Review Meeting on NSEL Issues Implementation

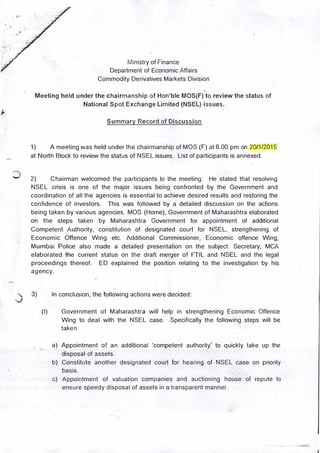

- 1. Ministry of Finance Department of Economic Affairs Commodity Derivatives Markets Division Meeting held under the chairmanship of Hon'ble MOS(F) to review the status of National Spot Exchange Limited (NSEL) issues. Summary Record of Discussion 1) A meeting was held under the chairmanship of MOS (F) at 6.00 pm on 20/1/2015 at North Block to review the status of NSEL issues. List of participants is annexed. 2) Chairman welcomed the participants to the meeting. He stated that resolving NSEL crisis is one of the major issues being confronted by the Government and coordination of all the agencies is essential to achieve desired results and restoring the confidence of investors. This was followed by a detailed discussion on the actions being taken by various agencies. MOS (Home), Government of Maharashtra elaborated on the steps ta�en by Maharashtra Government for appointment of additional Competent .Authority, constitution of designated court for NSEL, strengthening of Economic Offence Wing etc. Additional Commissioner, Economic offence Wing, Mumbai Police also made a detailed presentation on the subject. Secretary, MCA elaborated the current status on the draft merger of FTIL and NSEL and the legal proceedings thereof. ED explained the position relating to the investigation by his agency. 3) In conclusion, the following actions were decided: (I) Government of Maharashtra will help in strengthening Economic Offence Wing to deal with the NSEL case. Specifically the following steps will be taken: a) Appointment of an additional 'competent authority' to quickly take up the disposal of assets. b) Constitute another designated court for hearing of NSEL case on priority basis. c) Appointment of valuation companies and auctioning house of repute to ensure speedy disposal of assets in a transparent manner.

- 2. d) Publicize the actions initiated in expediting the refund of due amount to the affected investors so as to restore public confidence in the system. 11 1) Government of Maharashtra to move application for clubbing of the cases. filed in di�erent states to avoid delays in multiple suits. Government of India will support the step, if needed, by the Government of Maha�ashtra. l;:•, Department of Revenue and Enforcement Directorate to ensure speedy disposal of assets attached .b{the ED ana cons1de·(necessary amendment to PMLAAct. (IV) Department of Revenue to examine release of Rs. 59 crores seized by Income Tax Department. (V) Ministry of Corporate Affairs to defend the case regarding merger/ amalgamation of NSEL with FTIL in expeditious manner before the High Court of Mumbai. �'.'I) Department of Economic Affairs to take up the issue regarding outstanding dues of NAFED with Ministry ofAgriculture. 4) Meeting ended with a vote of thanks to the Chair.

- 4. REVIEW MEETING RELATING TO THE IMPLEMENTATION OF THE , RECOMMENDATIONS OF THE SPECIAL TEAM OF SECRETARIES (STS) ON THE NATIONAL SPOT EXCHANGE LIMITED (NSEL). Summary Record of Discussion A meeting to review action taken on the recommendations of the Special Team of Secretaries (STS) to examine the violation of laws and regulations by NSEL or any associated company or any of the participants was held at 03.00 PM on 02.03.2015 in the Committee ma. Room No. 41, North Block, New Delhi under the chairmanship of Additional Secretary (Inv.). The list *of participants is annexed. 2. After welcoming the participants, the Chairman expressed concern that nothing significant appears to be happening for refund of the money of the investors of NSEL. The investigation process is not reaching the point where the investors can be given relief through the refund of invested money. 3. The Chairman desired to know the status of action taken by Government of Maharashtra regarding the decisions taken in the last meeting held on 20th January, 2015 under the chairmanship of MOS (Finance). He expressed displeasure over the absence of the representative of Govt. of Maharashtra in the meeting. Shri Rajvardhan, Additional Commissioner of Police, EOW, Mumbai informed that a follow-up meeting under the chairmanship of Hon'ble MOS (Home) Govt. of Maharashtra was held in this regard in January, 2015 after the meeting taken by MOS(Finance), GOI. However, he was not aware of the further action taken by the State Govt. on the decisions taken in the meeting of MOS(F), *NW GOI. 4, Shri Rajvardhan informed that the Government of Maharashtra, MPID court and Mumbai Police, EOW, are the three organic components of the system which are working for attaching the property and disposing off the same within the ambit of the law. After the investigation by the EOW, MPID court has started taking action. In the meantime, Bombay High Court has constituted a Committee to look into the issue of how property can be disposed off. This has perhaps been causing confusion in the MPID court as to how to 1

- 5. proceed in the backdrop of thi•formation of a committee by High Court to look into the matter. 5. The Chairman intervened stating that for expediting the recovery, it is necessary that Government of Maharashtra may request the Advocate General to appear before the Court for pressing the need to accord due priority to the disposal of the case. Chairman, FMC, remarked that the action of the Bombay High Court in forming a committee is in no way an impediment in the faster proceeding by the MPID court as the former action is independent • and in parallel. 6. The Chairman advised that a draft letter may be put up from Hontle Minister of State • (Finance) to Chief Minister, Maharashtra immediately to ask Government of Maharashtra,..„4- expediting the process of the recovery of the invested fund by disposing of the attached property of the defaulter. Adviser (CD) informed that the file has already been submitted to MOS (F) in this regard. 7. Shri Rajvardhan drew attention towards three issues. First, the Income Tax Department has confiscated t 59 crores of one defaulter Company- viz. Mohan India Pvt. Limited. The MPID court had directed the IT Dept. to release the amouht of 59 Crores. The EoW has also requested the IT Department to release the amount. The IT Deptt. has however not refunded the money. AS (Inv.) desired that the matter may be taken up with Department of Revenue separately. 8. Shri Rajvardhan also invited attention towards the action of ED in attaching the properties of the defaulters which is coming in the way of the EOW in processing the case for dealing with such attached property of the defaulter. Shri S W Naqvi of E.D informed that the, confiscated property of Mohan India Limited is outside the preview of the settlement' agreement listing the property for sale for NSEL dues. Therefore, there is no reasor hy EOW cannot attach and dispose off other such properties listed in the settlement agreement. 9. Shri S.W Naqvi of ED informed that ED has passed fifteen attachment orders for properties worth 481.79 crores. Out of these 15 orders, 10 orders have already been confirmed by adjudicating authority. 10. Advisor (CD & CM) requested to know as to how long it will take for the ED to liquidat€1 an attached property in view of the proposed amendment in PMLA as brought in Finance Bill 2015. Shri Naqvi explained the prescribed time frame for different processes starting fror 2

- 6. attaching the property of the defaulter to the O0ifli of its disposal. However, he could not spell out any definitive time frame. 11. The Chairman stated that in the back drop of the proposed amendment in PMLA as per Finance Bill 20.15, the process of drafting the Rules under the Prevention of Money Laundering Act may be initiated so that by the time the Finance Bill, 2015 is passed, the draft Rules are ready for notification. 12. As for the third issue, the Economic Offence Wing of the Mumbai Police has received several complaints against broking houses. There are 139 brokers which is huge no. and EOW is not in a position to tackle the mammoth task of probing into the complaints against 139 broking houses. Therefore, it would be in the interest of timely administration of justice if FMC also concurrently takes action against such broking houses. While replying to a query in this regard, he stated that though the letters of complaints of aggrieved investors can be tagged into the FIR lodged by the Mumbai Police, it would be in the fitness of the things if FMC takes action on the complaints under the provisions of the FCRA. 13. Chairman, FMC informed that in the beginning itself i.e., when the NSEL payment crisis case came to the fore, FMC circulated two volumes of complaints and related papers to every investigating agency for necessary action. As for the complaints against braking houses, the FMC has not yet been provided any such complaint by the investigating agency. Therefore, if EOW so desires, it may give a copy of the forensic report to the FMC for action. Shri Rajvardhan regretted that the laws do not permit sharing of forensic report in such matter. However, EOW may not have any objection to sharing names of prominent broking houses with FMC and SEBI which can conduct independent enquiry against such alleged defaulting broking houses. 14. Shri Prabodh Kumar, Joint Director, CBI informed that they are working on 3 cases, out of which 2 regular cases (against MMTC and PEC) have been registered. In the third case, Preliminary Enquiry is being made with regard to the exemption given by the Department of Consumer Affairs to NSEL under section 27 of the FCRA. 15. Dr. Navrang Saini, MCA informed that based on the suggestions of the Forward Markets Commission (FMC) and the Department of Economic Affairs, the MCA issued a draft order on 21.10.2014 under section 396 of the Companies Act, 1956 proposing merger/ amalgamation of NSEL with FT1L. As per the provision of the Companies Act and direction of High Court, steps as required under the provision of the Section 396(4)(b) of the Companies Act, 1956, are being taken before the merger shall actually take place. However, the Bombay High Court had initially given a stay on the merger issue. The Court has now ruled that the government can

- 7. first pass the final order and the aggrievod party can then challenge it legally. MCA is under process 10 finalize the order. which is likely lo Le finalized by around 7"' April. 2015. :16. Ms. Deepika Mittal, Additional Director, FIU staled that a show-cause notice has been issued to NSEL in January, 2015 for non-compliance with the provisions of the Prevention of Money Laundering Act. As the proceedings under section 13 of PMLA are quasi-judicial, FIU sought certain clarifications. On these issues, desired clarifications had been received by FIU on 24.2.2015 and the matter is under examination for further course of action. To enable them to process the case further, they need certain documents from FMC and Department of Economic Affairs. The Chairman directed that the Commodity Derivatives Markets Division/FMC to provide the requisite information to FIU immediately. 17. Chairman, FMC said that some money is recoverable from NAFED, which needs to be recovered at an early date so that the investors could be granted relief by the recovery of fund from NAFED. Advisor (CD & CM) informed that the matter has already been taken with the Secretary (Agriculture). Their response is still awaited. 18. While concluding, the Chairman re-interated that the Government of Maharashtra has a key role to play in this case. Therefore, they may be again reminded to ensure taking necessary action on points decided in the meeting taken by MOS(Finance) on 20th January, 2015. 19. The meeting ended with the thanks to the chair. ***** 4

- 8. ANNEXURE LIST OF PARTICIPANTS Ministry of Finance, Department of Economic Affairs 1. Shri Ajay Tyagi, Additional Secretary (Investment) 2. Dr. C. K. G. Nair, Adviser (CM) 3. Shri Lekhan Thakkar, Director 4. Shri Praveen Trivedi, OSD(Law) - Chairman Forward Markets Commission Shri Ramesh Abhishek, Chairman Ministry of Corporate Affairs Dr. Navrang Saini, Director (Inspection & Investigation) Economic Offence Wing, Mumbai Police Shri Rajvardhan Sinha, Additional Commissioner Central Bureau of Investigation Shri Prabodh Kumar, Joint Director Enforcement Directorate Shri S.W. Naqvi, Addl. Director Financial Intelligence Unit, India Ms. Deepika Mittal, Additional Director 5

- 10. REVIEW MEETING RELATING TO THE IMPLEMENTATION OF THE RECOMMENDATIONS OF THE SPECIAL TEAM OF SECRETARIES (STS) ON NATIONAL SPOT EXCHANGE LIMITED (NSEL) Summary Record of Discussion The seventh meeting to review the action taken on the recommendations of the Special Team of Secretaries which had been set up to examine the violation· of laws arid regulations by NSEL or. any associated co,�pany or any of the participants, was held at 04.30 pm on· 12.06.15 in the Corr:imittee Room No. 131-A, North Block, New Delhi under tl1e chairmanship of Additional Secretary (EA). The list of participants is annexed. 2. The Chairman welcomed the participants and informed that owing to unforeseen engagements, Finance Secretary _could not make it to the me_eting. While emphasizing th� need to hglp. the investors of NSEL in _getting bac�. their _i_nvestrrients withou.t fur:ther delay, he highlighted the vital role of the Mumbai Police in the matter of recovery of the lost investments as well as prosecuting the offenders. He requested its representative to apprise about the actions taken in this regard. 3. Shri Dhananjay Kamlakar, Joint C.P, Economic Offence Wing(EoW) of the Mumbai Police replied in response that during the course of the investigation, EoW has· attached, under MPID Act, 437 immoveabie assets, 239 bank accounts, 24 demat accounts etc. worth Rs. 6204 Crores. Such assets include brand value of Dunar Foods (Rs. 600f Crores) and 11rupati Brand of NK Proteins (300/-Crores). Tnese brands have been · frozen by sending a. letter to the Commissioner of Patents. He ·aoded that the process to dispose· of these. properties under the provisions of MPID Act is at very advance stage. Report cif the forensic audit is also being utilized to ·serve the purpose. 4. With �egard to matters·pending·in different Courts, ·shri Kamlakar informed that · anticipatory bail application of _ the··.Director of Aaslha Minmet Mohit Agarwal is pending

- 11. ! in the High Court. As per the direction of the High Court, the valuation of property at Titwaia, Than·e of the accused Mohit Agarwal has been completed with the help of NSEL which comes to Rs. 54 Crores. In addition, hearing of anticipatory bail application of the Director of NK Proteins Pvt. Ltd. Nimish Patel is pending before the High Court. Besides, the NI< Proteins Pvt. Ltd., M/s Yathuri Associates and M/s Lotus Refineries .Pvt. Ltd. have filed quashing petition befor_e the High Court. 5. Financial Techn_ology (India) Ltd. has filed Criminal Writ Petition in Bombay High · Court challenging the notice _under MPID Act issued by EOW directing not to dispose of companies assets. Besides this the NSEL has i:!lso filed another Criminal. Writ Petition challenging the applicability of the MPID Act in the case of NSEL. ·There are about ·45 Miscellaneous Applications filed by different persons/companies ma.inly for de-freezing their bank accounts, relaxing conditions of bail etc. pending in MPID Court. Four companies have filed civil writ petitions in Chandigarh and Ahmedabad High Courts for . sfaying ·the operations of notices issued to secure their assets under the.provisions of MPID Act. 6. . With regard to the attachments, Shri Kamlakar informed that attachment df property worth Rs. 3400 crore have been notified in the _Gazette. As for the rate,·he darified that all the' rates quoted ,are·" general" rates which- are sut;lject to- .proper evaluation.by the valuer. So far, orders have. been received to dispose. of only two properties worth Rs. 92·.lQ crore, which are now ripe for bidding. So far, bidding has taken place for the property worth � 56 crore. 7. Shri Kamalakar informed that there are 9 warehouses wherein commodities such as raw wool; paddy, soya steel; ferrochrome etc. with expected value of Rs. 110 Crores are lying. NSEL is taking legal recourse to sell these commodities. So far, the NSEL has filed two applications in the MPID Court for release of commodities of M/s Metkore . . Alloys & Industries Ltd.. (Ferrochrome worth_ Rs. 92 Crores) and M/s· Shree Radhey Trading Co. (Red Chilly and pepper worth Rs.. 10 Cr6res), The Competent Authority has . subrTJitted a proposal in the_ Court to.auction the same.· Tlie MPID Court. h�s granted permission to the NSa to auction the commodities of M/s Me.tkore Alloys & Industries Ltd..and therefore, NS�L has invited bids to auction the same. · 8.. Shri l<amalakar said that till date, 608 investors, who .had invested an· amount of R_s. 2 lakhs. and l�s have received their full amount. The amount deposited so far by. these clefaulter"switnNSEC fi f R�-363 Crores which has been disbursed to the investors on pro rata basis.

- 12. 9. Shri Rame::>n A'ohishek, Chairman, FMC clarified that reimbursement of � 363 crores was effected much earller through the Escrow account being maintalned by the FMC. 10. Shri Kamlakar further informect that out of 25 defaulter companies, M/s Sankhya Investment and M/s Topworth Steels & Power Pvt. Ltd. have settled their accounts with the NSEL by repaying their outstanding amount and M/s· Mohan India Pvt. Ltd.- had entered _ into settlement agreement_ with the NSEL and agreed to repay an amount of _ Rs. 770 Crores. This agreement has been ratif i ed by the MPID Court. However, since - the company failed to make scheduled payment, the NSEL has filed an application in the MPID Court to dispose of its properties. Application is pending in MPID Court, The company has deposited � 52 Crores till date in the Escrow Account.- Besides, M/s Mohan India sold sugar lying in their godowns as per Court Order and deposited 't 14.5 Crores in the Escrow Account. 11. The chairman desired to know as to flow long it would ·take to dispose of the attached_ properties and realize. jts value for the disbursemen� amongst the investors. -Shri · Kamalakar replie·d that _it_ would _ become possible to . dispose of the attached property. after completing the _procedural formalities for the purpose which include the prerequisite of seeking orders of the MPID Court and the vacation of stay orders, if ariy, . of any other competent court ·of law. The Deputy Collector(Land Acquisition), Mumbai City, who has ·been appointed as a Conipeteht Authority under the provisions of MPID Act for the attachment and disposal-of properties, also attends· to other regular,work in addition to the NSEL related work. As a result, his attending to the attachment related - takes time. Under the circumstances, it would not be possible to. calculate any reasonably accurate spell of time needed to dispose offinally the attached property. The DIG, CBI stated that cases of such nature generally consume nearly two years. 12. The Chairman expressed the need to take up immediately with the Chief Secretary, Maharashtra, _the issue of assigning the competent authority NSEL related work only, in exclusion of any other work. If possible, at least one more MPID court rnuld be set up immediately to · expedite disposal of the long pending property attachment/d; ° sposal work. He hop�d that EoW wouid take .steps to expedite_the process to provide relief to the investors with9ut further delay. 13. Dr. Ncivrang Sain1, Director(Inspection & Investigation), Miriistry of Corporate Affairs stuted_that c1s per tl1e orders·dated -04.02.1.5 of the High Court,· Bombay, the _ Ministry · is requiied to consider objections/ · suggestions - received from various stakeholders on the draft order of the_amalgamation of NSEL with FfIL and finalize the · i i

- 13. order by 07.04.15. However, the Ministry has received a large number of the merger related references. For considering it before the finalization of the Order, the Ministry has been granted time till 31.07.15 by the High co"urt, Bombay. 14. Dr. Saini added that the Ministry has· filed a petition before the Company Law Board on 25.02.15, under different sections of the Companies Act, against th.e · mismanagement of affairs of NSEL by the Board of Di.rectors of TTIL and seeking to remove the Board of Directors of TTIL and to appoint Government nominees in their place. The next date of hearing is on 30.06.15; 15. The chairman remarked that if the MCA could succeed in the matter,· lots of r-elief could 9e expected as a result. ·16. ShrJ S.W. Naqvi,. Special Director, Enforcement Directorate(ED) stated tliat the ED has filed a prosecution complaint in this case before the City Civil. Court and Additional Sessions Judge, Greater Bombay _on 30.03.2015 against NSEL and 67 other accused persons under the PMLA, 2002. Th.e charged· persons· include Board of Directors of NSEL along with t�e key management pe.rsons. Out of the total 25 defaulting membe.rs, 14 defaulting members and their controlling persons/associates· have aiso ·oeerf-<:harged··1ri lhe..said complaint. 'The Charge sheet ·details· money trail•, amounting to Rs: 3721.22 crores. Investigation against the r.emaining defaulting members is also in progress, 17. So far, out of the 19 Provisional Attachment Orders issued in respect of the proceed of the crime identified, under Section 5 of PMLA 2002, 13 have already been confirmed by the PMLA Adjudicating Authority. 18. Dr. Naqvi pointed out that there have be.en cases of the attachment of certain properties by both the investigating agencies i.e., the ED has attached a few properties und�r the PMLA and the EOW has .attached the same properties under the MPID Act. Property of. M/s Mohan �ndia is a point in the case. Such overlapping set qf attachments are· causing avoidable ccmstraints: 19. The chairman .emphasized the need for the . avoidanc;e of overlapping or such . actions by the tvvo inyestigating · agencies. He underlined that in the process, the ultimate objCctiVCS of .recovery of the lost investments and pcnaihlng ff,-e defaulter may. not be lost sight·· of. It would be·· proper :f it is examined whether the·ccises mi;;ht be pursued by .the Enforceme.nt Directorate becau·se, as pointed out by tr,e Chair�a�:. FMC, tile PMl�A has relatively stri1:rPr pro'!i�iOP ff!r ITJ�f:'�ing thF: 0!Jj1-2ctives.. I hr;refon�, i� v,r(1c. ··£#: 'bc7_r:hf1Cf'7:VI-�VY1i1tmt_,. '•·1•$3 riTri' tr

- 14. r· decided that the ED would see!<. immediatel'f legal advice of the Ministry of Law fl.. asc_erraining whether in the interest of speediei administration of justice, in respect of the attachments of the same properties being made by ED as well as EoA/ of Mumb2i Poiice, if such cases can be tried in the courts of law under only PMLA by transferring also such cases from MPID courts. 20. Shri Ramesh Abhishek, Chairman FMC sought to know whether EOW can share forensic report so that suitable action can, if so required, could be initiated against the defaulting firms. Shri Kamalakar however expressed reservation on account of legal issues involved on the ground that the same ·being made a part of the charge sheet against the offending firms. 21. Smt. Deepika Mittal, Additional Director, FIU informed that Show Cause Notice has been issued to NSEL for non-compliance of the provisions of PMLA. They have sought information about the Board of Di�ectors, key officials during 15.02.13 to 19.09.14 and those who are in position riow. Besides, information relating to brokers (who are intermediaries under PMLA) have also been sought. ·22. The FIU is examining the NSEL' reply to the �how Cause Notice. However, FIU is still awaiting the information relating to the Board Members/Directors and key officials in position during 15.02.13 to 19.09.14. ln response to a query, Smt. Mittal clarified that under the PMLA, FIU can impose only monetary penalty on the offenders. 23. Shri Madhup Tewari, DIG, CBI informed that they are pursuing 2 Regular Enquiries and 1 Preliminary Enquiry(PE) in the NSEL related matter. In the PE, roles of officials of Forward Markets Commission and the Department of Consumer Affairs in the NSEL payment crisis case are being probed. The PE is nearly 4 - 5 months old. 24. The meeting ended with a vote of thanks to the chair.

- 16. 8 th REVIEV MEETING ON IMPLEMENTATION OF THE RECOMMENDATIONS OF THE SPECIAL TEAM OF SECRETARIES (STS) ON NATIONAL SPOT EXCHANGE LIMITED (NSEL) The eighth meeting ,:::: 3 :i:�:::o: f ,: IB �:=�ndfilions of ilie Specifil Team·� of Secretaries (STS) to examine the violation oflaws and regulations by NSEL or any associated 1 compar1y or any of the participants was held at 03.�0 PM on 14.08.2015 in the committee room No. 131-A, North Block, New Delhi under the chairmanship of Finance Secretary. The list of participants is annexed. 2. After welcoming the participants, the Chairman desired to know about the·action taken' by the various agencies, starting with the Ministry of Corporate Affai.rs (MCA) about the merger of NSEL with the FTIL. 3. Dr. Navrang Saini, Director (Inspection & Investigation) ofMinistry of Corporate Affairs informed that the Ministry had planned to take a final view on the issue of final Order on NSEL- FTIL merger by 31.07.2015 after giving brief hearing to FTIL and NSEL on 07.07.2015 and 08.07.2015 respectively. However, the hearings were adjourned for four weeks in compliance of the directions of the Bombay High Court dated O 1.07.2015. The matter was further heard by Bombay High Court on 07.08.2015 when it permitted extension of the period of time up to 30.10.2015 for the issuance of the final order on the :nerger by the Ministry. As regards the petition filed by the Ministry before the Company Law Board (CLB), it was informed that the CLB, on 30-06-2015, granted interim relief by directing that FTIL will not sell/ alienate or create third party rights on its assets and investmerits till further orders. I{owever, FTIL filed an application before .the Madras High Court, .seeking stay on the order of CLB. The Madras High Court vide order dated 10-07-2015 ordered partial suspension of the CLB order dated 30-06- 2015. The next date of hearing in CLB has been fixed for 02-09-2015. FS stated that keeping in ------------ . - -·- 1

- 17. ·iew the importance of, and intricacies involved, in the case, the MCA needs to engage-suitable �nior advocate(s) for defending the case. 4. Shri S.W. Naqvi, SpecialDirector, Enforcement Directorate (ED) stated that ED had filed prosecution complaint before special PMLA Court, Mumbai on 30.3.2015 against NSEL and 67 other accused persons under the PMLA, 2002. However, trial has not yet started and the application for transfer of cases from MPID court vould be heard by Special Court on 17/8/2015. He mentioned that EU had issued 19 provisional attachment or<ler::; iu re::;ped uf assets worth Rs. 837 crore and all these orders were confirmed by the Adjudicating Authority under PMLA. 5. On a query by the Revenue Secretary as to Vhether there are overlapping sections under PMLA in the action being taken by ED and the ones under MPID in action being taken by EOW, Mumbai. Shri Naqvi from ED clarified that while there are no overlapping sections, some ofthe properties secured for attachment by ED have ,been fou nd to be overlapping. Shri Dhananjay Kamalakar, Joint Commissioner, EOW, Mumbai clarified that as per their records, such overlapping properties are worth Rs. 464 crore whereas ED's estimate for such property is Rs. 203 crore. At this, the Additional Chief Secretary, Govt of Maharashtra requested for expeditious decision in respect ofsuch properties with overlapping attachments ·by ED as .Vell as by EOW. AS (I), DEA stated that attached property could be liquidated under MPID Act as action under this act appears to be faster. Finance Secretary urged that the ED and EOW should urgently reconcile the overlapping properties and action to liquidate the attached property should be pri_oritized under such Act which may help speedier reliefto the aggrieved investors. 6. Revenue Secretary desired to know about the action pending, ifany, with his Department. Adviser, (CM), mentioned that the issue of release of Rs. 59 crore seized by Income Tax Department is pending. Finance Secretary stated that claims of the sovereign may be examined as per the prevalent practice and a decision on the matter taken. 7. Shri P. K. Tiwari, Director FIU-India informed that Show cause Notices were issued to NSEL for non-compliance ofthe provisions of the PMLA read with the Rules made thereunder. As a consequence of this action, the statutory process of imposing sanctions u/s 13 ofPMLA has 2 --...,,..

- 18. been 1nitiated. Revenue Secretary observed that FIU's action should have been faster. Explaining the delay in action on the part of FIU, Shri Tiwari stated that examination of the issue of 'deemed reporting' status of NSEL under the PMLA took time. FS advised that FIU's statutory proceedings should be expedited to which Shri Tiwari responded by stating that the process is likely to be completed by September, 2015. 8. Shri K.P. Bakshi, Additional Chief Secretary, Govt. of Maharashtra referred to the meeting he had with the Chairman, FMC on 10/08/15 regarding some of the pending issues with the Qovt. of Maharash�.ra to expedite the process of inquiry in NSEL related matters and disposal of attached properties. He informed that an Additional Collector has been appointed as an additional Competent Authority under MPID Act for attachment and disposal of properties in addition to the Deputy Collector (Land Acquisition), Mumbai. Chief Justice, Bombay High Co in his recent meeting with Chief Minister, Maharashtra agreed in-principle for setting up of one more special :MPID Court. As regards appointment of auctioneers, he sought to know the guidelines since they are doing it the first time..FS suggested that one way could be to utilize the panel of auctioneers available with the Court or evaluators and auctioneers registered with ED for engaging their services. Shri Bakshi also sought to know as to how the Govt. of Maharashtra is expected to meet the expenditure in respect of the competent authority and additional staff as well as services of auctioneers etc. Additional Secretary (I) suggested that since MPID is a State enactment, Maharashtra Government may follow the rules, regulations and procedures issued under this A�t. FS suggested that the Govt. of Maharashtra may move an application in the . Court to get appropriate orders in this regard. As (I) also underlined need for the Government of , Maharashtra to auction the attached property without further delay so that flow of fund back to investors could start forthwith. As regards clubbing of cases, Shri Bakshi informed that Advocate Ge ral of Maharashtra would request all other courts to transfer all NSEL related cases· to Mumbai High court. 9. It was noted that soon after the NSEL settlement crisis broke out, FMC directed all regulated commodity exchanges to take appropriate disciplinary measures against defaulting members of NSEL trading on their platforms as members or clients and also. to prohibit them rom trading in their exchange platforms. Accordingly, trading/membership rights of defaulting 1embers of NSEL were suspended by various- commodity exchanges. FMC declared Financial 3

- 19. Technologies (India) Ltd., Shri Jignesh Shah, Shri Joseph Massey and Shri Shreekant Javalgekar as not "fit and proper" to be Shareholder/Director in the management and the Board of any Exchange. FMC also filed a complaint dated 16.01.2015 with the EOW, Mumbai requesting them to take appropriate legal action against NSEL u/s 21 of FCRA. Shri V.C. Chaturvedi, Director, FMC mentioned that they had received complaints from NSEL against some of its members/brokers for alleged wrongdoings such as large scale unique client code (UCC)' mod . ifica �ion, fu � ding of trade, false as _ suranc � of high retu �� etc. and they have called f1..,"·!§i detailed information from NSEL for tak.mg action as per prov1s10ns of FCRA, 1952. FS state��· · ·· that FMC should have taken action against such brokers/wrong-doers particularly who are; Members of regulated commodity exchanges based on the facts/ records/complaints. He further urged that action must be expedited and not to show any leniency on such violations. 10. Shri Dhananjay Kamalakar, Joint Commissioner, EOW, Mumbai reported that properties worth Rs. 6204.78 crore have been secured for attachment under MPID act. These include 4801 immovable assets, 239 bank accounts 24 demat accoW1t and 23 motor vehicles. Attachment ofi properties worth Rs. 5500 crore has been notified in the Gazette of the Govt. ofMaharashtra. He, also ir.formed that 166 new properties have heen identified, in addition, for attachment. AS (I) observed that some properties should be expeditiously auctioned and a workable time table mayi be framed to auction attached properties. 11. Concluding the meeting Finance Secretary emphasized·that people who lost their mone 1 must get reliefas early as possible and all investigating and other agencies should expedite the· actiorr with this goal in mind. This is reflected in the recent set of anguished complain expressing distress over the long pending grievances by affected investors.and their association�, 12. The meeting ended with the vote ofthanks to the chair. ***** 4 -· rttswrrentun«mzesff c ·t - § - ?arififr

- 20. ' ' LIST OF PARTICIPANTS Ministry ofFinance, Department of Economic Affairs I. Shri Rajiv Mehrishi, Finance Secretary 2. Shri Ajay Tyagi, Additional Secretary (Investment) 3. Dr. C. K. G. Nair, Adviser(CM) 4. Shri K. N. Mishra , Deputy Secretary(CD) Department ofRevenue Shri Shaktikanta Das, Secretary Financial Intelligence Unit, India Shri P. K. Tiwari, Director ForwardMar:kets Commission Shri V. C. Chaturvedi, Director Ministry of Corporate Affairs Dr. Navrang Saini, Director (Inspection & Investigation) Govt ofMaharashtra Shri K.P Bakshi, Additional ChiefSecretary (Home). Economic Offence Wing, Mumbai Police Shri Dhananjay Kamalakar, Joint commissioner Enforcement Directorate Shri S.W. Naqvi, Addl. Director 5 ***** · . . ;•.... -- ----- --------------------------- ANNEXURE

- 22. .. Government of India Ministry of Finance Department of Economic Affairs Commodity Derivatives Markets Division ***** REVIEW MEETING ON THE IMPLEMENTATION OF THE RECOMMENDATIONS OF THE SPECIAL TEAM OF SECRETARIES (STS) ON NATIONAL SPOT EXCHANGE UMITED (NSEL) Summary Record of Discussion The ninth meeting to review the action taken on the recommendations of the Special Team of Secretaries (STS) which had been set up to examine the violation of laws and regulations by NSEL or_any associated company or many of the participants, was held at 01.00 P.M. on 17.12.2015 in the Committee Room No. 131-A, North Block, New Delhi under the chairmanship of Secretary(Economic Affairs). The list of participants is annexed. 2. After welcoming the participants, the Chairman requested for updated Action Taken Report by the Departments/Agencies represented in the meeting. 3. Shri Dhananjay Kamlakar, Joint Commissioner, EOW, Mumbai Police stated that he is representing both the Govt. of Maharashtra and the EOW, Mumbai Police in the meeting. He informed that the Govt. of Maharashtra has appointed an Additional Collector, Mumbai City as competent authority under MPID Act, 1999. Thus, now there would be two competent authorities under the Act with a view to expediting the attachment and disposal of properties. Setting up of a dedicated special Court under the provisions of MPID Act, appointment of digital forensic auditors, services of reputed firms for valuation and auction of attached assets etc. are at present un'der the consideration of the Govt. of Maharashtra. In connection with the setting up of a separate court exclusively for NSEL related cases, justification has been sought which is in the process of being submitted shortly Action towards clubbing of cases pending in different courts and filing an SLP ir. th1<; regard in

- 23. Supreme Court is also under examination. Advocate General would, for defending the case in a consolidated manner in one court, request all courts hearing NSEL related cases to transfer such cases to the Bombay High Court. 4. Presenting updated position about the action taken by EOW, Mumbai, Shri Kamlakar added that look out notices have been issued against 65 key officials of ml, NSEL and accused member companies. EOW has so far file� three charge sheets including against Shri Jignesh Shah, Ex-vice Chairman, NSEL 5. Shri Kamlakar further informed that Hon'ble High Court of Mumbai has upheld applicability of provisions of MPID Act to the case on a writ petition filed by NSEL, which 1s a very significant development for facilitating further investigation and progress in the matter. The MPID court has issued notice to all accused persons/property owners whose assets have been attached to file objections, if any, against the attachment. The next date of the hearing is 12.01.16. He reported that properties worth Rs. 6204 crore have been secured for attachment under MPID Act, out of which, attachment of properties worth R!> 5332 crore has been notified in the Gazette of the Govt. of Maharashtra. He also informer that additionally, they have identified few more properties for attachment. 6. As regards progress in auctioning of attached prope-tres, in reply to a �uerv of tht' Additional Secretary(Investment), Shri Kamlakar intimated that objections filed by accusea persons/property owners would be heard by the MPID court on 12.01.16 and thereafter, as per court orders, further action in the matter would be taken. He also mentioned that two properties of Mohan India Pvt. ltd are in the pror.ess of getting auctioned as per order dated 17.10.2015 of the MPID Court. This auction is likely to fetch approximately Rs. 300 to 400 crores. The Chairman underlined the need for the expeditious steps for auctioning attached properties. 7. Shri Anil Ramteke, Joint Director, Entorcement DrrectoraLe ([D) stated tnat subsequent to filing prosecution complaint under the PMLA, 2002 against NS[L and 67 other accused persons before special PMLA Court, Mumbai on 30.3.2015, ED had issued 19 provisional attachment orders in respect of assets worth Rs. 837.01 crore and all these 2

- 24. orders were confirmed by the Adjudicating Authority under PMLA. He mentioned that ED had attached properties based on money trail of proceeds of crimes and such properties can be liquidated only after its confiscation by the Trial Court. 8. On the issue of reconciliation of overlapping action with regard to the attachment ol properties by ED and EOW Mumbai, Shri Kamlakar from EOW stated that attachment under MPID may be preferred over attachment under PMLA keeping in view the process and efficacy under two enactments. Shri Ramteke suggested that EOW should focus on attaching and auctioning such properties which are not covered by action taken by ED under PMLA. The Chairman observed that ED and EOW should work in sink on the issue with a view to expediting the process and progress of attachment, auction and recovery of lost money. He further advised that ED and EOW may discuss the issue of overlapping actions with a view to arriving at a mutually agreeable solution at the earliest and apprise this Department about the outcome immediately and in any case, before the next meeting.. 9. The Chairman also emphasized that the properties without any dispute may be considered for auction without further delay. 10. Shri P. K. Tiwari, Director, AU-India informed that Order under Section 13 of the Prevention of Money Laundering Act, 2002 was passed on 04.11.15 imposing a penalty of Rs. 1.66 crores on NSEL for non-compliance of various provisions of Pf'vlLA. 11. Dr. Navrang Saini, Director(Inspection & Investigation) of Ministry of Corporate Affairs informed that for disposing off suggestions/objections of various stakeholders and in compliance·of the order dated 7.8.2015 of the Honble Bombay High Court, an application has been submitted before the Hon'ble High Court of Bombay for extension of time till 29.02.16 for taking considered view on the draft Order. 12. In respect of the petition filed by MCA before CLB on 25.02.15 regarding mismanagement of affairs of NSEL by the Board of Directors of FTIL, ,t was informed that CLB, vide its order dated 30/6/2015, granted stay on the disposal/hiving off of assets by ml. However, ml filed an appeal before Madras Higl1 Court seeking to quash the stay 3

- 25. order of CLB. The Mijdras High Court, vide order dated 10.07.15, partially suspended the stay order. Consequently, stay on the diSposal of immoveable properties continues but for investments there is no stay. MCA filed an application before the Hon'ble Madras High Court seeking to set aside the stay order dated 10.07.15. However, the Madras High Court in rts order dated 10-08-15 disposed of the application directing that the stay will continue till the petition filed by the MCA before CLB is disposed of. MCA is in the process of filing an SLP before the Hon'ble Supreme Court, seeking to quash the order of the Madras High Court. 13. The Chairman directed that keeping in view the importance of the issue, a senior counsel may be engaged by MCA to defend the interests of the Government. 14. With regard to the request of FMC/SEBI to share forensic audit reports in respect of members/brokers of NSEL (which was also reiterated by Shri Mohanty from SEBI ), Shrr Kamlakar stated that the matter would be considered after the receipt of reports which art· being prepared at present. 15. Shri Mohanty informed that after taking over the regulation of the Commodity Derivatives Market, SEBI is examining the complaints against NSEL brokers who are also members of the Commodity Derivatives Exchanges and is investigating specifically the role 1 of five brokers against which NSEL had complained for their improper act1v1ties. The chairman observed that SEBI should examine the issue as a whole with broader perspective and not just restrict its investigation to the complaint of NSEL. Complicity of NSEL with the brokers should specifically be investigated. 16. Shri Madhup Tewari, DIG, CBI stated that CBI had registered two cases- one against NSEL and PEC and another against NSEL and MMTC. Both the cases are at the final stage of investigation. He mentioned that in respect of PEC case, charge sheet is likely to be filed by January, 2016 whereas in MMTC case, it might be filed by Februar1, 2016. He also mentioned that the final report in a Preliminary Enquiry conducted by the CBI about the role of Government/FMC officials has already been submitted to the 0/0 of DEA ,n July, 2015 recommending departmental action against certain officers. While an appropnate view 4

- 26. has been taken with the approval of competent authority with regard to the then chairman, FMC, the rest of the report is under examination in DEA in consultation with the CVO. 17. The meetlng ended with the vote of thanks to the chair. ***** 5