68 348 19.7 459,950 1,422 80.3 799,000

Q2 2010 1,658 749,000 63 345 20.8 469,000 1,313 79.2 830,000

Q1 2010 1,340 757,900 64 311 23.2 475,000 1,029 76.8 849,000

Q4 2009 1,233 768,000 80 286 23.2 468,950 947 76.8 868,888

Q3 2009 1,552 795,000 67 315 20.3 499,000 1,237 79.7 879,000

Q2 2009 1,594 799,000 68 345 21.6 499,000 1,249 78.4 899,000

Q1 2009 1,336 788,000 75 331 24.8 490,000 1,005 75.2 895,000

Q4 2008 1,336 788,000 84 305 22.8 499,900 1,031 77.2 897,000

Clarus MarketMetrics® 2 of 2 02/16/2012

Information not guaranteed. © 2012 - 2013 Terradatum and its suppliers and licensors (www.terradatum.com/about/licensors.td).

12 of 18

- 13. Ronny Budiutama Intero Real Estate

Expired Properties by Quarter

Q4 2008 vs. Q4 2011: The number of Expired properties is down 34%

Q4 2008 vs. Q4 2011

Q4 2008 Q4 2011 Change %

441 289 -152 -34%

MLS: SFMLS Period: 3 years (quarterly) Price: All Construction Type: All Bedrooms: All Bathrooms: All Lot Size: All

Property Types: Residential Sq Ft: All

Cities: San Francisco

Clarus MarketMetrics® 1 of 2 02/16/2012

Information not guaranteed. © 2012 - 2013 Terradatum and its suppliers and licensors (www.terradatum.com/about/licensors.td).

13 of 18

- 14. Ronny Budiutama Intero Real Estate

Expired Properties by Quarter

Q4 2008 vs. Q4 2011: The number of Expired properties is down 34%

Full Market Bank Properties Non-Bank Properties

Time Period # Properties Median Price Average DOM # Properties % Bank Median Price # Properties % Non-Bank Median Price

Q4 2011 289 699,000 107 58 20.1 459,450 231 79.9 759,000

Q3 2011 284 699,000 95 67 23.6 435,000 217 76.4 799,000

Q2 2011 210 749,000 109 45 21.4 425,000 165 78.6 819,000

Q1 2011 197 670,000 114 51 25.9 448,000 146 74.1 793,500

Q4 2010 410 748,500 108 60 14.6 462,500 350 85.4 799,000

Q3 2010 353 799,000 98 67 19.0 499,000 286 81.0 849,000

Q2 2010 260 749,000 88 59 22.7 478,000 201 77.3 875,000

Q1 2010 189 799,000 106 40 21.2 525,000 149 78.8 879,000

Q4 2009 291 959,000 102 48 16.5 512,750 243 83.5 1,095,000

Q3 2009 278 877,000 101 53 19.1 499,000 225 80.9 979,950

Q2 2009 259 974,500 102 60 23.2 567,450 199 76.8 1,098,000

Q1 2009 256 799,000 106 54 21.1 507,450 202 78.9 889,000

Q4 2008 441 949,000 97 55 12.5 524,000 386 87.5 999,000

Clarus MarketMetrics® 2 of 2 02/16/2012

Information not guaranteed. © 2012 - 2013 Terradatum and its suppliers and licensors (www.terradatum.com/about/licensors.td).

14 of 18

- 15. Ronny Budiutama Intero Real Estate

Supply & Demand by Quarter

Q4 2008 vs. Q4 2011: The number of for sale properties is down 7% and the number of sold properties is up 36%

Q4 2008 vs. Q4 2011 Q4 2008 vs. Q4 2011

Q4 2008 Q4 2011 Change % Q4 2008 Q4 2011 Change %

1,336 1,244 -92 -7% 481 656 175 +36%

MLS: SFMLS Period: 3 years (quarterly) Price: All Construction Type: All Bedrooms: All Bathrooms: All Lot Size: All

Property Types: Residential Sq Ft: All

Cities: San Francisco

Clarus MarketMetrics® 1 of 2 02/16/2012

Information not guaranteed. © 2012 - 2013 Terradatum and its suppliers and licensors (www.terradatum.com/about/licensors.td).

15 of 18

- 16. Ronny Budiutama Intero Real Estate

Supply & Demand by Quarter

Q4 2008 vs. Q4 2011: The number of for sale properties is down 7% and the number of sold properties is up 36%

# Properties Average DOM # Properties Average DOM

Time Period For Sale For Sale Sold Sold

Q4 2011 1,244 82 656 58

Q3 2011 1,665 67 614 63

Q2 2011 1,538 68 680 62

Q1 2011 1,387 74 498 71

Q4 2010 1,448 87 615 60

Q3 2010 1,770 68 578 58

Q2 2010 1,658 63 672 54

Q1 2010 1,340 64 467 61

Q4 2009 1,233 80 649 57

Q3 2009 1,552 67 651 58

Q2 2009 1,594 68 557 65

Q1 2009 1,336 75 333 62

Q4 2008 1,336 84 481 57

Clarus MarketMetrics® 2 of 2 02/16/2012

Information not guaranteed. © 2012 - 2013 Terradatum and its suppliers and licensors (www.terradatum.com/about/licensors.td).

16 of 18

- 17. Ronny Budiutama Intero Real Estate

The Average Days on Market by Quarter

Q4 2008 vs. Q4 2011: The average days on market is up 7%

Q4 2008 vs. Q4 2011

Q4 2008 Q4 2011 Change %

64 68 4 +7%

MLS: SFMLS Period: 3 years (quarterly) Price: All Construction Type: All Bedrooms: All Bathrooms: All Lot Size: All

Property Types: Residential Sq Ft: All

Cities: San Francisco

Clarus MarketMetrics® 1 of 2 02/16/2012

Information not guaranteed. © 2012 - 2013 Terradatum and its suppliers and licensors (www.terradatum.com/about/licensors.td).

17 of 18

- 18. Ronny Budiutama Intero Real Estate

The Average Days on Market by Quarter

Q4 2008 vs. Q4 2011: The average days on market is up 7%

Time Period Average DOM # UC Units

Q4 2011 68 635

Q3 2011 59 664

Q2 2011 59 678

Q1 2011 71 573

Q4 2010 68 557

Q3 2010 60 590

Q2 2010 56 679

Q1 2010 53 543

Q4 2009 62 548

Q3 2009 56 633

Q2 2009 63 665

Q1 2009 68 413

Q4 2008 64 400

Clarus MarketMetrics® 2 of 2 02/16/2012

Information not guaranteed. © 2012 - 2013 Terradatum and its suppliers and licensors (www.terradatum.com/about/licensors.td).

18 of 18