Sebi action in rs60000 cr nse colo scandal is eyewash startling revelations in cbi complaint

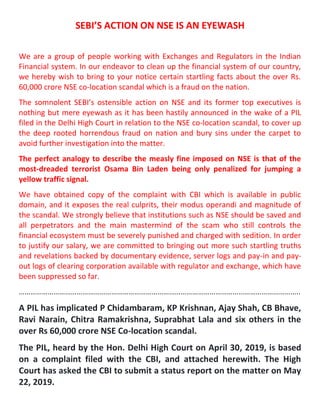

- 1. SEBI’S ACTION ON NSE IS AN EYEWASH We are a group of people working with Exchanges and Regulators in the Indian Financial system. In our endeavor to clean up the financial system of our country, we hereby wish to bring to your notice certain startling facts about the over Rs. 60,000 crore NSE co-location scandal which is a fraud on the nation. The somnolent SEBI’s ostensible action on NSE and its former top executives is nothing but mere eyewash as it has been hastily announced in the wake of a PIL filed in the Delhi High Court in relation to the NSE co-location scandal, to cover up the deep rooted horrendous fraud on nation and bury sins under the carpet to avoid further investigation into the matter. The perfect analogy to describe the measly fine imposed on NSE is that of the most-dreaded terrorist Osama Bin Laden being only penalized for jumping a yellow traffic signal. We have obtained copy of the complaint with CBI which is available in public domain, and it exposes the real culprits, their modus operandi and magnitude of the scandal. We strongly believe that institutions such as NSE should be saved and all perpetrators and the main mastermind of the scam who still controls the financial ecosystem must be severely punished and charged with sedition. In order to justify our salary, we are committed to bringing out more such startling truths and revelations backed by documentary evidence, server logs and pay-in and pay- out logs of clearing corporation available with regulator and exchange, which have been suppressed so far. ……………………………………………………………………………………………………………………………….. A PIL has implicated P Chidambaram, KP Krishnan, Ajay Shah, CB Bhave, Ravi Narain, Chitra Ramakrishna, Suprabhat Lala and six others in the over Rs 60,000 crore NSE Co-location scandal. The PIL, heard by the Hon. Delhi High Court on April 30, 2019, is based on a complaint filed with the CBI, and attached herewith. The High Court has asked the CBI to submit a status report on the matter on May 22, 2019.

- 2. The Gang of NSE Co-Location Scam P Chidambaram Former Finance Minister K P Krishnan The Then Joint Secretory, Capital Market Division, Ministry of Finance Ajay Shah Professor, NIPFP C B Bhave Former SEBI Chairman Ravi Narain Former MD & CEO, National Stock Exchange Chitra Ramakrishna Former MD & CEO, National Stock Exchange

- 69. Blowing the Whistle on Manipulation in NSE Sucheta Dalal 19 June 2015 We are crowd-sourcing investigation on a whistleblower account detailing how NSE’s system has been exploited. Please use the comment section to share your information High-frequency trading using colocation that give traders advantages by a few milliseconds have come to occupy the centerstage of equity markets all over the world. Such automated trading, which executes pre-programmed instructions, generating thousands to millions of trades every trading day come out of black boxes designed by whiz kids in the secret corners of trading firms. If deployed unfairly, a tiny unfair advantage can translate into crores of rupees of illegal profit. Moneylife has repeatedly argued that India has no system of monitoring complex automated systems, leave along trading transaction. Consequently, organisations that operate such technology have become a law unto themselves, supervised by nobody. Even when there is a major glitch or a fat finger trade, no report is put into the public domain. So, if HFT trades are done illegally, they fly below radar and very few people about them. Fortunately, we have in our possession a detailed document that blows the whistle on what’s possibly going on in NSE. The document below was came by snail mail from Singapore and addressed to Mr B K Gupta, DGM Securities and Exchange Board of India (SEBI). It is dated 14th January 2015 with a copy to Sucheta Dalal. It is not clear what SEBI has done with it in all these months. Moneylife has written to the SEBI Chairman, the chairman of National Stock Exchange, Ravi Narain, and managing director of NSE, Ms. Chitra Ramakrishnan, asking whether they have acted on this document. Our letters and text messages have been met with complete silence. In trying to get to the bottom of this over the last two months, we have shared this

- 70. document with the exchanges, regulators, government agencies and key traders. We realised that the only people who can throw light on it are actual HFT players who understand how this game is played. Hence we are putting out this long document to crowd source informed opinion and facts on this. Hopefully, your information will stir the investigative agencies into looking deeper into it. After reading this document, post your facts and information below. You need not use your actual identify. Your data is secure with us. If you want to write with specifics, please write to sucheta@moneylife.in or editor@moneylife.in

- 71. NSE drags Moneylife to HC for algo reports, seeks Rs 100cr In a recent report, Moneylife had claimed that certain institutions registered for algo trading were allowed to profit illegally by the NSE BS Reporter & PTI | Mumbai Last Updated at July 22, 2015 00:52 IST The National Stock Exchange (NSE) on Tuesday said it has filed a Rs 100-crore defamation suit in the Bombay High Court against online news portal Moneylife for allegedly publishing false reports on algorithm (algo) trading mechanism on its platform. The exchange said it had sought withdrawal of the reports and had made a claim of Rs 100 crore (which can be revised upwards) from Moneylife for the defamation. “We have filed a defamation suit against Moneylife and its representatives who published unsubstantiated and misleading reports against the exchange,” NSE said in a statement. According to NSE, the reports filed by Moneylife refer to algo trading mechanism. “Since inception, the NSE has been maintaining a high degree of surveillance and integrity in its daily operations and strictly adheres to the rules, regulations and guidelines issued by the regulators from time to time,” the stock exchange said. In one of its reports recently, Moneylife had claimed that certain institutions registered for algo trading were allowed to profit illegally by the NSE. When contacted, Sucheta Dalal, managing editor, Moneylife, said, “NSE has sent us a legal notice. We have replied to it.”

- 72. 22 July 2015 LIVE MINT Moily panel seeks Sebi report on alleged malpractices at NSE NSE spokesperson says exchangeis not aware ofany regulatory probe and has not ‘received any intimation till now’ The Parliamentary Standing Committee on Finance has directed the Securities and Exchange Board of India (Sebi) to submit a report on alleged malpractices at the National Stock Exchange of India Ltd (NSE) involving allotment of co-location servers and sharing price-sensitive information. Co-location refers to bourses allowing members to set up automated trading systems on their premises to reduce the time required for orders to flow between the exchange and the broker’s trading system. At a meeting held last Thursday, the committee asked the capital market watchdog to investigate the matter and submit a report within a couple of weeks, said a member of the committee who spoke on condition of anonymity. A report on website Indiasamvad on 16 July said that the committee headed by member of Parliament M. Veerappa Moily had told Sebi chairman U.K. Sinha to look into the matter. An NSE spokesperson said the exchange is not aware of any regulatory probe and has not “received any intimation till now”. The issue was brought to the parliamentary committee’s notice after Moneylife, a personal-finance-focused website, published a letter written by an official of a Singapore-based hedge fund to Sebi. “I wish to draw your attention to a sophisticated market manipulation done at NSE for several years at NSE co-location. The most shocking aspect is that when the matter came to the knowledge of NSE management team, they have chosen to hush up the matter under the carpet rather than coming out in open against the same,” says the letter addressed to B.K. Gupta, deputy general manager, Sebi. “The market manipulation that I am referring to has been occurring by enabling certain vested brokers to get market price information ahead of the rest of the market and thus enabling them to front-run the rest of the market,” it adds. The stock exchange has denied these charges. “NSE has filed a defamation suit against an organisation and its representatives who published unsubstantiated and misleading reports against the exchange,” said the spokesperson for the exchange, without naming Moneylife. A separate press release from the exchange said that a defamation suit with a claim of Rs.100 crore had been filed in the Mumbai high court.

- 73. “As you know since inception, NSE has been maintaining a high degree of surveillance and integrity in its day to day operations, strictly adheres to the rules, regulations and guidelines issued by the regulators from time to time,” added the spokesperson in the emailed response. As per information available on its website, NSE launched co-location facilities in January 2010 and currently charges up to Rs.12 lakh depending on the size of the server with an initial setup charge of Rs.1 lakh. As per Sebi data, the share of turnover originating from co-location facilities on the NSE increased from 2.3% in April 2010 to 22.6% in December 2014. In June, co-location trades accounted for nearly 25% of the total turnover on NSE, according to data available on the exchange website. “The increased complexities of algorithm coding and reduction in latency due to faster communication platforms need focused monitoring, as they may pose risks in the form of increased possibilities of error trades and market manipulation,” the Reserve Bank of India said in its Financial Stability Report released in late June. Two months ago, Sebi issued a circular directing exchanges to provide co-location facility in a “fair, transparent and equitable manner” and that all participants should get fair and equal access to data feeds. It also said that all entities availing of co-location facilities should be provided “similar latency.” Latency is the technical term used to describe the time lag between placing an order and executing a trade. These were some of the issues that were highlighted in the letter written by the Singapore-based hedge fund manager to Sebi in January. Sebi did not respond to a mail seeking comments on the matter. Market participants say the issue has led to doubts in the minds of many investors who say they are losing out, not due to technology, but because of the undue benefits enjoyed by a certain set of entities. “It is not that investors have problem with technology but there should be transparency in regulations. There should be a proper public discussion before the rules are framed. We have copied the Western markets by allowing algo and co- location here but the legal redressal systems are much better overseas. Right now, investors have doubts regarding these systems due to lack of transparency and Sebi and exchanges should address that,” said Sandeep Shah, member-core committee, Investors’ Grievances Forum, a Sebi-registered investor association.

- 74. ¼ããÀ¦ããè¾ã ¹ãÆãä¦ã¼ãîãä¦ã ‚ããõÀ ãäÌããä¶ã½ã¾ã ºããñ¡Ã Securities and Exchange Board of India Page 1 of 3 CIRCULAR CIR/MRD/DP/07/2015 May 13, 2015 To, All Stock Exchanges. Dear Sir / Madam, Subject: Co-location / proximity hosting facility offered by stock exchanges The facility of co-location or proximity hosting (or by whatever name called) is offered by the stock exchanges to stock brokers and data vendors whereby their trading or data-vending systems are allowed to be located within or at close proximity to the premises of the stock exchanges, and are allowed to connect to the trading platform of stock exchanges through direct and private network. 2. Based on the recommendations of SEBI’s Technical Advisory Committee (TAC), it has been decided that stock exchanges while facilitating co-location / proximity hosting shall follow the guidelines given below. 3. In order to ensure fair and equitable access to the co-location facility, stock exchanges shall: 3.1. provide co-location / proximity hosting in a fair, transparent and equitable manner. 3.2. ensure that all participants who avail co-location / proximity hosting facility have fair and equal access to facilities and data feeds provided by the stock exchange. 3.3. ensure that all stock brokers and data vendors using co-location / proximity hosting experience similar latency with respect to exchange provided infrastructure. 3.4. ensure that the size of the co-located / proximity hosting space is sufficient to accommodate all the stock brokers and data vendors who are desirous of availing the facility. 3.5. provide the flexibility to avail rack space in the co-location / proximity hosting so as to meet the needs of all stock brokers desirous of availing such facility.

- 75. ¼ããÀ¦ããè¾ã ¹ãÆãä¦ã¼ãîãä¦ã ‚ããõÀ ãäÌããä¶ã½ã¾ã ºããñ¡Ã Securities and Exchange Board of India Page 2 of 3 3.6. expeditiously decide on the request of the desirous stock brokers / data vendors for availing co-location / proximity hosting and communicate the decision within fifteen working days from the receipt of the request from the stock brokers / data vendors. In case of a rejection, stock exchanges shall also provide reasons in writing to the stock brokers / data vendors. 3.7. facilitate stock brokers to receive data feeds from other recognised stock exchanges at the co-location facilities and allow routing of orders to other recognised stock exchanges from the co-location facilities. 3.8. make available on their websites description of the co-location / proximity hosting, including requirements to be fulfilled by stock brokers / data vendors who avail the facility, details on fees / charges associated with the facility, etc. 3.9. publish on their websites suitable quarterly reports on latencies observed at the exchange. 3.10. be able to identify orders emanating from the co-located servers of stock brokers and the resultant trades. Suitable statistics relating to such orders and trades shall be disseminated by the stock exchanges 4. In order to ensure that the facility of co-location / proximity hosting does not compromise integrity and security of the data and trading systems, stock exchanges shall: 4.1. implement suitable mechanism to protect their systems and systems of stock brokers and data vendors at co-location / proximity hosting from unauthorized access. 4.2. frame guidelines on access and conduct of the personnel of stock brokers / data vendors in the premises of the stock exchange, including in the co-located space. 4.3. not provide access in any form to the personnel of stock brokers / data vendors to the stock exchange’s trading platform and databases. 5. Stock exchanges are directed to: 5.1. take necessary steps to put in place systems for implementation of the circular, including necessary amendments to the relevant bye-laws, rules and regulations, within three months from the date of the circular. 5.2. bring the provisions of this circular to the notice of the stock brokers and also disseminate the same on its website.

- 76. ¼ããÀ¦ããè¾ã ¹ãÆãä¦ã¼ãîãä¦ã ‚ããõÀ ãäÌããä¶ã½ã¾ã ºããñ¡Ã Securities and Exchange Board of India Page 3 of 3 5.3. communicate to SEBI the status of implementation of the provisions of this circular. 6. This circular is being issued in exercise of powers conferred under Section 11 (1) of the Securities and Exchange Board of India Act, 1992 to protect the interests of investors in securities and to promote the development of, and to regulate the securities market. Yours faithfully, Maninder Cheema Deputy General Manager email: maninderc@sebi.gov.in

- 77. Bombay High Court National Stock Exchange Of India ... vs Moneywise Media Pvt Ltd And 2 Ors on 9 September, 2015 Bench: G.S. Patel 904-NMS-1220-15-F4.DOC Atul IN THE HIGH COURT OF JUDICATURE AT BOMBAY ORDINARY ORIGINAL CIVIL JURISDICTION NOTICE OF MOTION NO. 1220 OF 2015 IN SUIT NO. 627 OF 2015 NATIONAL STOCK EXCHANGE OF INDIA LIMITED, a recognized Stock Exchange and a Company incorporated under the Companies Act, 1956 and having its Registered Office at Exchange Plaza, Bandra Kurla Complex, Bandra (East), ...Plaintiff Mumbai - 400 051 Versus 1. MONEYWISE MEDIA PRIVATE LIMITED, a company incorporated under the laws of India having its Registered Office at Unit No. 315, 3rd Floor, Hind Services Industries, Off Veer Savarkar Marg, Dadar (West), Mumbai - 400 028 2. MS. SUCHETA DALAL, the Managing Editor, Adult, Indian Inhabitant of Mumbai having her office at Unit No. 315, 3rd Floor, Hind Services Industries, Off Veer Savarkar Marg, Dadar (West), Indian Kanoon - http://indiankanoon.org/doc/197656447/ 1

- 78. 2. On 14th January 2015 an anonymous letter in hard copy was sent to Mr. B.K. Gupta, the Deputy General Manager of the Market Regulation Department of SEBI.1 This document was copied to Ms. Dalal. It is a most technical eight page letter and it appears to detail at very considerable length what it describes as the illegality or impropriety in "high-frequency trades" ("HFT") or algorithmic trades ("algo trades") facilitated by NSE's allowing co-location of its servers. I do not claim to be able to understand every single one of the financial and technical details that are set out in this anonymous letter, but I think that is of little moment at this interim stage. On 19th June 2015, several months after the anonymous letter, appeared the article on moneylife.in of which the NSE now complains. 3. This article contained the following statements that the NSE says constitute defamation. These are reproduced from paragraphs 11, 16 and 18 of the plaint. "11(i) Finance Ministry nudges regulators in Mumbai to probe NSE's HFT scam. Mumbai - 400 028 3. MR. DEBASHISH BASU, the Executive Editor, Adult, Indian Inhabitant of Mumbai having his office at Unit No. 315, 3rd Floor, Hind Services Industries, Off Veer Savarkar Marg, Dadar (West), Mumbai - 400 028 ...Defendants 1 of 30 904-NMS-1220-15-F4.DOC Dr. Veerendra V. Tulzapurkar, Senior Advocate, with Mr. Viraag Tulzapurkar, Senior Advocate, Mr. Vikram Trivedi & Mr. Sachin Chandarana, i/b Manilal Kher Ambalal & Co., for the Plaintiff. Mr. Bapoo Malcolm, for Defendant No. 1. Ms. Sucheta Dalal, Defendant No. 2, in person Mr. Debashish Basu, Defendant No. 3, in person. CORAM: G.S. PATEL, J ig DATED: 9th September 2015 ORAL JUDGMENT:- 1. This is an application for injunction in a defamation action brought by the National Stock Exchange ("NSE"), one of the two premier Stock Exchanges of this country. The NSE complains that an article published on 19th June 2015 by Defendants Nos. 2 and 3, Ms. Sucheta Dalal and Mr. Debashish Basu, on their online news and analysis journal or website moneylife.in, is per se defamatory. Ms. Dalal is the Managing Editor of Moneylife; Mr. Basu is its Executive Editor. Their article accuses the NSE of actively permitting, in circumstances that I will describe in somewhat greater detail shortly, illicit trading advantages being afforded to a select few using high-end technology. Much of what is alleged is very technical indeed, but the NSE's case as presented by Dr. Tulzapurkar is that the assertions made by Ms. Dalal and Mr. Basu, even allowing for the fact that they were based on an anonymous letter dated 14th January 2015 addressed to the Securities & E x c h a n g e B o a r d o f I n d i a ( " S E B I " ) w i t h a c o p y t o M s . D a l a l , a r e i n 2 o f 3 0 904-NMS-1220-15-F4.DOC themselves reckless and defamatory of the NSE. The article clearly alleges illegality and criminality in the actions of the NSE. It goes further and accuses the NSE of being "like a fortress" and unwilling to part with any information or to provide any clarification. 2

- 79. (ii) ...certain institutions registered for HFT...were allowed to profit illegally by the NSE's (National Stock Exchange) insiders..." immediately preceded by the Plaint, Exhibit "A1", p. 44 3 of 30 904-NMS-1220-15-F4.DOC statement that "...multiple agencies have woken up to the possible dangers of large-scale market manipulation by large institutional traders who run high-frequence trading (HFT) programmes in India." [Emphasis supplied] (iii) "...NSE's insiders allowed some chosen traders to benefit through faster connectivity, day after day...", followed by the statement that, "These high-frequency trades contributed to the high froth of trading volumes on the Exchange." [Emphasis supplied] (iv) "Government sources also tell us that "NSE's management of HFT servers in the initial years until 2013 (which are the subject of the whistleblower's letter) may need a detailed review by SEBI or an investigation agency."" [Emphasis supplied] (v) "... NSE operates like a fortress and outsiders had no details..." [Emphasis supplied] (vi) "Then, there is the issue of corruption. Clearly, people at the NSE and SEBI who permitted the manipulation of algo trades and attempted to bury the scandal cannot be in charge of this investigation." [Emphasis supplied] 16(i) "For several months, I shared the letter with key market-players and investigators to find out more; but the NSE operates like a fortress and outsiders had no details." (ii) "Nobody we spoke to was surprised to know that the system was manipulated and each one speculated about the likely beneficiaries; but no proof was forthcoming." (iii) "The reason for this is best explained on the jacket of Michael Lewis's book Flash Boys. It says" "Now, the world's money is traded by computer code, 4 of 30 904-NMS-1220-15-F4.DOC inside black boxes in heavily guarded buildings. Even the experts entrusted with your money don't know what is happening and those who do aren't about to tell - because they are making a killing." (iv) These high-frequency trades contributed to the huge froth of trading volumes on the Exchange. Since top management salaries at the NSE are linked to the turnover and profit generated by the Exchange, there may have been a reluctance to upset the applecart. The NSE is unique in having had the same senior management for the entire 20+ years of its existence." 18(i) "... We expected the whistle-blower's letter to (ii) trigger, at least, an investigation"... 3

- 80. "...we published the letter on 19th June on our website."... (iii) "Action started only after that. We now have information from credible sources that the finance ministry has desired that, apart from SEBI, the Reserve Bank of India (RBI) also take a detailed look at the implications of continuing HFT without adequate safeguards. Government sources also tell us that NSE's management of HFT servers in the initial years until 2013 (which are the subject of the whistle-blower's letter) may need a detailed review by SEBI or an investigation agency." (iv) Soon, SEBI and RBI dutifully responded to the finance ministry's direction. The Financial Stability Report (FSR) released in June suddenly identified algo trading as an area of concern." (v) "Immediately thereafter, the Business Standard and other papers reported that SEBI was considering steps to slow down the pace of trading through measures such as a minimum resting time for orders 5 of 30 904-NMS-1220-15-F4.DOC before execution and rendomising the time priority of orders that an Exchange receives." 4. A second article followed on 8th July 2015.2 The combined effect of this, according to Dr. Tulzapurkar, is that the articles tend to lead "the lay reader" to conclude to the detriment of the NSE that firstly it is because of the articles that regulators such as the Reserve Bank of India ("RBI") and SEBI have commenced investigations; second, that there are serious wrongdoings on the part of the NSE; and third, that the NSE itself is complicit in permitting these illegal HFTs or algo trades. 5. Dr Tulzapurkar submits that these allegations are entirely false. He points to paragraph 18A of the plaint, one that was added by an amendment permitted on 24th July 2015, after the suit was filed and on the day the Notice of Motion was first moved for ad- interim reliefs. 6. To understand that paragraph and what it seeks to portray, I think some background to what is being alleged is necessary. The case presented by the Defendants in their articles, at least as I understand it, is thus. The NSE, as indeed many other bourses, both here and abroad, routinely permit what is called co-location. Typically, a co-location centre (often called a 'colo') is a data centre that rents equipment, space, and bandwidth to retail subscribers. This allows for leveraging economies of scale, more advanced infrastructure, lower latency (lag times), upgraded system security and so on. In the present variant, I understand the complaint in the anonymous letter to mean that the NSE permitted, for a significant Plaint, pp. 52 to 54. 6 of 30 904-NMS-1220-15-F4.DOC rental, premium co-location access. This is allowed at a very high premium to persons or entities engaged in high volume and high value transactions. It is, in my understanding of it, intended to be nothing more than a convenience.3 Where the co-location server is allowed to be installed at a subscriber's or renter's premises, this is, if I might be permitted a parallel, more or less like arranging to have a dedicated branch of a bank in one's own building if one is on a daily basis engaged in a large number of high value banking transactions. The system 4

- 81. allows the users at these locations quick and reasonably disruption-free access to the servers. This is useful in an age when the trades are no longer done manually but are all done digitally and online. 7. Algo trades are the product of very high end mathematical modelling. These are models devised specifically to anticipate the most microscopic changes in markets and to respond to those changes in a matter of seconds. This is done not through any human intervention, an aspect that is totally eliminated, but in a wholly automated fashion by computer-generated or triggered transactions. In high value transactions the number of such transactions that can be put through is very considerable indeed. A most rudimentary example might be this: an 'algo' is designed to detect the most minute changes in stock prices and to respond accordingly. In anticipation of a rise in a particular stock's value, say, with no manual intervention but by a computer program responding to the data input, a series of purchases are triggered made at a lower value so that when the markets later reach the higher level, a considerable profit is then, equally automatically, Co-location service offerings and details are available on the NSE website. 7 of 30 904-NMS-1220-15-F4.DOC generated and booked. The same can also operate in reverse to minimise a potential loss. Of course, these are utterly basic examples. I imagine the actual models are far more sophisticated and complicated, for use in complex scenarios for highly evolved financial and security transactions. The point is, however, that these trades are automatic and computer-generated, and they happen at very high speed and in high volumes. 8. The anonymous letter sent to SEBI and Ms. Dalal is a lengthy dissertation on not only the evolution of online trading at the NSE but also the very many pitfalls encountered in the last five years or so. It points to the initial deployment of relatively low- bandwidth leased lines to multicast price streams and this is said to have been done using a technology by then already deprecated so that the information dissemination was sequential, thus allowing the person or persons who first received the data to act on it well before others downstream received the data. In the intial days, traders were allowed to deploy the NSE's application programming interfaces or APIs to write their own programs. The system, so the anonymous letter seems to say, was not designed for high traffic volumes; and, given the sequential (as opposed to simultaneous) dissemination of data (as might be achieved using the User Datagram Protocol or UDP, for instance, as other exchanges even then did), often meant that the last in line to be connected to the data stream was often well behind the person who connected first. The NSE then apparently had limited servers with unbalanced loads, and this in turn generated what is called a latency (the time required for transmission of data packets) for the last user. At the time, this gave the first mover (or connector), who accessed a 8 of 30 904-NMS-1220-15-F4.DOC server then least loaded with traffic, the fastest access; those downstream had to deal with increasingly burdened servers as more and more persons connected, with a corresponding increase in latency. Switching on servers ahead of time allowed some to gain an advantage and a priority. To mitigate this, the NSE took steps to balance its server loads and to more evenly distribute them. Technically, the letter suggests, this should have been enough. But (and this appears to be the nub of it) some started connecting to backup real-time servers with nil traffic, even though these were to be used only in emergencies, thus enabling quicker access to market data; and the NSE's co-location 5

- 82. services facilitated this early-bird data or information receipt. 9. It is in this scenario that we have to assess the concern that seems to have been expressed by the Defendants in their articles. They say that entities permitted co-location access gained a small and perhaps infinitesimal time advantage in receiving advance market information. This allowed a select handful to, as the Defendants put it, 'front-run' the rest of the market. In other words, knowing that a stock was likely to move, say, in a particular direction, algo trades would be triggered to take advantage of that advance information long before other individual traders lacking the advantage of co-location could capitalize or move on that information. The result is not as negligible, the Defendants say, as might appear. There is, firstly, some question of whether these algo trades worked to inject liquidity into the market or whether they created distortions in the real underlying value of the stocks in question. The point, they seem to suggest, is that the select handful got a very considerable advantage simply because they received 9 of 30 904-NMS-1220-15-F4.DOC information even a few seconds or milliseconds ahead of the rest of the market. 10. This, the NSE now says, is entirely impossible. Paragraph 18A of the plaint reads thus: "18A. The Plaintiff states that the allegation that some trading members got advantage with connivance of the Plaintiff over others is false. It is impossible for any trading member to ensure a particular position in a queue in the port since such a position is automatically allocated by the network card and cannot be tweaked manually. There are maximum 30 trading members per port. The time lag between the first person and the last person (depending on the load) is maximum 50 micro seconds (1 micro second = 1 millionth of a second) which by no stretch of imagination can confer any advantage to any person." 11. This paragraph forms the centre of NSE's case in defamation. For, as Dr. Tulzapurkar puts it, if it is just not possible that the time lag is sufficient for any person to give any such advantage, then there is no question of there being the slightest element of truth in what the Defendants alleged. There is also then no question that their articles are per se defamatory. To the extent that their articles are contradicted by paragraph 18A of the plaint, the articles cannot be fair comment and no qualified privilege attaches to them. Any such privilege, Dr. Tulzapurkar submits, must be "relevant to the occasion". It cannot be absolute and there is no absolute privilege that attaches to any such article. 10 of 30 904-NMS-1220-15-F4.DOC 12. To begin with, I believe this paragraph is yet another attempt at misdirection. Curiously, the anonymous letter seems to presage or anticipate precisely such a response. The last paragraph on page 4 of the letter4 deals exactly with these fractional time frames and in terms alleges that 50 micro-seconds are all it takes to effect the illicit trade. The question is also not of a person ensured a particular position in a port queue; the issue is of certain entities being among the early-birds to connect to the server at low-load and low-traffic times to ensure minimal latency and fastest data inflow. The anonymous letter specifically mentions the advantages that paragraph 18A tries to deny, 6

- 83. possibly in the hope that the judicial mind can safely be presumed to be ignorant of all matters technical and too easily overawed by an outpouring of technical jargon. The issue is also not about ensuring a prior place but, as the letter says, whether it is possible to 'game the system' through a variety of means, including continuous server-pinging to test when the server comes online, to gain even a minute advantage. The issue is also not about an absolute advantage, but rather one of degree, i.e., of gaining an advantage ahead of the rest of the market. Pages 5 and 6 of the letter deal with an earlier point in time. Pages 6 and 7 however make a very direct reference to a new evolution in the process of 'gaming the system', and that is by connecting to the backup servers, ones that had zero load and much improved latency. I note that paragraph 18A does not even begin to address the very many technical questions pointedly raised in the letter and to which Ms. Dalal drew the NSE's attention. Instead, that paragraph cherry-picks one isolated facet that possibly relates to an earlier point in the history of the NSE's systems automation and presents Motion paperbook, p. 84 11 of 30 904-NMS-1220-15-F4.DOC that as a 'complete' answer. Indeed it is not. And this is telling: for at least now, after the suit was filed, the NSE had the undeniable opportunity to deal with the technical aspects. It has chosen not to do so, and the reasons that suggest themselves are, in my estimation, and I expect in the estimation of any rational-minded person who went through this carefully, precisely those that Ms. Dalal outlined in her articles. It is certainly not insignificant that the letter in question outlines a typical instance with figures of how these advantages can be obtained. 13. Mr. Tulzapurkar first relies on a very old decision of a Single Judge of this Court in Mitha Rustomji Murzban v. Nusserwanji Nowroji Engineer.5 That was also an action in damages, partly in libel and partly in slander. It related to an article in a weekly journal in Gujarati. Wadia J held that even if there is criticism in the press it must be fair and while it may not be necessary to prove malice by the defendant, the test must be this: whether any reasonable person, however prejudiced or however strong of opinion, could say that the work in question was a fair comment. Even allowing latitude for personal opinion and individual prejudice, the test must be that of a reasonable, and I would suggest in this particular case, a knowledgeable person, in such matters. Mere boldness or strength of expression, or even exaggeration does not per se make a comment unfair. If a reasonable person would not have been moved to draw the conclusions or make the statements that the Defendants have made, then the NSE must succeed. This test applies to every comment including an imputation as to character, conduct or professional behaviour. Newspapers are no exception. They have no AIR 1941 Bom 278 12 of 30 904-NMS-1220-15-F4.DOC special right or privilege in civil law, and I am mindful of the fact that while the Defendants have attempted to place this in the context of a fundamental right to freedom of expression and Constitutional guarantees, that is not my direct remit in a civil suit, though Courts seem to have often juxtaposed the two concerns. If the imputation or the conclusion remains unwarranted by the facts, it cannot be fair comment. The Defendants must show, to claim a qualified privilege, that they had some duty public or private, legal, moral or social to their intended audience. They must show they had a duty to convey the information. They must also show that the information that they conveyed was published in the context of this moral, social or other duty, public or private, and that it was relevant or pertinent to that duty and not completely alien to it. If there is no discernible nexus between what is stated and what is intended or what is now claimed to have been intended, the action must succeed. This is true whether or not the target audience is a select niche audience or the public at large. Dr. Tulzapurkar also refers to a Division Bench decision of the Calcutta High Court in Tushar Kanti Ghose v Bina 7

- 84. 15. Ms. Dalal and Mr. Basu appeared in person. They have each presented their written submissions. I have taken these on record and permitted them to read them in Court. They contain much that is, perhaps understandably, generalized and not strictly speaking in the nature of legal submissions. I will refer to only such portions as are necessary for our purposes. 16. The single most important factor that strikes me in this particular case, quite apart from the technical aspects of it, is the enormous time gap between the receipt of the anonymous letter in 14 of 30 904-NMS-1220-15-F4.DOC January 2015 and the publication of the first article on 19th June 2015. What is it that Ms. Dalal and Mr. Basu did in that time? Did they merely sit silent for all those months and come out with the article without any further acts? The plaint is curiously silent, though it could not possibly have been. Ms. Dalal in her note and in her Affidavit in Reply points out that after she received the anonymous letter she did make enquiries with various regulators, Stock Exchanges, and traders. She does not provide details of these. Dr. Tulzapurkar says that this is the information that ought to have been disclosed. Maybe so. However, there is other material that Ms. Dalal has disclosed but the Plaintiffs have not though, in my view, they were obliged to do so. This is the fact that on 11th June 2015, well before the article appeared, Ms. Dalal emailed the Chairman of SEBI with a copy to the two persons at the helm of the NSE's affairs, Mr. Ravi Narayan and Ms. Chitra Ramakrishan, persons who have been in those positions for a very long time indeed and who can reasonably be supposed to be au courant with the NSE's dealings, processes and affairs, seeking their response to the anonymous letter, with a copy of it. 9 There was no answer. Nothing in the nature of what is stated now in paragraph 18A was returned to Ms. Dalal. She sent a reminder a few days later on 15th June 2015.10 This too met with silence. The next day she sent an SMS to Mr. Ravi Narayan and Ms. Chitra Ramakrishan asking specifically whether the NSE had anything to say on Bhowmick6 to much the same effect and most importantly saying that fair comment is not the private preserve of newspapers but is a right of other citizens and persons in the country. 14. In Shree Maheshwar Hydel Power Corporation Ltd. v Chitroopa Palit & Anr.,7 a learned Single Judge of this Court 8 was concerned with an expression said to be defamatory and contained in a press note issued in some newspapers. This related to the Narmada River 57 CWN 378 2004 Vol. 106(1) Bom.L.R. 186 S. Radhakrishnan J, as he then was 13 of 30 904-NMS-1220-15-F4.DOC Valley Project. The relevant statement is set out in paragraph 5 of the report. The Court accepted the argument that unlike English law on the subject, where a mere plea of justification would be sufficient to dislodge the interim application, in India, the defendants must also produce sufficient material supporting their contentions and the Court is certainly entitled to scrutinize these. Should substance be found in this material then the plea of justification in defence is proper. Much case law was cited in this regard before the Court, which held that the article complained of may be justified in the public interest if it be shown that the defendants had taken every reasonable precaution of ascertaining the truth. The defendants must therefore show on material available that a reasonable person could come to the conclusion that the comments made and complained of were not mala fide. I am not here concerned of course with the tone of the comments but only with an examination of whether the comments made by the Defendants before me today can be said to be defematory as Dr. Tulzapurkar insists they are. 8

- 85. these emails. 11 Again: no response. There are, thus, three distinct communications from Ms. Dalal to the two persons at the NSE best placed to answer the questions she raised. There is not even a whisper of these Motion paperbook, p. 89 Motion paperbook, p. 90 Motion paperbook, p. 91 15 of 30 904-NMS-1220-15-F4.DOC communications in the plaint. Even today, despite the amendment, there is no explanation as to why these two persons chose not to respond to Ms. Dalal. What is stated in paragraph 18A of the plaint cannot be new. It was then known to the NSE. If it is indeed a complete answer, it ought to have been provided. It was not; and we are left to speculate as to why the NSE did not think it necessary to provide the response when it was sought. 17. If the answer to this is that the NSE is not bound to respond to any and every person who writes to it, then that is not one that I am prepared to accept in this particular case. The reason suggests itself. It certainly stares one in the face when one considers the Affidavit in Reply and Ms. Dalal's undoubted and well documented track record in financial matters. She is a much-decorated and highly regarded journalist in financial sectors with nearly three decades of experience in the field. Her work and she have received recognition and are renowned. She is not, despite the quite petty- minded and churlish statements in the Affidavit in Rejoinder, somebody who can be said to be even remotely irresponsible, scare- mongering, populist or given to hyperbole. To the contrary. It is to her credit that in April 1992, 23 years ago this year, it was she who was primarily responsible for exposing what came to be known as the Harshad Mehta scam, one that can, I think, safely be said to have directly led to the introduction of a series of regulatory measures and protective standards that govern, interestingly enough, the NSE itself. She has also been a columnist of various newspapers and the business editor of leading financial newspapers. She is known to have worked closely with at least one former chairman of SEBI. All of this is in the public domain. It acquires 16 of 30 904-NMS-1220-15-F4.DOC significance only for this limited purpose: Ms. Dalal's query to Mr. Ravi Narayan and Ms. Chitra Ramakrishan was no idle accusation. She had then not gone to press with her article. She took the trouble firstly to make her own investigations, and then specifically to solicit the views of the two persons who manage and run the NSE. I do not believe she was duty-bound to do more. She had with her a damning letter, albeit anonymous, but one that contained a welter of detail that could not be denied and that, on my reading of it, certainly calls for a response, irrespective of the source. To decry this as the handiwork of a disgruntled individual or to belittle the anonymous author is, I think, in this day and age of the statutory recognition of what are called 'whistleblowers', to attempt to deny the undeniable. To say that there must be material from which a person may draw a conclusion is only half the story. Very often, as in such cases, while silence might not quite be 'consent' as Mr. Malcolm for the 1st Defendant would have it, it might certainly be enough to lead one to a conclusion that the addressees of this letter had nothing in fact to say in response at all. The only alternative to that view is again a point that Ms. Dalal makes in her articles, viz., that the persons in charge at the NSE felt it beneath them to deign to respond to what is indubitably a very serious case made manifestly in the public interest. The question of paragraph 18A of the plaint not having received a reply on affidavit, is, I think, somewhat misplaced. That is not the issue. The question is why was this so-called answer not provided at a time when the NSE had a opportunity to provide it? Had that been done, and had that answer not been further investigated or controverted and had the present offending article then 9

- 86. 18. I do not think it necessary to examine NSE's past record in any great detail. This is not because Dr. Tulzapurkar claims it to be entirely irrelevant, though he may be right to some extent, but because it is a needless distraction at this stage. What is not, however, irrelevant is a point that Mr. Basu makes in his written submissions, that even following the report complained of, apart from the NSE itself there has been a very considerable amount of material in the public domain that indicates that these matters at the NSE, i.e., specifically algo or HFT trades are being investigated, and this is being done at the highest possible level, including the chairman of SEBI. Some of this material is appended 18 of 30 904-NMS-1220-15-F4.DOC to the note and to the Affidavit in Reply filed by Defendants Nos. 2 and 3.12 19. What of the "duty" that Wadia J alluded to, and what of the material that is required to be placed to substantiate justification? As a responsible journalist, one who is not some sensationalist muck-raker, Ms. Dalal certainly had and has a duty to the common investor, the everyday trader. That is her social and moral duty. But she also has a perhaps more profound ethical duty, and that is to take all possible steps to ascertain her position before she goes to press. Had she not sought the NSE's views, and merely accepted as gospel what the anonymous communication to her said, matters might be very different indeed. But she did abide by that ethical standard. She did her investigations, and she did first solicit the NSE's response. Had there been a response, of the nature now suggested, or something in that vein, I imagine she would have followed this up with further investigations and correspondence before committing herself. I do not see how it can possibly be open to the NSE to accuse her of a lapse in ethical and journalistic standards when, despite the opportunity, it chose not to respond. Was Ms. Dalal supposed to imagine and speculate what that response might be? I find it exceedingly odd, too, that despite having received these communications, the NSE does not even mention them in the plaint. It gives instead the impression that Ms. Dalal acted immediately and solely on the anonymous letter and rushed to print. Nothing could be further from the truth. The elision of that correspondence from the plaint is neither irrelevant nor minor. Today, once the Affidavits in Reply are in, the plaint Exhibits "J" and "K" to Mr. Basu's compilation. been published as if there was no such answer, the NSE might then have had a case to make. I do not 17 of 30 904-NMS-1220-15-F4.DOC think that it is at all possible for the NSE to try and retrofit answers in this fashion. Even assuming that the contents of paragraph 18A of the plaint are correct, I do not see how Ms. Dalal's articles could be said to be defamatory on account of an answer that came after those articles rather than being given before them when an answer was indeed sought. This is putting the cart very firmly before the horse. What paragraph 18A says is hardly public-domain material. What the NSE seems to be saying to Ms. Dalal is something like this: "your articles are per se defamatory because they are contrary to the information we now provide in our plaint but which we did not provide before you wrote your articles, though you did seek our response." There is certainly something of the cum hoc ergo propter hoc fallacy in this formulation and possibly even the post hoc fallacy, for temporal sequencing is integral to causality in defamation actions. The Plaintiffs' answer in paragraph 18A of the plaint is therefore far too little far too late. 10

- 87. 20. Are the articles, or any part of them, irrelevant to the occasion or out of context? I do not think so in the least. The "occasion" and the "context" are, in my understanding of the expressions, references to the purpose and intent of the articles. Absent a timely response (and there was not even a holding reply to Ms. Dalal's queries), both occasion and context presented themselves; and what followed can only be called, I think, fair comment precisely for want of that very response that Dr. Tulzapurkar now extols. Indeed, I would venture to suggest that the so-called response in paragraph 18A of the plaint is itself out of context and now irrelevant to the occasion, which is the present suit. In the plaint itself, a very curious picture is attempted to be portrayed of the NSE as an organization that is, by its own telling of it, incapable of any mistake or any wrongdoing. There are suggestions, for example, that algorithmic trading is regulated by circulars, that there are recommendations of technical advisory committees, that the financial stability report of the RBI is sufficient control over the operations of the NSE and that, there is, therefore, never a question that can be raised against the NSE. This is the distinct impression that one gets from a reading of the plaint and it seems strangely like a claim to the kind of infallibility best left to divinities not mortal institutions; and, as our mythology tells us, even our divinities have their foibles and failings. The NSE expects respect. That is to be earned. It is not to be torn out of the throats of public the NSE is meant to serve. The NSE is after all a public institution and it is in some sense or the other a custodian if not of 20 of 30 904-NMS-1220-15-F4.DOC public funds then at least of an undeniable public trust. This demands, I think, the most complete transparency, accountability and openness in its actions, dealing and operations. I include in this its duty to respond in a measured fashion to a question that has been placed in a measured fashion. It has no duty to respond to a wild or reckless allegation. But when a person, having made some enquiries, and herself having something of an established track record, makes a politely worded and pointed enquiry, not to respond to it seems to me either to be an example of the most egregious hubris and arrogance or, alternatively, an admission that there is an element of truth in what was being said. There is no third alternative. 21. In his written submissions, Mr. Basu makes this telling point: that despite the articles of which it complains, the NSE has suffered no loss or damage at all. He produces some documents that prima facie so indicate.13 It is one thing to contend that damage must be presumed if defamation be shown; but where it is affirmatively shown that no damage has resulted, then I do not see how any case in 'defamation' can be said to have been made out. After all, at the heart of defamation lies denigration, the lowering of the plaintiff in the public estimation. 22. Mr. Basu has also done some quite formidable legal research. The point he makes is this: that there is a material difference when the complainant plaintiff is a public persona or figure or institution, as the NSE undoubtedly is, as opposed to a private citizen. He cites, of course, the classic decision in New York Times Co. v Exhibits "A" and "A-1" to Mr. Basu's compilation. 19 of 30 904-NMS-1220-15-F4.DOC seems strangely like a government statistic: what it tells us is merely interesting; what it conceals is vital. 11

- 88. 1. The seriousness of the allegation. The more serious the charge, the more the public is misinformed and the individual harmed, if the allegation is not true. 2. The nature of the information, and the extent to which the subject-matter is a matter of public concern. 3. The source of the information. Some informants have no direct knowledge of the events. Some have their own axes to grind, or are being paid for their stories. 4. The steps taken to verify the information. 5. The status of the information. The allegation may have already been the subject of an investigation which commands respect. 21 of 30 904-NMS-1220-15-F4.DOC Sullivan,14 for its proposition that a public official cannot recover damages in a defamation action unless he proves with convincing clarity that the statement was made with knowledge of its falsity or with reckless disregard of whether or not it was false. This standard has been generally applied to public figures, but I will for the present, set this to one side since Sullivan seems to me to be closely hinged on the First and Fourteenth Amendments to the US Constitution. Mr. Basu's reliance on Reynolds v Times Newspapers Ltd & Ors.15 may be more appropriate. That seems to me to be a case closer to our conception of the law in the field, though the law it states is somewhat different, as Radhakrishnan J noticed, from our own standard. I do not think this distinction is material, given the facts of this case. The House of Lords in Reynolds inter alia reviewed the law from other jurisdictions, including ours: it referenced the Supreme Court decision in Rajagopal v State of Tamil Nadu,16 to much the same effect as Sullivan in relation to public officials. Now if there is no doubt, and I do not think there can be any doubt, that the NSE is very much a public body, then this standard must apply. In that situation, a demonstration that the defendant acted after a reasonable verification of the facts is sufficient to dislodge a claim for an injunction and a charge of malice. In dismissing the appeal, Nicholls LJ, upholding the decision of Bingham LJ of the court below, 17 did not accept that there should be a shift in the burden of proof, i.e., that the burden should be on the plaintiff for that would turn the law of qualified privilege on its head. It is for he who asserts privilege to prove it. 376 US 254 [2001] 2 AC 127 : [1999] 4 All ER 609 (1994) 6 SCC 632 Hope LJ dissenting. 22 of 30 904-NMS-1220-15-F4.DOC But where there is a factual demonstration of sufficient steps being taken to ascertain the 'other side of the story' and this opportunity, when presented, has been ignored, no more can be expected if it is also shown that the article when published was not unreasonable in its content, tone and tenor. This decision gave us the 'Reynolds defence', one that can be raised where it is established that the journalist in question had a duty to pubish an allegation even if it ultimately turned out to be wrong. The fact that this has now been abolished by a subsequent statute in England is I think immaterial to this discussion.18 Nicholls LJ set out ten criteria against which attempts to use the Reynolds defence might be assessed. This list, reproduced below, was even then said to be not exhaustive and very largely fact-dependent: 12

- 89. 6. The urgency of the matter. News is often a perishable commodity. The Defamation Act, 2013 23 of 30 904-NMS-1220-15-F4.DOC 7. Whether comment was sought from the plaintiff. He may have information others do not possess or have not disclosed. An approach to the plaintiff will not always be necessary. 8. Whether the article contained the gist of the plaintiff's side of the story. 9. The tone of the article. A newspaper can raise queries or call for an investigation. It need not adopt allegations as statements of fact. 10. The circumstances of the publication, including the timing. It matters little, I think, whether or not this is taken as a lodestar for assessment in such cases. What is relevant is that these observations, a little over a decade and a half ago, seem oddly prescient today. Consider items 2, 4, 5, 6, 7 and 9. Each of these seems to have an echo in the case before me. That must surely be enough. Even if we do not adopt the Reynolds defence as an absolute standard, the decision nonetheless contains valuable guides to a judicial assessment in a case such as this. 23. With that, I return to the tests in Wadia J's decision in Mitha Rustomji Murzban. What would a reasonable person used to dealing in financial markets make of the fact that Ms. Dalal had sent this query and this letter to the NSE and sought its responses not once but three times and received no response? I believe the response of any such person might be substantially along the lines of what the Defendants said, though perhaps others may not have put it quite in the same fashion. That does not make the article complained of defamatory per se. I am unable to understand how it can be possibly 24 of 30 904-NMS-1220-15-F4.DOC said in these situations that the refusal to answer a legitimate query, one raised in the public interest where a large body of investors is concerned can be said to be defamatory. 24. As I said earlier, this is not directly a question of freedom of press or free speech. At the same time I do not believe that a defamation action should be allowed to be used to negate or stifle genuine criticism, even pointed criticism or criticism that is harshly worded; nor should it be allowed to choke a fair warning to the public if its interest stands threatened in some way. It is to me a matter of very great dismay that the NSE should have attempted this action at all. Except where it is shown that the article complained of is facially defamatory, that is to say, it is prima facie intended to defame or libel, an injunction will not readily be granted. Every criticism is not defamation. Every person criticized is not defamed. 25. Defamation law is not to be used to gag, to silence, to suppress, to subjugate. Ms. Dalal and Mr. Basu are I think correct generally when they say that of all the freedoms guaranteed by Article 19 of the Constitution, the freedom of speech and expression is arguably the most volatile, the most sensitive to assault, and the most precious. Its restrictions, and defamation law is indeed such a 13

- 90. restriction, are to be narrowly construed. 19 Defamation is a very thin red line. It must not be crossed, but it is not actionable only because it is approached, however closely. It is indeed protected fair comment when questions are raised in the public interest after due care is shown to have been taken to elicit a Devidas Ramachandra Tuljapurkar v State of Maharashtra, (2015) 6 SCC 1; Shreya Singhal v Union of India, 2015 5 SCC 1 25 of 30 904-NMS-1220-15-F4.DOC response. It is no answer at all to then say that no question of muzzling free speech arises, or to simply allege that there might indeed yet be an answer, and it matters not that that answer, or what passes for it, was not provided when an opportunity presented itself, and the fact of that answer being sought is so wholly concealed. More and more, in the name of security or reputation, we are increasingly too eager to surrender this, and its sister, freedoms. When we do so we forget: we forget that these freedoms are vital to our survival and our existence as a nation, as a people. We forget that these freedoms have not come easily. They have not come cheap. They were hard won after years of sacrifice and toil and struggle. They have not been given. They have been forged. We surrender them at our peril. To suggest, as the Plaintiffs do, that because they are a much-vaunted public body, they are, only for that reason, immune from all error and wrongdoing is, I think, a grotesque over-simplification. It is fashionable these days to deride every section of the media as mere papparazzi, chasing the salacious and steamy. We forget again. None of the scams and the leaks of the past two decades would have been possible without journalists, editors, newspapers and television news anchors. We have grown accustomed to mocking them. We deride their manner, describing them as loud, brash, obnoxious, abrasive and opinionated. We forget. We forget that but for them the many uncomfortable questions that must be asked of those in authority and those with the sheer muscle power of money would forever go unasked and unanswered. We forget that it is these persons we are so wont to mock who are, truly, the watchdogs of our body politic, the voice of our collective conscience, the sentinels on our ramparts. They may annoy. They may irritate. They certainly 26 of 30 904-NMS-1220-15-F4.DOC distress and cause discomfort. That is not only their job. It is their burden. Watchdogs respond to whistles and whistles need whistleblowers; and between them if they can ask what others have not dared, if they can, if I may be permitted this, boldly go where none have gone before; if they can, as they say, rattle a few cages, then that is all to the good. Neither of our principal stock exchanges are strangers to scandal; no matter what the NSE may think of itself, and even if Dr. Tulzapurkar insists that the past is the past and irrelevant today, public memory is not that short. The scams that beleaguered our exchanges in the past, and those that continue to occupy the time of this Court have at least in part come to light because of persons like Ms. Dalal and her fellow travellers. If regulatory agencies have been compelled to make changes, and if our own Supreme Court has felt it necessary to step in with drastic orders, it is because every oversight process has either failed or been subverted. The Plaintiffs are in error when they describe Ms. Dalal as some out-of-control lone wolf. The nation may or may not want to know; Ms. Dalal does. So do her readers. And, as it happens, so do I. She is certainly entitled to ask, to question, to doubt and to draw legitimate conclusions. 26. Today, all our institutions face the crisis of dwindling public confidence. Neither the NSE nor the judiciary are exceptions to this. It presents a very real dilemma, for the existence of our institutions is posited on that very public confidence and faith and its continuance. The challenge is, I think, in finding legitimate methods of restoring that public trust, that balance. Hence the cries for Indian Kanoon - http://indiankanoon.org/doc/197656447/ 14

- 91. 27. As a result, there is no prima facie case made here at all, nor is there any question of balance of convenience or any sort of prejudice being caused to the Plaintiffs if the injunction sought is declined. I will not grant the injunction sought. The Notice of Motion is dismissed. The previous ad-interim order is vacated. 28. There remains the question of costs. Looking to the material that has been published, and the manner in which this action has been brought, I have very little doubt in my mind that this is a matter that cries out for the award of costs. Not only is this 28 of 30 904-NMS-1220-15-F4.DOC necessary because the NSE is what it says it is, but if it is truly an organization or an institution that acts in the public interest then this must be demonstrated. The suit and the NSE's conduct seem to me attempts at deflection and evasion. I also believe this entire action to be a gross abuse of the process of this Court. The NSE seems to have taken it more or less for granted that our Courts are too easily cowed by self-congratulatory assertions and overblown claims of rectitude to even consider refusing their claim. This is an approach that must be deprecated, and there is only one way to do that when dealing with an institution like the NSE. I intend to award costs in two parts. I am aware that as a matter of law, the second of these is one that is normally not done and is perhaps even frowned on. There are, however, in my view exceptional circumstances in which an action that is entirely and deliberately mala fide in its intent ought to receive an award of costs, if nothing else then at least as a matter of conveying to such a Plaintiff that Courts do not view these matters lightly. To any protest that an award of costs is unjustified because these costs represent 'public funds', the answer is simply that so do the considerable legal costs and court fees incurred by the NSE. Our Courts are not to be treated as playgrounds for imagined and imaginary slights for those who command considerable resources. 29. There will be an order of costs in the amount of Rs. 1.5 lakhs each in favour of Ms. Dalal and Ms. Basu separately. In addition, the Plaintiff will pay an amount of Rs. 47 lakhs in punitive and exemplary costs payable not to the Defendants but to public causes, viz., in equal parts to the Tata Memorial Hospital and the Masina Hospital, it being made clear that these amounts are to be used only 29 of 30 904-NMS-1220-15-F4.DOC for the free treatment of the indigent. These amounts will transparency and accountability everywhere; and I see no reason why the NSE should be any exception to this. Quelling dissent and 27 of 30 904-NMS-1220-15-F4.DOC doubt by strong-arming seems to me a decidedly odd way of going about restoring that public faith. It is not a move that, from a public institution, readily commends itself. For public bodies and figures, I would suggest that the legal standard is set higher to demonstrated actual malice and a wanton and reckless embracing of falsehood though countered at the first available opportunity. I do not think it is reasonable to propose a legal standard of utter faultlessness in reportage or public comment in relation to such bodies or persons. If there is indeed a factual error, can it be said to have been made in good faith, and in a reasonable belief that it was true? The 'actual malice' standard seems to me to suggest that one or both of these must be shown: intentional falsehood, or a reckless failure to attempt the verification that a reasonable person would. In this case, I do not think that the Plaintiffs have met that standard, or demonstrated either intentional falsehood or a failure to attempt a verification. The burden of proof in claiming the qualified privilege that attaches to fair comment can safely be said to have been discharged. Indian Kanoon - http://indiankanoon.org/doc/197656447/ 15

- 92. be paid within a period of two weeks from today. 30. The application for stay is refused. (G. S. PATEL, J.) CERTIFICATE "Certified to be a true and correct copy of the original signed Judgment/Order." 30 of 30 16

- 93. Page 1 of 4 Chief General Manager Market Regulation Department-Division of Policy E-mail: mdrao@sebi.gov.in MRD/ DoP/SE/Cir- 7 /2008 April 03, 2008 The Managing Director and CEO Bombay Stock Exchange Phiroze Jeejeebhoy Towers Dalal Street Mumbai 400001 The Managing Director National Stock Exchange of India Ltd., Exchange Plaza Bandra Kurla Complex Bandra (E) Mumbai- 400 051. Dear Sir, Sub:- Introduction of Direct Market Access facility Direct Market Access (DMA) is a facility which allows brokers to offer clients direct access to the exchange trading system through the broker’s infrastructure without manual intervention by the broker. Some of the advantages offered by DMA are direct control of clients over orders, faster execution of client orders, reduced risk of errors associated with manual order entry, greater transparency, increased liquidity, lower impact costs for large orders, better audit trails and better use of hedging and arbitrage opportunities through the use of decision support tools / algorithms for trading. While ensuring conformity with the provisions of the Securities Contract (Regulations) Act, 1956 (42 of 1956), Stock Exchanges may facilitate Direct Market Access for investors subject to the following conditions: 1. Application for Direct Market Access (DMA) facility Brokers interested to offer DMA facility shall apply to the respective stock exchanges giving details of the software and systems proposed to be used, which shall be duly certified by a Security Auditor as reliable. The stock exchange should grant approval or reject the application as the case may be, and communicate its decision to the member within 30 calendar days of the date of completed application submitted to the exchange. The stock exchange, before giving permission to brokers to offer DMA facility shall ensure the fulfillment of the conditions specified in this circular.

- 94. Page 2 of 4 2. Operational specifications All DMA orders shall be routed to the exchange trading system through the broker’s trading system. The broker’s server routing DMA orders to the exchange trading system shall be located in India. The broker should ensure sound audit trail for all DMA orders and trades, and be able to provide identification of actual user-id for all such orders and trades. The audit trail data should available for at least 5 years. Exchanges should be able to identify and distinguish DMA orders and trades from other orders and trades. Exchanges shall maintain statistical data on DMA trades and provide information on the same to SEBI on a need basis. The DMA system shall have sufficient security features including password protection for the user ID, automatic expiry of passwords at the end of a reasonable duration, and reinitialisation of access on entering fresh passwords. Brokers should follow the similar logic/priorities used by the Exchange to treat DMA client orders. Brokers should maintain all activities/ alerts log with audit trail facility. The DMA Server should have internally generated unique numbering for all such client order/trades. A systems audit of the DMA systems and software shall be periodically carried out by the broker as may be specified by the exchange and certificate in this regard shall be submitted to the exchange. The exchanges and brokers should provide for adequate systems and procedures to handle the DMA trades. 3. Client Authorization and Broker – Client agreement Exchanges shall specify from time to time the categories of investors to whom the DMA facility can be extended. Initially, the permission is restricted to institutional clients. Brokers shall specifically authorize clients for providing DMA facility after fulfilling Know Your Client requirements and carrying out due diligence regarding clients’ credit worthiness, risk taking ability, track record of compliance and financial soundness. Brokers shall ensure that only those clients who are deemed fit and proper for this facility are allowed access to the DMA facility. Brokers shall maintain proper records of such due diligence. Individual users at the client end shall also be authorized by the broker based on minimum criteria. The records of user details, user-id and such authorization shall be maintained by the broker. Details of all user-ids activated for DMA shall be provided by the broker to the exchange.

- 95. Page 3 of 4 The broker shall enter into a specific agreement with the clients for whom they permit DMA facility. This agreement will include the following safeguards: (a) The client shall use the DMA facility only to execute his own trades and shall not use it for transactions on behalf of any other person / entity. (b) Electronic/Automated Risk management at the broker’s level before release of order to the Exchange system. The client shall agree to be bound by the various limits that the broker shall impose for usage of the DMA facility. (c) Right to withdraw DMA facility if the limits set up are breached or for any other such concerns (d) Withdrawal of DMA facility on account of any misuse or on instructions from SEBI/Exchange. Exchanges shall prepare a model agreement for this purpose. The broker’s agreement with clients should not have any clause that is less stringent/contrary to the conditions stipulated in the model agreement 4. Risk Management The broker shall ensure that trading limits/ exposure limits/ position limits are set for all DMA clients based on risk assessment, credit quality and available margins of the client. The broker system shall have appropriate authority levels to ensure that the limits can be set up only by persons authorized by the risk / compliance manager. The broker shall ensure that all DMA orders are routed through electronic/automated risk management systems of the broker to carry out appropriate validations of all risk parameters including Quantity Limits, Price Range Checks, Order Value, and Credit Checks before the orders are released to the Exchange. All DMA orders shall be subjected to the following limits: (a) Order quantity / order value limit in terms of price and quantity specified for the client. (b) All the position limits which are specified in the derivatives segment as applicable. (c) Net position that can be outstanding so as to fully cover the risk emanating from the trades with the available margins of the specific client. (d) Appropriate limits for securities which are subject to FII limits as specified by RBI. The broker may provide for additional risk management parameters as they may consider appropriate.

- 96. Page 4 of 4 5. Broker to be liable for DMA trades The broker shall be fully responsible and liable for all orders emanating through their DMA systems. It shall be the responsibility of the broker to ensure that only clients who fulfill the eligibility criteria are permitted to use the DMA facility 6. Cross Trades Brokers using DMA facility for routing client orders shall not be allowed to cross trades of their clients with each other. All orders must be offered to the market for matching. 7. Other legal provisions In addition to the requirements mentioned above, all existing obligations of the broker as per current regulations and circulars will continue without change. Exchanges may also like to specify additional safeguards / conditions as they may deem fit for allowing DMA facilities to their brokers. 8. The Stock Exchanges are advised to: • make necessary amendments to the relevant bye-laws, rules and regulations for the implementation of the above • bring the provisions of this circular to the notice of the member brokers/clearing members and also disseminate the same on their website. • communicate to SEBI, the status of the implementation of the provisions of this circular in the Monthly Development Report. 9. A review of the working of this facility shall be undertaken after six months from its introduction. 10. This circular is being issued in exercise of powers conferred under Section 11 of the Securities and Exchange Board of India Act, 1992 to protect the interests of investors in securities and to promote the development of, and to regulate the securities market. Yours faithfully, S V Murali Dhar Rao

- 97. MEMBERSHIP DEPARTMENT Circular No. 693 Ref. No: NSE/MEM/12985 August 31, 2009 Dear Members, Sub: Co location services at NSEIL premises As you are aware the Exchange permits DMA and ALGO trading and many members have already opted for the same. Some of these members have been representing that a co- location facility would help them make better user of DMA and ALGO trading. In keeping up with the global trends, member representation and in continuation of service excellence the Exchange is providing our members a co-location facility for their DMA and ALGO IT infrastructure at NSEIL premises in BKC shortly. In this regard Trading Members may please note the following: • In view of limited availability, racks will be allotted on first come first basis based on the receipt of complete application along with the payment. However, if there is more demand than the availability, request for more than 1 rack would be rationed. • The minimum period for which the racks are allotted will be one year and any renewal would require an advance notice of 45 days. • Co-location facility is a paid facility and the list of charges for the same is enclosed as Annexure-1. • Format of the Application form for applying for usage of Co-location facility is enclosed Annexure -2. The Application form has to be accompanied by requisite Payment which has to be made by way of cheque / demand draft drawn in favour of National Stock Exchange of India Limited payable in Mumbai. • The racks will be allotted on 1 rack basis. No partial rack would be allotted. • The co-location facility shall be used only for DMA and Algo trading on NSE. • Members may take one or more leased line to the co location facility from MTNL, TATA, Bharti or Reliance for the purpose of setting up or modifying parameters, trading related activities and hardware, software, network related access, software download / upload and monitoring and data downloads. • Basic IT services namely Help Desk (24*7), Hardware Checks, Incident Management (Level 1), On-site coordination, Daily reports, Named resource (SPOC) for the account and Power ON/OFF / Boot on request will be provided.

- 98. • Due to security reasons, Physical access to co-location data centre will be restricted only to the initial set up and access for periodic or urgent maintenance if any would be only with prior permission from NSE and that such permission will be allowed only after Exchange trading hours. • The Exchange would not be responsible for insuring the member assets at the co- location premises. • The co location would have the following features: o Facilities with dual UPS power source and 100% DG capacity which ensures uninterrupted power. o Multiple Precision air conditioning units, with N+1 redundancy ensuring optimal temperature at all times. o Standard 42 U Rack with 6KVA power. o Order Connectivity and market data connectivity will be provided on 1Gbps network port. • The Exchange will provide co-location facility on best efforts basis and it will not be responsible for any direct / indirect / consequential, harm / loss / damage of any kind for whatsoever reason including but not limited to power failure, air conditioning failure, system failure and loss of connectivity. Further, the Exchange shall not be liable for any stoppage in co-location facility owing to legal or regulatory requirement. For further technical clarification and queries kindly contact Mr. Mahesh Soparkar on telephone number 022-26598136 and on email msoparkar@nse.co.in. For clarification and queries in regard to application form kindly contact the Membership Dept on telephone number 26598249 and on email minward@nse.co.in. For National Stock Exchange of India Ltd Sd/- Rehana D’souza Manager