Kotak Mahindra Bank vs RBI

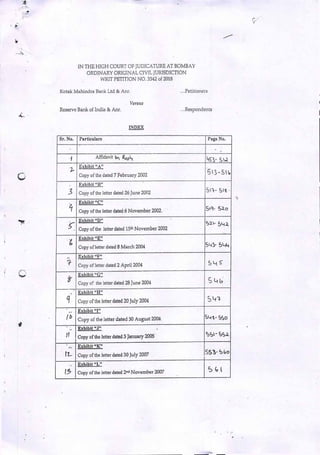

- 1. IN THE HIGH COURT OF JUDICATURE AT BOMBAY ORDINARY ORIGINAL CIVIL JURISDICTION WRIT PETITION NO. 3542 of 2018 Kotak Mahindra Bank Ltd & Anr. .. Petitioners Reserve Bank of India & Anr. Versus Respondents INDEX Sr. No. Particulars Page No. 'I Affidavit Exhibit "A" 11-5Copy of the dated 7 February 2002 Exhibit "B" Copy of the letter dated26 June 2002 Exhibit "C" Copy of the letter dated 6 November 2002. • Exhibit "D" Copy of the letter dated 15th November 2002 •. Exhibit "E" 5'4Copy of letter dated 8 March 2004 Exhibit "F" 5 kCopy of letter dated 2 April 2004 • Exhibit "C" Copy of the. letter dated 28 June 2004 Exhibit "H" SCopy of the letter dated 20 July 2004 Exhibit "I" t SOCopy of the letter dated 30 August 2004 ;. Exhibit "J" Copy of the letter dated 3 January 2005 - .. Exhibit "K" '' °Copy of the letter dated 30 July 2007 15' Exhibit "L" Copy of the letter dated 2nd November 2007 I

- 2. C. lf Exhibit "M" 5(0 - SCopy of the letter dated I9th November .2007 Exhibit "N" (0Copy of the letter dated 5th December 2007 1 Exhibit "0" Copy of the letter dated 29 December 2007 - Exhibit "P" 5 CCopy of the letter dated 27 February 2008 l. Exhibit "0" Copy of the letter dated 27 March 2008 Exhibit "R" 5Copy of the letter dated 12 March 2009 2V Exhibit "S" Copy of the letter dated 1 April 2009 2?. Exhibit "T" 5Copy of the letter dated 3d June 2009 2 Exhibit "U" SCopy of the letter dated 9th November 2009 2 Exhibit "V" Copy of the letter dated 10th December 2009 2St Exhibit "W" Copy of the letter dated 2nd February 2010 Exhibit "X" S ?sO Copy of the letter dated jst November 2010 - Exhibit "Y" ICopy of email dated 2' AUgUSt 2018 L

- 3. L L5 IN THE HIGH COURT OF JUDICATURE AT BOMBAY ORDINARY ORIGThIAL CIVIL JURISDICTION WRIT PETITION NO. 3542 of 2018 Kotak Mahindra Bank Ltd & Ann . . Petitioners Versus. Reserve Bank of India & Anr. . Respondents - It'A tts1 RPL'q ON BEHALF OF RESPONDENT NO..d TO OPPOSE THE ADMISSION OF THE WRIT PETITION 1, N. Ramasubramaflian, s/u V. Natarajan, Deputy General Manager, Department of Banking Regulation, Reserve Bank of India, Central Office, Fort, Mumbai, do hereby solemnly affirmandsay that; 1 have gone through the above Writ Petition(hereinafter referred to as "the Petition") and the documents filed along with the same. I have also, duly and fully acquainted myseif with the facts of the case,based on the records and papers of Respondent No.1 (hereinafter referred to as "RBI"), and I am also authorized to file this affidavit onits behalf. I say. therefore, that I am both able and competent to depose to this affidavit. 2. I am filing this Affidavit in Reply for the limited purpose of opposing the admission of the Petition and the want of any interim / ad interimrelief. I crave leave of this Hon'ble Court to file a further affidavit, should the same become necessary, or be advised. 3. At the outset, I deny all allegations, contentions and submissions made in the Petition, whichare contrary to or inconsistent with what is.stated in this Affidavit. I further say that any allegations, contentions or submissions in the said Petitionwhich have not been specifically dealt with or denied by me, may not be deemed to he adm elYfl4CC0Uflt of non-traverse. .c, ;:'Is/ aJ * Q JOg,

- 4. 4. At the further outset, I say that the reliefs prayed for in the Petitionare not capable of being granted in the exercise of the writ jurisdiction of this Hon'ble Court. 5. Without prejudice to the above, I submit that the nature of the reliefs sought is such that a Writ Petition is inappropriate. A reading of the Petition would show that its central purpose is to involve this Hon'ble Court in questions of economic policy -- to wit, what is the ideal degree of ownership/control which may he allowed in private banks, in order to prevent the concentration of economic power, and make such banks more responsive to the voices of their minority stakeholders. 6. 1 say that the Banking Regulation Act, 1949 ("the BR Act") empowers the RBI to supervise and regulate banking institutions (both public and private) in the Country. Banking business involves financial intermediation and plays a key role in the mobilization and distribution of the Country's savings. Banks are "special" as they not only accept and deploy large amounts of uncollateralized public funds in a fiduciary capacity, but they also leverage such funds through credit creation. In view of these considerations, banking business has been a highly regulated area all over the world. The powers conferred upon RBI under the provisionS of the BR Act,are exercised keeping in mind the depositors' interest, banking policy, and public interest at large, which cannot be diluted for the interest of a few. 7. A cursory reading of the Petition shows that, the matters complained of therein have been the subject of keen deliberation within the RBI, and the Executive and Legislative anns of the State at large. There is also a broad policy framework, which the law in force places within the sole ompetence of the RBI, as a central bank, to evolve and refine, based on nowledge, experience and expertise. The reliefs sought in the. Petition, 11SL1 7)4 2

- 5. if granted, shall result in making inroads into the RBI's autonomy, and to permit the Petitioners and others (whose actions the RBI is meant to reulate to become regulators of their own selves. Not only will thisturn banking policy, as reflected in the BR Act, on its head, but wll, in the respectful submission of the RBI, set an unhealthy precedent. 8. Moreover, and strictly without prejudice, it is respectfully submitted that, the Petitioners before this Hon'ble Court, have no standing to question the RBI's policy decisions at issue. Those decisions, if at all, seek to regulate shareholding rights of Petitioner No. l's promoters. Those promoters have not filed any petition. They, therefore, have no issue with their holding being regulated in the manner provided for by the RBI. The correspondence annexed to the Petition contains not one letter addressed by thesePromoters. If theydid not and/or do not, think it necessary to question the dilution of their rights, the Petitioners can hardly have a complaint in relation to the same. The very fact that these Petitioners have come before this Hon'ble Court, and not those whose rights in property the Petition claimsshall be affected by the impugned communications, shows first-hand the need to make private banks more independent, and reflective not of the interests of one individual or faniilybut all stakeholders, whose voices must be heard in their (the banks') running. 9. Itis, therefore, submitted that, the Petition smacks of ulterior motives, and aims at the defeat of statutory powers and duties conferred upon / vested in the RBI. It is further submitted that if the reliefs as prayed are granted, the very purpose of the directions /instructions/ guidelines issued by RBl under the provisions of the BR Act will be defeated. 10. I say further that, the Petitioners, have also made several willful misrepresentations of fact and raised arguments wholly irrelevant to the real matters in issue, in order to obfuscate the latter. The Petitioners have, by such misrepresentation, clinically singled out unrelated issues; 3 4-

- 6. L attempting to portray an atmosphere of instability jr the financial regulatory functions of the RBI. I say that the Petitioners are also guilty of suppressio yen and suggestiofalsi. 11. For all the reasons above, I submit that, the above Petition is not maintainable, and/or that, it deserves to be dismissed, with costs. 12. Strictly without prejudice to what is aforesaid, and so as to give this Hon'ble Court the full and unvarnished facts and circumstances of the case, I shall now set these out briefly. Thereafter, and based on those facts, I shall deal with the contents of the Petition, paragraph-wise. Where documents/materials refened to by me, are already annexed to the Petition, I am not now re-annexing the same. 13. Petitioner No.1 ("1CM") is a private, Indian bank. Petitioner No. 2 is a shareholder of KM. Petitioners• ostensibly challenge a letter dated 13.08.2018fr0m the RBI, requiring compliance with RBI's Ownership in Private Sector Banks Directions, 2016, by diluting KIvis promoters' shareholding in KM to 20% of its 'paid-up voting equii' capital" by 31.12.2018, and to 15% by 31.03.2020. The reliefs sought, hoviever, also cover 8 prior "Reduction (2ommunications" issued by RI, between February 2008 and January 2017, 14. Thismatter stretches back over 18 years. On 3 January 2001, RBI issued its "Guidelines on Entry of New Ban/cs in the Private Sector" ("2001 Guidelines") requiring a "minimum" promoters' contribution of 40% of a banks paid-up capital, with a 5 years' lock-in. The 2001 Guidelines required that, "In case the promoters' contribution to the initial capital is in excess of. ..40 per cent, they shall dilute their excess stake after one year of the bank's operations. (In case divestment after one year is proposed to be spread over a period of time, this would require specflc approval of ithe RBI)." Hence, even at thatstage, the holding of promoters in banks- :LII.! 0

- 7. 5 OJq N 49% of paid-up capital, "in order to provide a level playf ngfield." e17j /3 so. 15. On 7 June 2002, the RB! issued a Press Release statingthat the "maximum limit" of Indian promoters' shareholding in private banks was raised to q covered by those Guidelines, was capped at 40%, one year after it commenced operations. 15. On 30 March 2001, KIVI applied for a banking license, under S. 22 (1) of the Banking Regulation Act, 1949, pursuant to the 2001 Guidelines. The application (from Kotak Mahindra Finance Ltd.) stated that, initially, the proposed bank would be. a subsidiary, but that, "The sharcholding will be diluted afier obtaining approvals from RBL" 16. On 7 February 2002, RB! wrote to KM, making a reference to its letter dated 30.03.2001, and communicated to the latter RBl's "in principle approval to enable it to convert itself into a new banking company. The terms and conditions on which that approval was granted were set out in an Annexure to RBI's letter. Conditions 4 and 7 of that Annexure reiterated the need for KM to comply with the limit on promoters' holding, as contained in the 2001 Guidelines, Conditions 15, 17 and 18 in the Annexure, further provided as follows: "...15.There shall be an 'arms — length' relationship organizationally and operationally between the b nk and its promoters and all transactions between them should be as between two independent unconnected entities on market related rates and with due adherence to approved practices in completion of such transactions. .1 7.As regards interpretation of the clauses! provisions of the terms and conditions of the in-principle' approval the decision of the RBI shall be final. "18. RBI may impose additional conditions that it deems appropriate..." A copy of this letter, which is not annexed to the Petition, is annexed as Exhibit "A".

- 8. A5g is. On 26 June 2002, RBI wrote to Kl4, making a reference to Conditions 4 and 7 of the "in principle" approval, and advising the latter of the issuance of the above Press Note, in that behalf. A copy of this letter, which is not annexed to the Petition is annexed as Exhibit "B". 19. On 6 November 2002, and in response to KM's letter dated 28 August 2002 (enclosing the proposed Memorandum and Articles of Association of the proposed Bank, for RET's approval), the RBI wrote to the latter advising it that KM had the RBI's approval to pioceed with the Memorandum and Articles of Association, "subject to the condition (inter alia, that)... The company may ensure that section -12 of the Banking Regulation Act 1949 is complied with and the same is properly incorporated in the capital clauses both in the Articles & Memorandum of Association..." A copy of this letter (along with one of the letter dated 28.08.2002), which is also not annexed to the Petition, is annexed as Exhibit "C". 20. On 15 November 2002, a letter was addressed on behalf of KM to the RBI, referring in terms to the 2001 Guidelines and all communications addressed by the latter, setting out the terms and conditions that KM was required to comply with before its conversion into a bank, and informing it (RBI) that it (K1vI) had, in fact, complied with the same. In particular, KIVI noted that it was in compliance with RET's letters dated 07.02.2002, 26.06.2002 and 06.11.2002, and that, "The excess holding will be divested after one year of the proposed bank s operations — as per RBI guidelines". Annexure D of this letter further contained the following undertakings: "...2. KMFL undertakes that on receipt of the operating license to carmy out banking business and on conversion into a bank it shall abide by all the regulations of the Banking Regulation Act 1949, Reserve Bank of India Act, 1934, other relevant statutes and the Directives (in addition to those already accepted). Prudential regulations and other Cidelines/ Instructions issued by the RBI and rhe regulations of SEBI regarding pub/ic issues and other guidelines apjflable to 6 ()

- 9. annexed as Exhibit "E". ,7 11*1'S Al F'ø /Iti17, '. 0 1 "/ e FBI responded to this letter vide its letter dated 2 April 2004, stating "As the bank has completed one year of operations, the ban/c may listed banking companies unless specfically waived by the PJJI. "3. We confirm our acceptance to system of consolidated supervision by the RBI for the proposed bank and its group companies." A copy of the said letter dated 15.11.2002 (also not annexed to the Petition) is annexed as Exhibit "0". 21. On 6 February 2003, RI granted KM a banking license, subject at all times to its compliance with every rule, regulation, direction or advice furnished by the RBI, and to the RBI's powers to interpret its own regulations authoritatively. 22. On 3 February 2004, RBI issued "Guidelines for acknowledgement of transfer / allotment of shares in private sector banks" ("2004 Acknowledgement Guidelines"). The Petitioners rely on Clauses 9, 10 and 13 to contend that the Guidelines "contemplated shareholders' holding more than 30% of the paid-up capital", They however acknowledge that "voting rights would be restricted in accordance with the provisions of the B.R. Act...". 23. On 8 March 2004, KM wrote to RBI, noting the impending completion of one year of its banking operations, and the consequent requirement for it to dilute its promoter holding to 49% of paid up capital. KM also made a reference to the Government of India's Press Note No. 2 (2004 series), dated 5 March 2004, increasing the FDI limit in private sector banks, and in view thereof asked that the RBI "approve the promote.s holding in excess of 49% without the condition of dilution after one year of the Bank's operations." A copy of that letter (not annexed to the Petition) is 7

- 10. L6O di!uie the promoters holding to 49% as per the terms and conditions of the license issued vide our letter DBOD.l'To.PSBS 928/16.01.136/2002-03 dated February 6 2003 as already advised. The bank nay, therefore, advise us the spec7Ic steps it proposes to take to bring down the promoters holding to 49%." A copy of the said letter (not annexed to the Petition) is annexed as Exhibit"F'.. 25. KM responded to the above letter, by its letter dated 28 June 2004, stating that it was "presently considering various options for dilution ofpromoter holding as advised by you. We will keep you apprised on r/u specflc steps in due course." A copy of this letter (also not annexed to the Petition) is annexed as Exhibit "G". 26. In response, RBI sent KM a letter dated 20 July 2004, advising the latter "to formulate a firm action plan for dilution of promoter s holding in the bznk to the stipulated level of 49% and advise us the specfIc steps to bring down the promoter '.s holding to the stipulated level ar the earliest." A copy of the said letter (not annexed to the Petition) is annexed as Exhibit "H". 27. KM, by its letter dated 30 August 2004, and apart from giving a "broad business plan", inter alia, noted as under: Post raising of additional capital as indicated above and exercise of options granted, it is expected that the promoter holding will dilute to 49% in a phased manner by March 2008... "..,As seen above, raising capital as per requirements of the business plan will dilute promoter's holding to around 49% in a phased manner by Marc/i 2008. You would also notice that we intend to maintain prudential levels of capital adcquacy at each stage despite proposed growth. It may be noted that the lock in on promoter's shareholding is up to March 2008 as per the licence granted to the Bank..." A copy of the said letter (not annexed to the Petition) is annexed as 1' CD

- 11. 28. On 3 January 2005, KM wrote again to the RBI, referring, inter alia, to the letter dated 30.08.2004, giving a "revised plan of the proposed dilution of promoter's holding to 49%..." KM now stated that it would achieve that target by 30 June 2007 (instead of March 2008). A copy of this letter (again, not annexed to the Petition) is annexed as Exhibit "J". 29. On 28 February, 2005, RBI issued "Guidelines on Ownership and Governance of Private Sector Banks (O&G Guidelines,) ". The Petitioners contend that the objective of these Guidelines "was not to avoid conccntration of control or voting rights, which was separately and distinctly provided for by the legislature under Section 12(2) of the BR Act." 30. This is not correct, inter alia, because it ignores the fact that; (a) RBI's Guidelines, set out certain "broad principles.., relating to ownership and governance of private sector banks", the first of which was "to ensure that... (t)he ultimate ownership and control of private sector banks is well diversIied." (b) The Guidelines went on to provide, inter alia, the following; "...5. Shareholding ".,.(i1,) In the interest of diversified ownership of banks, the objective will be to ensure that no single entity or group of related entities has shareholding or control, directly or indirectly, in any bank in excess of 10 per cent of the paid up capital of the private sector bank Any higher level of acquisition will be with the prior approval of RBI and in accordance with the guidelines of February 3, 2004 for grant of acknowledgement for acquisition of shares. "(iii) Where ownership is that of a corporate entity, the objective will be to ensure that no single individual/entity has ownership and control in excess of 10 per cent of that entity. Where the ownership is that of a financial entity the objective will be to ensure that it is a widely held entity, publicly listed... "...9. Transition arrangements "...(ii) Where any existing shareholding by any individual entity/group of related entities is in excess of 10 per cent, the bank with be required to indicate a time table for reduction of holding to the pernissible level. While considering such cases. 9

- 12. RBJ will also take into account the terms and conditions of the banking licenccs..." 31 On 30 July 2007, KM wrote to the RBI, seeking the latter's approval (in accordance with KM's license conditions) for the "issue / oftr of equity shares" to Qualified Institutional Buyers ("QIBs"). KM's letter noted that, "Post the above issue, the promoter holding which is currently at 55.46% will come down to 52.71%. Further, the Bank as a policy has been granting stock options to its employees as a measure to attract and retain talent. Options granted constitute 4.72% of the current paid up equito (sic,) capital of the Bank We are also seeking shareholders approval for increasing the number of stock optiofls that may be granted to the employees. After taking into account options already granted. options approved by shareholders but not yet granted and the proposed issue, the promoters' holding will reduce to below 49%..." A copy of this letter (again, not annexed to the Petition) is annexed as Exhib1t.. 32. On 2 and 19 November, in response to a letter of the P.131, dated 30 October 2007, KM wrote to it giving details of the allotment to QIPs (as proposed in KM's letter dated 30 July 2007), and stating that, "...The Promoter holding after the issue, in teims of the actual number of shares held is 181,143,319 equity shares of Rs1O/- each being 52.67% of the total paid up capital of the Bank." Copies of the said letters dated 02.11.2007 and 19.11.2007 (also riot annexed to the Petition) are annexed as Exhibits L and respectively. 33. The RB! replied to the letter dated 02,11.2007 by its letter dated 5 December 2007 giving KM its "'post facto" approval for the allotment to QIBs. However, it noted that, "even after the said QIP. the promoters' holding is 52.d7% of the bank's total paidup capital. You are, therefore, 5 ,vised to ensure reduction of the promoters' holaing to 49% by , ,: 10 '' N)f-

- 13. S December 31, 2007." A copy of this letter (not annexed to the Petition) is " 1 annexed as Exhibit 34. On 29 December 2007, Kvl replied to the above letter, recording, inter a/ia, as under: "As seen above, the Bank has raised Rs. 2140 crore by way of additional capital. However, thanks to the rising stock prices, the issuances have been at significantly higher prices as against the envisaged price of Rs. 70/- per share. "These capital issuance (sic) have been executed keeping in mind the growth of the Bank and the consequent requirements of capital adequacy to fund the expanding asset base. While the favourable markets made it possible to raise about five times the amount of capital initially envisaged, the desired promoter dilution has not yet happened as the price at which shares have been issued has been substantially higher. "In October 2007 the Bank issued 17,000,000 equity shares to Qualfled Institutional Buyers. Post issuance, the equity share capital of the Bank has increased to 343,950,052 equity shares of Rs. 101= each amounting to Rs. 343.95 crores. The promoter hoding as on December 10, 2007 is 181,140,319 equity shares of Rs. 101= each constituting 52.63% of the paid up capital. "Going forward the Bank shall raise additional capital when neededfor its operations. KM then gave details of its ESOP schemes and plans in relation to the same. It contended that, "If ESOPs a!ready granted to employees as well as those approved by the shareholders for future grants are considered, the promoter holding conies to 48.98%, below the limit." It thereafter stated that it was waiting for the RBI's "final clarflcations" on "holding company structure in the Indian fInancial system", since, according to it (KM) these "could provide us with an opportunity to restructure the holding pattern of the Bank and accelerate compliance with the licensing condition on promoter holding." KM concluded by stating the foilowing: "The three issuances of capital in last three years and further grant of ESOPs to employees clearly demonstrate the seriousness of the efforts made by Ban/c in reducing promoter holding. Further, at this tage, the Bank has a very comfortable capital adequacy ratio of ver 17% with Tier I itseif being over 13% and any issuance at this age will result in suboptimal utilisation of capital. 'The Bank would raise further capital as and when the need arises to take care of its expanding business which would further dilute 4- ii

- 14. promoter holding. We also await the clarUications on holding company structure and will accordingly, look at accelerating the dilution ofpromoter holding. We, therefore, request you to permit us to reduce the promoter holding to 49% as indicated herein." A copy of the above letter (not annexed to the Petition) is annexed as E*hibit "0". 35. On 7 February 2008, RBI wrote to K.M, in reply to the letter dated 29.12.2007, noting: (a) That, the 5 years' lock-in period for the promoters' 49% shareholding was coming to an end; (b) That, despite KM's commitment to reduce promoters' aggregate holding to 49% of "paid-up capital" by June 2007, the same was not complied with, and had to be achieved by 31.03.2008 and that no further extension of time would be granted; (c) That, KM's explanations for its failure as aforesaid, were "not acceptable"; and (d) That, since the 0 & G Guidelines were now applicable to KM, it had to submit a "time-bound action plan, as prescribed vide paragraph 9('iii,.l of the said Guidelines, towards reduction of the promoters' holding to 10% of the paid-up capital of the bank by February 29, 2008" 36. In response, by a letter dated 27 February 2008 (which has not been disclosed by Petitioners; and a copy whereof is annexed as iibit "P", KM wrote as under: Subsequent to your letter, we have had a meeting with the Top Management of RB.!. We have highlighted therein that the present market conditions are volatile and a few equity issues have been withdrawn from the market after opening, considering the same and, with a view o give you a definite time frame. we request you to give us time upto March 31, 2009 to bring down the promoter holding to 49%. We confirm that we shall not seek any further extension beyond March 31, 2009. "As regards para 5 of your letrer, we shall revert to you by the end of March 2008, after discussions with the members of the Board as also tha members of the promoters 'family." 12

- 15. 37. By its letter in reply,dated 27 March 2008 (also not disclosed; and a copy whereof is annexed as Exhibit "0"), RBI stated the following: "....2. You are hereby granted extension of time up to March 31, 2009 to bring down the promotens' holding in the bank to 49% of the bank's paid-up capital in accordance with the licensing conditions. in this connection, ii is clarified that g. further extension of time would be granted and that :he promoters would have to divest a par! of their holding if it becomes necessaly to do so in order to ensure compliance. We also advise that in case any corporate governance issues arise in the meanwhile, the promoters will have to sell their holding in excess of49% forthwith. 3. You may also please submit to us, by June 30, 2008. a time bound action plan tcwards further ;'eduction of the promoters holding to 70% of the hank's paid-up capital as laid down in the Ownership & Governance ('ruidelines issued by RB! on Februamy 28, 2005. 38. On 25 June .2008, lUvi wrote to RBI, seeking a 'clarification" whether KM's reading of the banking license, 2004 Acknowledgement Guidelines and 0 & 0 Guidelines, that the "permissible level" of promoter sharehoiding was 49%, was correct. KM felt the need for clatifications and/or interpretations, only when the long and oft-extended deadlines were about to expire. 39. On 3liuly 2008, KM wrote to RBI stating, in continuation of the above letter, that, if the latter was of the view that KM needed to bring down the promoter holding to below 49%, that RBI "consider the permissible holding of the promoters in our Bank to atleast 40%." KM went on to say that, "based on (RBI's) approval we will revert to you at the earliest on the time bound plan of bringing down the promoter holding level." 40. On 12 March 2009, KM v'rote to the RB! once more, seeking yet another extension (despite what was stated in its letter dated 27.02.2008) "of one year...i.e. up to March 31, 20)0", to bring down its promoters' holding to 49%.A copy of the letter dated 12 March 2009 (not annexed to the Petition) is annexed as Exhibit "R". 13

- 16. 44. KM wrote back on 10 December 2009, purporting to justi' keeping the name "Mahindra" and requesting the RBI to "take on record our compliance with the promoter dilution conditton without requiring us to drop Mahindra "from our name and brand." A copy of that letter (also ot annexed to the Petition), is annexed as Exhibit "V". 14 t . , z 41. By its letter dated 1 April 2009, RBI acceded to the above request, however, the extension granted to bring the promoters' holding to 49%, in accordance with the licensing conditions was only permitted up to 30 June 2009. A copy of the letter dated 1 April 2009 (also not annexed to the Petition), is annexed as Exhibit "S". 42. On 3 June 2009, KM replied to the above letter claiming that, pursuant to a "request" from one of its promoters (Mr. Anand Mahindra), and "taking into account inter alia the nature of his involvement in the affairs of the Bank since 2003, a significant dilution in his shareholding in the Bank over the last decade and the fact that he is not a person acting in concert with the other promoters... the Board of Directors at its meeting e'n June 3, 2009 resolved that he is no longer a promoter of the Bank." In view thereof, Xlvi contended that, "the promoter shareholding in the Bank stands at 48.53% as on date and the Bank is in compliance with the license condition to bring down the holding of the promoters to 49% of the paid-up capital..." A copy of the letter dated 3June 2009 (not annexed to the Petition), is annexed as Exhibit "T". 43. By its letter dated 9 November 2009, REI responded to the above letter stating that its claim to having complied with the dilution requirement on account of Mr. Mahindra's ceasing to be a promoter / promoter director could be considered if the bank stopped using or dropped the name "Mahindra", from its name. A copy of that letter (again, not annexed to the Petition), is annexed as Exhibit "U".

- 17. 45. On 2 February 2010, KM wrote again to RBI, referring to a meeting between parties' representatives on 22 January 2010, and undertaking that, "As indicated to you at the meeting, we shall bring down the holding qf the promoters in such a manner that the promoter holding plus the holding of Mr. .4nand Mahindra, his relatives and entities controlled by them would be below 49% within a period of one year." A copy of that letter (also not annexed to the Petition), is annexed as Exhibit "W". 46. On 5 March 2010, and in view of the above letter, RBI wrote to KM granting an extension (upto 31.10.2010) to bring down promoters' holding in the bank to 49% of "paid-up" capital, and once more asking for "a time bound planforfurther dilution of the promoter 's stake in the bank so as to conform to the 0 & Gguidelines..." 47. On 29 March 2010, KM replied to the above letter, and, in relation to the necessary action plan for further dilution of its promoters' holding, reiteratedwhat was stated in its letters of 25 .06.2008 and 31,07.2008. 48. On 29 October 2010, RBI wrote to KM, referring to the former's letter of 05.03.2010; noting that KM was yet to submit the time bound road map asked for; and advising once more that the same be submitted, immediately. 49. On 1 November 2010, KM wrote to the RBI, inter alia, recording as under: ",,,We wish to inform you that as of October 29" . (a) the promoters' shareholding in the Bank is 33,57,90,268 equity shares constituting 45.76% of the Bank total paid up equity share capital: and 'b,) the shareholding of Anand Mahindra (Group) in the Bank is 2,36,89,352 equiry shares constituting 3.23% of the Bank's total 0 paid up equity share capital. The collective shareholding as per (a) "' and (2?) as aforesaid is 48.99% of th Bank's total paid up equity "* shore capital. With this, we have complied with the requirement < jcommunicated vide your letter of Marsh 5, 2010. *IL.ii The dilution of shareholding as above has been achieved by way of ptiferential allotment of shares by the Bank to Sumitomo Mitsui L67

- 18. Banking Corporation as well as allotment of shares to the employees of the Bank & its subsidiaries Ofl exercise of ESOPs." A copy of the above letter (not aexed to the Petition), is arexed as Exh!bJt'XL. 50. On 4 November 2010, KM responded to P31's letter dated 29.10.2010, with a letter virtually identical to the one dated 29.03.2010. 51. On 10 Match 2011, RBI responded to the above letter, noting that it had examined KM's representati0ns but that "as per the requirement under the 0 & G guidelines... banks are required to have a divers /ied 5ar holding" }I was, therefore, Once again asked "to provide a definite plan Jbr dilution of promoters stake in the bank in vo stages i.e. a) to 20% and b) to JO%...pO5itiY before April 30, 2011." 52. On 29 April 2011, KM replied to the RBI, essentiallY 000tending (as it did earlier) that, "there has been no clarity in relation to what the RBI considers to be the "permissible" level of shareholding by pronzoters." nor the criteria it would apply and the process that it would follow in determining the same..... This letter also made armentS reflecting the stand taken in the Petiti'Jfl, to wit: asking promOtet to reduce their holding, would inevitably lead to .jcreasedfogn 5areholding" KM further referred to proposed amendments to the BR Act, to allow "voting rights in excess of 10% admitting need for individual or group 5areholding in excess of 10%." In vieW of the above, the RB! was agaln asked to "clarif5) its policy regarding the permissthle level of promoter hotding..." 53. HoweVer, in what it teed a "good faith" measure, KM undertook "to reduce the promoters' 5reholdtg from current level of 45.5% (not uding the holdi'ig of Shri Anafld Mahindra, as intimated previouslY. /A ' 1f 'kJ1S ceased to be a promoter of the bank and has also recentlY stepped C 16

- 19. down as a director) to 40% within a period of three years." KM also added that, it would "try for a suitable M & A proposal to bring down the shareholding ofproinoters." 54. On 29August 2011, RBI issued Draft Guidelines for Licensing of New Banks in the Private Sector ("2011 Proposed Guidelines") for feedback. These contemplated that; (a) Promoter I promoter groups would set up the bank only through a "wholly-owned Non-Operative Holding company ('NOHc,)", which will hold the bank as well as all other financial services companies regulated by RBI or other financial regulators. The objective was to "ring fence" the regulated financial services activities of the group (including the bank) from its other activities, and so that, "only non- financial services companies / entities and individuals belonging to the promoter group will be allowed to hold shares in the NOHC'. Financial sen'ices companies belonging to the promoter group would be held by the JVOHC and would not have shareholding in it." b) The NOHC's shareholding in the bank would be brought down to 20% of "paid-up" capital ("PUC") within 10 years, and to 15% within 12 years, from the date of licensing and retained at that level thereafter. (c) At least 50% of the NOI-IC's Directors would have to be independent of the promoter / promoter group entities, their business associates, customers or suppliers. (d) RBI would have to be satisfied that the corporate.structure does not impede financial services under the NOHC from being rjng fenced, and that it would be able to supervise the bank and the NOHC on a onsolidated basis. uwnership and management should be separate and distinct in the romoter / promoter group entities that own or controithe NOHC. '"9 :17

- 20. iI/• ';k:- •,.,".. I •-c" 'l cc; iij Ji - / 0/Il k'1-1) (I') Shareholding of 5% or more of the PUC of the bank by individuals I entities / groups would be subject to RBI approval. No single entity or group of related entities, other than the NOHC, shall have shareholding or control, directly or indirectly, in excess of 10% of the PUC of the bank. (h) The promoters, their group entities, NOHC and the bank shall be subject to the system of consolidated supervision by RBI. 55. On 10 January 2012,RBI wrote to KM, once more stating that, "The promoters' stake in the bank should be brought down to 10% of the paid- up capital of the bank latest by March 3], 2016 positively." KM was also, again, requested to submit a road map in that behalf, by 15.03.2012. It may be noted that in the Petition, the Petitioners portray RBI's letters as being unresponsive to their requests for "clarity", notwithstanding that,(a) the latter's stand could not have been clearer; and b) no road map towards dilution to 10% had been forthcoming. KM's April 2011 letter purported to give merely a "good faith" assurance to reduce the holding to 40% within 3 years. It was on that basis that the above timeline (10% by 31.03.2016) was set. But, rather than comply, KM later gave a "best eslimate" to go downto 20%, by March 2020, instead. 56. On 16 January 2012, KM replied to the above letter, claiming that the RB I's requirements would "cause serious disruption". As in the Petition, KM contended that the dilution would require the raising of "around Its. 1,25,000 crore (higher than the market capitalization of our largest banks today)..." However, KM went on to state asunder: "...Keeping the above considerations in mind, we have undertaken vide our letter dated April 29, 2011 to bring down our promoter holding to 40% prior to April 29, 2014. Therefore, ([directed to implement your requirement, we would have to dilute 30% (from 40% to 10%) of our promoter holding in less than two years... This would then effectively constitute the road map sought by you. "However, whilst the policy and statutory basis of .the. above requirement is not clear to us, ow best estimate of a fairand non- 18

- 21. L-fl 4- disruptive road map for the dilution of our promoter holding is a dilution to 20% of our paid up capital by March 31, 2020 in the following manner: (a) 40% by March 31, 2014; ('&) 30% by March 31, 2017; and(c) 20% by March 31, 2020, "Such dilution will be effected through a combination of capital raising, ESOPs to employees, inorganic growth through mergers & acquisitions. iduction of strategic and financial investors and possibly a partial sale of our promote:' holding. "We earnestly hope for a favourable consideration of our proposed road map." 57. On 26 June 2012, upon a review of the estimate given in the above letter, RBI wrote to KM, referring to R131's letters dated 29,04.2011 and 06.01.2012, and advising it that, upon a careful examination of KM's request, as well as the targets it had given,KM should ensure that the promoter' stake is brought down to 20% of the "paid-up" capital by 31.03.2018, and further to 10% by 3 1.03.2020. However, it was noted that, "a view will be taken on dilution ofpromoters stake from 20% to 10% or such other percentage depending up on the prescription in the new bank guidelines." 58. On 6 July 2012, KM replied to the above letter, setting out an estimated road map for meeting what it itself.described as "deadlines" for dilution of promoter holding "as per your (RBI's) directions" of (a) 40% by 31.03.2014; (b) 30% by 31.12.2016; and (e) 20% by 31.03.2018. II further recorded the followhg: "...As regards further dilution, we note thai a view will he taken by you on reduction from 20% to 10% or such other percentage depending on the prescription in the new bank guidelines. We hope that any threshold in excess of 20% under the new bank guidelines will also be extended to us." 59. In January 2013, the Banking Laws (Amendment) Act, 2012 ("2012 Amendment Act"), came into force, adding to Section 12(2) of the BR f'Act, a proviso enabling the RBI, to increase "in a phased manner", ceiling ting rights from (the then existing) 10% to 26%. The Act also ced Section 12-B to the BR Act, prohibiting any person acquiring 19

- 22. "shares of a banking company or voting rights therein" which acquisition taken together with shares and voting rights, if any, held by him I affiliates already, accumulate to 5% or inoreof the 'paid-up share capital", or "entitles him to exercise fIve percent. or more of the voting rights", in such company, from doing so without prior pennission from the RI. 60. On 22 February 2013, RBI issued final Guidelines for Licensing of New Banks in the Private Sector ("2013 Guidelines"), in line with the 2011 Proposed Guidelines, and with the 2012 Amendment Act. However, the •same made the following important changes:— (a) The NOFHC (called "NQHC" in the 2011 Proposed Guideline) must have a capital structure in which "voting equity shares" not exceeding 10% of the "total voting equity shares" may be held by promoter group individuals / family / entities [Gl. 2(C)(ii)(a]; (b) Only promoter group companies having 51%+ of "voting equity shares" held by "the public", must hoid 51%+ of the NOFHC [GI. 2(C)(ii)(b)]; (c) The NOFHC must have a minimum 40% of the "paid-up voting equity capital' ('PUVC") of the bank, locked-in for 5 years [01.. 2(D)(ii); any excess being brought down to 40% in 3 years [01. 2(D)(iii)]; (d) The NOFHC's shareholding in the bank would be brought down to 20% of PUVC within 10 years, and to 15% within 12 years, from the date of commencement of business [01. 2(D)(v)]; (e) The bank must get its shares listed on the stock exchange within 3 years of commencing its business [01. 2(D)(vii)]; (f) Any acquisition of shares which would take the aggregate holding of any individual I entity I group to 5% or more of the PUVC would require prior approval of RBI [01. 2(K)(ii)]; /. ,C I. .' •• Z 20

- 23. C (g) No single entity or group of related entities, other than the NOFHC, shall have shareholding or control, directly or indirectly, in excess of 10% of the PUVC [01. 2(K)(iii)J; and (h) The Bank was also required to maintain an ann's length relationship with Promoter / Promoter Group entities, and the major suppliers and major customers of these entities [Gl. 2(K)(iv)J. 61. Pursuant to the 2013 Guidelines, RBI granted 'in principl& approval to two new banks. 62. on 18 March 2014, i.e. just before the targeted deadline of 30 March 2014 (to achieve 40% dilution), KM wrote to RBI, sharing with it the steps taken to reduce the promoters' holding in line with its letter of 06.07.2012 That holding had come down to 43.59%. KM also altered its deadline to bring the holding to 40% by 30.09.2014 (instead of3l.03.2014); (b) 30% by 31.12.2016; and (c) 20% by 31.03.2018, but recorded that, "we wish to comply with obligation to you to achieve the reduction of promoter shareholding by March 31, 2018, and are taking all prudent, reasonable and lawful steps in that regard." 63. On 23 May 2014, RBI wrote to KM in response, expressing its displeasure with the latter's failure to achieve even the first milestone of dilution to 40%. KM was advised that no further revision of existing timelines would be permitted, and that it had to (a) apprise RBI of the follow up action taken; and (b) submit quarterly progress reports on the dilution. KM was also put to notice of the initiation of regulatory action, if it did not adhere to its commitments. 64. On 27 November 2014, the RBI issued Guidelines for Licensing of Small /__Zax1 Banks, and for Payments Banks, in the Private Sector. These kt & s similarly required promoters to hold a minimum of 40% for a five years from the date of commencement of business. 21

- 24. 65. Pursuant to these Guidelines, RBI panted 'in principle' approval to 11 Payments Banks and 0 Small Finance Banks. 66. On 5 March, 2015, RBI issued a Notification u/S. 12 (2) of the BR Act, raising the ceiling on voting rights, initially, from 10% to 15%. 67. On 27 October 2015, KM wrote to the RB!, inter alia, in relation to "Mr. C/day Kotak's promoter shareholdiflg in the Bank" The letter noted developments such as the merger of iNG Vysya with KM, and the "significant changes in the policy aid regulatory landscape relating to matters of ownership and governance of banks and the concept of 'control". It was noted that, between 2003 and October 2015, the promoter holding was diluted from 61.5% to 33.71%, "primarily through actions and activities of banking business." KM acknowledged that,"Only a small reduction in percentage occurred on account of Mr. Uday Kotak divesting a part of his shareholding, which was only done to avoid any regulatory action against the Bank..." 68. KM then requested RBJ to reconsider its advice / direction and to pennit Mr. Kotak to hold his current stake of 33.7 1% and allow dilution to occur in a non_disruptive mannex. RBI was also requested to keep its letter of 26.06.2012 in abeyance. It ought to be noted that although this letter noted the 2011 Draft Guidelines, it made no reference to the Guidelines finally issued in 2013, and which spoke of the PUVC concept. 69. On 19 November 2015, pursuant to Ss. 12-B, 21 and 35-A of the BR Act, the RBI issued its Prior Approval for Acquisition of Shares or Voting Rights in Private Sector Banks DirectionS, 2015 ("2015 Prior Approval OXDireCt10fls"). Direction 2 made these applicable "to the exLsting and .-, p ' roposed "major shareholder.c" of the Private Sector Banks and all — - -) ) z/'r'vate Sector Banks including Local Area Banks licensed to operate in ( / °c 22

- 25. 5- India ', by RBI. As far as existing 'major shareholders" were ct neerned, any rise in their holdings above 10% required RBI approval, inexplicably, the Petitioners (wrongly) contend that these Directions applied only to future acquisitions. 70. On 5 May 2016, RBI issued Draft Guidelines for On Tap Licensing of Universal Banks in india ("2016 Draft On-Tap Guidelines"), retaining the PUVC concept (with nearly identical thresholds) as were provided under the 2013 Guidelines. 71. On 12 May 2016, RBI issued its Ownership in Private Sector Banks Directors ("2016 Ownership Master Directions"). The Petitioners rely on (a) c1auses5 and 7 thereof; (b) the retaining of the PUC concept therein; and (c) their proximity in date to the 2016 Draft On-Tap Guidelines, to suggest that RBI consciously applied the PUC concept to existing banks, r and not PUVC. What they gloss over isthe express application to "promoters being individuals and non-financial entities in existing banks", of shareholding qualifications "in line with" the 2013 Guidelines. 72. On 2lJu1y 2016, RBI issued a further Notification u/S. 12(2) of the BR Act, raising the ceiling on voting rights from 15% to 26%. 73. On 1 August 2016, R131 issued final Guidelines for On Tap Licensing of Universal Banks in in the Private Sector ("2016 Final On-Tap Guidelines"), retaining the PUVC concept. Petitioners once more (and obviously incorrectly) seek to juxtapose these with the Draft On-Tap Guidelines and the Ownership Master Guidelines, to contend that the same exhibited a conscious decision by the RBI to apply PUVC only to new banks, whilst retaining PUC for existing ones (like KM) 9 September 2016, KM wrote to the RBI stating that post its merger ING Vysya, the promoter holding in the bank had come down to 23

- 26. 4 33.6%. It noted that, under its "voluntary estimate", it was to bring this down to 30% by 31.12.2016, but that this would entail new capital of Rs.17,000 crores (in view of the steep rise in the bank's market capitalization). It also noted the issuance of the Final On-Tap Guidelines, and stated that it was evaluating the changes made thereby. In the meantime, RBI was informed that, "...as discussed, we will not be pursuing the interim estimate of 30% by December 31, 2016." 'Ar 75. On 18 November201O, RBI iespondedto the above letter, advising KM to "comp7y with the interim target of 30%" by 3 1.12.2016, and "20% by March 2018", as was committed in Kiv1s letter of 06.07.2012. It was also advised that KM should bring down the holding to 15°/o by 31.03.2020, in compliance with RBI's letter of 26.06.2012. It was further, and once again recorded that, non-adherence to those timelines may invite regulatory action as indicated in RBI's letter of 23,05.2014. 76. On 13 December 2016, K.M replied, seeking to "reaffirm our commitment to work within the RBlframework and the law at all time,s." However, it once more cited the rise iii market capitalization and contended that the reduction targeted for 3 1.12.2016 was "an impossibility." It then noted the changes to the laws and policies governing banks, acknowledging that, although "(o)rdinarily, policy changes would apply to entities licensed under the relevant policy but the P81 has been uniformly applying relevant policy changes to both nei and existing banks." KM ended by reiterating its letter of 19.09.20 16, and requested RBJ to also reconsider the tinielines for March, 2018 and March, 2020. 77. On 29 December 2016, Ral wrote back stating that the matter was under consideration. 24

- 27. 78. On 30 January 2017, RBI wrote to KM informing it that, upon examining the bank's request, it was being permitted to achieve dilution of promoters' shareholding in the following manner: (a) 30% by 30.06.2017 (instead of3l.12,2016); (b) 20% by 31.12.2018 (instead of31.03.2Ol8) and (c) 15% by 31.03.2020 (unchanged). KM was notified that non-adherence to the above timelines would invite regulatory restrictions, It was also suggested that the bank may explore options such as sale of promoters' stake, infusion of capital by public subscription, or mergers and acquisitions. 79. On 3 April 2017, KM wrote to RBI informing it that the above letter was placed before the former's Board, and that it would "continue to work SO that our promoter .chareholding could he diluted in a nondisruptive manner." It noted that, that holding was now at 32%, pursuant to a "secondary sale", by the promoters. The letter went on to note KM's Board's approval of a "capital raise", to achieve a further 1% promoter dilution, and efforts to increase FII/FPI headroom to enable investors to acquire KM stock. 80. On 25 May 2017, KM notified RBI that its promoter shareholding now stood at 30%. 81. On 12 February 2018,RBI wrote to KM, referring to the above letter and advising the latter to submit details of the present promoter holding and proposed course of action / plans / swategy to comply with the timelines for dilution. 82. On 23 February 2018, KM replied noting that the matter was to be taken up at a Board Meeting on 1('' at the promoter holding then was '/ust below 30%".

- 28. .7 L _-__..,NPrOmGters PUVC moved not an inch. 26 83. On 26 March 2018, KM wrote again to RBI, recording that it was continuing "to evaluate its various business options ana its legal obligations." It noted that any plans / action / strategy impacting shareholding could only be disclosed once approved by the Board, and in accordance with law, and that the same would be made "as may be required by the Bank in discharge of its commercial, fiduciarj and lawful obligations and requirements" 84. On 13'' April 2018, RBI wrote to KM recording, inter alia, as under: ".2. While we appreciate that it would be important to be alive to the market sensitivities of any plans for bringiug the promoter stake down, the purpose of our letter was to underscore the fact that another milestone in this regard is fast approaching and timely steps need to be taken by the bank to avoid seeking extension of' time. We felt if appropriate to convey this to you so that the board pursues this matter for achieving the required outcomes in a timely manner and conveys to us its commitment to achieve the dilution as per the timelines stipulated. "3. It may be added that any request for further exteirsion of the tinelines to bring down the promoters' shareholding to the required level will not be considered by the Reserve Bank" 85. The next deadline for KM to reduce PUVC of its promoters (to 20% by 3 1.12.2018) was fast approaching. It knew it had not taken the necessary steps to achieve that target (which it knew also, was binding). A failure now would have put KM in a serious breach of the law. Consequently, in August 2018, KMcame up with the novel ruse of issuing, by private placement, PerpetualNon-cumulative Preference Shares ("PNCPS"), in keeping with the Master Circular on Basel III Capital Regulations, of 01.07.2015 ("Basel III Capital Regulations"). The fact that the PNCPS were merely an instrument to skirt KM's legal obligations, is clear from the fact that, whilst these let it claini that dilution below 20% was achieved, in reality, nothing could be further from the truth since, KM's

- 29. On 4 September 2018, KM responded to the Impugned Letter, recording vents behind its decision to issue PNCPS, and claiming that it had 4 N,, ' ( the RBI of the issuance of the PNCPS soon after the decision of < ,q C/S/ e 27 86. Moreover, the clandestine and unilateral manner in which KM went about doing this, makes it clear that its only object was t.o attempt to present RB1 with afait accompli. It was for this reason that, on 13August 2018, RB! issued a communication ("the Impugned Letter"), inter alia, recording as follows: ".4. We note that the bank's Board of Directors approved the proposal to raise funds by way of NCPS of up to Rs.500 crore in its meeting held on May 19, 2018 and that this was reported to the MGA. We also note that the Board, in its meeting on July 19, 2018, was informed that the issue of PNGPS would, inter die, reduce promoter shareholding to below 20% of paid up capital and that a legal opinion in this regard was being obtained. The resolutions passed in this regard were communicated to MCA. "5.In the 4GM held on July 19, 2018, the matter of dilution of promoter shareholding was discussed and a special resolution was passed authorizing issue of NPS, for an amount not exceeding Rs.500 crore. This was communicated to the stock exchanges on the same day. "6.However, the bank did not care to apprise Reserve Bank of these developments, thus going back or. the assurance given in your letter of March 26. We were informed of the PNCPS issue only after it was completed. We have taken serious exception to this, which amounts to willful non-disclosure of information sought by the Reserve Bank. "7. The bank will be aware that the purpose of the dilution in promoters' shareholding to the prescribed level of 15% of paid up capital is to avoid concentration of control in the hands of the promoters. This therefore requires dilution of voting shares. Spec j/lcally, our Master Direction on Ownership in Private Banks stipulates, in section 5(i) and the footnotes to the shareholding matrix in section 6 of the Direction, that, for all existing banks, the permitted promoter / promoter group shareholding will be in line Nit/i what has been permitted in the February 22, 2013 uidelincs on licensing of new banks in the private sector. These guidelines clearly state that the dilution of shareholding shall be in respect of paid-up voting equiy capital. "8. Accordingly, the issue of PNCPS by the Bank does not alter the percentage of paid-up vting equity capital in the hands of the promoters, which is to be brought down to the stipulated limitsT within the tjmeline communicated to the bank vide our letter dated January 30, 2017. "9.Please have this letter placed before the members of the Board of the banlç for their perusal. in the next meeting of the Board."

- 30. the NC'PS Issuance Committee and again immediately upon allotment. Consequently. our disclosures to RBI were in accordance with our letter of March 26, 2018 and we have acted in a transparent, honest and legal manner." It claimed that; (a) The RBI had consistently communicated to it, and that it had always understood and acted on the basis that, the promoter holding in KM was to be a percentage of PUC, not PUVC.; (b) The reference to PUVC in the Impugned Letter was the first time RBI had made such a demand; (c) The applicable guidelines and directions, in relation to existing banks, spoke always and only of PUC, not PUVC, and that the reference to the 2013 Guidelines was inapplicable; and (d) That, KM had received Legal Opinions to backup its claims. 88. Interestingly, however, KM yet felt the need to state, in para 17, as under: 17. It may be appreciated that over the years the shareholding of the Bank's promoter has come down as a percentage of paid-up capital in a nondisruptive manner and in accordance with law and in compliance with the Bank's commercial, fiduciary and lawfid obligations and requirements. When we received legal confirmation that the issuance of the PN'PS would result in the shareholding of the promoter coming down to 19.7% of paid-up capital well before December 31, 2018 in a non-disruptive manner, it became an additional factor for the Bank to undertake this issuance. We would urge the RBJ to recognize our actions as compliant in law. Please note that the Bank has always tried to work with the RB! and to ensure that nothing should affect the standing and reputation of this institution and its relationship with RBI." 89. On 24 September 2018, KM addressed another letter to RBI, inter alia, reiterating its stand, and questioning the latter's policy on ownership as disadvantageous to Indian ownership of Indian banks. It purported to question the rationale behind the requirement for caps on "voting control", contending that "sharcholding is not a relevant consideration for voting control in the context of banks as voting rights have always been separately capped...". KM, indeed, questioned the tire policy • ework on the issuance of banking licences, as having "anomalies" 28

- 31. #-, IA •''I) I . A, Q I '4w •' .' t ,. "&7,3D' '.4e it. :t //6' <r.. o51 Q 7' and its purpose, have been the subject-matter of Rules, Regulations and (•_ 1* I' .. - nes at least since 2013; and have been understood by KM to be 90, On 26 November 2018, KM wrote to individual members of the RBJ's Board for Financial Supervision,reiterating its stand. Klvl even claimed that the communications which the RBI claimed were not complied with, were in the nature of an "advice" or "caution", and may not be binding on banking companies, a position rutming counter to KM's own past conduct. 91. On 10 December 2018, the above Petition was filed seeking, inter alia, the following reliefs: (a) A writ of Certiorari qua all 8 Reduction Communications, as well as the Impugned Letter; (h) If not (a), then a writ of Mandamus to withdraw I cancel the said Communications and Letter; and (o If neither (a), nor (b), then a Mandamus declaring that the reduction of promoter shareholding pursuant to the said Communications shall be complied with, if achieved as a percentage of PUC, not PUVC, "and not as sought to be done for the first time in the (Impugned Letter)". 92. The facts narrated hereinabove clearly show that, parties have been in correspondence right since 2004, on the very questions now raked up in the Petition. Throughout this period, RBI has been consistent and unequivocal about the settled position, and K1vI has never seriously contested this. The very fact that the Petition challenges RBI's consistent actions stretching back more than a decade, is itself telling. Moreover, and in any event, I respectfully submif that, the capping of promoters' PUVC holding is a measure that seeks to dissuade the concentration of power in their hands, and to make private banks more democratic. Such capping, 29

- 32. 93. The need for KM to challenge communications from the year 2008 is the fact that, these are all based on the RBI's consistent understanding (which heretofore were unchallengP.d by 1(M) that, any restriction on promoters' holdings are, in the main, aimed at preventing the concentration of power, and to ensure that private banks are not run as private fiefs. Where a banking company has only ordinary equity shares (as KM had until its issuance of the PNCPS), the effect of a reduction in a promoter's PUC holding ipso facto reduced the concentration of PUVC in his hands. KM's claim to have met the 31.12,2018 target by the issuance of PNCPS is, therefore, both' mischievous and misconceived. Those shares hold no voting rights. Thus, even if their issuance leads to a dilution in PUC, it has no effect on promoters' PUVC holding — which is the correct milestone KM had to achieve (and in respect of which it remains in defaule. KM knew (and knows) this. 94. it is for this reason that it claims the relief for a declaration that "the reduction of promoter shareholding pursuant to the Reduction Communications shall stand complied with if achieved as a percentag of the paid-up capital...and not the paid-up voting equity capital." This relief itself demonstrates that even 1QvI understood the purport of the Reduction Communications (right since 2008) was, in ultimate, to require a reduction in its promoters' voting power. 95, Accordingly, I submit that, the present Petition also suffers from inordinate, and entirely unexplained delay. Moreover, the Petitioners having not challenged any of the Guidelines / Directions issued by the RBI, at least since 2013, they ought not to be permitted now to question mere correspondence which seeks to enforce the same. Setting aside the (ifli Impugned Letter, or any of the Reduction Communications, shall not alter (/4, /;:, 'c7 /1 / ', ' 'çt,he state of the law. The same would yet require the same caps on paid-up i' Z - crj 30

- 33. C' voting equity capital holding, and KivI's promoters shall remain bound by the same. 96. It is far too well-settled that, a Writ Court is one of equity, and equity does not allow the Court to issue injunctions which are of no use, or idle. Given that, e'en absent the letters here challenged, Petitioner No. l's promoters shall remain bound to give effect to the very directions contained therein, coupled with the fact that, those promoters have deliberately not joined Petitioners in filing this Petition (realizing that to do so would require them to challenge the very Guidelines they have always professed to honour and be bound by), RBI humbly submits that, the above Petition deserves to be dismissed in lirnine, and with costs. 97. Strictly without prejudice to all that is aforesaid, I shall now very concisely deal with the contents of the Petition, paragraph-wise. All paragraph numbers hereinafter appearing are, therefore, reference to those in the Petition (unless otherwise specified). 98. With reference to paragraphs 1 to 4, I say that the averments made by the Petitioners therein are matters of record. 99. With reference to paragraph 5, it is submitted that neither the issuance of the impugued communication by RBJ, nor that of any of the so-called reduction communications, nor even any claimed action on its part, is either arbitrary, or ultra vires. In fact, the actions under challenge arc instructions issued in terms of the policies, guidelines on licensing and directions on ownership in private sector banks, issued by RBI from time to time, in exercise of powers conferred on it under the B R Act. These policies and therelevant guidelines (which, as aforesaid, are not themselves under challenge) are sector banks including the Petitioner. ) S 31

- 34. 100. With reference to paragraph 6, it is submitted that in terms of the licensing conditions imposed by RBI, at the time of issuance of license to the 1° Petitioner, the "promoter's contribution shall be a minimum of 49 per cent of the paid up capital. Promoter's contribution shall be locked in for a minimum period offive years from the date of licensing of the bank The promoter's holding in excess of the minimum proportion of 49%, shall be diluted afier one year of the bank's operations." It is true that the RBI communicated to the Petitioner vide its letters, as admitted by the P.titioner, to dilute its promoters' shareholding and to adhere to the licensing conditionG. These communications indicate that the Petitioner bank was given sufficient time for dilution and time and again advised to comply with the licensing conditions. 101. With reference to paragraph 7, it is submitted that the Petitioners have tried to make cut a case that they have adhered to the conditions imposed by the RBI and no lapse can be attributed to them. In this regard, it is submitted that until the B R Act was amended in January 2013, sub- section 12(1)(ii) excluded 'preference shares' (except those issued before July 1, 1944) from the capital of a banking company. Hence, from the issue of license in 2003, until the aforesaid amendment, the communications exchanged with the Petitioner bank regarding reduction in the percentage of promoters' shareholding in terms of 'paid up capital' were within the limited context of reduction in the percentage of equity shares only. 102. Moreover, and importantly, during the span of several years prior to January 2013, there were repeated requests by the Petitioner bank for extension of time to comply with the required reduction in percentage of shareholding. These were coupled with assurances given by the

- 35. 'paid up capital' meant when these assurances were given. It is, thexefore, crystal clear that these assurances were given in relation to the percentage of holding of 'equity shares' alone, and not any other class of shares. Petitioner No. 1, in fact, had no other class of shares. Consequently, any reduction in PUC ipso facto reduced PUVC. 103. Subsequent to the amendments to the BR Act, RBI in 2013, issued 'Guidelines for Licensing of New Banks in the Private Sector' and the 'Master Direction (MD) on Ownership in Private Banks' dated May 12, 2016. rhese Directions, inter alia, stipulated that, for all existing banks, the permitted promoter I promoter group shareholding v,ill be in line with what has been permitted in the February 22, 2013 guidelines on licensing of new banks in the private sector. These new bank guidelines clearly stated that the dilution of shareholding shall be in respect of "paid-up voting equity capital".As on the date of issue of the MD in May 2016, the Petitioner bank fell under the category of an 'existing bank'. 104. Furthermore, it is also necessary to reiterate that the Petitioner bank had no other class of shares except 'Equity shares' till July 2018, when it amended its Memorandum and Articles of Association ("MoA" and "AoA") to issue 'preference shares', to enhance its authorised capital and to include 'preference shares' in its authorised capital. Before this amendment of the MoA and AoA, the entire capital of the Petitioner bank consisted of only 'equity shares' and thus the entire capital was considered as 'voting equity capital'. There was, therefore, no occasion to have to convey to the Petitioner bank that reduction of promoter shareholding had to be a percentage of "paid-up voting equity capital". only after the amendment in the MoA and AoA that capital of titioner bank came to have two different components i.e. 'voting Ois e, capital' (equity shares) and 'non-voting equity capital' 33

- 36. (preference shares). This was the reason for making explicit use of the word 'paid up voting equity capital', since August 2018. It is further submitted that, RBI, therefore, did not issue a letter to the Petitioner bank, until after amendment to its AoA and MoA, referring explicitly to 'paid up voting equity capital'. Petitioners conveniently ignore the fact that, their own shareholding structure meant that a reference to 'paid up capitaY meant nothing but 'paid up voting equity capital', in law and in spirit, until such time as the bank issued preference shares, during August 2018. 105, 1 further submit that, diversified shareholding results in voting rights being distributed among shareholders and thereby avoids concenatiOfl of control. Section 12(2) of the BR Act complements this broader objective by providing only for a ceiling for voting rights. Even in 2001, vihen the initial holding was 49%, voting rights were capped at 10/0.Tbe objective of allowing the higher shareholding of around 49% and a lock-in of 5 years was to ensure that the promoters had sufficient skin in the game in the formative stages of the bank to influence the functioning of the bank irrespective of the fact that voting rights were capped at 10%. 106. I say that, at each step, the submissions made by the Petitioner bank, in relation to its request for extension of time were examined carefully and the Petitioner bank was advised that its promoters' stake should be brought down to 20% of the PUC by March 31, 2018, (thereby giving a longer period of 15 years from the date of licensing, than the 12 years contemplated under the new bank guidelines then being drafted). A further period of 2 years, up to March 31, 2020, was promoters' shareholding from 20% to 10% or depending upon the prescription in the new Petitioner bank was also, once again, advised to allowed to reduce the such other percentage bank guidelines. The submit a road map for 34

- 37. dilution of its promoters' stake urgently. Thus, the Petitioner bank was given several opportunities to meet the requirements of RBI. 107. That said, and with reference to paragraphs 8 and 9, it is denied that the letter dated 13 August 2018 is at all arbitrary, illegal or unreas',nable, or that any of its contents were arrived at on the basis of a retrospective / illegal / impermissible application of any Guidelines issued by the RBI.It is denied that the fact that bringing down of promoter shareholding limits concentration of control in the hands of promoters is at all misconceived, arbitrary or unreasonable. It is denied that the same is a matter of "belief" or "assumption". 108. With further reference to paragraph 9, it is denied that the Rejection Communications or the 2018 RBI Letter are inconsistent with the RBI's own policies or directions; or that the same bear no nexus with the object sought to be achieved by those policies and directions; or that the same are contrary to the objects, purposes or provisions of the BR Act; or that they are in any way arbitrary, unreasonable, illegal, without authority of law, ultra vires, unconstitutional o bad in law. 109. With reference to paragraph 10, its contents are essentially legal submissions based on an "erroneous" interpretation of Sections 12 and 12- B of the BR Act. I, therefore, crave leave to make appropriate submissions thereon, at the hearing of the Petition. For the present, however, I deny that either the Reduction Communications or the 2018 RBI letter contain any directions which go beyond the scope and/or ambit of those Sections, or that for this or any other reason, the same are ultra vires the. BR Act. With reference to paragraphs 11 to 14, the averments made therein are c ircly speculative and Petitioners submissions/allegations based therkn,' ' "p . .. . ' a .aseless and/or plainly false. The Petitioners have chosen to raise these 4, 4$' f '"1 ?4,; 35

- 38. t1j arguments after over 15 years only because during that period they have continued to drag their feet in the matter of compliance with the RBI's directions. The facts stated hereinabove; clearly show that at each step the RBI's stand has been consistent, and was not, at the relevant time, questioned by the Petitioners. They repeatedly sought extensions of time to comply with those directions. The contents of the paragraphs under reply are neither new nor novel. 'I'hese, as shall be evident from what is stated earlier raised over a decade, have been consistently rejected, and which rejections, the Petitioners did not challenge until it became clear to them that they would miss yet another deadline (i.e. of 20 per cent of bringing PUVC below 20 per cent by 3l' December, 2018). 111. Each of the submissions raised in the paragraphs under reply have been answered point by point by the R131 as far back as in June, 2012. The RBI went to the extent of granting extension after extension, even agreeing that the date for bringing Petitioner No. l's promoter shareholding to 15 per cent shall be deferred to 3 15 March, 2020. Not only did the Petitioners miss extended deadlines but they now seek to turn a virtue into a vice by suggesting that the RBI's actions challenged in the Petition would either put Indian Banks into foreign hands or lead to concentration of voting powers with ibreign proxy advisors or would •force Petitioner No. I to become a foreign institution. Each of these suggestions is denied. 112. In any event, I submit that this is scaremongering without any basis. Petitioner No. I is a listed companyand its shares are freely traded on the Stock Exchanges. The non-promoter holding is 69.99% (as on December 31, 2018). This Petition is not interested in retaining Indian ownership. It seeks to perpetuate "Promoter" ownership. It is, therefore, also denied that any part of Reduction Communications or the 2018 RBI letter is ,-zQNi - easonable or arbitrary or that compliance with the same wo44be in the ./,, _ th of public interest rather than in furtherance of it. . ( a.g> cg N /o// r'

- 39. 0r7.Thus, it would be clear that, these guidelines were for acquisition or of shares and not for the acknowledgement of holding by existing era. The 'Independent Advisory Committee', referred to by the 37 C 113. With reference to paragraphl5, I say that the contents are formal in nature. 114. With reference to paragraphs 16 to 74 of the Petition, I say that these purport to contain a narration of the facts of the case. I have already, hereinabove, set out those facts in their entirety and demonstrated how the inferences which the Petitioners seek to draw from those facts, are unsustainable both in fact and in law. I, therefore, merely repeat and reiterate what is stated by me in the earlier paragraphs and deny all that is contrary thereto, or inconsistent therewith in the paragraphs under reply. 115. Without prejudice to the aforesaid, where necessary, I have hereinafler set out RBI's stand on the contentions raised by the Petitioners in the said paragraphs under reply. Save and except for what I have stated herein, the contents of those paragraphs are denied in their entirety. 116. As far as the constitution of the independent Advisory Committee is concerned, I say that in paragraph 12 of the 'Guidelines for acknowledgement of transfer/allotment of shares of private sector banks' issued in 2004, it was mentioned that; "12, The RBI will conslitute an independent Advisory Committee which will make appropriate recommendations to P21 for dealing with applications for grant of acknowledgement as indicated in paragraph 4 above." Paragraph 4 of the guidelines read as: 4, As hitherto, aclrnowledgement from RBI for acquisition/transfer ofshares will be requiredfor all cases of acquisition ofshares which will take the aggregate holding of an individual or group to equivalent of 5 percent or more of the paid-up capital of the bank RB! while granting acknowledgement may require such acknowledgement to be obtained for subsequent acquisition at any higher threshold as may be spec ffled.

- 40. ___ ..:O'>çthe issuance of the O&G Guidelines which is yet to comply with the /1 / /-:. . c!.1 . 38 Petitioner bank was to make recommendations to RBI, wheth.r to want acknowledgement or not, for the acquisition/transfer of shares in a private sector bank, exceeding 5% and not to deal with clarifications on policy including holding by existing promoters. 118. It is important to note that the requests of the bank for seeking time or extending timeline for achieving dilution targets were considered sympathetically on several occasions and the Petitioner bank has been allowed sufficient time for dilution of its promoters' shareholdirig. Further, intermediate targets were prescribed to provide a glide path and obviate the need for too large a dilution towards the end of the timeline. As such, the Petitioner bank's allegation thai the dilution has been compelled within a short period of four months is totally devoid of truth. In any case, the Petitioners are not, even in the Petition, seeking time for compliance. It is, in effect, asserting that its subterfuge is compliance. 119. It is further submitted that in May 2005, subsequent to the istivance of the O&G guidelines in February 2005, a review was undertaken to assess the status of the compliance of all private sector banks with the guidelines. Based on the review, 3private sector banks, other than Petitioner bank, with promoters' shareholdirig of greater than 10%, which were not held by well regulated, widely he!d financial institutions or by government/public sector entities, were pursued for dilution of the promoters' stake. 120. Out of these 3 banks, DCB Bank Ltd. and Indusind Bank achieved the dilution of promoters' shareholding to below 15%. In respect of YES Bank, which was licensed in 2001 along with Petitioner No. 1 and had a promoter shareholding of 72.20% at inception, the same was brought down to 19.91% as on September 30, 2018. Thus Petitioner No. I is the only bank in the entire bankine industry which was in existence at the time

- 41. directions of RBI for dilution of promoter shareholdin No individual or group of individuals has been allowed to have shareholding in excess of 10% in a bank. Petitioner bank is the only bank with an individual holding equity shares over 10%. If anything, it could be argued by other banks that the FBi's sympathetic attitude to Petitioner No. 1 has enabled the latter to deny a level playing field to its competitors. 121. With specific reference to paragraph 47, it is submitted that, Section 2 of the'Prior Approval for acquisition of Shares or Voting Rights in Private Sector Banks: Directions, 2015' ("2015 Acquisition Directions") reads as under: "2. Applicability - The provisions of these Directions shall apply to the existing and proposed "ma/or shareholders" of the Private Sector Banks and all Private Sector Banks" The definitions of 'Aggregate holding", major shareholder', and related definitions are as under: Section 3 'i,) rb,) "Acquisition" means the act of acquiringShares orcompulsorilyconvertihie preference shares / debentures / bonds, orvoting rights, orconverting of optionally convertible ; reference shares / debentures / bonds, or o combination of the above, through purcha.se or transfer. in apri vale sector bank." Section 3 (V ('e,) -"Aggregate holding" means the total holding including through "acquisition" nd shares or compulsorily convertible debentures / bonds or voting rights held by the applicant, his relatives, associate enterprises and persons acting in concert with him in the concerned bank. The aggregate holding will also include optionally convertible preference shares / debentures / bonds ([the option of conversion is proposed to be exercised. In case of compulsorily convertible preference shares / debentures / bonds, the computation of holding in this respect will be as if the event of conversion has occurred and as such, the quantum of these Instruments shall be included in "aggregate holding" and also to the paid-up share capital of the bank In case of optionally convertible preference shares / debentures / bonds also, the computation of holding will be the same as indicated for compulsorily convertible preference shares / debentures / bonds, ([the option of conversion is proposed to be exercised. ction 3 (1) (i) - "Major shareholder" means shareholder having / ikely to have an "aggregate holding" to the extent of 5 per cent 39