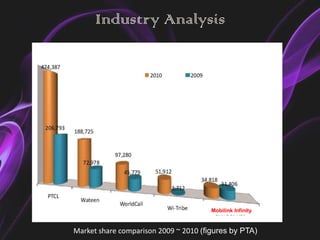

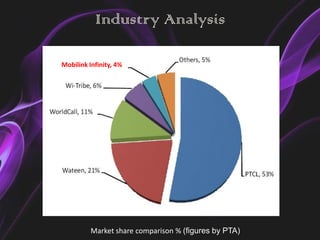

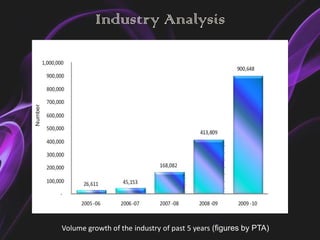

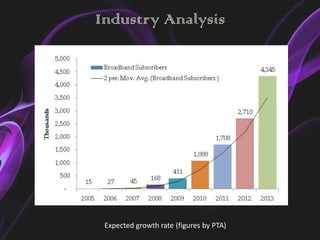

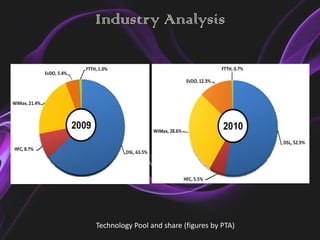

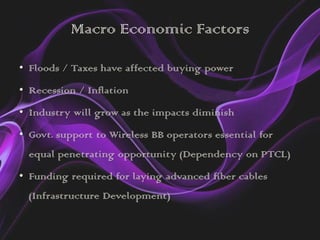

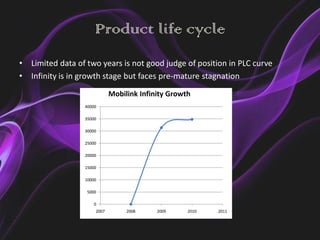

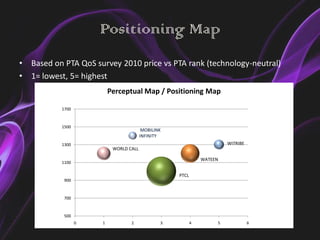

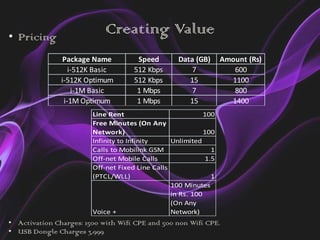

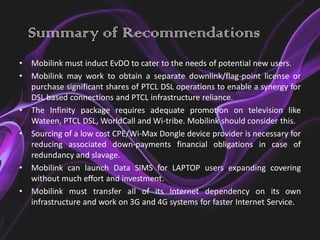

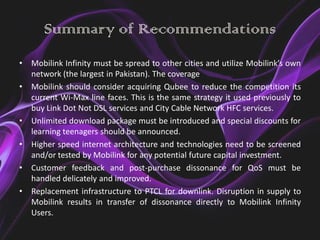

Mobilink Infinity is a wireless broadband internet service provider in Pakistan. It is a subsidiary of Mobilink GSM and launched its Infinity service in 2008. The summary provides recommendations for Mobilink Infinity to expand its services, introduce new packages, improve promotions, and reduce reliance on other networks to better compete in the growing broadband market. Key recommendations include expanding coverage to new cities, acquiring competitors to reduce competition, introducing unlimited data packages, and investing in newer internet technologies.