Unmask FTMF by pressing NO VOTE on winding up

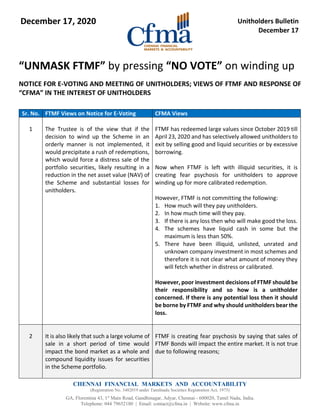

- 1. CHENNAI FINANCIAL MARKETS AND ACCOUNTABILITY (Registration No. 3482019 under Tamilnadu Societies Registration Act, 1975) GA, Florentina 43, 1st Main Road, Gandhinagar, Adyar, Chennai - 600020, Tamil Nadu, India. Telephone: 044 79652180 | Email: contact@cfma.in | Website: www.cfma.in “UNMASK FTMF” by pressing “NO VOTE” on winding up NOTICE FOR E-VOTING AND MEETING OF UNITHOLDERS; VIEWS OF FTMF AND RESPONSE OF “CFMA” IN THE INTEREST OF UNITHOLDERS Sr. No. FTMF Views on Notice for E-Voting CFMA Views 1 The Trustee is of the view that if the decision to wind up the Scheme in an orderly manner is not implemented, it would precipitate a rush of redemptions, which would force a distress sale of the portfolio securities, likely resulting in a reduction in the net asset value (NAV) of the Scheme and substantial losses for unitholders. FTMF has redeemed large values since October 2019 till April 23, 2020 and has selectively allowed unitholders to exit by selling good and liquid securities or by excessive borrowing. Now when FTMF is left with illiquid securities, it is creating fear psychosis for unitholders to approve winding up for more calibrated redemption. However, FTMF is not committing the following: 1. How much will they pay unitholders. 2. In how much time will they pay. 3. If there is any loss then who will make good the loss. 4. The schemes have liquid cash in some but the maximum is less than 50%. 5. There have been illiquid, unlisted, unrated and unknown company investment in most schemes and therefore it is not clear what amount of money they will fetch whether in distress or calibrated. However, poor investment decisions of FTMF should be their responsibility and so how is a unitholder concerned. If there is any potential loss then it should be borne by FTMF and why should unitholders bear the loss. 2 It is also likely that such a large volume of sale in a short period of time would impact the bond market as a whole and compound liquidity issues for securities in the Scheme portfolio. FTMF is creating fear psychosis by saying that sales of FTMF Bonds will impact the entire market. It is not true due to following reasons; December 17, 2020 Unitholders Bulletin December 17

- 2. CHENNAI FINANCIAL MARKETS AND ACCOUNTABILITY (Registration No. 3482019 under Tamilnadu Societies Registration Act, 1975) GA, Florentina 43, 1st Main Road, Gandhinagar, Adyar, Chennai - 600020, Tamil Nadu, India. Telephone: 044 79652180 | Email: contact@cfma.in | Website: www.cfma.in 1. As FTMF claims that out of Rs 28,000 crore of outstanding, about Rs 11,576 has been received by way of maturities, coupons and pre-payments which is 41% of entire outstanding. Therefore, it is wrong that entire holding has to be sold. It is a lie. 2. The investment by FTMF are bespoke, unlisted, illiquid and poorly rated companies due to which these transactions will not happen in market and so market confidence will not be shaken or affected. It is a lie. 3. If the investments are already in illiquid and unlisted securities with high concentration then there is no question of liquidity getting affected for the entire market. These sales will be bilateral with the investee company as no one in market will buy such securities. So this too is a lie. 3 Further, if the Scheme is opened for redemptions under these circumstances, meeting redemption demand as they come is likely to result in disorderly distributions, besides significant losses for Unitholders. FTMF did exactly this since October 2019 until April 23, 2020 by letting large redemptions take place without sounding all unitholders what was wrong in the scheme. Now they are fearing that injustice will happen with some. A well-intentioned management will see that this pressure is overcome and injustice is prevented through a special mechanism approved by judicial or regulatory approval. However, all this fear being expressed by FTMF now has been created by FTMF due to illegal decision taken by them. 4 Thus, in an orderly winding-up, there is a greater likelihood of realizing fair value from the investments within a reasonable period of time by the person authorized under Regulation 41 (Authorised Person). FTMF wound up the scheme illegally and withdrew the rights of unitholders which has caused this situation now. Worrying about orderly winding-up cannot be expected from FTMF Trustees and so has to happen under the Supervision or through a mechanism put in place by Hon’ble Supreme Court.

- 3. CHENNAI FINANCIAL MARKETS AND ACCOUNTABILITY (Registration No. 3482019 under Tamilnadu Societies Registration Act, 1975) GA, Florentina 43, 1st Main Road, Gandhinagar, Adyar, Chennai - 600020, Tamil Nadu, India. Telephone: 044 79652180 | Email: contact@cfma.in | Website: www.cfma.in 5 Unitholders may note that a significant portion of the scheme assets is held in securities and the liquidity position of each security, and consequently the value realized may vary depending on the time available to generate liquidity. An orderly liquidation would obtain better value for Unitholders. This is a creation of FTMF, their KMP’s and their Trustees that the securities of these 6 schemes are bespoke investments, illiquid, concentrated in investment, unlisted, low rated or not rated, etc. The FTMF AMC was supposed to worry about these things as a professional Fund Manager before they illegally wound up the schemes as they were charging a fee for this service. They can’t now scare unitholders to get more leeway from unitholders when their conflict of interest has been seen glaringly since the winding up schemes. 6 There can be no guarantee that the outcomes will be exactly as the Trustee expects. We urge Unitholders to carefully consider the following and seek appropriate advice and guidance in making this important decision. • There is no guarantee from FTMF. • There is no money assurance on amount to be received by unitholders or no loss would occur. • No time assurance for closing paying back all money. • They are not sharing the Forensic Audit Report. • With all these limitations, they are asking Unitholders to seek advice and guidance in making this important decision. Thus, Unitholders have to seek this advice from the Hon’ble Supreme Court only after preventing winding up by their “No Vote”. 7 Voting “Yes” to the Resolution means opting for an orderly Winding-up of the Scheme with a potential to realize fair value from the assets. This is a strategy of confusion where unitholders are being first told to decide on their own but now they are being coerced to vote Yes under the lure of orderly winding up. What is orderly winding up if FTMF has not disclosed. 1. The amount of money unitholders will receive. 2. No loss would occur to unitholders. 3. How much time will it take for winding up and paying back all money. 4. FTMF is not sharing the Forensic Audit report which documents all their non-compliances.

- 4. CHENNAI FINANCIAL MARKETS AND ACCOUNTABILITY (Registration No. 3482019 under Tamilnadu Societies Registration Act, 1975) GA, Florentina 43, 1st Main Road, Gandhinagar, Adyar, Chennai - 600020, Tamil Nadu, India. Telephone: 044 79652180 | Email: contact@cfma.in | Website: www.cfma.in 8 Voting “No” to the Resolution means opting for the Scheme to be reopened, potentially leading to distress sale of assets and loss of value 10,128 4,683 (46.24% of AUM). The matter is before Hon’ble Supreme Court now and therefor do not worry about post Supreme court handling of redemption as the Hon’ble Supreme Court will put suitable corrective system to ensure the conflict of interest of FTMF is removed. “Voting No” for winding up means cleaner system under the Hon’ble Supreme Court and coming out of the clutches of unreliable FTMF AMC, KMP’s and Trustees. 9 • The securities in the Scheme can be liquidated in an orderly manner without the need to proceed with distress sale (as redemptions are not allowed) therefore enabling an orderly liquidation of the portfolio assets at fair value. The proceeds realized by the Scheme will be distributed to the Unitholders in proportion to the units held by them, at regular intervals. • This option will enable recovery of maximum value of securities held by the Scheme. • The Authorised Person would be in a position to take the most appropriate action with regard to liquidation of each security as there will be no undue haste or selling pressure. • The NAV would not be negatively impacted as liquidation would be orderly and there would be no need for distress sales • Unitholders will not be required to apply for redemptions. Unitholders will receive regular pro-rata distributions of investment proceeds This is False hope. FTMF has collected Rs 11,576 crore of outstanding Rs 28,000 crore without any effort or resolution as this portfolio was clean. This has been received by way of maturities, coupons and pre-payments which is 41% of entire outstanding. Therefore, it is wrong that entire holding has to be sold. It is a lie. Further, what has been reported by FTMF and others in media is that more than 50% of their portfolio is concentrated in illiquid securities, low rated unlisted securities, etc. and it is exactly that money which continued to be outstanding even after 8 months of public debate and scrutiny. FTMF is describing the procedure of managing sale but the truth is that securities cannot be sold due to the nature of choice in investment made by FTMF.

- 5. CHENNAI FINANCIAL MARKETS AND ACCOUNTABILITY (Registration No. 3482019 under Tamilnadu Societies Registration Act, 1975) GA, Florentina 43, 1st Main Road, Gandhinagar, Adyar, Chennai - 600020, Tamil Nadu, India. Telephone: 044 79652180 | Email: contact@cfma.in | Website: www.cfma.in as assets are systematically liquidated by the Scheme. 10 • The Scheme would be required to reopen immediately and may need an emergency liquidation of securities, if a high volume of redemption is received. • This may entail distress sales of securities in order to meet the redemptions received. The market is unlikely to have the liquidity to absorb such large quantities of securities over a short period of time and it may not be possible to get bids at reasonable prices for all securities in such circumstances. • A distress sale of securities held in the portfolio could result in a rapid and steep decline in the NAV leading to substantial losses for Unitholders (irrespective of market conditions). While the endeavor would be to minimize losses, however there is no assurance that the Scheme will be successful in doing so. • Unitholders will need to apply for redemptions if they wish to receive monies. This may result in disproportionate distribution of any cash generated to Unitholders depending on the time of redemption. • An adjustment in valuation and consequential reduction in the NAV may be required on account of the above factors in accordance with applicable regulations. *subject to TER 13. This is fear psychosis being created by FTMF to coerce unitholders to give then a yes vote so that they are free from all criminal and civil investigation on the grounds that the unitholders have cleared this arrangement. This is a trick of FTMF and Unitholders must not fall in this trick, by “Voting No”. The matter is before Hon’ble Supreme Court now and therefor do not worry about post Supreme court handling of redemption as the Hon’ble Supreme Court will put suitable corrective system to ensure the conflict of interest of FTMF is removed. “Voting No” for winding up means cleaner system under the Hon’ble Supreme Court and coming out of the clutches of unreliable FTMF AMC, KMP’s and Trustees.

- 6. CHENNAI FINANCIAL MARKETS AND ACCOUNTABILITY (Registration No. 3482019 under Tamilnadu Societies Registration Act, 1975) GA, Florentina 43, 1st Main Road, Gandhinagar, Adyar, Chennai - 600020, Tamil Nadu, India. Telephone: 044 79652180 | Email: contact@cfma.in | Website: www.cfma.in 11 • If the Trustee is authorized to proceed with an orderly winding-up of the Scheme as aforesaid, it will proceed forthwith to seek further approval from Unitholders for appointment of a person under Regulation 41(1) to carry out the winding up. The Scheme currently has approximately Rs 4,683 crores (46.24% of AUM) of cash accumulated from prepayments/part payments, maturities, coupons etc. • In the event of Unitholder approval being received, the Trustee expects that the Authorised Person would be in a position to pay out this amount to Unitholders soon after its appointment. • For all the reasons explained above, the Trustee believes that it will be beneficial for Unitholders to vote ‘YES’ to the proposed resolution. No Trust in FTMF or their Trustees so “Vote No”. There is inherent conflict of interest between unitholders requirements and FTMF actions until now and their future agenda. No good can come out of FTMF or their KMP’s or Their Trustees. Note: In the interest of unitholders of other mutual funds, you are requested to circulate to maximum number of people